|

市場調查報告書

商品編碼

1692472

美國消費者身分和存取管理:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)US Consumer Identity And Access Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

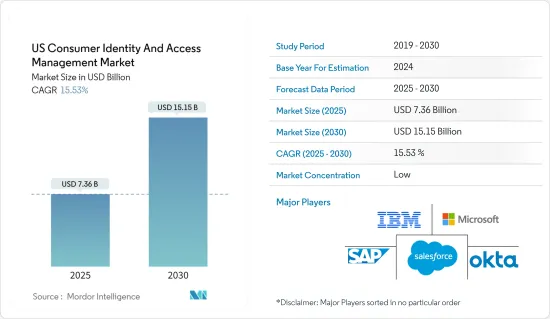

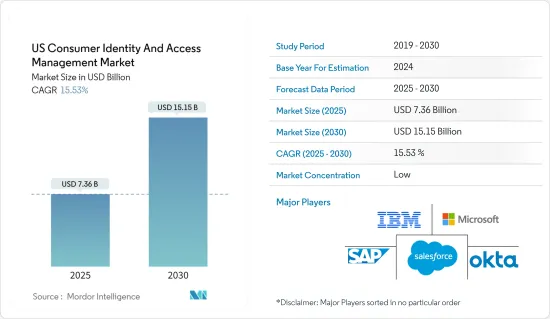

美國消費者身分和存取管理市場規模預計在 2025 年為 73.6 億美元,預計到 2030 年將達到 151.5 億美元,在市場估計和預測期(2025-2030 年)內以 15.53% 的複合年成長率成長。

CIAM 包括客戶入職、自助服務帳戶管理、同意和偏好管理、單一登入 (SSO)、多因素身份驗證 (MFA)、存取管理、目錄服務和資料存取管治等功能。

主要亮點

- 消費者身分和存取管理 (CIAM) 使企業能夠安全地收集、儲存和管理消費者身分和個人資料資料,並監控和限制消費者對軟體和服務的存取。

- CIAM 包括客戶入職、自助服務帳戶管理、同意和偏好管理、單一登入 (SSO)、多因素身份驗證 (MFA)、存取管理、目錄服務和資料存取管治等功能。

- 客戶對資料安全的期望和擔憂不斷增加,加上美國不斷增強的技術力和監管要求,促使消費者採取積極主動的安全措施。這推動了對消費者身分和存取管理 (CIAM) 解決方案的需求。

- 駭客瞄準多個平台和提供者的消費者帳戶,讓他們可以存取多個系統,因此一個人的資料經常被用來滲透另一個人的帳戶。這意味著從他人那裡獲取的個人資訊或身分證號碼可能導致嚴重的資料外洩甚至更嚴重的犯罪,例如從金融轉帳或保險提供者中刪除客戶資料。

- 許多網站利用網際網路為客戶提供基本服務。使用者對 CIAM 系統的需求日益成長。為了應對 COVID-19 疫情,一些政府和監管機構已要求公共和私營企業採用新的遠程辦公技術並實施社交隔離。

美國消費者身分和存取管理市場的趨勢

雲端運算領域有望推動成長

- 雲端技術使服務供應商能夠輕鬆提供對共用資源池(包括網路、伺服器、儲存、自訂和客製化服務)的隨選存取。

- 雲端運算為消費者提供了可擴展性、靈活性、快速投資回報以及快速部署硬體和軟體的優勢。此外,消費者還將享受一系列好處,包括改進的資料儲存以及無縫存取網際網路、電子郵件、社交媒體和其他類型的資訊。正是由於這些優勢,各種消費品公司和眾多消費者都在採用雲端技術。

- 由於對雲端技術的需求不斷成長,消費者身分和存取管理解決方案正在雲端中開發和使用。雲端基礎的CIAM 解決方案比本地解決方案具有多項優勢:

- 考慮從本地 CIAM 解決方案遷移到雲端基礎的用戶主要檢查潛在解決方案的關鍵功能,例如透過一個中央主機支援各種作業系統、平台和供應商,從任何地方提供對所有平台資源的一致、受控訪問,提高合規性和審核,以及加快部署速度。

網路攻擊增加推動美國市場成長

- 在數位化的世界裡,一切活動都在網路上進行,網路犯罪的誕生威脅著人身安全,並造成了經濟和其他損失。在美國各地用戶資料外洩事件日益增多的背景下,該地區對消費者身分識別解決方案的需求也隨之增加。

- 此外,網路犯罪分子一直在尋找新的方法來利用這一點,最近該地區發生的一系列針對不同用戶的重大資料外洩事件再次證明了安全系統往往比你想像的更脆弱。美國則位居第二,截至 2023 年,共有 285 個使用者帳號遭入侵。

- 此外,儘管財富 500 強公司的網路攻擊和資料外洩事件佔據頭條新聞,但用戶對網路安全和保險的需求開始大幅增加。這導致網路威脅情勢不斷擴大,從而引發消費者對身分和存取管理解決方案的需求。

- 此外,隨著消費者越來越意識到此類違規行為的風險,新資料保護法規的實施預計將刺激新興的消費者身分和存取管理市場。

美國消費者身分和存取管理產業概況

美國消費者身分和存取管理市場似乎分散,由多家公司組成。此外,知名市場參與企業正在大力投資研發,以增強安全性,並為消費者身分存取管理市場產品提供有效的解決方案,從而加劇了市場競爭。主要公司包括微軟公司、SAP SE、Salesforce Inc. 和 IBM 公司。

- 2024 年 4 月,Akamai Technologies, Inc. 宣布推出 Akamai Guardicore 平台,協助企業達成零信任目標。 Akamai Guardicore 平台是第一個將業界領先的零信任網路存取(ZTNA) 與微分段相結合的安全平台,可協助安全團隊阻止勒索軟體、滿足合規性要求並保護混合勞動力和混合雲端基礎設施。

- 2023 年 10 月 Okta Inc.Identity Threat Protection AI 為 Okta Workforce Identity Cloud 推出新產品,以即時偵測並回應基於身分的威脅。身分威脅防護利用 Okta 的 AI,根據從組織的安全堆疊中提取的資訊,在用戶登入時將安全性擴展到身份驗證之外。這使得管理員和安全團隊能夠在整個活動會話中持續評估使用者風險,並自動回應整個生態系統中的身分威脅。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 市場促進因素

- 網路攻擊增加

- 對個人資料隱私的擔憂日益加劇

- 市場限制

- 缺乏隱私法規

- COVID-19對市場的影響

第5章:技術展望

第6章市場區隔

- 雲

- 本地

第7章競爭格局

- 公司簡介

- IBM Corporation

- Microsoft Corporation

- Salesforce Inc.

- SAP SE

- Okta

- Akamai Technologies

- Ping Identity Holding Corp.

- ForgeRock Inc.

- Ubisecure Inc.

- Auth0 Inc.

- WSO2 LLC

- Open Text Corporation

- Optimal IDM

- Loginradius Inc.

第8章 市場機會與未來趨勢

The US Consumer Identity And Access Management Market size is estimated at USD 7.36 billion in 2025, and is expected to reach USD 15.15 billion by 2030, at a CAGR of 15.53% during the forecast period (2025-2030).

CIAM includes features such as customer registration, self-service account management, consent and preference management, single sign-on (SSO), multi-factor authentication (MFA), access management, directory services, and data access governance.

Key Highlights

- Through consumer identity and access management (CIAM), businesses can securely collect, store, and manage consumer identity and profile data and monitor and restrict consumer access to software and services.

- CIAM includes features such as customer registration, self-service account management, consent and preference management, single sign-on (SSO), multi-factor authentication (MFA), access management, directory services, and data access governance.

- With the increase in customer expectations and concerns regarding their data security, coupled with the growing technological capabilities and regulatory requirements in the United States, consumers are stimulated to adopt a proactive approach to security. Thus, this fuels the demand for consumer identity and access management (CIAM) solutions.

- As hackers target consumer accounts across several platforms and providers with access to multiple systems, data from one individual is frequently used to get into another's account. This means that personal information or identity numbers acquired from another individual can lead to significant data breaches and even more serious crimes, like financial transfers or deleting client data from an insurance provider.

- Several websites are using the Internet to offer essential services to customers. The need for a CIAM system grew among users. Several governments and regulatory bodies ordered public and private businesses to adopt new teleworking techniques and preserve social distancing in the wake of the COVID-19 pandemic.

USA Consumer Identity and Access Management Market Trends

Cloud Segment is Expected to Gain Significant Traction

- Cloud technologies make it easy for service providers to offer on-demand access to a shared pool of resources, e.g., networks, servers, storage, applications, and custom services that can be quickly set up and discharged with low management efforts.

- Consumers can benefit from advantages such as scalability, flexibility, quick returns, and rapid implementation of hardware and software through cloud computing. In addition, consumers benefit from a range of benefits, such as improved data storage and seamless access to the Internet, email, social media, and other types of information. The adoption of cloud technologies by different consumer product companies and many consumers is due to these advantages.

- Consumer identity and access management solutions are being developed and used in the cloud as a result of an increasing demand for cloud technologies. Cloud-based CIAM solutions offer a variety of benefits compared to on-premise solutions.

- Users who have been considering moving from an on-premise CIAM solution to a cloud-based CIAM solution are primarily checking the potential solutions for their capabilities concerning critical features that include supporting a wide range of operating systems, platforms, and providers through one central console, providing consistent control access to all of the platform's resources from anywhere, increased compliance and audibility, and increased speed of deployment.

Increasing Cyber Attacks Drive Market Growth in the United States

- In the digitalized world, when every activity is online, the birth of cybercrime has threatened the safety of individuals, resulting in financial or other losses. The need for consumer identity solutions in the region is being driven by an increasing number of data breaches among different users within the United States.

- In addition, new methods are constantly being explored by cyber criminals, and a series of major data breaches across the various users in the region have once again shown that supposedly secure systems are often surprisingly vulnerable. The United States ranked second, with 285 users' accounts breached as of 2023.

- Furthermore, while cyberattacks and data breaches at Fortune 500 companies tend to dominate the headlines, users are starting to push the demand for cybersecurity and insurance significantly. Due to this, the cyber threat landscape is growing, leading to their appetite for consumer identity and access management solutions.

- Moreover, the introduction of new rules on data protection is expected to boost the country's emerging market for access management and consumer identity as consumers are informed about the risks posed by such breaches.

USA Consumer Identity and Access Management Industry Overview

The US consumer identity and access management market appears to be fragmented due to the presence of many players. Furthermore, prominent market participants invest heavily in research and development to strengthen security and launch efficient solutions in consumer identity, and access management market products are driving the competition in the market. Major players include Microsoft Corporation, SAP SE, Salesforce Inc., and IBM Corporation.

- April 2024: Akamai Technologies Inc. announced the launch of the Akamai Guardicore Platform, which helps businesses meet their zero trust goals. The Akamai Guardicore Platform is the first security platform to combine industry-leading zero trust network access (ZTNA) and micro-segmentation to help security teams stop ransomware, meet compliance mandates, and secure their hybrid workforce and hybrid cloud infrastructure.

- October 2023: Okta Inc. Identity Threat Protection AI announced a new product for Okta workforce identity cloud, which provides real-time detection and response to identity-based threats. The ID Threat Protection uses Okta AI to extend security beyond authentication at any time a user is logged in based on information drawn from an organization's security stack. This enables administrators and security teams to continuously assess user risk throughout active sessions, which automatically responds to identity threats across their entire ecosystem.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Cyber Attacks

- 4.2.2 Growing Personal Data Privacy Concerns

- 4.3 Market Restraints

- 4.3.1 Lack of Regulations Regarding Privacy

- 4.4 Impact of COVID-19 on the Market

5 TECHNOLOGY OUTLOOK

6 MARKET SEGMENTATION

- 6.1 Cloud

- 6.2 On-premise

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Microsoft Corporation

- 7.1.3 Salesforce Inc.

- 7.1.4 SAP SE

- 7.1.5 Okta

- 7.1.6 Akamai Technologies

- 7.1.7 Ping Identity Holding Corp.

- 7.1.8 ForgeRock Inc.

- 7.1.9 Ubisecure Inc.

- 7.1.10 Auth0 Inc.

- 7.1.11 WSO2 LLC

- 7.1.12 Open Text Corporation

- 7.1.13 Optimal IDM

- 7.1.14 Loginradius Inc.