|

市場調查報告書

商品編碼

1692137

半導體產業的流量控制-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Flow Control In The Semiconductor Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

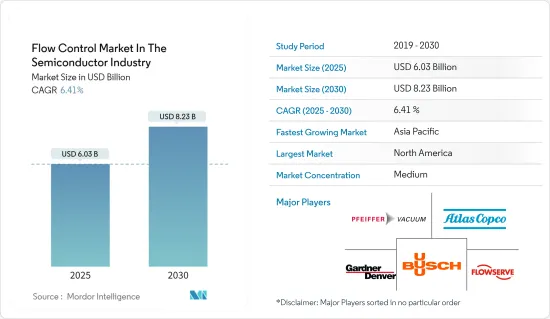

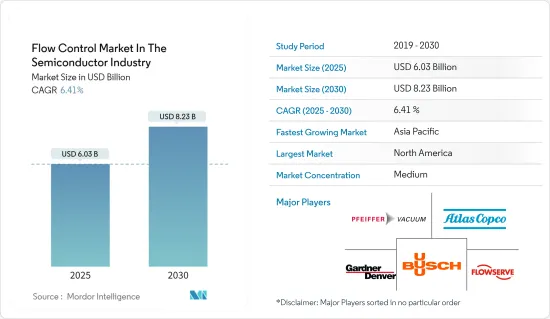

半導體工業流控制市場預計將從 2025 年的 60.3 億美元成長到 2030 年的 82.3 億美元,預測期內(2025-2030 年)的複合年成長率為 6.41%。

主要亮點

- 不斷成長的需求強調了嚴格製程控制的必要性,推動了對新半導體製造設施的投資。在半導體產業中,精確的流量控制至關重要。在電漿蝕刻和化學氣相沉積 (CVD) 等製程中,多種氣體以精確的方式相互作用,形成必要的層或薄膜。準確的氣體計量至關重要,因為即使氣體流量的微小偏差也可能導致製程失敗。

- 半導體和電子產業的重大進步預計將推動產業成長。由於新冠疫情的影響,在家工作生活方式的建立也可能刺激電子設備需求的激增。此外,技術進步和成熟的分銷網路也鼓勵西方電子製造商擴大在新興國家的業務。此外,中國和印度年輕人對消費性電子產品的日益普及也有望推動對半導體晶片的需求,從而對市場成長產生正面影響。

- 半導體行業不斷成長的需求正在支持市場成長。例如,2024 年 5 月,半導體產業協會報告稱,由於預測期內全球半導體市場的成長,預計到 2032 年美國的半導體製造能力將增加兩倍。這將增加半導體產業對流量控制設備的需求,從而為所研究的市場提供幫助。

- 然而,半導體製造的高成本預計仍將是市場成長的主要挑戰。此外,考慮到與半導體產業相關的應用的關鍵性,設計流量控制設備/組件所涉及的複雜性也對所研究市場的成長構成了挑戰。市場正在整合,大型企業正在採取收購策略,這將對小型企業的成長構成挑戰並影響整體市場的成長。

- 在新冠疫情爆發初期,市場面臨全球封鎖等干擾,嚴重擾亂了晶片製造商的供應鏈和生產能力。然而,在疫情期間和疫情之後,半導體晶片的需求激增,預計這一趨勢將在整個預測期內持續下去。需求的成長刺激了對新生產設施的投資,並推動了對流量控制解決方案的需求。

流量控制市場趨勢

機械軸封市場成長最快

- 機械軸封的主要作用是防止流體和氣體通過軸和容器之間的間隙洩漏。機械軸封由碳環隔開的兩個面組成。旋轉設備與靜止的第一個表面接觸。此外,密封圈(第一面)是密封的主要部件,彈簧、波紋管或設備內的流體產生的機械力作用於此密封圈。在半導體產業中,密封件始終位於處理系統的區域內,這些區域必須承受高腐蝕性氣體、液體、蒸氣和等離子體,並且通常在真空和高溫下進行。

- 近年來,機械軸封行業經歷了顯著成長,預計未來將繼續成長,這主要得益於對半導體製造設施的投資增加。在新興國家,人工智慧、機器學習和物聯網的興起,以及智慧型手機和家用電器的發展,預計將推動半導體產業的進一步發展政策和投資。集裝式密封、平衡式密封、非平衡式密封、推動式密封、非推動式密封和傳統密封是推動市場擴張的一些機械軸封。

- 密封可靠性和減少污染在半導體產品製造中極為重要。化學過濾、化學品轉移、AODD 泵浦密封、矽晶片製造是一些關鍵的半導體應用,其中機械軸封已被證明是最佳選擇。

- 沉澱、蝕刻、灰化/剝離、等離子、熱處理或退火是構成彈性密封材料最具挑戰性的環境的協同製程技術。這些是在半導體積體電路製造過程中經常遇到的。潔淨室製造的密封件不含顆粒和微量金屬污染,最大限度地減少了產量比率損失和化學侵蝕率。這些密封件具有許多優勢,例如可增加系統運作、延長平均故障間隔時間 (MTBF)、減少濕式和機械清潔頻率、降低耗材成本 (CoC),從而降低擁有成本 (CoO)。

- 數位化和自動化趨勢正在顯著增加對半導體的需求。例如,2023 年 9 月,廣州傑斯特密封件科技推出了 FFKM O 形圈,該材料在所有橡膠 O 形圈和墊圈材料中具有最高的耐溫度(高達 620°F)和最常見的耐化學性。可用於半導體製造製程的高溫熱風環境,最高工作溫度為315°C。這種發展表明半導體產業對機械軸封設備的需求不斷成長,這與半導體製造業投資的增加和全球銷售額的成長一致。

美國對市場成長貢獻龐大

- 在美國,自《美國晶片與科學法案》提案以來,建立國內晶片製造設施的提案有所增加。新工廠建設和研發計劃正在接受投資,以吸引原始晶片製造商(OCM)進入美國,美國各州正在頒布立法,要求額外融資以支持市場開發對流量控制組件的需求。

- 美國宣布計劃透過在晶片設計、電子設計自動化(EDA)和半導體製造設備等半導體技術高價值領域展示強大的領導地位,繼續為全球價值鏈做出貢獻。預計這將支持國內半導體製造設備企業的成長並促進市場成長。

- 全球半導體公司正在擴大在美國的業務,這可能為美國市場創造成長機會。例如,2024年4月,晶片公司台灣半導體製造股份有限公司(TSMC)宣布計劃在亞利桑那州建造第三家晶圓廠,使其在美國的總投資額從400億美元增至650億美元。

- 美國政府優先發展半導體製造業,並加強晶片供應鏈。它還宣布了進一步加強供應鏈、支持研發和晶片設計、增加半導體勞動力的政策行動,以確保晶片從國家經濟和國家安全中獲得最大利益,這將有助於國家的半導體生態系統並推動未來的市場成長。

- 美國消費科技美國將成長 2.8%,達到 5,120 億美元。半導體在製造家用電子電器、智慧型手機和個人運算設備的應用將推動對半導體的需求。這可能會在預測期內為美國半導體產業的流量控制市場創造成長機會。

流量控制行業概況

由於全球範圍內存在多個領先品牌爭奪市場佔有率,因此流量控制設備供應商之間的競爭較為溫和。近年來,隨著新興國家家電和智慧型手機的普及,真空幫浦的需求急劇增加。這使得客戶獲取和銷售管道創建成為關鍵策略重點。主要市場參與企業包括 Pfeiffer Vacuum GmbH、Atlas Copco AB、Gardner Denver 和 Busch Holding GmbH。

- 2024 年 2 月 Busch Holding GmbH 的 Busch 真空解決方案部門擴大了其 O11O 數位服務範圍,以涵蓋真空系統。 O11O for Systems 可讓您同時監控真空系統中的多個真空產生器,以確保您的生產流程在正確的真空水平下運作。這有效地降低了生產停機風險並顯著節省了成本。 O11O IoT 儀表板可透過 PC 或行動裝置存取,提供方便用戶使用的介面,用於全面的系統監控,並支援市場上流量控制組件的交叉銷售機會。這些發展表明供應商正在投資產品創新以保持市場競爭力。

- 2023 年 12 月,阿特拉斯科普柯集團宣布計劃收購 KRACHT GmbH,後者是一家提供外嚙合齒輪泵、流量測量、閥門、液壓驅動器和分配系統等高品質技術的供應商。預計這將推動流量控制設備市場未來的成長。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業分析—波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 透過工業物聯網數位化電子產業發展

- 市場挑戰

- 市場一體化進程加劇競爭

第6章真空幫浦與閥門在半導體產業的主要應用

- 真空幫浦

- 物理氣相澱積/濺鍍

- 化學沉澱(等離子體/亞大氣壓力)

- 擴散/低壓化學沉澱(LPCVD)

- 原子層沉澱

- 乾燥剝離並清潔

- 介電蝕刻

- 導體和多晶矽蝕刻

- 原子層蝕刻

- 離子布植

- 負載鎖和傳輸

- 臨界尺寸掃描電子顯微鏡

- 前開式通用艙內的顆粒監測

- 空氣中的分子污染

- 閥門

- 化學品供應

- 多晶矽工藝

- 晶圓製造

- 化學製造

- 泥漿供應

- 溶劑供應

- 水療

- 光刻

- 蝕刻

- CMP

- 化學品和泥漿回收

第7章市場區隔

- 組件類型

- 真空

- 閥門

- 球

- 蝴蝶

- 門

- 手套

- 其他閥門

- 機械軸封

- 按國家

- 美國

- 中國

- 台灣

- 韓國

- 日本

- 世界其他地區

第8章競爭格局

- 公司簡介-真空泵

- Pfeiffer Vacuum GmbH

- Atlas Copco AB

- Gardner Denver(ingersoll Rand Inc.)

- Flowserve Corporation

- Busch Holding Gmbh

- Kurt J. Lesker Company

- 公司簡介 – Valve

- Fujikin Incorporation

- GEMU Holding GmbH & Co.KG

- VAT Vakuumventile AG

- Swagelok Company

- Festo SE & Co. KG

- GCE Group

- 公司簡介 -機械軸封

- DuPont De Nemours Inc.

- EKK Eagle SC Inc.

- EnPro Industries Inc.

- Freudenberg Group

- AESSEAL PLC

- Parker-Hannifin Corporation

- Greene, Tweed & Co. Inc.

第9章 投資與未來展望

The Flow Control Market In The Semiconductor Industry is expected to grow from USD 6.03 billion in 2025 to USD 8.23 billion by 2030, at a CAGR of 6.41% during the forecast period (2025-2030).

Key Highlights

- Increased demand highlighting the need for stringent process control drives investments in new semiconductor production facilities. Precise flow control is crucial in the semiconductor industry. Processes like plasma etch and chemical vapor deposition (CVD) depend on the exact interaction of multiple gases to create essential layers or films. Even a slight deviation in gas flow can cause process failure, making accurate gas metering essential.

- Significant advancements in the semiconductor and electronics industries are expected to drive industrial growth. The strong adoption of the work-from-home lifestyle may also add to the surge in demand for electronic equipment caused by the COVID-19 pandemic. Furthermore, with technological advancements and well-established distribution networks, European and US electronics manufacturers strive to expand operations in emerging nations. Furthermore, the increasing popularity of consumer electronics among China's and India's youth is expected to boost the demand for semiconductor chips, which, in turn, will have a positive impact on the market's growth.

- The growing demand for the semiconductor industry supports the market's growth. For instance, in May 2024, the Semiconductor Industry Association reported that the United States is projected to triple its semiconductor manufacturing capacity by 2032, in line with the semiconductor market's growth worldwide during the forecast period. This would support the market studied by enhancing the demand for flow control equipment in the semiconductor industry.

- However, the higher cost involved with semiconductor manufacturing is anticipated to remain among the major challenging factors for the growth of the market. Additionally, the complexity involved in designing flow control devices/components, considering the critical nature of applications associated with the semiconductor industry, also challenges the growth of the market studied. The market has become consolidated, and significant players are following an acquisition strategy, creating a challenge for the growth of small companies, which would impact the overall market growth.

- During the initial phase of the COVID-19 pandemic, the market faced disruptions, including global lockdowns, which notably hampered chip manufacturers' supply chains and production capacities. Yet, the demand for semiconductor chips surged during and after the pandemic, a trend expected to persist through the forecast period. This increasing demand is poised to spur investments in new production facilities, fueling the need for flow control solutions.

Flow Control Market Trends

Mechanical Seals to Register the Fastest Market Growth

- A mechanical seal's primary function is to prevent fluid or gas leakage through the clearance between the shaft and the container. Mechanical seals are made up of two faces separated by carbon rings. The revolving equipment comes in touch with the initial face, which is stationary. Furthermore, the seal ring (first face) is the main component of the seal on which the mechanical force generated by springs, bellows, or fluids in the equipment acts. In the semiconductor industry, seals are invariably housed in areas of the processing system where they need to withstand highly corrosive gases, liquids, gases, and plasmas, often in vacuum conditions or at elevated temperatures.

- The mechanical seal segment has grown substantially in recent years and is expected to continue growing over the coming years, primarily due to increasing investments in semiconductor manufacturing facilities. In emerging nations, the rise of AI, ML, and IoT, as well as smartphone and consumer electronics development, is predicted to prompt further development policies and investments in the semiconductor industry. Cartridge seals, balanced and unbalanced seals, pusher and non-pusher seals, and conventional seals are examples of mechanical seals driving the market's expansion.

- In the fabrication of semiconductor products, seal reliability and contamination reduction are crucial. Chemical filtration, chemical transfer, AODD pump sealing, and silicon wafer fabrication are essential semiconductor applications where mechanical seals have proven to be the best option.

- Deposition, etch, ash/strip, plasma, and heat processing or annealing are synergistic process technologies that constitute some of the most difficult environments for elastomer seal materials. These are frequently encountered during the fabrication of semiconductor-integrated circuits. Clean-room manufactured seals with low particle and trace metal contamination are used to minimize yield loss and chemical erosion rates. These seals can provide benefits such as increased system up-time, increased mean time between failure (MTBF), decreased wet clean or mechanical clean frequency, and reduced cost of ownership (CoO) through lower consumable costs (CoC).

- The digitization and automation trends have significantly enhanced the demand for semiconductors. For instance, in September 2023, Guangzhou JST Seals Technology Co. Ltd launched its FFKM O-rings to provide the highest temperature (up to 620 °F) and the most common chemical resistance among all rubber O-ring and gasket materials. These can be used in the environment of high-temperature hot air in the semiconductor manufacturing process, and the maximum operating temperature is 315 °C. Such developments show the growth in the demand for mechanical sealing equipment in the semiconductor industry, which is in line with the growing investments in semiconductor manufacturing and their increasing sales worldwide.

The United States Expected to Contribute Significantly to Market Growth

- The United States has registered increased domestic chip manufacturing facility proposals since the US CHIPS and Science Act was proposed. Developing new plants and research and design projects have received investments to entice original chip manufacturers (OCMs) to the country, and US states have implemented legislation requiring them to provide additional financing, which would support the demand for flow control components in the market.

- The United States has announced plans to continue contributing to the global value chain with strong leadership positions in high-value-added areas of semiconductor technology, including chip design, electronic design automation (EDA), and semiconductor manufacturing equipment. This would support the growth of semiconductor manufacturing units' establishments in the country and fuel market growth.

- Global semiconductor companies are expanding their footprints in the country, which would create a growth opportunity for the US market. For instance, in April 2024, chip company Taiwan Semiconductor Manufacturing Company (TSMC) announced plans to build a third factory in Arizona, raising its total investment in the United States from USD 40 billion to USD 65 billion, which shows future market growth opportunities for flow control components in the country.

- The country's government has prioritized semiconductor manufacturing in the United States and reinforced chip supply chains. It also identifies policy actions that will further strengthen supply chains, support R&D and chip design, grow the semiconductor workforce, and ensure CHIPS delivers maximum benefits to the country's economic and national security, which would help the semiconductor ecosystems in the country and fuel market growth in the future.

- The Consumer Technology Association estimated US retail sales of consumer technologies to rise 2.8% and reach USD 512 billion in 2024, supported by the increasing sales of personal computers, smartphones, and other gadgets. This would fuel the demand for the semiconductor market due to the application of semiconductors in manufacturing consumer electronics, smartphones, and personal computing devices. This would create growth opportunities for the flow control market in the semiconductor industry in the United States during the forecast period.

Flow Control Industry Overview

The competitive rivalry among flow control equipment providers is moderate, owing to the presence of various dominant brands competing for market share globally. The demand for vacuum pumps has spiked in recent years due to the massive penetration of consumer electronics and smartphones across developing countries. This has led to an increased focus on customer acquisition and formulating distribution channels as key strategies. Some key market players include Pfeiffer Vacuum GmbH, Atlas Copco AB, Gardner Denver, and Busch Holding GmbH.

- February 2024: Busch Holding GmbH's Busch Vacuum Solutions segment expanded its range of O11O Digital Services to include vacuum systems. O11O for systems enables the simultaneous monitoring of multiple vacuum generators in a vacuum system and the supervision of the production process to ensure it runs reliably and with the correct vacuum levels. This effectively minimizes production downtime risk and leads to significant cost savings. Accessible via a PC or a mobile device, the O11O IoT dashboard presents a user-friendly interface for comprehensive system monitoring and to support the company's cross-selling opportunity for flow control components in the market. Such developments demonstrate market vendors' investments in product innovations to remain competitive.

- December 2023: Atlas Copco Group announced plans to acquire KRACHT GmbH (Kracht), a manufacturer of high-quality technologies, including external gear pumps, fluid measurement, valves, hydraulic drives, and dosing systems. This is expected to support the company's future growth in the flow control equipment market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Analysis - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Electronics Industry Driven by IIoT Digitalization

- 5.2 Market Challenges

- 5.2.1 Increasing Market Consolidation Expected to Create Stiff Competition

6 MAJOR APPLICATIONS OF VACUUM PUMPS AND VALVES IN THE SEMICONDUCTOR INDUSTRY

- 6.1 Vacuum Pumps

- 6.1.1 Physical Vapor Deposition/Sputtering

- 6.1.2 Chemical Vapor Deposition (Plasma/Sub-atmospheric)

- 6.1.3 Diffusion/Low Pressure Chemical Vapor Deposition (LPCVD)

- 6.1.4 Atomic Layer Deposition

- 6.1.5 Dry Stripping and Cleaning

- 6.1.6 Dielectric Etch

- 6.1.7 Conductor and Polysilicon Etch

- 6.1.8 Atomic Layer Etching

- 6.1.9 Ion Implantation

- 6.1.10 Load Lock and Transfer

- 6.1.11 Critical Dimension Scanning Electron Microscope

- 6.1.12 Particle Monitoring in Front Opening Universal Pods

- 6.1.13 Airborne Molecular Contamination

- 6.2 Valves

- 6.2.1 Chemical Supply

- 6.2.2 Polysilicon Process

- 6.2.3 Wafer Manufacturing

- 6.2.4 Chemical Manufacturing

- 6.2.5 Slurry Supply

- 6.2.6 Solvent Supply

- 6.2.7 Water Treatment

- 6.2.8 Lithography

- 6.2.9 Etching

- 6.2.10 CMP

- 6.2.11 Chemical and Slurry Recovery

7 MARKET SEGMENTATION

- 7.1 Type of Component

- 7.1.1 Vacuum

- 7.1.2 Valves

- 7.1.2.1 Ball

- 7.1.2.2 Butterfly

- 7.1.2.3 Gate

- 7.1.2.4 Globe

- 7.1.2.5 Other Valves

- 7.1.3 Mechanical Seals

- 7.2 By Country

- 7.2.1 United States

- 7.2.2 China

- 7.2.3 Taiwan

- 7.2.4 South Korea

- 7.2.5 Japan

- 7.2.6 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles - Vacuum Pumps

- 8.1.1 Pfeiffer Vacuum GmbH

- 8.1.2 Atlas Copco AB

- 8.1.3 Gardner Denver (ingersoll Rand Inc.)

- 8.1.4 Flowserve Corporation

- 8.1.5 Busch Holding Gmbh

- 8.1.6 Kurt J. Lesker Company

- 8.2 Company Profiles - Valves

- 8.2.1 Fujikin Incorporation

- 8.2.2 GEMU Holding GmbH & Co.KG

- 8.2.3 VAT Vakuumventile AG

- 8.2.4 Swagelok Company

- 8.2.5 Festo SE & Co. KG

- 8.2.6 GCE Group

- 8.3 Company Profiles - Mechanical Seals

- 8.3.1 DuPont De Nemours Inc.

- 8.3.2 EKK Eagle SC Inc.

- 8.3.3 EnPro Industries Inc.

- 8.3.4 Freudenberg Group

- 8.3.5 AESSEAL PLC

- 8.3.6 Parker-Hannifin Corporation

- 8.3.7 Greene, Tweed & Co. Inc.