|

市場調查報告書

商品編碼

1692475

中東和非洲正排量幫浦:市場佔有率分析、產業趨勢和統計數據、成長預測(2025-2030 年)MEA Positive Displacement Pumps - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

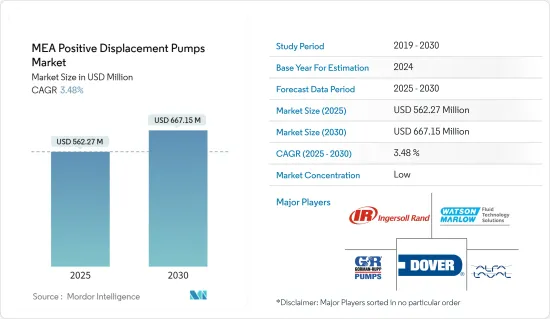

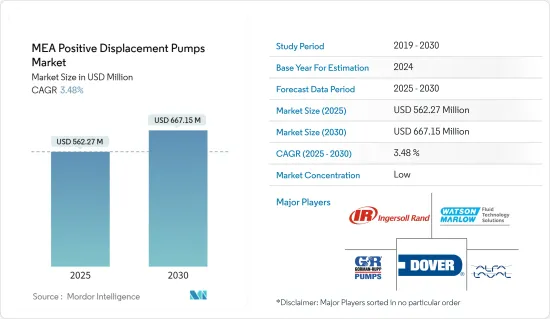

預計 2025 年中東和非洲正排量幫浦市場規模將達到 5.6227 億美元,預計到 2030 年將達到 6.6715 億美元,預測期內(2025-2030 年)的複合年成長率為 3.48%。

正排量幫浦用於泵送高黏度流體,例如油、油漆、樹脂和食品。它是需要精確分配和高壓輸出的應用的首選。與離心式幫浦不同,容積泵的排氣量不受壓力的影響。因此,在供應不穩定的情況下,它們可能會更受青睞。

為了評估中東和非洲正排量幫浦市場的收入,我們追蹤了中東和非洲地區正排量幫浦的收入。報告中考慮了各種類型的泵,包括隔膜泵、活塞泵、齒輪泵、葉片泵、蛇形泵、螺桿泵、葉片泵和蠕動泵,這些泵用於多個最終用戶行業,包括石油和天然氣、化學、食品和飲料、水和用水和污水、製藥和發電。我們透過競爭格局來計算正排量泵的滲透率以及公司將如何參與有機和無機成長策略。

正排量幫浦的工作原理是捕獲一定量的水並將其從排放管道中排出。容積泵也有吸入側具有擴張腔、排出側具有收縮腔的型號。眾所周知,容積泵可以將一定量的流體困在腔體中,然後迫使流體從排放管流出。另一方面,離心式幫浦透過旋轉的葉輪將馬達的動能傳遞給液體,吸入液體並增加其速度以將其移動到排出口。

容積泵在石油和天然氣作業的各個階段都至關重要,包括探勘、開採、精製和分配。這些泵浦對於處理高黏度液體和提供一致的流速至關重要,使其適用於石油和天然氣領域的關鍵應用。這些泵浦的運作速度較低,降低了處理高黏度油和漿體時損壞的風險,使其在工業中更加有用。

正排量幫浦所需的高額初始投資是市場成長的主要障礙。這些泵浦通常比其他類型的泵浦更昂貴,這可能會阻止潛在買家,尤其是小型企業。此外,泵浦的維護難題也推高了整體成本,影響了銷售和市場滲透。

在中東和非洲等新興地區,民用水利基礎設施的快速成長對容積式幫浦的需求日益增加。公共和工業部門對廢水處理的需求大幅增加,導致泵送設備的安裝增加。海水淡化和零液體排放(ZLD)等技術的採用預計將進一步推動民用和工業領域的正排量泵市場的發展。

中東和非洲容積幫浦市場趨勢

建築業的成長將推動家具產品的需求

- 隔膜泵,也稱為 AODD(氣動雙隔膜),是一種利用壓縮空氣運轉的雙隔膜容積泵。隔膜泵利用氣動閥在泵浦的兩側之間交替壓縮空氣。隔膜泵擅長處理含有懸浮固體的各種黏度的液體。由於其設計配置和所用材料類型,這種類型的泵浦可以安全有效地處理特別腐蝕性的化學物質。

- 隔膜泵位於液面上方,即使內部沒有液體且乾燥時也可以吸液。幫浦和液位之間的距離會產生損耗負載。如果泵浦沒有封裝,其抽液最大高度不能超過6m,但如果泵浦封裝,則可達到9.5m。

- 某些應用需要泵送兩種流體,但沒有足夠的空間容納兩個獨立的泵浦。各公司都提供透過分離輸送和吸入來客製化泵浦的機會。這意味著同一個幫浦可以泵送兩種不同顏色的流體。然而,流體必須具有相同的黏度和密度特性。

- 水和污水處理、石油和天然氣、食品和飲料以及製藥業的需求不斷成長是市場成長的主要動力。例如,在科威特,碳氫化合物佔GDP的50%,石油提供了約90%的出口和財政收入。科威特計畫在2035年將石油產能提高到每天400萬桶,到2040年將天然氣產能提高到每天4,250萬立方公尺。 KPC的目標是到2050年實現淨零排放,這為能源轉型帶來了機會。科威特計劃在未來五年內投資 480 億美元用於探勘和鑽探,以擴大現有成熟油田的石油產量。

預計亞太地區將佔據主要市場佔有率

- 沙烏地阿拉伯是世界上最大的石油和天然氣生產國和出口國之一。沙烏地阿拉伯在塑造正排量幫浦市場需求方面發揮關鍵作用。在沙烏地阿拉伯豐富的蘊藏量和戰略舉措的推動下,該國的石油和天然氣產業需要廣泛的設備和技術,包括正排量幫浦。

- 沙烏地阿拉伯政府正積極投資石油和天然氣領域,發現新油田,擴大現有油田,並提高產量。這些投資促進了該地區石油和天然氣工業的發展,從而推動了對正排量泵的需求。

- 2023 年 11 月,沙烏地阿美宣佈在空白之地地區發現兩處新的天然氣田。已確認發現 Al Hiran天然氣田,指示流量為每天 3000 萬標準立方英尺,同時伴隨每天 1600 桶冷凝油。同樣,Al Mahakik天然氣田的存在也得到證實,該氣田生產85 萬標準立方英尺的天然氣。 2024年2月,沙烏地阿美在陸上Jafurah傳統型油田又發現了15兆立方英尺天然氣和20億桶冷凝油。

- 沙烏地阿拉伯的2030願景旨在利用該國的位置、戰略夥伴關係、能源來源和物流,推動該國工業化和自動化達到新的水平。該國還計劃在2030年實現國內生產一半的軍事需求,並實現可再生能源和工業製造部門的自動化。

- 2023年,環境、水和農業部(MEWA)宣布將在未來幾年內為計劃撥款800億美元。這符合聯合國永續目標(SDG),旨在讓全球人民平等獲得清潔安全的水資源。

- MEWA 的目標是到 2030 年透過海水淡化滿足沙烏地阿拉伯 90% 的用水需求,其餘 10% 來自地下水和地表水。為了滿足預計的每天450萬立方公尺的缺水量,有必要建立一座新的都市區海水淡化廠,以滿足當前的都市區用水需求並確保可靠的供水。

中東和非洲正排量幫浦產業概況

中東和非洲正排量幫浦市場高度分散,主要參與者包括 Dover Corporation、Ingersoll Rand Inc.、Watson-Marlow Fluid Technology Solutions(Spirax Group PLC)、Alfa Laval AB 和 Gorman-Rupp Corporation(Gorman-Rupp 旗下公司)。市場上的公司正在採取夥伴關係和收購等策略來加強其產品供應並獲得永續的競爭優勢。

2024 年 6 月 - 英格索蘭公司成功收購 ILC Dover (ILC)。此外,該公司還透過收購 Complete Air and Power Solutions (CAPS)、Del PD Pumps &Gear Pvt 等公司,增強了其產品組合。 Ltd(Del Pumps)和 Fruvac Ltd(Fruitland Manufacturing)合計投資約 1.5 億美元。

2023 年 9 月 - Busch 推出最新創新產品-節能的 R5 RA 真空幫浦。該泵浦具有時尚、衛生的設計、低發熱量和簡化的維護。可選的 Ecotorque 變速驅動器可提高 50% 的能源效率並將泵送速度提高 20%。此外,該配件還擴展了泵浦的電壓範圍,提高了全球可用性。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 一次性水位嚴重短缺和地下水污染導致PD泵浦需求增加

- 石油和天然氣產業的需求不斷成長

- 市場挑戰

- 高成本、相容性問題

第6章市場區隔

- 按泵類型

- 隔膜泵

- 活塞泵

- 齒輪泵浦

- LOBE泵

- 單軸螺旋泵浦

- 螺旋泵

- 葉片泵

- 蠕動幫浦

- 柱塞泵

- 按最終用戶產業

- 石油和天然氣

- 化學

- 食品和飲料

- 用水和污水

- 製藥

- 發電

- 其他最終用戶產業

- 按國家

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 科威特

- 非洲

第7章競爭格局

- 公司簡介

- Dover Corporation

- Ingersoll Rand Inc.

- Watson-Marlow Fluid Technology Solutions(Spirax Group PLC)

- Alfa Laval AB

- Gorman-Rupp Corporation(Gorman-Rupp Company)

- Busch Vacuum Solutions Inc.(Busch Group)

- Celeros Flow Technology Inc.

- Flowserve Corporation

- Atlas Copco AB

- Xylem Inc.

第8章 市場展望

The MEA Positive Displacement Pumps Market size is estimated at USD 562.27 million in 2025, and is expected to reach USD 667.15 million by 2030, at a CAGR of 3.48% during the forecast period (2025-2030).

Positive displacement pumps are used for pumping high-viscosity fluids, including oil, paints, resins, or foodstuffs. They are selected in applications where accurate dosing or high-pressure output is required. Unlike centrifugal pumps, the production of a positive displacement pump is not affected by pressure. Thus, they are also likely to be preferred in any situation where the supply is irregular.

To evaluate the market revenue for the Middle East & African positive displacement market, the sales of positive displacement pumps across the Middle East & Africa have been tracked. Different types of pumps are considered in the report, including diaphragm, piston, gear, lobe, progressive, screw, vane, and peristaltic, which are used in multiple end-user industries like oil and gas, chemicals, food and beverage, water and wastewater, pharmaceuticals, power generation, among others. The competitive landscape has been taken to calculate positive displacement pump penetration and how players involve themselves in organic and inorganic growth strategies.

A positive displacement pump operates by trapping a set amount of water and pushing it into the discharge piping. Some models of positive displacement pumps feature an expanding cavity on the suction side and a shrinking cavity on the discharge side. Positive displacement pumps are known for their operation of trapping a fixed volume of fluid in a cavity and then pushing that fluid into the discharge pipe. On the other hand, centrifugal pumps transfer the motor's kinetic energy to the liquid through a spinning impeller, which draws in fluid and increases velocity to move the liquid to the discharge point.

Positive displacement pumps are integral to various oil and gas operations stages, including exploration, extraction, refinement, and distribution. These pumps are crucial for handling high-viscosity fluids and providing consistent flow rates, which make them suitable for critical applications in the oil and gas sector. The ability of these pumps to work at lower speeds reduces the risk of damage when handling high-viscosity oils and slurries, further enhancing their utility in the industry.

The high initial investment required for positive displacement pumps is a significant barrier to market growth. These pumps are often more expensive than other types, which can deter potential buyers, especially small and medium-sized enterprises. In addition, the difficulty of maintaining these pumps further adds to the overall cost, affecting their sales and market penetration.

The swift growth of civic water utility infrastructure in emerging regions like the Middle East & Africa has resulted in a higher need for positive displacement pumps. There has been a significant rise in the demand for sewage treatment in both the public and industrial sectors, leading to an increased installation of pumping units. Implementing technologies such as desalination and zero-liquid discharge (ZLD) is anticipated to further drive the market for positive displacement pumps in civic and industrial sectors.

MEA Positive Displacement Pumps Market Trends

Growth in the Construction Sector Boosting the Demand for Furniture Products

- The diaphragm pump, also called an AODD (Air Operated Double Diaphragm), is a type of double diaphragm positive displacement pump operated using compressed air. Diaphragm pumps utilize a pneumatic valve to alternate compressed air between the pump's two sides. They excel at managing liquids of diverse viscosities, including those with suspended solids. This type of pump, due to its design configurations and type of materials used, is also capable of safely and efficiently handling particularly aggressive chemicals.

- The diaphragm pump is positioned above the fluid level and can aspirate it, even starting from dry when it has no liquid inside. The distance between the pump and the fluid level results in loss loads. If the pump is not potted, the maximum height at which the fluid can be aspirated cannot exceed 6 m, while if the pump is potted, we can reach 9.5 m.

- In some applications, two fluids need to be pumped, but there is not enough room to accommodate two separate pumps. Various companies offer the opportunity to customize their pumps by splitting both delivery and suction. This means that with the same pump, customers can pump two fluids, for example, of two different colors. The fluids, however, need to have similar viscosity and density characteristics.

- The growing demand in water and wastewater treatment, oil and gas, food and beverage, and pharmaceutical industries is a significant driver of market growth. For instance, in Kuwait, hydrocarbons contribute 50% of its GDP, with oil accounting for approximately 90% of export earnings and fiscal revenues. Kuwait planned to increase its oil production capacity to 4.0 million barrels per day by 2035 and gas capacity to 42.5 million cubic meters per day by 2040. KPC aims for net zero by 2050, presenting opportunities in the energy transition. Kuwait intends to invest USD 48 billion in exploration and drilling over the next five years to expand its oil production from existing and mature oil fields.

Asia-Pacific is Expected to Hold Significant Market Share

- Saudi Arabia is one of the world's largest producers and exporters of oil and gas. It plays a significant role in shaping the market's demand for positive displacement pumps. The country's oil and gas industry, driven by its vast reserves and strategic initiatives, demands various equipment and technologies, including positive displacement pumps.

- The Government of Saudi Arabia has been actively investing in the oil and gas sector, identifying new oil fields, expanding existing fields, and enhancing production. These investments contribute to the growth of the oil and gas industry in the region and subsequently drive the demand for PD pumps.

- In November 2023, Saudi Aramco unveiled two fresh natural gas finds in the Empty Quarter region. The Al-Hiran gas field's discovery was solidified as it exhibited a flow rate of 30 million standard cubic feet per day, accompanied by 1,600 barrels of condensate daily. Similarly, the Al-Mahakik gas field's presence was affirmed as gas emanating at 0.85 million standard cubic feet. In February 2024, Saudi Aramco found an additional 15 Tcf of natural gas and 2 billion barrels of condensate in the onshore Jafurah unconventional field as the world's biggest oil exporter pushes ahead with efforts to expand gas production.

- Saudi Arabia's 2030 Vision calls for leveraging the Kingdom's location, strategic partnerships, energy sources, and logistics to stimulate a new phase of industrialization and automation in the country. It also aims to bring manufacturing half of the Kingdom's military needs within the Kingdom by 2030 and to automate the Kingdom's renewable energy and industrial manufacturing sector.

- In 2023, the Ministry of Environment, Water and Agriculture (MEWA) announced that it would allocate USD 80 billion to water projects within the coming years. This aligns with the United Nations Sustainable Development Goals (SDGs), which aim to enable equal access to clean and safe water globally.

- MEWA aims to satisfy 90% of Saudi Arabia's water demand through desalination by 2030, with the remaining 10% sourced from ground and surface water. To bridge the projected water deficit of 4.5 million m3/day, new urban desalination facilities are deemed necessary, aligning with the current urban water needs and the assured water supply.

MEA Positive Displacement Pumps Industry Overview

The MEA positive displacement pumps market is highly fragmented, with the presence of major players like Dover Corporation, Ingersoll Rand Inc., Watson-Marlow Fluid Technology Solutions (Spirax Group PLC), Alfa Laval AB, and Gorman-Rupp Corporation (Gorman-Rupp Company). Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

June 2024 - Ingersoll Rand Inc. successfully finalized its acquisition of ILC Dover (ILC). In addition, the company bolstered its portfolio by acquiring Complete Air and Power Solutions (CAPS), Del PD Pumps & Gear Pvt. Ltd (Del Pumps), and Fruvac Ltd (Fruitland Manufacturing) for a consolidated sum of around USD 150 million.

September 2023 - Busch unveiled its latest innovation, the energy-efficient R5 RA vacuum pump. This pump boasts a sleek, hygienic design, lower heat emissions, and streamlined maintenance. The Ecotorque variable speed drive, an optional feature, delivers an impressive 50% boost in energy efficiency and a 20% uptick in pumping speed. Moreover, this accessory expands the pump's voltage range, enhancing its global usability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for PD Pumps Due to Huge Scarcity in the Disposable Water Level and Groundwater Adulteration

- 5.1.2 Increasing Demand From the Oil and Gas Industry

- 5.2 Market Challenges

- 5.2.1 High Cost and Compatibility Issues

6 MARKET SEGMENTATION

- 6.1 By Type of Pump

- 6.1.1 Diaphragm Pump

- 6.1.2 Piston Pump

- 6.1.3 Gear Pump

- 6.1.4 LobePump

- 6.1.5 Progressive Cavity Pump

- 6.1.6 Screw Pump

- 6.1.7 Vane Pump

- 6.1.8 Peristaltic Pump

- 6.1.9 Plunger Pump

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemicals

- 6.2.3 Food and Beverage

- 6.2.4 Water and Wastewater

- 6.2.5 Pharmaceutical

- 6.2.6 Power Generation

- 6.2.7 Other End-user Industries

- 6.3 By Country

- 6.3.1 Saudi Arabia

- 6.3.2 United Arab Emirates

- 6.3.3 Kuwait

- 6.3.4 Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Dover Corporation

- 7.1.2 Ingersoll Rand Inc.

- 7.1.3 Watson-Marlow Fluid Technology Solutions (Spirax Group PLC)

- 7.1.4 Alfa Laval AB

- 7.1.5 Gorman-Rupp Corporation (Gorman-Rupp Company)

- 7.1.6 Busch Vacuum Solutions Inc. (Busch Group)

- 7.1.7 Celeros Flow Technology Inc.

- 7.1.8 Flowserve Corporation

- 7.1.9 Atlas Copco AB

- 7.1.10 Xylem Inc.