|

市場調查報告書

商品編碼

1692443

電力驅動:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Electric Drives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

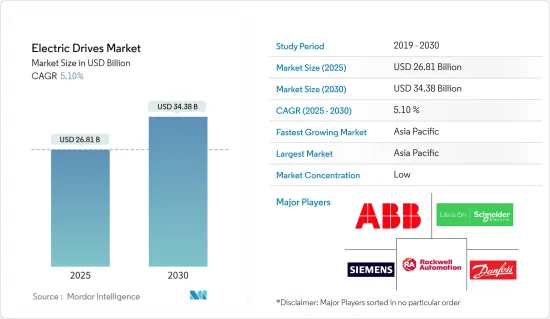

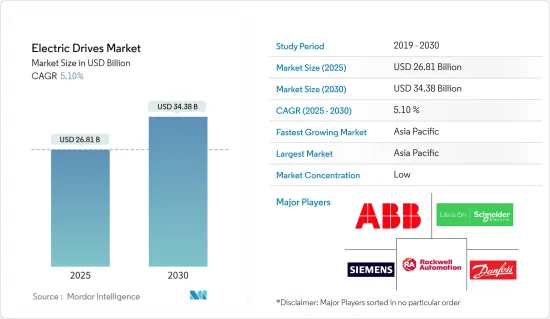

預計 2025 年電力驅動市場規模為 268.1 億美元,到 2030 年將達到 343.8 億美元,預測期內(2025-2030 年)的複合年成長率為 5.1%。

電力驅動器是用來控制馬達功率輸出的裝置。與內燃機或液壓系統等傳統機械驅動系統相比,它具有多種優勢。這些設備效率高,振動和噪音小,並能對馬達性能進行精確控制,使電力驅動成為對能源效率、精度和環保至關重要的應用的理想選擇。

主要亮點

- 快速的技術進步正在提高多個行業對驅動器的接受度。這項進步的重點是高可靠性和降低能源成本,配備馬達驅動系統的商業建築每平方英尺的能源消耗可能減少 30-40%。現代先進的驅動器還整合了網路和診斷功能,以提供更好的性能和更高的生產力。智慧馬達控制、降低尖峰電流和節省能源是選擇電力驅動器作為任何馬達驅動系統控制器的主要原因。

- 這個市場也越來越重視流程最佳化。在石油和天然氣行業,電力驅動可以減少停機時間,因為燃氣渦輪機需要頻繁維護,而電力驅動和馬達幾乎不需要維護。這可以提高產量、降低維護成本並提高生產力。這導致各石油和天然氣公司轉向電力驅動。

- 能源效率已成為聯邦監管機構和產業組織關注的重點。根據國際能源總署 (IEA) 的數據,馬達消耗了電力產業所用能源的 40%。當這些馬達與電力驅動裝置一起用於離心負載服務時,其效率會提高。電力電子技術的技術改進有望提高驅動性能並有助於節約能源。

- 在現有馬達上添加電力驅動裝置會帶來一些技術挑戰,這些挑戰對各行各業的許多公司都造成了採用障礙。將驅動器改裝到現有馬達後,馬達軸轉速會降低,導致軸驅動風扇的冷卻效果降低。馬達中的轉子非常敏感,旋轉過於頻繁可能會損壞。這是由於激進的動態煞車而發生的。如果轉子以這種方式停止,其熱膨脹將產生將轉子軸拉離定子的力,從而導致軸承故障。這通常發生在 VSD 未充分冷卻時。

- 在 COVID-19 疫情期間,所研究的市場成長逐漸增加,因為世界各國政府透過提供資金來擴展汽車、家電、電力、能源和公用事業等各種終端用戶產業的晶片,從而推動了基於半導體的電子和公共產業產業的發展。政府也幫助半導體製造商將生產轉移出中國,以避免供應鏈中斷。

電力驅動市場趨勢

主要終端用戶產業是發電

- 電力驅動是節約能源、提高性能、簡化系統和減少核子反應爐停機時間的關鍵。例如,在需要高速液體通道來冷卻核子反應爐堆芯的運作過程中,通常有四個大型6kV再循環泵和超過100個控制閥同時運作。此因素約佔核能發電廠營運能源成本的25%。

- 這證實了在核能發電產業中使用電力驅動的重要性。田納西河谷核能發電廠透過從馬達技術轉向電力驅動,效率從 70% 提高到 95%。使用電力驅動可以減少 50% 的電費,同時降低二氧化碳排放。

- 此外,透過確保不間斷的水循環,驅動技術的應用有助於工廠保護易受湍流影響的燃料棒和核燃料。這方面的規定非常嚴格。最好逐漸增加電力輸送,這可以透過仔細控制交流和直流驅動器來實現。希望此舉能為法國、英國等國家創造新的商機。核能發電廠生產了法國三分之二以上的電力。

- 據估計,馬達約佔工業用電量的65%,因此低壓馬達在工業領域的節能潛力巨大。消費量取決於馬達的額定功率、負載和運轉時間。因此,高效能低壓馬達可以在減少二氧化碳排放方面發揮重要作用。

能源需求正在穩定成長。同時,減少能源消耗、降低二氧化碳排放、確保電力供應安全的壓力也越來越大。據埃克森美孚公司稱,到 2040 年,全球電力需求將達到約 35.3 拍瓦時。預計這將在預測期內推動市場成長。

預計亞太地區成長最快

- 由於最終用戶產業的快速成長,亞太地區對研究市場的成長做出了重大貢獻,這些產業主要是石油和天然氣、用水和污水、化學和石化、食品和飲料、發電、暖通空調、紙漿和造紙、離散製造業等。

- 預計工業和製造業的成長,尤其是中國、印度和台灣等國家的工業和製造業的成長將在預測期內推動對交流電驅動器的需求。例如,根據印度銀行聯合會(IBEF)的數據,2022 年 1 月印度天然氣產量增加 11.7%,精製產量增加 3.7%,煤炭產量增加 8.2%,鋼鐵產量增加 2.8%,水泥產量增加 13.6%,電力產量增加 0.5%。

- 由於對上游和中游石油和天然氣行業的投資增加,預計預測期內交流變頻器市場將會成長。此外,上游石油天然氣公司正在逐步投資石油生產活動,這將提高交流馬達的更換率並促進市場成長。此外,2022 年 5 月,印度石油天然氣公司宣布計劃在 2022 至 2025 會計年度期間投資 40 億美元,加強其在印度的探勘活動。

- 此外,中階的經濟成長對印度的汽車需求有重大影響。例如,根據FADA(汽車經銷商協會聯合會)的數據,2022年該國售出約21,124,410輛乘用車和曳引機,與前一年同期比較去年同期成長約15.28%。此外,近年來,塔塔汽車、馬恆達、鈴木、巴賈傑等公司的銷量都大幅成長,本土汽車製造商也正在嶄露頭角。為了參與全球競爭,這些公司正在大力投資自動化生產線並擴大製造地,推動對電力驅動的需求。

- 韓國是一個高度都市化、人均所得較高的國家。由於中產階級人口的成長以及住宅、商業和其他建築數量的增加,該國對 HVAC 系統的需求正在增加。這些系統使用電力驅動來執行馬達控制等應用,因此該領域的成長將在預測期內推動對電力驅動的需求。

- 儘管東南亞國家電驅動市場的成長速度不如亞太地區其他主要國家,但近期的經濟趨勢和各產業的發展正在為所研究的市場創造機會。泰國、印尼等東南亞國家的工業和製造業也正在經歷顯著成長。例如,泰國和印尼是該地區領先的汽車製造商之一。由於馬達和發電機廣泛應用於汽車產業的自動化生產線,預計預測期內對電力驅動的需求將會成長。

電力驅動產業概況

電力驅動市場高度分散,主要參與者包括 ABB 有限公司、西門子股份公司、丹佛斯、羅克韋爾自動化公司和施耐德電氣股份有限公司。市場上的公司正在採用夥伴關係、創新和收購等策略來加強其產品供應並獲得永續的競爭優勢。

2023年5月,西門子推出SINAMICS S200伺服驅動系統。其精確的伺服驅動、強大的伺服馬達和易於使用的電線提供了高動態性能。新型伺服驅動系統特別適用於需要速度和扭力精度的應用,例如電池製造和電池組裝中使用的捲繞機和放捲機。

2023年3月,ABB推出了一款中壓VFD(變頻器),額定容量為400至1,000 kV,電壓高達6.9 kV。風冷式 ACS2000 VFD(變頻驅動器)專門用於水泥、採礦、冶金、紙漿和造紙、電力、水、化學和石油和天然氣行業的風扇、壓縮機、泵浦和其他公共設施應用。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 評估主要宏觀經濟趨勢的影響

第5章市場動態

- 市場促進因素

- 工業化進程加快,電力驅動在主要產業的應用日益廣泛

- 對能源效率的需求不斷增加

- 市場限制

- 設備的技術問題

- 設備高成本

第6章市場區隔

- 按產品

- 交流變頻器

- 直流驅動

- 伺服驅動器

- 按電壓

- 低電壓驅動器(<372.8KW 或 <1KV)

- 嵌入式

- 獨立

- 中壓驅動器(>=372.8KW 或 >=1KW)

- 低電壓驅動器(<372.8KW 或 <1KV)

- 按額定功率統計

- 小於250千瓦

- 251~500 kw

- 超過500千瓦

- 按最終用戶產業

- 石油和天然氣

- 用水和污水

- 化工和石化

- 飲食

- 發電

- 空調

- 紙漿和造紙

- 離散製造業

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 義大利

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東和非洲地區

- 北美洲

第7章競爭格局

- 公司簡介

- ABB Ltd.

- Siemens AG

- Danfoss

- Rockwell Automation Inc.

- Schneider Electric SE

- Yaskawa Electric Corporation

- Mitsubishi Electric Corporation

- Nidec Corporation

- SEW-EURODRIVE GmbH & Co. KG

- TMEIC Corporation

第 8 章供應商市場佔有率

第9章 市場展望

The Electric Drives Market size is estimated at USD 26.81 billion in 2025, and is expected to reach USD 34.38 billion by 2030, at a CAGR of 5.1% during the forecast period (2025-2030).

An electric drive is a device used to control the output of a motor. It offers several advantages over traditional mechanical drive systems like internal combustion engines or hydraulic systems. These devices are more efficient, produce less vibration and noise, and allow for precise control of motor performance, making electric drives ideal for applications where more energy efficiency, accuracy, and environmental considerations are essential factors.

Key Highlights

- Rapid technological progress has led to the higher acceptability of drives in several industries. The advances focus on high reliability and reduced energy costs, potentially reducing the per-square-foot energy by 30-40% when equipped with motor-driven systems in commercial buildings. The advanced and modern drives also integrate networking and diagnostic capabilities into better performance and improved productivity. Intelligent motor control, reduction of peak-current drawn, and energy savings are significant reasons to choose an electric drive as the controller in every motor-driven system.

- The market is also witnessing an increased focus on process optimization. An electric drive reduces downtime in the oil and gas industry because the gas turbines require frequent maintenance, while electric drives and motors require very little maintenance. This enables more production, lower maintenance expense, and improved productivity. This has encouraged various oil and gas companies to incorporate electric drives.

- Energy efficiency has been of key focus for federal regulators and industry organizations. According to the International Energy Agency, electric motors consume 40% of the energy used in power industries. When these motors are deployed with electric drives in centrifugal load service, their efficiency increases. With the technological improvements in power electronics technology, drives' performance is expected to improve, helping conserve energy.

- The addition of electric drives in existing motors gives rise to several technical problems, which have created a barrier to adoption among numerous players in various industries. After integrating the drive with an existing motor, the speed of the motor shaft reduces, which causes decreased cooling from the shaft-driven fan. The rotors in the electric drive motors are very sensitive and can get damaged by frequent spinning. This occurs because of aggressive dynamic braking. When the rotors are stopped this way, the thermal expansion of the rotor produces a force that pulls the rotor shaft away from the stator, leading to bearing failure. This usually occurs when the VSD is not adequately cooled.

- Growth in the market studied gradually increased during the COVID-19 pandemic because many governments worldwide pushed the semiconductor-based electronics and automation industry by providing funds to expand chips for various end-user industries, especially automobiles, consumer electronics, power, energy, and utilities. Moreover, governments helped semiconductor manufacturers shift their production facilities outside China to avoid supply chain disruption.

Electric Drives Market Trends

Power Generation to be the Major End-user Industry

- Electric drives are critical in saving energy, improving performance, simplifying a system, and cutting downtime in nuclear reactors. For instance, during operations, when the fast passage of liquid is required to cool down the reactor core, it is usual to have four big 6 kV recirculation pumps and more than 100 control values operating simultaneously. This factor accounts for around 25% of the energy costs of running a nuclear power plant.

- This supports the significance of using electric drives in the nuclear power industry. A nuclear power plant in the Tennessee Valley increased its efficiency from 70% to 95% by switching from motor technology to electric drives. Electricity costs can be cut by 50% when drives are used while reducing CO2 emissions.

- Furthermore, by ensuring uninterrupted water circulation, drive technology applications help the plants protect the fuel rods and nuclear fuel, both vulnerable to turbulence. In this regard, the rules are very strict. It is best to increase the electricity supply gradually, which can be done by carefully controlling AC and DC drives. In nations like France and the United Kingdom, new opportunities are anticipated to result from this. Nuclear power plants produce more than two-thirds of the electricity in France.

- Also, it has been estimated that electric motors account for about 65% of the electricity consumed in industrial applications; hence, the energy-saving potential of low-voltage motors in industries is enormous. Energy consumption depends on the motor's kW rating, loading, and hours run. Therefore, high-efficiency low-voltage motors, as such, can play a significant role in reducing CO2 emissions.

Energy demand is rising steadily. At the same time, pressure to reduce energy consumption, lower carbon dioxide (CO2) emissions, and provide secure power supplies is becoming more reliable. According to Exxon Mobil, worldwide electricity demand will reach around 35.3 petawatt hours by 2040. It is expected to drive market growth over the forecast period.

Asia Pacific Expected to be the Fastest Growing Region

- The Asia-Pacific region is significantly investing in the studied market's growth, primarily due to the rapidly growing end-user industries such as oil and gas, water and wastewater, chemical and petrochemical, food and beverage, power generation, HVAC, pulp and paper, discrete industries, and many others in the studied market.

- The growth of the industrial and manufacturing sectors, especially across countries such as China, India, and Taiwan, is expected to drive the demand for AC electric drives during the forecast period. For instance, according to IBEF, in India, outputs increased for natural gas by 11.7%, petroleum refinery production by 3.7%, coal by 8.2%, steel by 2.8%, cement by 13.6%, and electricity by 0.5% in January 2022.

- With increased investments in the oil and gas upstream and midstream sectors, the AC drive market is expected to grow during the forecast period. Furthermore, oil and gas upstream companies are gradually investing in oil production activities, which will increase the replacement rate of AC electric motors, supporting market growth. In addition, in May 2022, the ONGC announced plans to invest USD 4 billion from FY22-25 to increase its exploration efforts in India.

- Furthermore, the economic growth of the middle class has significantly impacted the demand for automobiles in India. For instance, according to the Federation of Automobile Dealers Association (FADA), about 2,11,20,441 passenger vehicles and tractors were sold in the country in 2022, reporting a growth of about 15.28% year-on-year. Furthermore, in recent years, local automobile manufacturers have enhanced their presence, with companies like Tata Motors, Mahindra, Suzuki, and Bajaj significantly expanding their sales figures. To compete with global players, these companies are investing significantly in automated production lines and expanding their manufacturing footprint, driving the demand for electric drives.

- South Korea is a highly urbanized country with a high per capita income. Due to a rising middle-class population and an increasing number of houses, commercial buildings, and other structures, the demand for HVAC systems has been increasing in the country. As these systems use electric drives for applications such as motor control, the growth of the sector will drive the demand for electric drives during the forecast period.

- Although the growth of the electric drives market in Southeast Asian countries has not been at par with other major countries in the Asia-Pacific region, in recent years, the area's economic development and various industries' development have created opportunities in the studied market. The industrial and manufacturing sector is also witnessing notable growth in Southeast Asian countries such as Thailand and Indonesia. For instance, Thailand and Indonesia are among the leading automobile manufacturers in the region. As motors and generators are widely used in automated production lines of the automotive industry, the demand for electric drives is expected to grow during the forecast period.

Electric Drives Industry Overview

The electric drives market is highly fragmented, with major players like ABB Ltd, Siemens AG, Danfoss, Rockwell Automation Inc., and Schneider Electric SE. Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In May 2023, Siemens launched the SINAMICS S200 servo drive system, designed for many common applications in electronics, batteries, and other sectors. Its accurate servo drive, strong servo motors, and simple-to-use wires provide high dynamic performance. The new servo drive system is especially useful for applications that need accuracy in speed and torque, such as winding and unwinding machines used in battery manufacture and cell assembly.

In March 2023, ABB launched a medium-voltage VFD (Variable-frequency Drive) with a rated capacity of 400 to 1,000kV and a voltage of up to 6.9kV, appropriate for a broad range of applications without a unique engineering design. The air-cooled ACS2000 VFD (Variable-frequency Drive) was especially used for fans, compressors, pumps, and other public applications in cement, mining and mining, metallurgy, pulp and paper, electric power, water, chemical, oil, and gas industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 An Assessment of the Impact of Key Macroeconomic Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Industrialization and Increased use of Electric Drives Across Major Vertical Industries

- 5.1.2 Growing Demand for Energy Efficiency

- 5.2 Market Restraints

- 5.2.1 Technical Concerns of the Equipment

- 5.2.2 High Cost of the Equipment

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 AC Drives

- 6.1.2 DC Drives

- 6.1.3 Servo Drives

- 6.2 By Voltage

- 6.2.1 Low-Voltage Drive (<372.8KW or <1KV)

- 6.2.1.1 Embedded

- 6.2.1.2 Standalone

- 6.2.2 Medium-Voltage Drive (>=372.8KW or >= 1KW)

- 6.2.1 Low-Voltage Drive (<372.8KW or <1KV)

- 6.3 By Power Rating Statistics

- 6.3.1 <250 KW

- 6.3.2 251 - 500 KW

- 6.3.3 >500 KW

- 6.4 By End-user Industry

- 6.4.1 Oil and Gas

- 6.4.2 Water and Wastewater

- 6.4.3 Chemical and Petrochemical

- 6.4.4 Food and Beverage

- 6.4.5 Power Generation

- 6.4.6 HVAC

- 6.4.7 Pulp and Paper

- 6.4.8 Discrete Industries

- 6.4.9 Other End-user Industries

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 Germany

- 6.5.2.2 Italy

- 6.5.2.3 United Kingdom

- 6.5.2.4 France

- 6.5.2.5 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 Japan

- 6.5.3.3 India

- 6.5.3.4 South Korea

- 6.5.3.5 Rest of Asia-Pacific

- 6.5.4 Latin America

- 6.5.4.1 Brazil

- 6.5.4.2 Mexico

- 6.5.4.3 Rest of Latin America

- 6.5.5 Middle East and Africa

- 6.5.5.1 United Arab Emirates

- 6.5.5.2 Saudi Arabia

- 6.5.5.3 Turkey

- 6.5.5.4 Rest of Middle East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd.

- 7.1.2 Siemens AG

- 7.1.3 Danfoss

- 7.1.4 Rockwell Automation Inc.

- 7.1.5 Schneider Electric SE

- 7.1.6 Yaskawa Electric Corporation

- 7.1.7 Mitsubishi Electric Corporation

- 7.1.8 Nidec Corporation

- 7.1.9 SEW-EURODRIVE GmbH & Co. KG

- 7.1.10 TMEIC Corporation