|

市場調查報告書

商品編碼

1692468

碳酸鋰-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Lithium Carbonate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

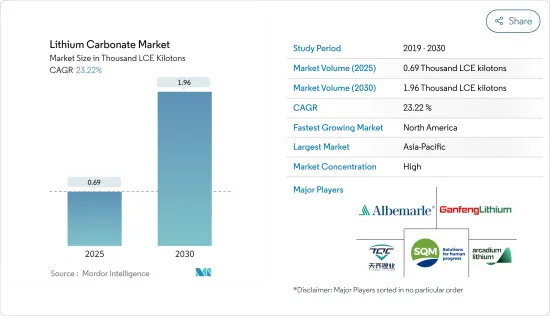

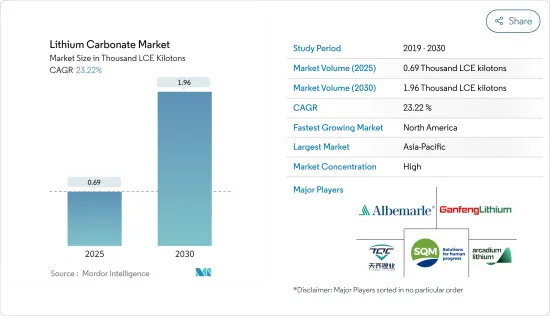

碳酸鋰市場規模預計在2025年為690千噸鋰,預計2030年達到1960千噸鋰,預測期間(2025-2030年)的複合年成長率為23.22%。

預計鋰離子電池需求的成長以及玻璃和陶瓷產業投資的增加將推動碳酸鋰市場的發展。然而,鋰提取的限制和鋰礦的地理限制預計會阻礙市場成長。

主要亮點

- 預計冶金業不斷擴大的商業機會將在預測期內為市場帶來機會。

- 預計亞太地區將主導市場。預計預測期內其成長率還將顯著。這是因為鋰離子電池、製藥、牙科以及玻璃和陶瓷應用對碳酸鋰的需求不斷增加。

碳酸鋰市場趨勢

鋰離子電池應用可望推動成長

- 根據EV Volumes預測,2023年全球電動車總銷量將成長15.8%,達到1,410萬輛,而2022年的總銷量為1,050萬輛。因此,電動車銷量的成長預計將增加對磷酸鋰鐵(LFP)電池的需求。

- 鋰離子電池由於重量輕、自放電率低、易於維護和擴充性高,擴大被光伏系統(利用光伏效應捕獲陽光並將其轉化為電能的工程設備)中的太陽能電池組所採用。北美、亞太和歐洲太陽能光電裝置的強勁成長正在推動整個市場對鋰離子電池的需求。

- 根據國際能源總署 (IEA) 的數據,受電動乘用車銷量大幅成長的推動,汽車鋰離子電池的需求預計將激增 65%,從 2021 年的 330全球整體時增至 2022 年的 550 吉瓦時,2022 年全球新註冊的電動乘用車數量將與前一年同期比較成長 55%。

- 鋰空氣電池領域的最新趨勢顯示出滿足各個工業領域日益成長的需求的跡象。例如,2023年2月,伊利諾伊理工學院(IIT)和美國能源局(DOE)阿貢國家實驗室的研究人員宣布研發出一種鋰空氣電池,一次充電可為電動車行駛1000多英里。該團隊開發的新型電池未來可能用於國內飛機和遠距卡車。

- 預計全球電池能源系統的興起將在未來幾年推動碳酸鋰的需求。根據 Rystad 2022 年能源報告,預計 2022 年至 2030 年間,年度電池能源儲存系統(BESS) 將成長十倍。預計全球新安裝的 BESS 數量將在 2022 年達到 43GWh,到 2030 年將達到 421GWh。

- 預計這些因素將在預測期內推動全球碳酸鋰市場成長。

預計亞太地區將佔據主要市場佔有率

- 預計預測期內亞太地區將主導碳酸鋰市場。中國、日本和印度等國家對碳酸鋰的需求很高,因為它用於鋰離子電池、製藥和鋁生產。

- 中國是碳酸鋰淨進口國。根據國際貿易中心(Trademap)的數據,該國在2023年第四季進口了價值11.7億美元的碳酸鋰,略低於2022年同期。本季度,該國從智利進口了近88%的碳酸鋰。同時,該國在2023年第四季出口了價值2,823萬美元的碳酸鋰。

- 據投資印度 (Invest India) 稱,印度製藥業的規模預計將從 2023 年的 500 億美元增至 2030 年的 1,300 億美元。政府的政策和計劃正在支持該行業的發展。例如,印度製藥部加強製藥業(SPI)計畫總資金為 6,090 萬美元(50 億印度盧比),正在向全國現有的製藥叢集和中小微型企業提供急需的支持,以提高生產力、品質和永續性。

- 印度鋁產量的增加預計將增加該國對碳酸鋰的需求。例如,根據礦業部的數據,預計2023年該國的鋁產量將達到350萬噸,比2022年下降13%。預計到 2025 年,國內鋁需求將翻倍,這將推動碳酸鋰的需求。

- 日本鋁合金協會表示,2023年再生裸金屬及再生鋁合金裸金屬的產量及出貨量較上年均增加。預計2023年的產量將比2022年增加0.8%至739,580噸,出貨量預計將增加0.6%至738,199噸。預計未來幾年國內鋁及其合金產量的增加將推動碳酸鋰的需求。

- 根據水泥協會預測,2023年國內水泥消費量預計為3,537萬噸,與前一年同期比較下降5.6%。因此,未來幾年水泥消費量的下降可能會影響日本所研究市場的成長。

- 由於這些因素,預計亞太碳酸鋰市場在預測期內將穩定成長。

碳酸鋰產業概況

全球碳酸鋰市場本質上是一體化的,主要企業貢獻了大部分市場佔有率。市場主要企業包括(不分先後順序)Albemarle Corporation、SQM SA、贛鋒鋰業集團、天齊鋰業和Arcadium Lithium。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 鋰離子電池需求不斷成長

- 增加對玻璃和陶瓷產業的投資

- 市場限制

- 鋰提取限制和鋰礦的地理限制

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 按年級

- 技術等級

- 電池級

- 工業級

- 按應用

- 鋰離子電池

- 製藥和牙科

- 玻璃和陶瓷

- 鋁製造

- 水泥工業

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Albemarle Corporation

- Arcadium Lithium

- Jiangxi Ganfeng Lithium Group Co. Ltd

- Levertonhelm Limited

- Lithium Americas Corp.

- Lithium Argentina Corp.

- Shandong Ruifu Lithium Co. Ltd

- SQM SA

- Tianqi Lithium Industry Co. Ltd

第7章 市場機會與未來趨勢

- 冶金業的成長機會

The Lithium Carbonate Market size is estimated at 0.69 thousand lce kilotons in 2025, and is expected to reach 1.96 thousand lce kilotons by 2030, at a CAGR of 23.22% during the forecast period (2025-2030).

The growing demand for lithium-ion batteries and the increasing investments in the glass and ceramics industries are expected to drive the market for lithium carbonate. On the flip side, constraints in lithium extraction and geographical restrictions of lithium mines are expected to hinder the growth of the market.

Key Highlights

- The growing opportunity in the metallurgy industry is expected to create opportunities for the market during the forecast period.

- The Asia-Pacific region is expected to dominate the market. It is also expected to register a considerable growth rate during the forecast period. This is due to the rising demand for lithium carbonate from Li-ion batteries, pharmaceuticals and dental, and glass and ceramics applications.

Lithium Carbonate Market Trends

Li-Ion Battery Applications Expected to Drive Growth

- According to EV Volumes, in 2023, the total sales of electric vehicles globally increased by 15.8%, with total sales reaching 14.1 million units compared to 2022, when total sales stood at 10.5 million units. Thus, increasing sales of electric vehicles is expected to increase the demand for lithium iron phosphate (LFP) batteries.

- Li-ion batteries are being increasingly employed for solar energy battery bank applications in solar photovoltaic systems (engineered devices that capture and convert sunlight into electricity using the photovoltaic effect) on account of being lightweight, having low self-discharge, low maintenance, and high scalability. The high growth of solar power installation in North America, Asia-Pacific, and Europe is driving the demand for Li-ion batteries across the market.

- According to the International Energy Agency (IEA), the demand for automotive Li-ion batteries jumped by a whopping 65% in 2022, reaching 550 GWh, up from 330 GWh in 2021, propelled by the tremendous rise in electric passenger car sales as evidenced by the new EV passenger car registrations increasing by 55% in 2022 y-o-y globally.

- The development in the lithium-air battery segment in recent years has shown signs of meeting the growing demand from various industry sectors. For instance, in February 2023, researchers at the Illinois Institute of Technology (IIT) and the US Department of Energy's (DOE) Argonne National Laboratory announced the development of a lithium-air battery that could power electric vehicles for more than a thousand miles on a single charge. The team's new battery design could also power domestic airplanes and long-haul trucks in the future.

- The rising battery energy system globally is expected to boost the demand for lithium carbonate in the coming years. As per the Rystad Energy report 2022, the annual battery energy storage system (BESS) is expected to grow ten times from 2022 to 2030. The new global BESS installations are expected to reach 421 GWh by 2030 from 43 GWh in 2022.

- Owing to all these factors, the market for lithium carbonate is likely to grow globally during the forecast period.

Asia-Pacific Projected to Hold Major Market Share

- Asia-Pacific is expected to dominate the lithium carbonate market during the forecast period. There is a rising demand for lithium carbonate from the Li-ion battery, pharmaceutical, and aluminum production applications in countries like China, Japan, and India.

- China is a net importer of lithium carbonate. According to the International Trade Centre (Trademap), in the fourth quarter of 2023, the country imported USD 1,170 million worth of lithium carbonate, which is slightly lower than the same period in 2022. The country imported nearly 88% of lithium carbonate from Chile in the same quarter. On the other hand, the country exported USD 28.23 million worth of lithium carbonate in Q4 2023.

- The pharmaceutical industry in India is expected to reach USD 130 billion by 2030 from USD 50 billion in 2023, according to Invest India. The government policies and schemes are supporting the growth of the industry. For instance, The Ministry's scheme "Strengthening of Pharmaceutical Industry (SPI)," with a total financial outlay of USD 60.9 million (INR 500 crores), extends support required to existing pharma clusters and MSMEs across the country to improve their productivity, quality, and sustainability.

- The rising aluminum production in India is expected to increase the demand for lithium carbonate in the country. For instance, aluminum production in the country reached 3.50 million tons in 2023, which decreased by 13% compared to 2022, according to the Ministry of Mines. The demand for aluminum in the country is expected to double by 2025, which is projected to propel the demand for lithium carbonate.

- According to the Japan Aluminum Alloy Association, the production and shipment volumes of secondary aluminum ingots and secondary aluminum alloy ingots in 2023 have both increased compared to the previous year. Production volume increased by 0.8% to 730,958 tons in 2023, and shipment volume increased by 0.6% to 738,199 tons in 2023 compared to 2022. The rising aluminum and its alloy production in the country is likely to foster the demand for lithium carbonate in the coming years.

- According to the Cement Association of Japan, domestic cement consumption reached 35.37 million tons in 2023, which declined by 5.6% compared to the previous year. Thus, declining cement consumption will likely impact the growth of the market studied in Japan in the coming years.

- Due to these factors, the lithium carbonate market in Asia-Pacific is expected to experience steady growth during the forecast period.

Lithium Carbonate Industry Overview

The global lithium carbonate market is consolidated in nature, with top players contributing to the major share of the market. Some of the major players in the market include (not in any particular order) Albemarle Corporation, SQM SA, Ganfeng Lithium Group Co. Ltd, Tianqi Lithium Industry Co. Ltd, and Arcadium Lithium.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Demand From Lithium-ion Batteries

- 4.1.2 Increasing Investments in the Glass and Ceramics Industry

- 4.2 Market Restraints

- 4.2.1 Constraints in Lithium Extraction and Geographical Restriction of Lithium Mines

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Grade

- 5.1.1 Technical Grade

- 5.1.2 Battery Grade

- 5.1.3 Industrial Grade

- 5.2 By Application

- 5.2.1 Li-ion Battery

- 5.2.2 Pharmaceuticals and Dental

- 5.2.3 Glass and Ceramics

- 5.2.4 Aluminum Production

- 5.2.5 Cement Industry

- 5.2.6 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Albemarle Corporation

- 6.4.2 Arcadium Lithium

- 6.4.3 Jiangxi Ganfeng Lithium Group Co. Ltd

- 6.4.4 Levertonhelm Limited

- 6.4.5 Lithium Americas Corp.

- 6.4.6 Lithium Argentina Corp.

- 6.4.7 Shandong Ruifu Lithium Co. Ltd

- 6.4.8 SQM SA

- 6.4.9 Tianqi Lithium Industry Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Opportunity in the Metallurgy Industry