|

市場調查報告書

商品編碼

1690912

美國金屬罐:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)United States (US) Metal Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

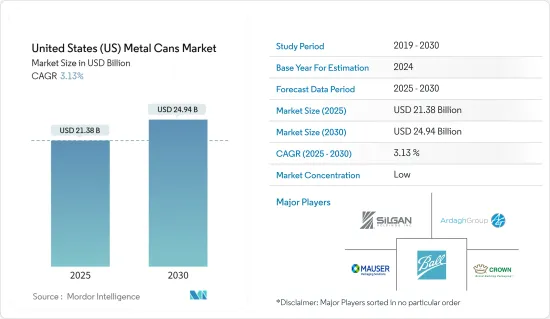

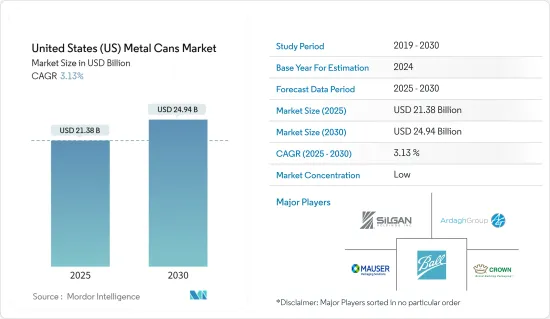

預計2025年美國金屬罐市場規模為213.8億美元,到2030年預計將達到249.4億美元,預測期內(2025-2030年)的複合年成長率為3.13%。

關鍵亮點

- 金屬罐越來越受歡迎是由於多種因素造成的,包括其永續性、耐用性和易用性,以及場外消費的成長和消費者對新形式(酒精和非酒精)、食品和氣霧劑的偏好,而罐頭是首選包裝。

- 金屬罐,尤其是鋁罐,是全球回收最多的包裝單元。鋁罐在其生命週期結束時可以回收利用,且品質不會劣化,使其成為各行各業品牌的首選包裝材料,優於塑膠和紙張等其他材料。在美國,每分鐘有105,784個鋁罐被回收,整體回收率約為50%,是所有飲料容器中回收率最高的。

- 預計到 2030 年,鋁罐的需求將大幅增加,其中北美,尤其是美國,預計將對這一需求成長做出重大貢獻。在美國,由於金屬容器和包裝的需求量龐大,縱向和橫向的聯盟不斷形成。 2023 年 5 月,Manna Capital 與 Ball Corporation 合作,擴建其在美國的鋁罐板製造和回收工廠。

- 金屬罐用於寵物食品包裝,在無塑膠寵物食品包裝中發揮重要作用。美國對寵物食品的需求不斷增加,推動了用於包裝寵物食品的金屬罐生產能力的提高。根據寵物永續發展聯盟 (PSC) 於 2023 年 7 月發布的一項研究,光是在美國,寵物食品和零食產業每年就排放約 3 億磅塑膠廢棄物。這是一些加工商放棄塑膠包裝、轉而使用金屬罐來生產寵物食品的關鍵因素。

- 金屬罐包裝面臨其他包裝解決方案的競爭。可用的替代包裝解決方案包括塑膠、紙和玻璃。塑膠包裝仍然是金屬包裝的主要競爭對手。食品和飲料行業是金屬罐的主要用戶,現在開始採用可回收塑膠包裝解決方案。塑膠罐是透明的,這有助於品牌表明食品的品質。

- 此外,塑膠包裝的逐漸增加也對市場構成了威脅。這主要是由於聚對苯二甲酸乙二醇酯(PET)等塑膠作為替代品的廣泛使用。 PET 塑膠有可能取代食品和飲料領域的金屬罐包裝解決方案。

美國金屬罐市場趨勢

鋁價確認成長

- 鋁罐可以長時間保存食物,並提供幾乎 100% 的防光、防氧、防濕氣和其他污染物保護。這種材料具有防鏽和防腐蝕的特性,是所有包裝中保存期限最長的材料之一。鋁罐在食品和飲料行業的使用日益增多,這是因為鋁罐具有保護性、永續性優勢和便利性。隨著製造商和消費者都認知到鋁包裝的好處,預計這一趨勢將會持續下去。

- 透過與罐體製造商合作開發新型鋁製氣霧罐合金,可以顯著減輕罐體重量。這使得它更加永續性。全層運輸包裝也是如此,它在該領域應用越來越廣泛,有利於物流和環境。

- 鋁製氣霧罐的市場佔有率受到個人護理和汽車行業使用量的增加所推動。 100-250毫升的鋁製氣霧罐因其實用的包裝選擇而變得越來越廣泛。其他細分市場(包括 251ml-500ml、100ml 以下和其他)在全球市場上獲得了更好的收益。

- 與競爭包裝類型相比,鋁罐的回收率和再生利用率更高。據鋁業協會稱,鋁罐是市場上回收最多的材料之一。 2022 年 4 月,鮑爾公司與 Recycle Aerosol LLC 合作,以提高美國鋁製氣霧罐的回收率。此次合作將促進氣霧罐的回收利用,並建立一個將舊罐回收製成新氣霧罐的封閉式環形回路系統。

- 根據鋁業協會統計,鋁業每年回收超過400億個罐頭。在美國,回收目前掩埋垃圾掩埋場的鋁每年可節省 8 億美元。

- 如今,鋁製飲料罐已成為國內最可回收的飲料容器。美國罐頭製造商協會 (CMI) 的飲料行業成員正致力於將美國鋁回收率提高到新的水平。 CMI 發布了一份詳細的入門指南和藍圖,說明如何實現 CMI 雄心勃勃的 2020-2021 年回收率目標。 CMI成員宣布的新的鋁飲料回收率目標是,到2030年,美國的回收率達到70%,到2040年達到80%,到2050年達到90%。

非酒精飲料預計將成長

- 飲料業包括碳酸飲料、果汁、咖啡、茶等多種飲料。該公司的目標客戶是那些偏好不斷變化的、追求清爽、高偏好飲料的消費者。對健康和保健的關注正在推動消費者對更健康飲料的需求。這推動了對強化水、運動飲料、維生素和礦物質強化飲料以及益生菌等機能飲料的需求。消費者越來越關注糖的攝取量及其對健康和福祉的影響。因此,對無糖、天然和有機飲料的需求日益成長。飲料產業格局的不斷發展是推動非酒精飲料罐市場成長的主要因素。

- 非酒精飲料領域的新產品推出對成長做出了重大貢獻。例如,2023 年 1 月,百事可樂推出了碳酸檸檬萊姆軟性飲料 Starry。它在美國零售店有兩種口味:普通口味和零糖口味。碳酸飲料傳統上都是罐裝,百事公司推出的Starly為市場增添了另一種使用罐裝包裝的產品。這可能會導致對通常用於碳酸飲料的標準和超薄飲料罐的需求增加。

- 根據飲料業雜誌報道,紅牛是2022年美國最大的機能飲料品牌,銷售額約68.5億美元。能量飲料(包括紅牛)通常採用罐裝,因為罐裝方便、易於攜帶,並且能夠保持產品的新鮮度和碳酸化。紅牛銷量的成長直接帶動了作為該產品類型主要包裝的飲料罐的需求成長。

- 據有機貿易協會稱,美國有機飲料消費量預計將在 2022 年達到 25 億美元,2025 年達到 28 億美元。有機飲料通常包括有機果汁、茶和其他健康食品,並且通常採用符合有機和永續性原則的環保容器包裝。

- 鋁罐是有機飲料的理想選擇,因為它們可回收並符合有機運動的永續性概念。隨著消費的成長,作為有機飲料包裝選擇的罐頭的需求也可能會增加。

美國金屬罐市場概況

美國金屬罐市場是一個競爭激烈的市場。由於消費者傾向於選擇更具特色的品牌,品牌身份驗證在市場上發揮重要作用。市場滲透率不斷提高,大型企業在現有市場中佔有一席之地,策略聯盟進一步加劇了競爭。該市場也是該行業中佔有較大佔有率的主要公司的所在地。由於金屬罐製造商需要剝離大量高度專業的資產,退出市場的門檻很高,競爭對手之間的競爭可能會加劇。在該地區營運的主要企業包括 Crown Holdings Inc.、Ball Corporation、Silgan Holdings Inc.、Mauser Packaging Solutions(BwayHolding Corporation)和 Ardagh Metal Packaging SA(Ardagh Group SA)。

- 2023年9月,永續鋁解決方案供應商Novelis宣布與北美Ball Corporation簽署了一份主力客戶協議。根據協議條款,Novelis 將向北美的球罐製造廠提供鋁板。

- 2023 年 5 月,鋁製飲料罐製造商 Ardagh Metal Packaging 和 Crown Holdings 宣布計劃投資一項新的津貼計劃,作為其持續支持在專門從事單流回收分類的資源回收設施內安裝更多鋁罐捕獲設備的努力的一部分。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場動態

- 市場促進因素

- 金屬包裝回收率高

- 罐裝食品方便且成本低廉

- 市場限制

- 替代包裝解決方案的可用性

第6章市場區隔

- 依材料類型

- 鋁

- 鋼

- 按罐型

- 食物

- 蔬菜

- 水果

- 寵物食品

- 湯

- 咖啡

- 其他

- 氣霧劑

- 化妝品和個人護理

- 家居用品

- 藥品和動物用藥品

- 油漆和清漆

- 汽車/工業

- 其他氣溶膠

- 飲料

- 酒精飲料

- 非酒精飲料

- 食物

第7章競爭格局

- 公司簡介

- Crown Holdings Inc.

- Ball Corporation

- Silgan Holdings Inc.

- Mauser Packaging Solutions(Bway Holding Corporation)

- Ardagh Metal Packaging SA(Ardagh Group SA)

- DS Containers

- CCL Container(CCL Industries Inc.)

- Independent Can Company

- Tecnocap Group

- CAN-PACK Group(Giorgi Global Holdings Inc.)

- Allstate Can Corporation

- Envases Group(ABA Packaging Corporation)

第8章投資分析

第9章:市場的未來

The United States Metal Cans Market size is estimated at USD 21.38 billion in 2025, and is expected to reach USD 24.94 billion by 2030, at a CAGR of 3.13% during the forecast period (2025-2030).

Key Highlights

- The increasing popularity of metal cans can be attributed to various factors, including their sustainability, durability, and ease of use, as well as the increase in non-premise consumption and consumer preference for new formats (alcoholic and nonalcoholic), food and aerosol in which cans are the preferred packaging.

- Metal cans, especially aluminum, are the most recycled packaging units worldwide. They can be recycled at the end of their lifecycle without quality degradation, making them the preferred packaging material for brands across industries, ahead of other materials, such as plastic and paper. In the United States, 105,784 aluminum cans are recycled each minute, leading to an overall recycling rate of nearly 50%, the highest recycling rate for any beverage container.

- The demand for aluminum cans is expected to increase significantly by 2030, and North America, specifically the United States, is anticipated to contribute hugely to that demand growth. Several vertical and horizontal alignments are constantly taking place in the country owing to the immense demand for metal packaging. In May 2023, Manna Capital collaborated with Ball Corporation to expand the aluminum can sheet manufacturing and recycling facility in the United States.

- Metal cans are used for pet food packaging and have played a significant role in plastic-free pet food packaging. The increased demand for pet food in the United States is driving the increase in the production capacity of metal cans for pet food packaging. According to a Pet Sustainability Coalition (PSC) study published in July 2023, the pet food and treats industry generates an estimated 300 million pounds of plastic waste annually from the United States alone. This is a significant factor due to which some processors are moving away from plastic packaging and gravitating more toward metal cans for pet food.

- Metal cans packaging faces much competition from other packaging solutions. Alternatives such as plastic, paper, or glass packaging solutions are available. Plastic packaging continues to be the main competitor of metal packaging. The food and beverage industry, the primary user of metal cans, has started adopting recyclable plastic packaging solutions. Plastic cans are transparent, which helps brands to show their food's quality.

- Moreover, incremental enhancements in plastic packaging are posing a threat to the market. This can primarily be attributed to the popularity of plastics, such as polyethylene terephthalate (PET), as substitutes. PET plastics threaten to displace metal can packaging solutions in the food and beverage sector.

United States (US) Metal Cans Market Trends

Aluminum to Witness the Growth

- Aluminum cans offer long-term food quality preservation benefits and nearly 100% protection against light, oxygen, moisture, and other contaminants. The material is rust and corrosion-resistant, providing one of the most extended shelf lives considering any packaging. The rising application of aluminum cans in the food and beverage industry can be attributed to their protective properties, sustainability advantages, and convenience. This trend is expected to continue as both manufacturers and consumers recognize the benefits associated with aluminum packaging.

- Significant weight reductions are made possible by creating new alloys for aluminum aerosol cans, which are advanced in collaboration with slug manufacturers. This promotes even greater sustainability. The same applies to complete-layer transport packaging, which is utilized more frequently in the sector and benefits logistics and the environment.

- The aluminum aerosol can market share is driven by the increased usage of these cans in the personal care and automotive industries. Due to their practical packaging options, 100 to 250-ml aluminum aerosol cans are becoming more widely used. Other segments, including 251 ml to 500 ml, less than 100 ml, and others, are capturing better revenue in the global market.

- Aluminum cans have a higher recycling rate and more recycled content than competing package types. According to the Aluminum Association, it is one of the most recycled materials on the market. In April 2022, Ball Corporation partnered with Recycle Aerosol LLC to boost the recycling rates of aluminum aerosol cans in the United States. The collaboration would increase aerosol can recycling and establish a closed-loop system in which used cans are recycled into new aerosol cans.

- According to the Aluminum Association, the aluminum industry recycles more than 40 billion cans annually. The United States saves up to USD 800 million per year by recycling the amount of aluminum that goes into landfills presently.

- Recently, aluminum beverage cans have become the most recyclable beverage containers in the country. The beverage industry members of the Can Manufacturers Institute (CMI) are on a mission to raise US aluminum recycling rates to new levels. CMI published an in-depth primer and roadmap to explain how the CMI's ambitious 2020-2021 recycling rate targets were met. The new aluminum beverage recycling rate targets, announced by CMI members, aim to achieve 70% by 2030, 80% by 2040, and 90% recycling rates by 2050 in the United States.

Non-alcoholic Beverages to Witness Growth

- The beverage industry includes a variety of beverages, from carbonated soft drinks and juices to coffee and tea. It targets consumers with ever-changing tastes for refreshing and indulgent drinks. Health and wellness concerns are driving consumers to seek healthier beverages. This has increased the demand for functional drinks such as fortified water, sports drinks, vitamin and mineral-fortified beverages, and probiotics. Consumers are becoming increasingly aware of their sugar intake and its impact on their health and well-being. As a result, there is a growing need for sugar-free, natural, and organic drinks. The evolving landscape of the beverage industry has been a key driver for the growth of the non-alcoholic beverage cans market.

- New product launches in the non-alcoholic beverage sector have significantly contributed to the growth. For instance, in January 2023, PepsiCo launched Starry, a lemon and lime carbonated soft drink with a crisp and refreshing taste. The drink is available in Regular and Zero Sugar versions at United States retailers. Carbonated soft drinks are traditionally packaged in cans, and PepsiCo's introduction of Starry adds another product to the market that relies on cans for packaging. This can increase demand for standard and slimline beverage cans commonly used for carbonated beverages.

- According to the Beverage Industry Magazine, Red Bull was the United States' largest energy beverage brand in 2022, based on sales of about USD 6.85 billion. Energy drinks, including Red Bull, are typically packaged in cans due to their convenience, portability, and ability to preserve the product's freshness and carbonation. As Red Bull's sales grow, it directly contributes to an increased demand for beverage cans as the primary packaging choice for this product category.

- According to the Organic Trade Association, in 2022, the US consumption of organic beverages amounted to USD 2.5 billion and is forecasted to reach USD 2.8 billion by 2025. Organic drinks, which often include organic juices, teas, and other health-conscious options, are typically packaged in eco-friendly containers that align with organic and sustainable principles.

- Aluminum cans are a suitable choice for organic beverages because they are recyclable and align with the sustainability ethos of the organic movement. As consumption grows, the demand for cans as a packaging option for organic beverages may also increase.

United States (US) Metal Cans Market Overview

The US metal cans market is competitive in nature. Brand identity plays a significant role in the market due to the consumers' inclination toward a more well-identified brand. Market penetration is growing, with a strong presence of major players in established markets, and strategic partnerships are further intensifying the competition. The market also has significant players operating in the industry with higher shares. The barriers to exiting the market are high since metal can manufacturers require a significant divestment of quite specialized assets, which tends to intensify the competitive rivalry. Some of the key players operating in the region include Crown Holdings Inc., Ball Corporation, Silgan Holdings Inc., Mauser Packaging Solutions (BwayHolding Corporation), and Ardagh Metal Packaging SA (Ardagh Group SA).

- In September 2023, Novelis, a sustainable aluminum solutions provider, declared that it entered into an anchor customer agreement with Ball Corporation in North America. The agreement stipulates that Novelis will provide aluminum sheets to the Ball can manufacturing facilities in North America under the terms of the contract.

- In May 2023, Ardagh Metal Packaging and Crown Holdings, producers of aluminum beverage cans, announced their plans to invest in a new grant initiative as part of their ongoing support for initiatives to encourage the installation of further aluminum can capture equipment within material recovery facilities, which specialize in sorting single-stream recyclables.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Recyclability Rates of Metal Packaging

- 5.1.2 Convenience and Lower Price offered by Canned Food

- 5.2 Market Restraints

- 5.2.1 Presence of Alternate Packaging Solutions

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Aluminum

- 6.1.2 Steel

- 6.2 By Can Type

- 6.2.1 Food

- 6.2.1.1 Vegetables

- 6.2.1.2 Fruits

- 6.2.1.3 Pet Food

- 6.2.1.4 Soups

- 6.2.1.5 Coffee

- 6.2.1.6 Other Foods

- 6.2.2 Aerosols

- 6.2.2.1 Cosmetics and Personal Care

- 6.2.2.2 Household

- 6.2.2.3 Pharmaceutical/Veterinary

- 6.2.2.4 Paints and Varnishes

- 6.2.2.5 Automotive/Industrial

- 6.2.2.6 Other Aerosols

- 6.2.3 Beverages

- 6.2.3.1 Alcoholic Beverages

- 6.2.3.2 Non-alcoholic Beverages

- 6.2.1 Food

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Crown Holdings Inc.

- 7.1.2 Ball Corporation

- 7.1.3 Silgan Holdings Inc.

- 7.1.4 Mauser Packaging Solutions (Bway Holding Corporation)

- 7.1.5 Ardagh Metal Packaging S.A. (Ardagh Group SA)

- 7.1.6 DS Containers

- 7.1.7 CCL Container (CCL Industries Inc.)

- 7.1.8 Independent Can Company

- 7.1.9 Tecnocap Group

- 7.1.10 CAN-PACK Group (Giorgi Global Holdings Inc.)

- 7.1.11 Allstate Can Corporation

- 7.1.12 Envases Group (ABA Packaging Corporation)