|

市場調查報告書

商品編碼

1690929

印度工業自動化:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)India Industrial Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

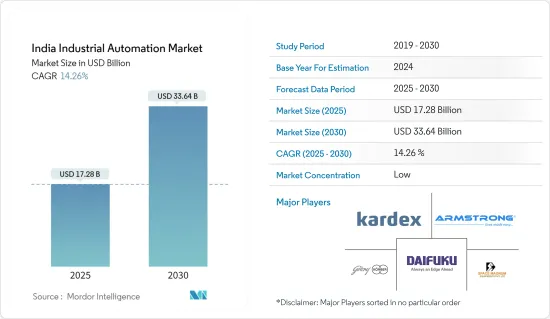

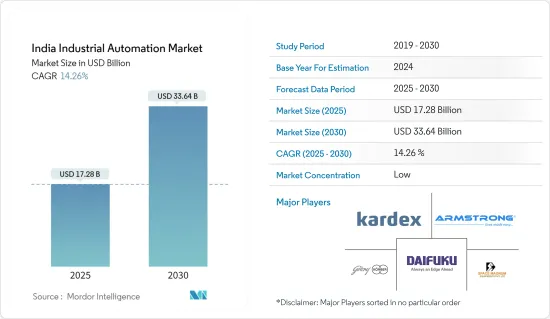

印度工業自動化市場規模預計在 2025 年為 172.8 億美元,預計到 2030 年將達到 336.4 億美元,預測期內(2025-2030 年)的複合年成長率為 14.26%。

工業自動化是指利用機器人、電腦、資訊科技和其他控制系統來取代人類處理產業中的多個流程和機器。從工業化範圍來看,是機械化的第二階段。

關鍵亮點

- 工業物聯網和工業 4.0 是完整物流鏈演進、生產和管理的現代技術方法的核心,也稱為智慧工廠自動化,是機器和設備透過網路連接的工業領域的主導趨勢。

- 貼標設備是多個產業生產線的重要組成部分。除了基本結構外,它還具有自動標籤進紙器,可記錄標籤長度並隨著產品尺寸的變化而檢索標籤。這些功能有利於減少停機時間、提高生產力並降低成本。

- 此外,隨著印度製造業的成長,醫療保健產業對自動化設備的採用預計也會成長。私人醫療保健提供者的崛起、製藥商的擴張以及全民醫療保健的引入等主要趨勢預計將塑造未來的製藥業。

- 智慧工廠自動化系統的實施和採購成本約佔其總生命週期成本的一半。此外,網路和技術的頻繁變化將大大增加初始投資以外的成本,進一步抑製印度工業自動化的採用。

- 新冠疫情和全球封鎖規定嚴重影響了工業活動。封鎖的影響包括勞動力短缺、供應鏈中斷、製造過程中使用的原料短缺、價格波動可能導致最終產品產量增加並導致預算超出、運輸問題等。

印度工業自動化市場趨勢

HMI推動成長

- 人機介面 (HMI) 是一種使用者介面或儀表板,其主要功能是將人與機器、系統或設備連接起來。 HMI 與可程式邏輯控制器 (PLC) 和輸入/輸出感測器通訊,以圖形、圖表和數位儀表板的形式檢索和顯示關鍵訊息,以及顯示和管理警報,並連接到 SCADA、ERP 和 MES 系統,所有這些都來自單一主機。在工廠自動化範圍內,促進與機器互動的關鍵組件是工業控制面板、工業用電腦和顯示器、機器控制、觸控螢幕、小鍵盤、開關和控制設備的軟體。

- 在工業環境中,HMI 主要用於直覺地顯示資料、追蹤生產時間、趨勢、標籤、監控關鍵績效指標 (KPI) 以及監控機器輸入和輸出。這些應用程式可提高生產力、降低硬體成本、簡化管理任務並減少與工作相關的事故。

- HMI 對於與製造相關的行業非常有用,因為它們主要需要根據工廠的具體要求進行定製編程,並且可以監控、控制和保護機器和操作,無論是簡單還是複雜的任務,都無需人工干預。

- HMI 技術正擴大被各行各業的組織所採用,包括能源、石油和天然氣、運輸、食品和飲料、電力、水和用水和污水、製造、回收和許多其他行業,其應用範圍廣泛,包括與設備互動和最佳化工業流程。

工廠自動化市場-汽車產業確認成長

- 汽車產業是世界自動化製造設施中佔有重要地位的突出產業之一。據觀察,各汽車製造商的生產設施都已自動化,以保持精度和效率。此外,電動車取代傳統汽車的趨勢日益成長,預計將進一步增加汽車產業的需求。

- 根據 IBEF 的汽車行業報告,隨著印度中產階級的不斷壯大以及年輕人口的不斷增加,二輪車在銷售上佔據了主導地位。此外,企業對開拓農村市場的興趣日益濃厚,進一步推動了該領域的成長。物流和客運行業的成長正在推動商用車的需求。預計未來市場的成長將受到汽車電氣化等新興趨勢的推動,尤其是小型車和三輪車。

- 此外,該公司正在使用自動化汽車組裝來製造馬達、變速箱、燃油系統和泵浦等零件。機器人技術和視覺技術非常適合建造符合人體工學且高效的產品線,可以快速完成組裝,同時使人工遠離危險環境。因此,安全也是印度汽車產業自動化背後的驅動力。

- 此外,印度是主要的汽車出口國,預計在預測期內出口將顯著成長。此外,印度政府推出的多項舉措,如印度市場的報廢措施、2026 年汽車使命計劃以及與生產相關的獎勵計劃,可能會使印度成為二輪車和四輪車市場的強大參與企業。

印度工業自動化產業概況

印度工業自動化市場競爭激烈,有多家參與企業,包括 BHEL、ABB Limited、Grey Orange Pte Ltd、Kardex India Storage Solutions Pvt.Ltd、三菱電機等。為了增加市場佔有率和可回收性,參與企業正在採用產品創新、合作、合併和收購來進一步推動市場發展。

- 2023 年 6 月 - Schaefer Systems International Pvt. Ltd 推出了 SSI 零件揀選應用程式,這是一個具有一系列創新功能的全自動零件揀選系統。這種高度通用的解決方案包括專用的智慧軟體,並擁有先進的功能,例如使用人工智慧 (AI) 的物體識別、拾取和放置、取得專利的抓握點確定和極其溫和的產品處理。

- 2023 年 6 月 - 三菱電機宣布,其全資子公司 ICONICS Corporation 已正式同意收購 ICONICS UK, Ltd. 的完全子公司,該公司銷售 SCADA(監控和數據採集)*1 軟體並開發相關的雲端應用程式。三菱電機和 ICONICS 計劃利用 ICONICS UK 的技術經營模式,以最佳化工廠設備和系統。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- COVID-19 工業影響評估

第5章市場動態

- 市場促進因素

- 使用數位印刷技術生產的標籤的需求不斷增加

- 醫療和化妝品領域的採用率很高

- 市場限制

- 缺乏能夠承受惡劣天氣條件的產品

第6章市場區隔

- 按解決方案類型

- 自動化物料輸送解決方案

- 硬體

- 輸送機/分類系統

- 自動儲存和搜尋系統(AS/RS)

- 移動機器人(自動導引運輸車和自主移動機器人)

- 自動識別資料擷取(AIDC)

- 軟體 - 倉庫管理系統 (WMS) / 倉庫控制系統 (WCS)

- 工廠自動化解決方案

- 工業控制系統

- DCS

- SCADA

- PLC

- HMI

- 其他控制系統

- 現場設備

- 感應器和變送器

- 交流電交流變頻器

- 伺服馬達

- 電腦數值控制(CNC)機床

- 逆變器

- 工業機器人

- 其他工廠自動化解決方案

- 軟體

- 製造執行系統(MES)

- 產品生命週期管理 (PLM)

- 其他

- 自動化物料輸送解決方案

- 按最終用戶

- 自動化物料輸送市場

- 製造業

- 非製造業

- 通用產品

- 醫療保健

- 快速消費品/非耐久財

- 其他

- 工廠自動化市場

- 飲食

- 製藥

- 車

- 纖維

- 力量

- 石油和天然氣

- 石化產品和化肥

- 其他

- 自動化物料輸送市場

第7章 競爭基準化分析

- 競爭對手排名

- 市場排名分析:自動化物料輸送

- 市場排名分析:工廠自動化解決方案

第8章競爭格局

- 物料輸送公司簡介

- Daifuku India Private Limited(Daifuku Co. Ltd)

- Space Magnum Equipment Pvt. Ltd

- Godrej Koerber Supply Chain Limited

- Kardex India Storage Solutions Private Limited(Kardex Holding AG)

- Armstrong Ltd

- Falcon Autotech Private Limited

- Grey Orange Pte Ltd

- Addverb Technologies Private Limited

- Hinditron Group

- The Hi-Tech Robotic Systemz Limited

- Bastian Solution Private Limited(Toyota Industries)

- ATS Conveyors India Pvt. Ltd(ATS Group)

- Kuka India Private Limited(Kuka AG)

- Schaefer Systems International Pvt. Ltd(SSI Schaefer AG)

- Rucha Yantra LLP

- 公司簡介 - FA解決方案

- Bharat Heavy Electricals Limited(BHEL)

- ABB Ltd

- Yokogawa Electric Corporation

- Siemens AG

- Emerson Electric Co.

- Schneider Electric

- Honeywell International Inc.

- Rockwell Automation Inc.

- Mitsubishi Electric Corporation

- Danfoss A/S

- Fuji Electric Co. Ltd

- Larsen & Toubro Ltd

- Crompton Greaves Ltd

- Robert Bosch GmbH

- Bain & Company Inc

- Boston Consulting Group

第9章投資分析

第10章:投資分析市場的未來

The India Industrial Automation Market size is estimated at USD 17.28 billion in 2025, and is expected to reach USD 33.64 billion by 2030, at a CAGR of 14.26% during the forecast period (2025-2030).

Industrial automation refers to using control systems, like robots, computers, and information technologies, to handle several processes and machinery in an industry to replace human beings. It is the second step past mechanization in the scope of industrialization.

Key Highlights

- The Industrial Internet of Things and Industry 4.0 is at the center of the latest technological approaches for the evolution, production, and management of the complete logistics chain, also known as smart factory automation, and are dominating the trends in the industrial sector with machinery and devices being connected via the internet.

- Labeling equipment is a crucial component for production lines in several industries. In addition to the basic structure, the machines also feature an automatic label feeder to keep track of label length and retrieve it as the product changes size. These features are beneficial in reducing downtime, increasing productivity, and reducing costs.

- Moreover, The adoption of automated equipment in the healthcare industry is expected to grow, owing to the growing manufacturing sectors in India. Major trends, such as the growth of private healthcare providers, the expansion of drug manufacturing companies, and the rollout of universal healthcare, are expected to shape the pharmaceutical industry in the future.

- The installation and acquisition cost of an automation system for an intelligent factory represents approximately half of the total cost during its lifetime. Further, the frequent changes in networking and technology result in substantial cost increases, which is more than the initial investment, further restraining the adoption of industrial automation in India

- The COVID-19 outbreak and lockdown restrictions worldwide severely affected industrial activities. The effects of the lockdown include labor shortages, disruptions in the supply chain, lack of availability of raw materials utilized in the manufacturing process, fluctuating prices that could force the production of the final product to increase and go beyond budget, shipping problems, etc.

India Industrial Automation Market Trends

HMI to Witness the Growth

- A Human-Machine Interface (HMI) is a user interface or dashboard whose primary function includes connecting a person to a machine, system, or device. HMI functions by communicating with Programmable Logic Controllers (PLCs) and input/output sensors to fetch and display important information in the form of graphs, charts, or digital dashboards, along with other functions such as viewing and managing alarms, and connecting with SCADA, ERP, and MES systems, all through one console. In the factory automation scope, major components that facilitate interaction with that machine include industrial control panels, industrial PC and display, machinery controls, touchscreens, keypads, switches, and software for controlling equipment.

- In industrial settings, HMIs are primarily utilized for Visually displaying data, tracking production time, trends, and tags, overseeing key performance indicators (KPIs), and monitoring machine inputs and outputs. These applications boost production rates, minimize hardware costs, ease managerial tasks, and reduce work-related accidents.

- HMI is extremely useful for industries related to manufacturing as it primarily needs customized programming according to the plant's specific requirements, and it is ready to monitor, control, and safeguard machines and operations without the need for human intervention in either simple or complex jobs.

- The growing use of HMI technology in all industrial organizations, such as energy, oil and gas, transportation, food and beverage, power, water and wastewater, manufacturing, recycling, and many more, as well as a wide range of the application of other companies to interact with their devices and optimize their industrial processes.

Factory Automation Market - Automotive Sector to Witness the Growth

- The automotive industry is one of the prominent sectors that hold a significant in the worldwide automated manufacturing facilities. It is observed that the production facilities of various automakers are automated to maintain accuracy and efficiency. Moreover, the growing trend of replacing conventional vehicles with EVs is expected to augment the automotive industry's demand further.

- According to the IBEF automobile industry report, the two-wheelers segment dominates the market in terms of volume due to a growing middle-class population, and a considerable percentage of India's population is young. Moreover, the rising interest of companies in examining the rural markets is further aiding the sector's growth. The growing logistics and passenger transportation industries are driving the demand for commercial vehicles. Future market growth is expected to be fueled by new trends, including the electrification of vehicles, particularly small passenger automobiles and three-wheelers.

- Furthermore, companies are using automated automotive assembly lines for manufacturing components such as motors, gearboxes, fuel systems, and pumps. Robotics and vision are best suited for creating ergonomic and efficient product lines that protect the human workforce from hazardous conditions while completing assembly quickly. Hence, the safety factor is also driving automation in the automotive industry of India.

- India is also a major auto exporter and has substantial export growth expectations for forecast period. Additionally, several initiatives by the Government of India, like the scrappage policy, Automotive Mission Plan 2026, and production-linked incentive schemes in the Indian market, are likely to make India a prominent player in the two-wheeler and four-wheeler markets.

India Industrial Automation Industry Overview

India's industrial automation market is competitive due to multiple players, such as BHEL, ABB Limited, Grey Orange Pte Ltd, and Kardex India Storage Solutions Pvt. Ltd, Mitsubishi Electric, and more. Players adopt product innovations, partnerships, mergers, and acquisitions to increase their market shares and recyclability, further driving the market.

- June 2023 - The Schaefer Systems International Pvt. Ltd launched a fully automated piece-picking system with numerous innovative features the SSI Piece Picking application. This versatile solution includes dedicated smart software and boasts advanced functions such as object recognition using artificial intelligence (AI), pick-and-place, patented gripping point determination, and extremely gentle product handling.

- June 2023 -Mitsubishi Electric announced that its wholly owned subsidiary ICONICS, Inc., has formally agreed to completely acquire ICONICS UK, Ltd., which sells supervisory control and data acquisition (SCADA)1 software and develops related cloud applications. Mitsubishi Electric and ICONICS plan to leverage ICONICS UK's technology and to establish a Circular Digital-Engineering business model for factory-automation solutions that optimize factory equipment and systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Labels Manufactured with Digital Print Technologies

- 5.1.2 High Adoption from the Healthcare and Cosmetic Segment

- 5.2 Market Restraints

- 5.2.1 Lack of Products with the Ability to Withstand Harsh Climatic Conditions

6 MARKET SEGMENTATION

- 6.1 By Type of Solution

- 6.1.1 Automated Material Handling Solutions

- 6.1.1.1 Hardware

- 6.1.1.1.1 Conveyor/Sortation Systems

- 6.1.1.1.2 Automated Storage and Retrieval System (AS/RS)

- 6.1.1.1.3 Mobile Robots (Automated Guided Vehicles and Autonomous Mobile Robots)

- 6.1.1.1.4 Automatic Identification and Data Capture (AIDC)

- 6.1.1.2 Software - Warehouse Management System (WMS)/ Warehouse Control System (WCS)

- 6.1.2 Factory Automation Solutions

- 6.1.2.1 Industrial Control Systems

- 6.1.2.1.1 DCS

- 6.1.2.1.2 SCADA

- 6.1.2.1.3 PLC

- 6.1.2.1.4 HMI

- 6.1.2.1.5 Other Control Systems

- 6.1.2.2 Field Devices

- 6.1.2.2.1 Sensors and Transmitters

- 6.1.2.2.2 Electric AC Drives

- 6.1.2.2.3 Servo Motors

- 6.1.2.2.4 Computer Numerical Control (CNC) Machines

- 6.1.2.2.5 Inverters

- 6.1.2.2.6 Industrial Robots

- 6.1.2.2.7 Other Factory Automation Solutions

- 6.1.2.3 Software

- 6.1.2.3.1 Manufacturing Execution System (MES)

- 6.1.2.3.2 Product Lifecycle Management (PLM)

- 6.1.2.3.3 Other Types

- 6.1.1 Automated Material Handling Solutions

- 6.2 By End-user

- 6.2.1 Automated Material Handling Market

- 6.2.1.1 Manufacturing

- 6.2.1.2 Non-manufacturing

- 6.2.1.2.1 General Merchandise

- 6.2.1.2.2 Healthcare

- 6.2.1.2.3 FMCG/Non-durable Goods

- 6.2.1.2.4 Other End-Users

- 6.2.2 Factory Automation Market

- 6.2.2.1 Food and Beverage

- 6.2.2.2 Pharmaceutical

- 6.2.2.3 Automotive

- 6.2.2.4 Textiles

- 6.2.2.5 Power

- 6.2.2.6 Oil and Gas

- 6.2.2.7 Petrochemicals and Fertilizers

- 6.2.2.8 Other End-Users

- 6.2.1 Automated Material Handling Market

7 COMPETITIVE BENCHMARKING

- 7.1 Competitors Ranking

- 7.1.1 Market Ranking Analysis - Automated Material Handling

- 7.1.2 Market Ranking Analysis - Factory Automation Solution

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles - Automated Material Handling

- 8.1.1 Daifuku India Private Limited (Daifuku Co. Ltd)

- 8.1.2 Space Magnum Equipment Pvt. Ltd

- 8.1.3 Godrej Koerber Supply Chain Limited

- 8.1.4 Kardex India Storage Solutions Private Limited (Kardex Holding AG)

- 8.1.5 Armstrong Ltd

- 8.1.6 Falcon Autotech Private Limited

- 8.1.7 Grey Orange Pte Ltd

- 8.1.8 Addverb Technologies Private Limited

- 8.1.9 Hinditron Group

- 8.1.10 The Hi-Tech Robotic Systemz Limited

- 8.1.11 Bastian Solution Private Limited (Toyota Industries)

- 8.1.12 ATS Conveyors India Pvt. Ltd (ATS Group)

- 8.1.13 Kuka India Private Limited (Kuka AG)

- 8.1.14 Schaefer Systems International Pvt. Ltd (SSI Schaefer AG)

- 8.1.15 Rucha Yantra LLP

- 8.2 Company Profiles - Factory Automation Solution

- 8.2.1 Bharat Heavy Electricals Limited (BHEL)

- 8.2.2 ABB Ltd

- 8.2.3 Yokogawa Electric Corporation

- 8.2.4 Siemens AG

- 8.2.5 Emerson Electric Co.

- 8.2.6 Schneider Electric

- 8.2.7 Honeywell International Inc.

- 8.2.8 Rockwell Automation Inc.

- 8.2.9 Mitsubishi Electric Corporation

- 8.2.10 Danfoss A/S

- 8.2.11 Fuji Electric Co. Ltd

- 8.2.12 Larsen & Toubro Ltd

- 8.2.13 Crompton Greaves Ltd

- 8.2.14 Robert Bosch GmbH

- 8.2.15 Bain & Company Inc

- 8.2.16 Boston Consulting Group