|

市場調查報告書

商品編碼

1690910

泰國 IT 與安全:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Thailand IT And Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

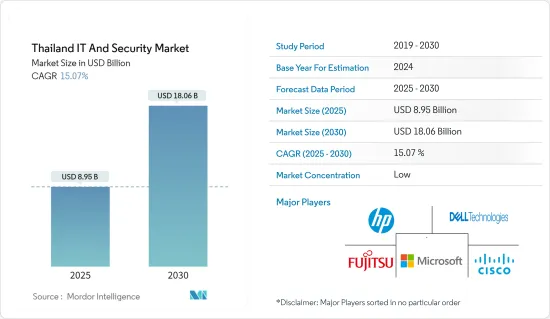

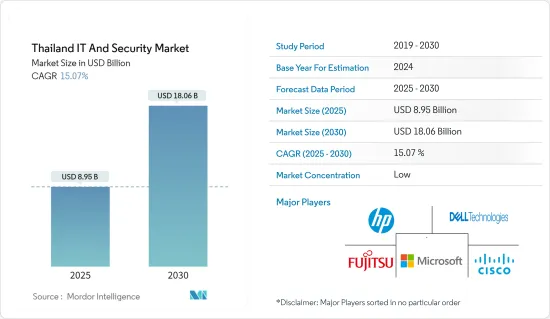

泰國 IT 和安全市場規模預計在 2025 年為 89.5 億美元,預計到 2030 年將達到 180.6 億美元,預測期內(2025-2030 年)的複合年成長率為 15.07%。

主要亮點

- 隨著網路的興起,泰國正在數位經濟轉型,為通訊服務供應商、數位娛樂、遊戲和家用電器等多個行業帶來新的收益來源。

- 數位轉型使企業更加依賴應用程式和擴展,從而使 IT 成為大多數企業的關鍵競爭優勢。此外,IT外包已不僅是一種削減成本的技術,還提供雲端遷移和雲端服務選項。這種新形式是由圍繞業務成長、客戶體驗和競爭顛覆的組織舉措所推動的。

- 政府推動數位技術發展和應用的措施也進一步推動了市場成長。例如,2023年11月,泰國政府與Google達成策略合作,以增強該國的數位競爭力並加速人工智慧創新。透過該協議,雙方有望共同實施人工智慧經濟蓬勃發展所需的四大基礎支柱。該協議包括增加數位基礎設施投資、促進安全負責任地採用人工智慧來轉變公共服務提供方式、嵌入雲端優先政策以及使該國更容易獲得數位技能等措施。

- 政府國防機構和企業正在將更多資料轉移到雲端,設計新的數位系統,並增加其網路基礎設施中的端點數量。對第三方和服務提供者的依賴性增加為攻擊者提供了滲透供應鏈的新機會。

- 推動該國網路安全解決方案和服務成長的因素包括該國網路攻擊的增加、對數位化和可擴展IT基礎設施的需求不斷成長、解決第三方供應商風險的需要不斷增加、MSSP 的發展以及雲端優先策略的採用。然而,缺乏滿足需求的熟練 IT 專業人員正在阻礙企業的業務並對泰國市場的成長構成挑戰。

- 新冠疫情加速了泰國各個終端用戶產業對數位技術的採用和數位化轉型力度。為了確保業務連通性,對雲端運算、協作工具和IT基礎設施相關解決方案的投資增加,導致對數位技術和遠端工作的依賴增加,從而引發了安全擔憂,導致市場對安全解決方案的需求增加。

泰國 IT 與安全市場趨勢

雲端安全推動市場成長

- 近年來,雲端運算服務在泰國經歷了顯著成長。此次轉型是政府推動數位化和雲端技術的舉措的一部分。泰國的許多行業正在採用雲端運算來實現業務流程的現代化並在各自的市場中獲得競爭優勢。

- 由於泰國擁有強大的網路基礎設施和高速網路連接,雲端運算在泰國越來越受歡迎。此外,本地和國際雲端服務供應商的不斷成長意味著泰國企業現在可以利用一系列雲端基礎的解決方案和服務。因此,預計預測期內最終用戶對雲端安全的需求將會增加,以保護雲端環境並打擊日益成長的網路威脅。

- 2023年7月,雲端運算服務供應商雲端運算解決方案(CCS)與全球科技公司騰訊的雲端業務騰訊雲端簽署了一份合作備忘錄,向泰國的商業企業提供騰訊雲端領先的雲端AI解決方案,包括IaaS、PaaS和SaaS。此次夥伴關係旨在透過售後服務提高客戶信任度和滿意度,促進正處於數位轉型階段的泰國各種規模和行業的企業業務成長。

- 泰國處於亞洲雲端運算採用趨勢的前沿。根據阿里雲「亞洲下一代雲端策略」調查,泰國的雲端運算採用正在迅速推進。大多數泰國企業(95%)計畫大幅增加雲端運算投資,領先印尼(94%)、菲律賓(91%)、香港特別行政區(83%)和新加坡(83%)等國家。調查結果顯示,許多企業基於可靠的本地支援和良好的安全聲譽而選擇公共雲端。這些以及其他與雲端技術及相關趨勢相關的發展預計將在未來幾年推動對雲端安全的需求。

IT硬體和設備預計將佔據較大的市場佔有率

- 泰國正在積極推行政府、醫療保健、教育和商業等多個領域的數位轉型。這個數位化進程需要對 IT 硬體和設備進行投資,以支援現代化工作、簡化業務並提高效率。

- 疫情期間,泰國政府鼓勵學校和大學進行線上活動,導致對桌上型電腦、平板電腦和筆記型電腦等 IT 硬體和設備的需求激增。更具包容性的數位世界的到來使得平板電腦等設備成為必需品而非奢侈品,從而推動了泰國的需求。

- 泰國是東南亞國家聯盟(ASEAN)地區最具活力的經濟體之一。該國的 IT 產業正在不斷擴大,對外國投資者的吸引力也越來越大。企業和政府機構的數位化不斷提高,加上精通科技的消費者數量不斷增加,推動了對 IT 硬體和設備的需求。

- 由於科技的應用日益廣泛,泰國的 IT 產業正在經歷強勁成長,為企業滿足高階用戶的需求提供了巨大的商業潛力。 2023 年 7 月,惠普宣布將把消費和商務用筆記型電腦的生產轉移到泰國和墨西哥,以實現中國以外的供應鏈多元化。

泰國 IT 和安全產業概況

泰國的 IT 和安全市場比較分散,一些全球性公司專注於擴大在基本客群,並採用有機和無機成長策略。

- 2024年3月,領先的雲端運算和網路安全解決方案供應商深信服科技與 VST ECS(泰國)建立策略合作夥伴關係,透過將 VST ECS 在 IT 解決方案分銷方面的專業知識和經驗與深信服的技術相結合,擴大深信服在泰國的基本客群。

- 2023 年 9 月富士通有限公司和富士通泰國有限公司收購了泰國 SAP 顧問公司創新諮詢服務 (ICS),增強了其在亞太地區的 SAP 諮詢和託管服務能力。這是富士通有限公司自 2021 年以來進行的第七次收購,也是其成為數位轉型全球領導者的程序化併購策略的一部分。

- 2023 年 7 月,惠普宣布計劃將數百萬台消費和商務用筆記型電腦的生產轉移到泰國和墨西哥,以實現其在中國以外的 PC 供應鏈多元化。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 產業影響評估

- 泰國主要 IT 進出口調查結果

- 泰國主要市場指數

第5章 市場動態

- 市場促進因素

- 數位化和對可擴展IT基礎設施日益成長的需求

- 網路安全事件和報告法規的快速增加

- 市場限制

- 市場分散、資料外洩增多以及缺乏支援基礎設施

- 網路安全專家短缺

第 6 章 泰國 IT 市場細分

- IT硬體和設備

- 桌面

- 筆記型電腦

- 藥片

- 資訊科技軟體

- 企業軟體

- 生產力軟體

- 應用開發軟體

- 系統基礎設施軟體

- IT 服務

- 業務流程外包

- IT諮詢與實施

- IT外包

- 其他IT服務

7. 泰國網路安全市場細分

- 人均網路安全支出

- 按類型

- 雲端安全

- 資料安全

- 身分和存取管理

- 網路安全

- 消費者安全

- 基礎設施保護

- 其他類型

第8章 競爭格局

- 公司簡介 - 主要 IT 硬體供應商列表

- Simat Technologies Public Company Limited

- Movaci Co. Ltd

- Acer Inc.

- Advice IT Infinite Company Ltd

- HP Development Company LP

- Samsung Electronics Co. Ltd

- Intel Corporation

- Dell Technologies Inc.

- 公司簡介 - 主要 IT 軟體供應商列表

- Outsourcify

- Hire Quality Software Co. Ltd

- Tech Curve AI and Innovations

- Fujitsu Thailand Co. Ltd(Fujitsu Limited)

- Movaci Co. Ltd

- AppSquadz Software Pvt. Ltd

- G-Able Co. Ltd

- Microsoft Corporation

- 公司簡介 - 主要 IT 網路安全供應商列表

- IBM Corporation

- Cisco Systems Inc.

- Fujitsu Thailand Co. Ltd

- Red Sky Digital Ventures Ltd

- Info Security Consultant Co. Ltd

- Dell Technologies Inc.

- Fortinet Inc.

- CGA Group Co. Ltd

- Intel Security(Intel Corporation)

第9章投資分析

第10章:市場的未來

簡介目錄

Product Code: 72436

The Thailand IT And Security Market size is estimated at USD 8.95 billion in 2025, and is expected to reach USD 18.06 billion by 2030, at a CAGR of 15.07% during the forecast period (2025-2030).

Key Highlights

- Following the widespread proliferation of the Internet, Thailand is transitioning into a digital economy, opening up new revenue sources for several industries, including telecommunications service providers, digital entertainment and gaming, and consumer electronics.

- With digital transformation, organizations have become increasingly dependent on applications and extensions that make IT a critical competitive advantage for most organizations. Moreover, IT outsourcing has become more than a simple cost-reduction technique with cloud migrations and cloud service options. This new form is driven by organizational initiatives regarding business growth, customer experience, and competitive disruption.

- Several government initiatives to propel digital technology development and adoption are further supporting market growth. For instance, in November 2023, the Thai government and Google strategically collaborated to boost the country's digital competitiveness and accelerate artificial intelligence innovation. Through this agreement, both parties are expected to work jointly to implement four foundational pillars that are essential for the country to thrive in the AI economy. The agreement includes advancing digital infrastructure investments, promoting secure and responsible AI adoption to transform public service delivery, anchoring on cloud-first policies, and making digital skills more accessible to the country.

- Various governmental defense agencies and companies are moving more data to the cloud, designing new digital systems, and increasing the number of endpoints in their network infrastructure. As a result of their increasing reliance on third parties and service providers, attackers have new opportunities to penetrate supply chains.

- The increasing number of cyberattacks in the country, the increasing demand for digitalization and scalable IT Infrastructure, the rising need to tackle risks from third-party vendor risks, the evolution of MSSPs, and the adoption of a cloud-first strategy are driving the growth of cybersecurity solutions and services in the country. However, the shortage of skilled IT professionals to meet the demand leads to businesses having difficulty in their operations, challenging the market's growth in Thailand.

- The COVID-19 pandemic has accelerated the adoption of digital technologies and digital transformation initiatives across various end-user industries in the country. The rising investment in cloud computing, collaborative tools, and IT infrastructure-related solutions to ensure business connectivity resulted in increased reliance on digital technologies and remote work, which has heightened security concerns, resulting in increased demand for security solutions in the market.

Thailand IT And Security Market Trends

Cloud Security is Expected to Drive Market Growth

- Cloud computing services in Thailand have seen remarkable growth in recent years. The transformation is part of the government's attribution initiatives to promote digitalization and cloud technologies. Many industries in Thailand have adopted cloud computing to modernize their business processes and gain a competitive advantage in their respective markets.

- Cloud computing has become increasingly popular in Thailand due to the country's strong internet infrastructure and high-speed internet connections. Additionally, the expanding presence of local and international cloud service providers has given Thai businesses access to a diverse range of cloud-based solutions and services. As a result, the demand for cloud security across end-users is expected to increase over the forecast period to secure cloud environments and respond to rising cyber threats.

- In July 2023, Cloud Computing Solutions Co. Ltd (CCS), a cloud computing services provider, and Tencent Cloud, the cloud business of global technology company Tencent, signed an MoU to offer leading Cloud-AI solutions from Tencent Cloud for business enterprises, including IaaS, PaaS, and SaaS in Thailand. This partnership aims to boost customer trust and satisfaction with an after-sales service, driving business growth for companies of all sizes and industries in Thailand in the midst of digital transformation.

- Thailand is at the forefront of Asia's cloud adoption trend. According to a "The Next-Generation Cloud Strategy in Asia" survey from Alibaba Cloud, the adoption of cloud is rapidly increasing in Thailand. A vast majority of Thai businesses (95%) are expected to significantly increase investment in the cloud across countries like Indonesia (94%), the Philippines (91%), Hong Kong Special Administration (83%), and Singapore (83%). The survey results indicated that many businesses chose the public cloud based on reliable local support and a strong reputation for security. Such developments related to cloud technology and related trends are anticipated to create demand for cloud security over the coming years.

IT Hardware and Devices Are Expected to Hold a Significant Market Share

- Thailand has been actively promoting digital transformation across various sectors, including government, healthcare, education, and businesses. This push toward digitalization requires IT hardware and device investments to support modernization efforts and improve efficiency by streamlining business operations.

- During the pandemic, the Thai government recommended schools and universities conduct activities online, which resulted in tremendous demand for IT hardware and devices like desktops, tablets, and laptops. With the advent of a more inclusive digital world, devices such as tablets became necessity rather than a luxury, driving demand in the country.

- Thailand has been one of the most vibrant economies in the Association of Southeast Asian Nations (ASEAN) region. The country's IT sector has expanded; it is becoming increasingly attractive to foreign investors. Businesses and government agencies are increasingly going digital, and more consumers are becoming tech-savvy, increasing the demand for IT hardware and devices.

- The IT sector has been growing significantly in Thailand, driven by the increasing usage of technology, offering vast business potential to companies to meet the demands of sophisticated users. In July 2023, HP announced the shifting of production of consumer and commercial laptops to Thailand and Mexico to diversify the supply chain beyond China.

Thailand IT And Security Industry Overview

The Thai IT and security market is fragmented owing to several global players focusing on expanding their client base across the country and adopting both organic and inorganic growth strategies.

- March 2024: Sangfor Technologies, a key provider of Cloud Computing and Cybersecurity solutions, strategically partnered with VST ECS (Thailand) Co. Ltd to expand Sangfor's customer base in Thailand by leveraging VST ECS's expertise and experience in IT solution distribution, combined with Sangfor's technology.

- September 2023: Fujitsu Limited and Fujitsu Thailand Limited acquired Thailand-based SAP consultancy Innovation Consulting Services (ICS) and strengthened its capabilities in SAP consulting and managed services across the Asia-Pacific region. This was the seventh acquisition by Fujitsu Limited since 2021 as part of its programmatic merger and acquisition strategy to become a global leader in digital transformation.

- July 2023: HP announced its plan to shift production of millions of consumer and commercial laptops to Thailand and Mexico to diversify its PC supply chain beyond China.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Industry

- 4.4 Coverage on major IT Imports and Exports - Thailand

- 4.5 Key Market Indicators in Thailand

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Digitalization and Scalable IT Infrastructure

- 5.1.2 Rapidly Increasing Cybersecurity Incidents and Regulations Requiring their Reporting

- 5.2 Market Restraints

- 5.2.1 Fragmented Nature of the Market and Growing Incidence of Data Breaches and Lack of Supporting Infrastructure

- 5.2.2 Lack of Cybersecurity Professionals

6 THAILAND IT MARKET SEGMENTATION

- 6.1 IT Hardware & Devices

- 6.1.1 Desktop

- 6.1.2 Laptop

- 6.1.3 Tablet

- 6.2 IT Software

- 6.2.1 Enterprise Software

- 6.2.2 Productivity Software

- 6.2.3 Application Development Software

- 6.2.4 System Infrastructure Software

- 6.3 IT Services

- 6.3.1 Business Process Outsourcing

- 6.3.2 IT Consulting and Implementation

- 6.3.3 IT Outsourcing

- 6.3.4 Other IT Services

7 THAILAND CYBER SECURITY MARKET SEGMENTATION

- 7.1 Cybersecurity Per-capita Spending

- 7.2 By Type

- 7.2.1 Cloud Security

- 7.2.2 Data Security

- 7.2.3 Identity Access Management

- 7.2.4 Network Security

- 7.2.5 Consumer Security

- 7.2.6 Infrastructure Protection

- 7.2.7 Other Types

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles - List of Major IT Hardware Vendors

- 8.1.1 Simat Technologies Public Company Limited

- 8.1.2 Movaci Co. Ltd

- 8.1.3 Acer Inc.

- 8.1.4 Advice IT Infinite Company Ltd

- 8.1.5 HP Development Company LP

- 8.1.6 Samsung Electronics Co. Ltd

- 8.1.7 Intel Corporation

- 8.1.8 Dell Technologies Inc.

- 8.2 Company Profiles - List of Major IT Software Vendors

- 8.2.1 Outsourcify

- 8.2.2 Hire Quality Software Co. Ltd

- 8.2.3 Tech Curve AI and Innovations

- 8.2.4 Fujitsu Thailand Co. Ltd (Fujitsu Limited)

- 8.2.5 Movaci Co. Ltd

- 8.2.6 AppSquadz Software Pvt. Ltd

- 8.2.7 G-Able Co. Ltd

- 8.2.8 Microsoft Corporation

- 8.3 Company Profiles - List of Major IT Cybersecurity Vendors

- 8.3.1 IBM Corporation

- 8.3.2 Cisco Systems Inc.

- 8.3.3 Fujitsu Thailand Co. Ltd

- 8.3.4 Red Sky Digital Ventures Ltd

- 8.3.5 Info Security Consultant Co. Ltd

- 8.3.6 Dell Technologies Inc.

- 8.3.7 Fortinet Inc.

- 8.3.8 CGA Group Co. Ltd

- 8.3.9 Intel Security (Intel Corporation)

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219