|

市場調查報告書

商品編碼

1692115

非洲電池:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Africa Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

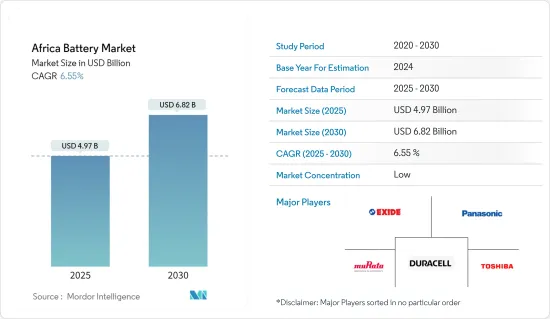

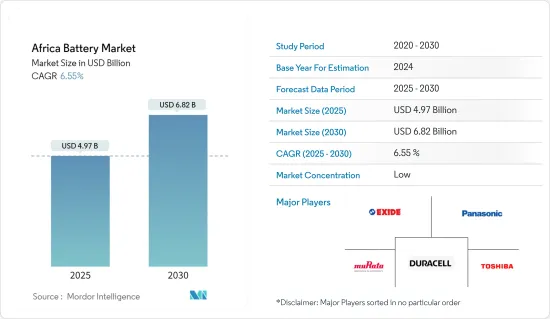

預計 2025 年非洲電池市場規模為 49.7 億美元,到 2030 年將達到 68.2 億美元,預測期內(2025-2030 年)的複合年成長率為 6.55%。

主要亮點

- 從中期來看,鋰電池成本下降和可再生能源採用率提高等因素預計將在預測期內推動市場研究。

- 然而,預計電池製造原料的需求和供應之間的不匹配將阻礙預測期內的市場成長。

- 然而,太陽能是一種間歇性能源來源,僅在白天產生電能。預計撒哈拉以南非洲地區將成為離網太陽能發電工程的重點熱點。將離網太陽能發電與能源儲存結合,提高了太陽能發電系統的利用率。因此,太陽能能源儲存在已開發國家越來越受歡迎,預計將為非洲電池市場創造巨大的機會。

- 由於太陽能和風能的普及以及即將開展的清潔能源計劃,南非預計將在預測期內成為電池市場成長最快的國家。

非洲電池市場趨勢

鋰離子電池佔市場主導地位

- 鋰離子電池是電子設備和能源汽車中常用的可充電電池。這些電池也用於儲存太陽能和風能等再生能源來源能源。

- 過去十年來,鋰離子電池價格大幅下跌。 2022 年,鋰離子電池的成本評估約為每千瓦時 151 美元。過去幾年價格持續下跌,2022年與2010年相比下降了85%以上。預計鋰離子電池的平均價格將繼續下降,到2026年將達到約74美元/kWh時,使其與其他類型的電池相比具有顯著的成本競爭力。

- 根據國際貿易中心貿易地圖,2022年,非洲地區鋰離子電池進口額將達11.2269億美元,高於2021年的4.36095億美元。

- 鋰離子電池系統為插混合動力汽車汽車和電動車提供動力。鋰離子電池具有快速充電、高能量密度和高放電功率等特點,是唯一能夠滿足車輛行駛里程和充電時間OEM標準的技術。由於比能量低、重量重,鉛基牽引電池不適用於混合動力汽車或電動車。

- 阿爾及利亞總統呼籲更廣泛地採用電動車,以減少該國在2020年的二氧化碳排放。因此,政府宣布了管理阿爾及利亞汽車產業活動的新規範。例如,限制進口三年以下的二手石化燃料汽車,禁止進口柴油車。這些對二手石化燃料汽車進口的限制預計將推動該國使用鋰離子電池發電的電動車產業的發展。

- 因此,鑑於上述情況,預計在預測期內,鋰離子電池領域將在研究市場中呈現顯著成長。

南非:預計將顯著成長

- 南非政府致力於提高國家發電能力和能源安全。因此,許多能源儲存計劃正在規劃為公私合作專案。

- 2021 年 6 月,挪威能源公司 Scatec 贏得了南非政府競標,將建造一個 540 兆瓦的太陽能發電工程,並配備 225 兆瓦/1,140 兆瓦時的電池儲能系統。該公司參與的這項工作是風險緩解電力採購計劃 (RMP) 的一部分,該計劃旨在在需求波動期間擴大能源輸送來源。

- 政府的目標是提高國家的發電量和能源安全。這就是為什麼目前有大量能源儲存計劃正在進行中,國有企業和私營企業正在共同合作。

- 南非能源儲存計劃的興起很大程度上與政府主導的可再生能源獨立電力生產商採購計劃(REIPPPP)有關。 2021 年 11 月,南非國有電力公司 Eskom 宣布啟動電池儲能系統 (BESS)計劃,該項目將在多個可再生能源發電發電廠建設一個 360 兆瓦的儲能系統。

- 2022年第四季度,南非進口了價值約3.5億美元的鋰離子電池和電池組,高於同年第三季的約2億美元。 2022年,南非花費約7億美元進口鋰離子電池和電池組。

- 因此,鑑於上述情況,預計預測期內南非的非洲電池市場將顯著成長。

非洲電池產業概況

非洲電池市場相當分散。該市場的主要企業(不分先後順序)包括東芝、村田製作所、埃克塞德工業有限公司、Panasonic和金霸王公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 2028 年市場規模與需求預測

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 鋰電池成本下降

- 可再生能源的採用日益增多

- 限制因素

- 電池製造原料供需不匹配

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場區隔

- 類型

- 一次電池

- 二次電池

- 科技

- 鋰離子電池

- 鉛酸電池

- 其他技術

- 應用

- 汽車電池

- 工業電池

- 可攜式電池

- 其他用途

- 國家

- 南非

- 奈及利亞

- 肯亞

- 埃及

- 其他非洲國家

第6章競爭格局

- 合併、收購、合作及合資

- 主要企業策略

- 公司簡介

- Duracell Inc.

- Panasonic Corporation

- Toshiba Corporation

- Exide Industries Ltd

- Murrata manufacturing Co. Ltd

- Uganda Batteries Limited

- Energizer Holdings Inc.

- Luminous Power Technology

第7章 市場機會與未來趨勢

- 擴大太陽能發電電池儲能系統的使用

簡介目錄

Product Code: 90678

The Africa Battery Market size is estimated at USD 4.97 billion in 2025, and is expected to reach USD 6.82 billion by 2030, at a CAGR of 6.55% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the declining cost of lithium batteries and increased adoption of renewable energy are expected to drive the market studied during the forecast period.

- On the other hand, a mismatch in the demand and supply of raw materials for battery manufacturing is expected to hinder the growth of the market studied during the forecast period.

- Nevertheless, solar energy is an intermittent source that generates electricity only during the day. The Sub-Saharan African region is projected to be a key hotspot for off-grid solar projects. Combining off-grid solar power with energy storage increases the utilization of solar PV systems. As a result, energy storage with solar PV has been gaining popularity in developed countries and is expected to create a massive opportunity for the African battery market.

- South Africa is expected to be the fastest-growing country in the battery market during the forecast period because of its increasing solar and wind energy installation and upcoming projects to generate clean energy.

Africa Battery Market Trends

Lithium-ion Batteries to Dominate the Market

- Lithium-ion batteries are rechargeable batteries commonly used in electronic devices and energy vehicles. These batteries are also used to store energy from renewable energy sources such as solar and wind.

- The price of lithium-ion batteries declined steeply over the past ten years. In 2022, the cost of a lithium-ion battery was valued at approximately USD 151 per kWh. The price fell continuously over the past few years, and it decreased by more than 85% in 2022 compared to 2010. The decline in average lithium-ion battery prices is expected to continue and reach around USD 74/kWh by 2026, making it much more cost-competitive with other battery types.

- In 2022, lithium-ion accumulators worth USD 1122.69 million were imported into the African region, an increase from USD 436.095 million in 2021, as per the ITC trade map.

- Lithium-ion battery systems propel the plug-in hybrid and electric vehicles. Due to its fast recharge, high energy density, and high discharge power, lithium-ion batteries are the only available technology capable of meeting OEM standards for car driving range and charging time. Due to their lower specific energy and heavier weight, lead-based traction batteries are not competitive in total hybrid electric vehicles or electric vehicles.

- The President of Algeria called for the promotion of electric cars to reduce the country's carbon footprints in 2020. Therefore, the government announced new specifications governing the activity of the automotive industry in Algeria. The government took several measures to promote electric vehicles in the country, such as restricting the importation of second-hand fossil fuel cars with fewer than three years and prohibiting diesel-based cars from importation. These restrictions on second-handed fossil fuel-based cars are expected to drive the country's electric vehicle sector, which uses lithium-ion batteries to generate power.

- Hence, owing to the above points, the lithium-ion batteries segment is expected to witness significant growth in the market studied during the forecast period.

South Africa Expected to Witness Significant Growth

- The South African government is committed to increasing the country's power generation capacity and energy security. As a result, many energy storage projects are being planned in collaboration between public and private entities.

- Scatec, a Norwegian energy business, won a government tender in South Africa in June 2021 for 540 MW of solar projects with 225 MW/ 1,140 MWh of battery storage. The company's involvement in the initiative was part of the Risk Mitigation Power Procurement Programme (RMP), which aims to expand the sources of energy dispatch in times of fluctuating demand.

- The government aims to expand the country's power generation and energy security. Therefore, many energy storage projects are in the works, with state-owned and private groups working together.

- Renewable Energy Independent Power Producer Procurement Programme (REIPPPP), a government initiative in South Africa, is mainly responsible for the country's increase in energy storage projects. The Battery Energy Storage Systems (BESS) project, which will create a 360 MW storage system across several renewable energy plants controlled by Eskom, South Africa's state-owned utility, was announced in November 2021.

- In quarter 4 of 2022, lithium-ion cells and batteries worth around USD 350 million were imported by South Africa, and around USD 200 million in quarter 3 of the same year. In 2022, the country spent around USD 700 million on importing lithium-ion cells and batteries.

- Hence, owing to the above points, South Africa is expected to see significant growth in the African battery market during the forecast period.

Africa Battery Industry Overview

The African battery market is moderately fragmented. Some of the key players in this market (not in particular order) include Toshiba Corp., Murata Manufacturing Co. Ltd, Exide Industries Ltd, Panasonic Corporation, and Duracell Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Declining Cost of Lithium Batteries

- 4.5.1.2 Increased Adoption of Renewable Energy

- 4.5.2 Restraints

- 4.5.2.1 Mismatch in Demand and Supply of Raw Materials for Battery Manufacturing

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Primary Battery

- 5.1.2 Secondary Battery

- 5.2 Technology

- 5.2.1 Lithium-ion Battery

- 5.2.2 Lead-acid Battery

- 5.2.3 Other Technologies

- 5.3 Application

- 5.3.1 Automotive batteries

- 5.3.2 Industrial Batteries

- 5.3.3 Portable Batteries

- 5.3.4 Other Applications

- 5.4 Countries

- 5.4.1 South Africa

- 5.4.2 Nigeria

- 5.4.3 Kenya

- 5.4.4 Egypt

- 5.4.5 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaborations, and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Duracell Inc.

- 6.3.2 Panasonic Corporation

- 6.3.3 Toshiba Corporation

- 6.3.4 Exide Industries Ltd

- 6.3.5 Murrata manufacturing Co. Ltd

- 6.3.6 Uganda Batteries Limited

- 6.3.7 Energizer Holdings Inc.

- 6.3.8 Luminous Power Technology

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Utilization of Solar PV Battery Energy Storage Systems

02-2729-4219

+886-2-2729-4219