|

市場調查報告書

商品編碼

1692465

汽車煞車皮:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Automotive Brake Pad - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

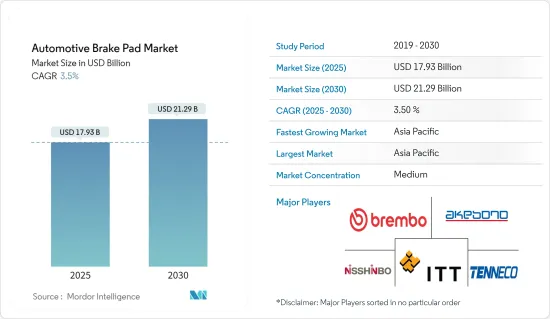

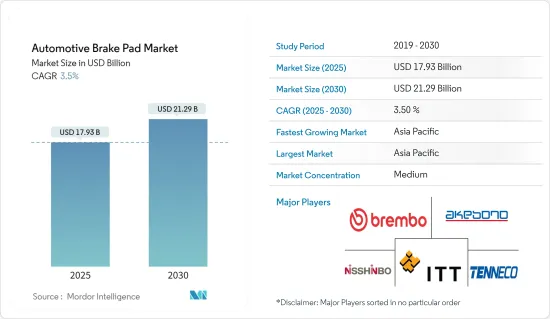

2025 年汽車煞車皮市場價值預計為 179.3 億美元,預計到 2030 年將達到 212.9 億美元,市場估計和預測期(2025-2030 年)的複合年成長率為 3.5%。

消費者和當局的安全意識不斷增強,推動了汽車煞車系統的重大發展,從而提高了安全性並減少了道路事故。隨著技術的進一步進步,市場有望看到更安全、更可靠的煞車系統。

汽車製造商正在將創新煞車皮融入他們的車輛中,以提高煞車效率。該行業的公司提供各種含有環保煞車皮材料的產品。預計這些因素將在預測期內推動市場成長。

此外,快速的都市化、交通堵塞以及對高性能汽車不斷成長的需求正在推動對乘用車和電動車(EV)的需求。電動車的廣泛應用為煞車皮製造商創造了機會,使他們能夠針對電動車再生煞車的獨特要求開發客製化解決方案。汽車需求的激增正在擴大煞車皮市場。

汽車煞車皮市場趨勢

乘用車是市場領導者

乘用車市場是汽車煞車皮市場最大的細分市場,其促進因素包括乘用車數量的增加、消費者對汽車升級的偏好變化以及煞車系統的技術進步等。

道路上客運車輛的大量增加直接導致了煞車皮需求的增加。 2023年全球乘用車銷量預計將達到5,701萬輛,而2022年則為5,075萬輛,與前一年同期比較去年同期成長約1.2%。乘用車產銷量的不斷成長,以及電動車在全球範圍內的廣泛應用,預計將在未來幾年推動對具有更高耐用性和散熱能力的先進汽車煞車皮產品的需求激增。

嚴格的安全法規和消費者對汽車安全的認知不斷提高也在推動研究市場的發展。乘用車是個人和家庭使用最廣泛的交通工具,容易發生事故,並受到嚴格的安全法規的約束。許多地區的政府都推出了有關車輛煞車系統的強制性法規。

- 例如,2023 年 7 月,NHTSA提案了新的聯邦機動車安全標準,要求輕型車輛配備自動緊急煞車系統,包括行人用AEB。 NHTSA 預計,擬議的規則每年將挽救至少 360 人的生命,並減少至少 24,000 起傷害事件。

高檔和豪華汽車製造商加大對具有先進功能的新產品的開發投資,加上已開發國家對乘用車的需求不斷增加,迫使市場主要企業投資研發,引進尖端材料和設計,以提高煞車皮的耐用性、性能和安全性。

- 例如,日本鳥井產業株式會社於2023年8月開始生產煞車皮,擴大其綜合解決方案。此產品系列新增的煞車皮適用於各種品牌的乘用車。這些煞車皮是作為OEM(目的地設備製造商)產品精心製造的,確保了卓越的品質。

因此,預計乘用車領域在預測期內將顯著成長。

亞太地區具有最大的成長潛力

從全球來看,汽車煞車皮市場以亞太地區為主,其次是歐洲和北美。由於嚴格的安全標準和政府法規,中國、印度、日本和韓國等國家預計將對全球防鎖死煞車系統收益做出重大貢獻。

中國是全球最大的汽車市場,預計將成為重點地區之一。 2022年,中國是全球最大的區域汽車市場,銷售超過2,360萬輛。這種成長直接影響了對煞車皮的需求,因為每輛車都需要這個重要零件。中國的汽車工業不斷發展,煞車皮技術也不斷發展。

降低噪音、延長墊片壽命和提高煞車性能是至關重要的特性。在噪音污染令人擔憂的城市環境中,對低噪音煞車皮的需求很強烈。中國煞車皮市場競爭激烈,國內外企業都在爭取市場佔有率。一些主要市場參與者正在大力投資在該國建立新的生產設施。

- 例如,美國供應商天納克於2023年6月設定了目標,透過專注於本土電動車製造商來提高其在中國的煞車零件業務的收益,而這些製造商也在推動中國煞車皮市場的發展。

此外,印度汽車產業的產量和銷售量正在成長,這使得該國成為煞車皮的潛在市場。售後市場在印度煞車皮市場中扮演重要角色。定期更換煞車皮對於道路安全和車輛維護以及推動售後市場銷售至關重要。眾多市場參與者正大力投資在該國建立新的生產單位,以滿足國內外市場日益成長的需求,並提高盈利和市場佔有率。

- 例如,2023 年 3 月,印度和全球OEM商的層級供應商 Brakes India 推出了專為電動車量身定做的採用先進摩擦技術的 ZAP煞車皮。這款專用煞車皮專為滿足電動車客戶的特定需求而設計,具有更好的防腐保護和更安靜的運行性能。

由於亞太地區如此有利的發展,預測期內汽車煞車皮的需求可能會以適度的速度成長。

汽車煞車皮產業概況

汽車煞車皮市場主要企業。這個市場由少數製造公司主導,他們投入大量資金進行研發,將尖端技術融入其產品中,並不斷推出升級產品以保持競爭力。

- 2023 年 9 月,Brembo SpA 宣布了一項策略性舉措,以滿足乘用車和商用車對碳陶瓷煞車盤日益成長的需求。作為該計劃的一部分,Brembo SGL 碳陶瓷煞車公司 (BSCCB) 已投資 1.695 億美元,到 2027 年將其位於德國梅廷根和義大利斯泰扎諾的工廠的生產能力提高 70%。

- 2023 年 5 月,羅伯特博世有限公司 (Robert Bosch GmbH) 推出專為 TVS Apache 設計的新型精英煞車皮。採用獨特的 Abracoat 技術的條紋塗層的尖端墊片。

- 2023 年 3 月,Brakes India 推出 ZAP煞車皮,該煞車片採用專為電動車設計的卓越摩擦技術。這些墊片不僅具有出色的耐腐蝕性,而且還能提供安靜的煞車,直接滿足電池驅動汽車的需求。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 煞車皮材料和技術的進步

- 市場限制

- 煞車故障和產品召回

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 依材料類型

- 半金屬

- 無石棉有機物

- 低金屬

- 陶瓷製品

- 按職位類型

- 正面

- 後部

- 按銷售管道

- 目的地設備製造商(OEM)

- 售後市場

- 按車輛類型

- 搭乘用車

- 商用車

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 韓國

- 日本

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東和非洲

- 北美洲

第6章競爭格局

- 供應商市場佔有率

- 公司簡介

- Brembo SpA

- ITT Inc.

- Robert Bosch GmBH

- Tenneco Inc.

- Akebono Brake Industry Co. Ltd

- ZF Friedrichshafen AG

- Continental AG

- Federal-Mogul Holdings LLC

- BorgWarner Inc.

- Nisshinbo Holdings Inc.

- Garrett Motion Inc.

第7章 市場機會與未來趨勢

第8章 主要供應商訊息

The Automotive Brake Pad Market size is estimated at USD 17.93 billion in 2025, and is expected to reach USD 21.29 billion by 2030, at a CAGR of 3.5% during the forecast period (2025-2030).

Increasing awareness about safety among consumers and authorities has led to significant developments in the automotive brake system, resulting in improved security and reduced accidents on the road. With further technological advancements, the market is expected to see even safer and more reliable brake systems.

Individual vehicle manufacturers are incorporating innovative brake pads in their vehicles to improve braking efficiency. Industry players offer a wide range of products that include environmentally friendly brake pad materials. Factors like these are expected to drive the market's growth during the forecast period.

Furthermore, rapid urbanization, traffic congestion, and the growing demand for high-performance vehicles are propelling the demand for passenger and electric vehicles (EVs). The proliferation of electric vehicles is presenting opportunities for brake pad manufacturers to develop specialized solutions tailored to the unique requirements of regenerative braking in EVs. This surge in demand for automobiles, in turn, augments the brake pad market.

Automotive Brake Pad Market Trends

Passenger Car is the Leading Segment in the Market

The passenger car segment is the largest segment in the automotive brake pad market, driven by factors like the increasing volume of passenger cars, changing consumer preferences toward vehicle upgradation, technological advancement in braking systems, etc.

The huge volume of passenger cars on the roads contributes directly to the demand for brake pads. In 2023, 57.01 million units of passenger cars were sold globally, as compared to 50.75 million units in 2022, registering a year-on-year growth of about 1.2%. The increase in passenger car production and sales and the anticipated greater adoption of electric vehicles across the globe are expected to create a surge in demand for advanced automotive brake pad products with higher durability and greater heat dissipation capability in the coming years.

Stringent safety regulations and increasing consumer awareness regarding vehicle safety also drive the market studied. Being the most widely used personal mode of transport for individuals and families, passenger cars are prone to accidents and thus are subject to strict safety norms. Governments in many regions have introduced mandatory regulations regarding braking systems in cars.

- For instance, in July 2023, the NHTSA proposed a new Federal Motor Vehicle Safety Standard to require automatic emergency braking systems, including pedestrian AEB, on light vehicles. The NHTSA projects that this proposed rule would save at least 360 lives a year and reduce injuries by at least 24,000 annually.

The rising investments from premium and luxury car manufacturers to develop new products with advanced features, coupled with the increasing demand for passenger cars in developed nations, are compelling key market players to invest in research and development to introduce advanced materials and designs that enhance the durability, performance, and safety of brake pads.

- For instance, in August 2023, Totachi Industrial Co. Ltd, based in Japan, expanded its comprehensive solution by initiating the manufacturing of brake pads. The latest addition to its product lineup encompasses brake pads designed for passenger cars across diverse brands. These brake pads are meticulously crafted to serve as OEM (original equipment manufacturer) products, guaranteeing exceptional quality.

Hence, the passenger car segment is expected to witness significant growth during the forecast period.

Asia-Pacific Witnessing Highest Potential for Growth

Globally, Asia-Pacific is the most dominant region in the automotive break pad market, followed by Europe and North America. Asia-Pacific is likely to possess the highest growth rate, with countries like China, India, Japan, and South Korea expected to contribute significantly in terms of revenue in the global anti-lock braking system due to safety norms and firm government regulations.

China is expected to emerge as one of the major regions, owing to its largest automotive market in the world. China was the world's largest regional market for automobiles in 2022, accounting for over 23.6 million unit sales alone. This growth directly influences the demand for brake pads, as each vehicle requires this essential component. The automotive industry in China is evolving, and so is the brake pad technology.

Noise reduction, extended pad life, and enhanced braking performance are crucial features. In urban environments where noise pollution is a concern, low-noise brake pads are highly sought after. The brake pad market in China is highly competitive, with both local and international players vying for market share. Multiple key market players are making substantial investments to establish new production facilities within the country.

- For instance, in June 2023, Tenneco, a US supplier, set its sights on boosting revenue from its brake parts business in China by focusing on local manufacturers of electrified vehicles, which also drive the brake pad market in the country.

Moreover, the growing vehicle production and sales in India's automotive sector make the country a potential market for brake pads. The aftermarket segment plays a substantial role in the Indian brake pad market. Regular brake pad replacement is essential for road safety and vehicle maintenance, which fuels aftermarket sales. Numerous players in the market are investing heavily in setting up new production units in the country to meet the rising demands for local and international markets and enhance their profitability and market share.

- For instance, in March 2023, Brakes India, a tier-1 supplier to both Indian and global OEMs, introduced ZAP brake pads featuring advanced friction technology tailored for electric vehicles. These specialized brake pads are designed to meet the unique needs of electric vehicle customers, providing improved corrosion protection and ensuring quieter braking.

Due to such favorable developments across Asia-Pacific, the demand for automotive brake pads is likely to grow at a decent rate during the forecast period.

Automotive Brake Pad Industry Overview

The automotive brake pad market is primarily dominated by key players such as ITT Inc., Brembo SpA, ADVICS, Beijing Delphi Wanyuan Engine Management Systems Co. Ltd, BorgWarner Shanghai Automotive Fuel Systems Co. Ltd, Robert Bosch GmBH, Delphi Technologies, Tenneco Inc., Akebono Brake Company, and EBC Brakes, among others. Few manufacturing companies dominate this market and invest heavily in research and development to integrate state-of-the-art technology into their products, consistently introducing upgraded offerings to maintain their competitive edge.

- September 2023: Brembo SpA announced a strategic initiative to meet the increasing demand for carbon ceramic brake discs in passenger cars and commercial vehicles. As part of the plan, Brembo SGL Carbon Ceramic Brakes (BSCCB) invested a whopping USD 169.5 million by 2027 to expand production capacities by 70% at its Meitingen, Germany, and Stezzano, Italy facilities.

- May 2023: Robert Bosch GmbH launched the new Elite brake pads specifically tailored for the TVS Apache. These cutting-edge pads boast a stripe-coating infused with the proprietary ABRACOAT technology.

- March 2023: Brakes India introduced ZAP brake pads, leveraging superior friction technology specifically designed for electric vehicles. These pads not only offer better corrosion protection but also ensure silent braking, catering directly to the needs of battery-powered.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Advancements in Brake Pad Materials and Technologies

- 4.2 Market Restraints

- 4.2.1 Brake Malfunctions and Product Recalls

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value (USD))

- 5.1 By Material Type

- 5.1.1 Semi-metallic

- 5.1.2 Non-asbestos Organic

- 5.1.3 Low-metallic

- 5.1.4 Ceramic

- 5.2 By Position Type

- 5.2.1 Front

- 5.2.2 Rear

- 5.3 By Sales Channel Type

- 5.3.1 Original Equipment Manufacturers (OEMs)

- 5.3.2 Aftermarket

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Commercial Vehicles

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 South Korea

- 5.5.3.4 Japan

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the world

- 5.5.4.1 South America

- 5.5.4.2 Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Brembo SpA

- 6.2.2 ITT Inc.

- 6.2.3 Robert Bosch GmBH

- 6.2.4 Tenneco Inc.

- 6.2.5 Akebono Brake Industry Co. Ltd

- 6.2.6 ZF Friedrichshafen AG

- 6.2.7 Continental AG

- 6.2.8 Federal-Mogul Holdings LLC

- 6.2.9 BorgWarner Inc.

- 6.2.10 Nisshinbo Holdings Inc.

- 6.2.11 Garrett Motion Inc.