|

市場調查報告書

商品編碼

1692453

交流 (AC)馬達-市場佔有率分析、行業趨勢與統計、成長預測(2025-2030 年)Alternating Current (AC) Motor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

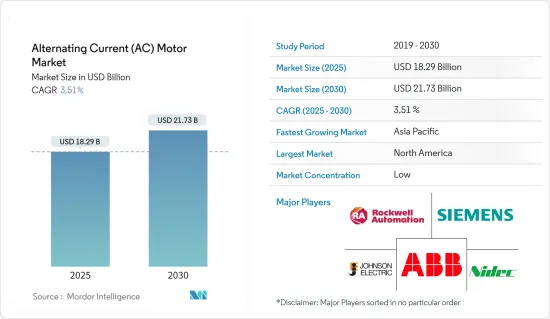

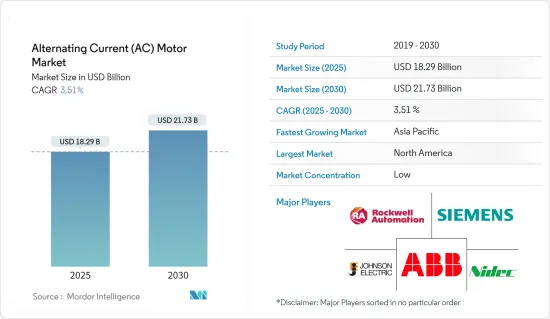

交流馬達市場規模預計在 2025 年為 182.9 億美元,預計到 2030 年將達到 217.3 億美元,預測期內(2025-2030 年)的複合年成長率為 3.51%。

主要亮點

- AC馬達AC馬達一種利用電磁感應現象將交流電轉換為機械動力的馬達。交流電驅動此馬達。定子和轉子是AC馬達最重要的部件。定子是馬達的靜止部分,轉子是馬達的旋轉部分。AC馬達有單相和三相。

- 三相交流馬達主要用於工業中將大量電能轉換為機械能。單相交流AC馬達主要用於小功率的轉換。單相交流AC馬達大多體積較小,在家庭、辦公室、商業關係、工廠等提供各種服務。大多數電器產品,如冰箱、電風扇、洗衣機、烘乾機和攪拌機,都使用單相交流AC馬達。

- 預計在預測期內,電動車的普及將支持市場成長。多年來,汽車產業的日產量顯著增加。根據國際汽車工業組織(OICA)的數據顯示,去年全球汽車產量約8,500萬輛,與前一年同期比較增加6%。去年,中國、日本和德國是最大的轎車和商用車生產國。

- AC馬達將各種其他組件組合成一個物理單元。標準配置包括引擎和驅動器、整合式編碼器、控制器、電纜和通訊連接埠。這增加了整個系統的成本。AC馬達所需的資本投資高於其他傳統馬達,這對市場成長構成了挑戰。

- 新冠疫情對全球市場的影響巨大,多個國家政府實施的防控措施對工業部門的成長產生了重大影響。結果,所研究的市場由於供應鏈問題而經歷了放緩,尤其是在初始階段。不過,隨著主要終端用戶產業全面恢復營運,智慧AC馬達的需求預計將會增加。

交流馬達市場趨勢

石油和天然氣產業預計將佔據主要市場佔有率

- 石油和天然氣產業在推動市場成長方面發揮關鍵作用。AC馬達因其簡單、可靠且價格實惠而廣泛應用於該行業。AC馬達為鑽機系統和設備提供可靠、穩定的電力,在石油和天然氣行業中發揮至關重要的作用。這些馬達產生的能量為原油、天然氣和石油等寶貴資源的開採、加工、儲存和運輸提供動力。感應馬達和同步發電機用於為陸上和海上鑽井作業的各種應用提供動力。

- 石油和天然氣產業對AC馬達的需求不斷成長,這是由於人們越來越重視在惡劣運作環境下的能源效率和可靠性。此外,交流馬達還具有卓越的速度控制和監控能力。由於交流電動機能夠在各種環境條件下有效運行,並且與其他類型的電動馬達相比具有更長的使用壽命,因此在陸上石油和天然氣工業過程中對交流馬達的採用顯著增加。

- 額定電壓低於 1 千伏特 (kV) 的交流電機經常用於石油和天然氣設施中的較小設備,例如泵浦、風扇、鼓風機和小型壓縮機。額定電壓在1kV至6.6kV之間以及6.6kV以上的交流電機廣泛應用於石油和天然氣行業的中高功率應用。這些馬達通常用於大型壓縮機、發電機、泵浦和其他重型設備。額定電壓高於 6.6kV 的交流馬達具有幾個值得注意的特點,包括提高功率輸出、提高效率和提高過載能力。

- 根據國際能源總署(IEA)的最新預測,即使在目前的政策環境下,全球石油和天然氣需求也將在未來幾年達到高峰。國際能源總署預測,到本世紀末,全球石油需求將成長約 800 萬桶/日,從而增加對海上活動的需求。由於海上作業和投資的增加,預計AC馬達的需求將激增。這些馬達用於各種海上應用,包括鑽井鑽機、生產平台、浮式生產儲油卸油設備油船 (FPSO)、海底系統和其他海上設備。

- 此外,歐佩克報告稱,近期全球原油消費量(包括生質燃料)為每天9,957萬桶。預計未來幾年這數字將增加至1.0189億桶/日,最終達到1.098億桶/日。預計輕質油和柴油的需求將從每天 2,760 萬桶增至每天 3,010 萬桶。預計這些因素將推動業界對AC馬達的需求。

預計亞太地區市場將顯著成長

- 中國正經歷快速工業化進程,製造業、汽車業、電子業等各領域都在快速發展。AC馬達廣泛應用於泵浦、壓縮機、輸送機和風扇等工業機械設備,這推動了對AC馬達的需求。

- 中國專注於高階製造業、電力事業以及石油和天然氣工業,中國同時使用低壓和中壓驅動器。例如,中國政府雄心勃勃的「中國製造2025」舉措,部分受到德國工業4.0的啟發,旨在提高中國在製造業的競爭力。

- 預計印度將佔據全球AC馬達市場的巨大佔有率。該國市場的發展受到製造業對馬達日益成長的需求以及能源效率意識不斷增強的推動。此外,預計能源成本的上升將加速各行各業對同步馬達的採用。由於印度擁有大量馬達製造商,預計該國在預測期內將佔據相當大的市場佔有率。

- 日本政府積極主動減少碳排放,並推出了鼓勵工業界採用節能解決方案的支持政策。這推動了AC馬達在交通運輸和工業自動化等廣泛行業的進一步應用。

- 日本透過工業4.0策略在亞太地區向自動化工業經濟轉型中取得了長足進步,並已成為向亞太地區其他區域市場供應工廠自動化產品的製造業中心。

- 據國土交通省稱,截至 2023 年 5 月,電動車 (EV) 約佔韓國汽車市場的 1.8%。韓國政府設定目標,在未來幾年內將電動和氫動力汽車在新車銷售的比例提高到33%。電動車領域的這些發展可能為供應商投資製造設施創造重大機會,從而推動市場發展。

交流馬達市場概況

交流 (AC)馬達市場高度分散,主要參與者包括羅克韋爾自動化公司、西門子股份公司、德昌電機、日本電產株式會社和 ABB 有限公司。市場上的公司正在採用聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2024 年 5 月 - ABB 推出配備 AMXE250馬達和 HES580 逆變器的電動公車先進套件。此整合式推進系統旨在提高效率、可靠性和可用性,為永續運輸解決方案樹立新標準。

- 2024 年 5 月 - KPS Capital Partners LP 透過一家新成立的附屬公司達成最終協議,以 35 億歐元的企業價值從西門子股份公司收購 Innomotics GmbH。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 產業價值鏈分析

- 新冠疫情及其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 能源效率需求日益成長

- 工業自動化的興起

- 市場挑戰

- 初始成本高

第6章市場區隔

- 透過感應交流AC馬達

- 單相

- 變形怪

- 採用同步交流AC馬達

- 直流勵磁轉子

- 永久磁鐵

- 磁滯馬達

- 磁阻馬達

- 按最終用戶產業

- 石油和天然氣

- 化工和石化

- 發電

- 用水和污水

- 金屬與礦業

- 食品和飲料

- 離散製造業

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 義大利

- 法國

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲地區

- 北美洲

第7章:供應商排名分析

第8章競爭格局

- 公司簡介

- Rockwell Automation Inc.

- Siemens AG

- Johnson Electric

- Nidec Corporation

- ABB Ltd

- Franklin Electric Co.Inc.

- WEG Electric Corporation

- Yaskawa Electric Corporation

- Kirloskar Electric Co. Ltd

- Bosch Rexroth AG(ROBERT Bosch GmbH)

- Regal Rexnord Corporation

- SEVA-tec GmbH

第9章投資分析

第10章:投資分析市場的未來

The Alternating Current Motor Market size is estimated at USD 18.29 billion in 2025, and is expected to reach USD 21.73 billion by 2030, at a CAGR of 3.51% during the forecast period (2025-2030).

Key Highlights

- An AC motor is an electric motor that converts the alternating current into mechanical power using an electromagnetic induction phenomenon called an AC motor. An alternating current drives this motor. The stator and the rotor are the two most essential parts of an AC motor. The stator is the stationary part of the motor, and the rotor is the rotating part of the motor. The AC motor may be single-phase or three-phase.

- Three-phase AC motors are primarily applied in the industry for bulk power conversion from electrical to mechanical. Single-phase AC motors are mainly used for small power conversion. Single-phase AC motors are nearly small and provide various services in the home, office, business concerns, factories, etc. Almost all domestic appliances, such as refrigerators, fans, washing machines, hair dryers, and mixers, use single-phase AC motors.

- The growing adoption of electric vehicles is expected to support the market's growth during the forecast period. The automotive sector witnessed a significant increase in daily units produced over the years. According to the International Organization of Motor Vehicle Manufacturers (OICA), in the previous year, approximately 85 million motor vehicles were produced across the world, an increase of 6% compared to the year before it. China, Japan, and Germany were the largest producers of cars and commercial vehicles last year.

- AC motor integrates various other components into one physical unit. Standard configurations include the engine and drive, integrated encoders, controllers, cabling, and communication ports. This increases the overall cost of the system. The capital investment required for AC motors is greater than that required for other traditional motors, posing a challenge to the market's growth.

- A notable impact of the global outbreak of the COVID-19 pandemic has been observed on the market as various containment measures taken by governments across multiple countries, such as the implementation of lockdown, significantly impacted the growth of the industrial sector. As a result, a slowdown was witnessed in the studied market, especially during the initial phase, due to supply chain issues. However, with significant end-user industries resuming operations at total capacity, the demand for smart AC motors is anticipated to increase.

Alternating Current (AC) Motor Market Trends

The Oil and Gas Industry is Expected to Hold a Major Share in the Market

- The oil and gas industry plays a significant role in driving market growth. AC motors are extensively utilized within this industry due to their simplicity, reliability, and affordability. Electric AC motors play a crucial role in the oil and gas industry by delivering dependable and steady power to drill rig systems and equipment. These motors generate the necessary energy to facilitate the extraction, processing, storage, and transportation of valuable resources such as crude oil, natural gas, and petroleum. Induction motors and synchronous generators are employed to supply power for a wide range of applications in both onshore and offshore drilling operations.

- The rising demand for AC motors in the oil and gas sectors can be attributed to the growing emphasis on energy efficiency and reliability in challenging operational environments. Moreover, AC electric motors provide exceptional speed control and monitoring capabilities. The adoption of AC electric motors in onshore oil and gas industrial processes has witnessed a substantial increase owing to their ability to operate effectively in diverse environmental conditions and exhibit longer life cycles compared to alternative motor types.

- AC electric motors with a voltage rating below 1 kilovolt (kV) are frequently utilized in smaller equipment such as pumps, fans, blowers, and smaller compressors within oil and gas facilities. AC electric motors with a voltage rating ranging from 1 kV to 6.6 kV, as well as those exceeding 6.6 kV, are extensively employed in medium to high-power applications within the oil and gas industry. These motors are commonly found in larger compressors, generators, pumps, and other heavy-duty equipment. AC electric motors with a voltage rating exceeding 6.6 kV possess several notable characteristics, including increased power output, enhanced efficiency, and improved overload capacity.

- According to the International Energy Agency (IEA), the latest projections indicate that global demand for oil and gas will reach its peak in the coming years, even with the current policy settings in place. The IEA anticipates that global demand will rise by approximately eight million barrels per day (bpd) by the end of the decade, leading to an increased need for offshore activities. As a result of this growth in offshore operations and investments, there is an expected surge in demand for AC motors. These motors are utilized in various offshore applications, such as drilling rigs, production platforms, floating production storage and offloading (FPSO) vessels, subsea systems, and other offshore equipment.

- Furthermore, as per OPEC's report, the global consumption of crude oil (including biofuels) recently stood at 99.57 million barrels per day. It is estimated to rise to 101.89 million barrels per day in the coming years and eventually reach 109.8 million barrels per day. The demand for diesel and gas oil is forecasted to amount to 30.1 million barrels per day, up from 27.6 million barrels. Such factors will encourage the demand for AC motors in the industry.

Asia-Pacific is Expected to Witness a Significant Growth in the Market

- China has been witnessing rapid industrialization and development across various sectors, such as manufacturing, automotive, and electronics. AC motors are widely used in industrial machinery and equipment for applications such as pumps, compressors, conveyors, and fans, driving the demand for AC motors.

- China has been focusing on high-end manufacturing industries, power utilities, and oil and gas industries, boosting the usage of both low and medium-voltage drives in the country. For instance, the Chinese government's ambitious 'Made in China 2025' initiative, partially inspired by Germany for Industry 4.0, aims to boost the country's competitiveness in the manufacturing sector.

- India is expected to hold a significant global AC Motor Market share. The country's market is driven by rising demand for electric motors in manufacturing industries and rising awareness about energy efficiency. Also, the rising energy costs are expected to accelerate the adoption of synchronous electric motors in various industries. Due to the presence of many electric motor manufacturers in India, the country is expected to maintain a considerable market share during the forecast period.

- Japanese government's proactive approach to reducing carbon emissions has led to supportive policies that encourage industries to embrace energy-efficient solutions. This has further increased the adoption of AC motors in a wide range of industries, including transportation and industrial automation.

- Japan has been significantly transforming into an automated industrial economy in Asia-Pacific through its Industrial version 4.0 strategies, and the country has emerged as a manufacturing hub for factory automation products and supplies to other regional markets in Asia-Pacific.

- As of May 2023, according to the Ministry of Land, Infrastructure, and Transport, electric vehicles (EVs) represented approximately 1.8% of the South Korean automobile market. The government of South Korea has set a target to raise the proportion of electric and hydrogen vehicles in new vehicle sales to 33% in the coming years. Such developments in the EV sector will create significant opportunities for the vendor to invest in manufacturing facilities, thereby driving the market.

Alternating Current (AC) Motor Market Overview

The alternating current (AC) motor market is highly fragmented, with major players like Rockwell Automation Inc., Siemens AG, Johnson Electric, Nidec Corporation, and ABB Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2024 - ABB unveiled an advanced package for electric buses featuring the AMXE250 motor and HES580 inverter. This integrated propulsion system is engineered to enhance efficiency, reliability, and availability, setting a new standard for sustainable transportation solutions.

- May 2024 - KPS Capital Partners LP, through a newly established affiliate, entered into a definitive agreement to acquire Innomotics GmbH from Siemens AG for an enterprise value of EUR 3.5 billion.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of the COVID-19 pandemic and other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for High Energy Efficiency

- 5.1.2 Rise in Industrial Automation

- 5.2 Market Challenges

- 5.2.1 High Initial Costs

6 MARKET SEGMENTATION

- 6.1 By Induction AC Motors

- 6.1.1 Single Phase

- 6.1.2 Poly Phase

- 6.2 By Synchronous AC Motors

- 6.2.1 DC Excited Rotor

- 6.2.2 Permanent Magnet

- 6.2.3 Hysteresis Motor

- 6.2.4 Reluctance Motor

- 6.3 By End-user Industry

- 6.3.1 Oil and Gas

- 6.3.2 Chemical and Petrochemical

- 6.3.3 Power Generation

- 6.3.4 Water and Wastewater

- 6.3.5 Metal and Mining

- 6.3.6 Food and Beverage

- 6.3.7 Discrete Industries

- 6.3.8 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 Italy

- 6.4.2.4 France

- 6.4.2.5 Russia

- 6.4.2.6 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 South Korea

- 6.4.3.5 Australia and New Zealand

- 6.4.3.6 Rest of Asia-Pacific

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Rest of Latin America

- 6.4.5 Middle East and Africa

- 6.4.6 Saudi Arabia

- 6.4.7 United Arab Emirates

- 6.4.8 South Africa

- 6.4.9 Rest of Middle East and Africa

- 6.4.1 North America

7 VENDOR RANKING ANALYSIS

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Rockwell Automation Inc.

- 8.1.2 Siemens AG

- 8.1.3 Johnson Electric

- 8.1.4 Nidec Corporation

- 8.1.5 ABB Ltd

- 8.1.6 Franklin Electric Co.Inc.

- 8.1.7 WEG Electric Corporation

- 8.1.8 Yaskawa Electric Corporation

- 8.1.9 Kirloskar Electric Co. Ltd

- 8.1.10 Bosch Rexroth AG (ROBERT Bosch GmbH)

- 8.1.11 Regal Rexnord Corporation

- 8.1.12 SEVA-tec GmbH