|

市場調查報告書

商品編碼

1690909

大尺寸印表機 (LFP):市場佔有率分析、產業趨勢與統計資料、成長預測(2025-2030 年)Large Format Printers (LFP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

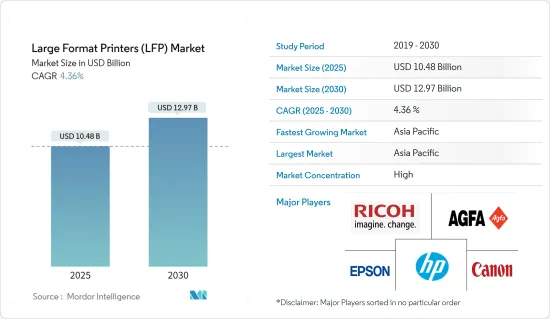

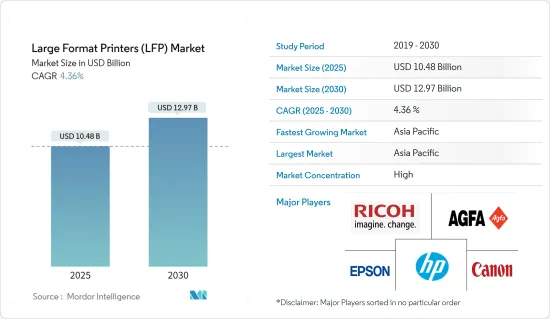

預計大尺寸印表機市場規模將在 2025 年達到 104.8 億美元,在 2030 年達到 129.7 億美元,預測期內(2025-2030 年)的複合年成長率為 4.36%。

關鍵亮點

- 廣告、包裝和紡織品是全球市場收益成長的主要貢獻產業。許多本地和國際品牌和公司都依賴大尺寸印表機來輔助戶外廣告宣傳。此外,媒體尺寸較大,這意味著從遠處就可以看到它。使用大型廣告看板、橫幅、標誌和建築包裝進行廣告宣傳可以吸引目標受眾並增加銷售額和收益。

- 大尺寸印表機主要用於列印較大的圖案或材料,這些圖案或材料因尺寸而無法在標準印表機上列印。這些印表機有時被稱為「寬幅印表機」。大尺寸印表機用於滿足需要在較大尺寸基材上列印的各種列印需求。這些印表機是列印紡織品、標誌、 CAD、技術列印、廣告海報等的理想解決方案。

- 印刷技術的進步和市場上各種油墨的供應增加了大尺寸印表機的應用,從而促進了市場的成長。此外,預計對大格式和技術圖形的日益關注將推動 2024 年至 2029 年的市場成長。

- 大尺寸印表機主要用於列印標誌,這將在 2024 年為市場收益做出貢獻。廣告看板是企業和公司戶外廣告的主要形式,在行銷產品、服務和公司方面非常有用。此外,室內標牌用於各種行銷和非行銷目的,包括銷售點廣告以及警告和指示標誌。隨著時間的推移,技術的進步促進了印表機的發展,從而提高了列印速度和生產率。因此,越來越重視快速列印服務的客戶正透過這些高速印表機得到滿足。

- 市場在地化程度不斷提高導致小批量包裝的需求增加。這使得公司能夠向專業產品製造商和當地零售商提供利基包裝,幫助最終用戶開拓新市場並增加銷售收益。這些印表機用於各種行業領域的大尺寸包裝應用,包括食品和飲料、電氣和電子、休閒和家具。預計這些產業的持續成長和產品需求的持續成長將在 2024 年至 2029 年期間推動對大尺寸印表機的需求。

- 大尺寸印表機需要在初始安裝、營運成本和維護方面進行大量投資。大尺寸列印也要求使用多種列印材料。此外,大尺寸印表機消耗大量電力。大尺寸印表機的高運作成本主要是由於印表機設計複雜以及墨水價格高,這限制了市場的成長。

大尺寸印表機(LFP)市場趨勢

預計紫外線固化油墨和基於 CAD 的解決方案的使用將刺激市場需求

- 包裝和紡織品是全球市場收益成長的主要貢獻產業。日本和海外的各種品牌和公司都在使用大尺寸印表機進行戶外廣告宣傳。此外,媒體尺寸較大,這意味著從很遠的地方就可以看到它。使用大型廣告看板、橫幅、標誌和建築包裝進行廣告宣傳可以吸引目標受眾,從而增加銷售額和收益。

- 折疊式紙盒、軟包裝和標籤印刷是三種需要印刷和切割的包裝應用,其中折疊式紙盒增加了一些文件準備(結構 CAD 文件)和整理(模切、折疊式、粘合)工序。此外,預計紙板消費將推動市場成長。據擁有百年歷史的巴西跨國公司Suzano稱,未來十年紙板需求量預計將進一步成長,從2024年的5,600萬噸增至2032年的6,600萬噸。

- 印表機技術的進步帶動了大尺寸印表機許多領域的發展。其中之一就是在更短的時間內製作出高品質的印刷品。最終用戶對更短交貨時間的需求不斷增加,這促使市場開發商開發能夠更快列印的印表機。此外,一些印表機的自動化流程消除了列印過程中的手動勞動,縮短了整個列印過程。

- 持續的技術進步對於客戶擴張和公司的持續成長至關重要。許多公司正在不斷加大力度製造先進的印表機。例如,2024年2月,佳能為亞太市場推出了三款採用新型LUCIA PRO II顏料墨水的imagePROGRAF GP系列(GP-526S/546S/566S)印表機。

- 此外,紫外線固化噴墨印表機的出現徹底改變了市場。紫外線固化油墨是完全配製的油墨,除非暴露在強紫外線下才會變硬,否則會保持液態。這些油墨不含溶劑,因此無法被基材吸收並乾燥。因此,油墨固化後就會乾燥。這種墨水可以用更少的時間和成本產生高品質的圖像。紫外線固化油墨正在推動大尺寸印表機市場的發展,因為它們可用於多種應用。

- 電腦輔助設計 (CAD) 印表機非常複雜,需要準確、精確的列印技術。這些設計主要由設計複雜、大型結構的建築師和工程師使用。公司正在向市場推出專門針對這些印刷應用的新產品。

- 例如,2023 年 2 月,佳能印度推出了 ImagePrograf TC~20,擴展了其印刷產品組合。這是該公司第一款具有 A1-plus 功能的桌上型四色顏料墨水大尺寸印表機。 TC-20 的設計旨在滿足當今建築師的多樣化需求。它外形時尚、結構緊湊,適合小型工作空間和家庭辦公室。儘管體積小,TC-20 仍能在大型藍圖和圖紙上輸出生動、多彩、高品質的輸出。因此,預計此類印刷技術將在 2024 年至 2029 年期間推動市場成長。

亞太地區預計將成為市場成長最快的部分

- 亞太地區是全球最重要的大尺寸印表機市場之一。中國、印度和日本等國家對該地區的全球佔有率做出了巨大貢獻。預計該地區在 2024 年至 2029 年間也將實現最快的成長。

- 新冠肺炎疫情對該地區的經濟造成了嚴重影響。隨著 2020 年市場完全關閉數月,零售、汽車、BFSI 等行業見證了客戶與品牌和產品互動方式的巨大轉變。數位商務也在成長。根據印度品牌資產基金會的數據,到 2025 年,印度的電子商務市場預計將成長到 1,114 億美元。因此,亞太地區主要經濟體數位化的提高預計將阻礙該地區大尺寸印表機市場的成長。

- 由於大尺寸印表機在圖形印刷、服裝紡織品印刷、電腦輔助設計 (CAD) 和技術印刷應用中的使用日益增多,亞太地區對大幅面印表機的需求很高。亞太地區被視為全球經濟的主要成長引擎。日本、韓國等國家已發展成為新興經濟體,而中國在過去二十年中一直是全球成長最快的經濟體。

- 此外,亞太地區是服裝和紡織產品的重要生產地,預計該領域也將穩定成長。尤其是印度,受印度良好經濟情勢的推動,其廣告和指示牌應用大尺寸印表機市場可能會顯著成長。

大尺寸印表機(LFP)市場概覽

大尺寸印表機市場適度整合,少數全球參與企業佔大部分佔有率。公司為保持競爭力而採取的對研發、新產品發布、市場舉措、併購、聯盟和其他關鍵成長策略的高投資包括:市場的主要企業是佳能、惠普公司、理光和愛普生。

- 2024 年 1 月,Canon宣布推出其廣受歡迎的 12 色 imagePROGRAF PRO大尺寸印表機的改良系列。新系列專為攝影和美術市場設計,包括三種型號:60 吋/1524 mm imagePROGRAF PRO-6600、44 吋/1118 mm PRO-4600 和 24 吋/610 mm PRO-2600,分別取代 imagePROGRAF PRO-6100、PRO-4100 和 PROimagePROGRAF PRO-6100、PRO-4100 和 PROimagePROGRAF PRO-6100、PRO-4100 和 PROimagePROGRAF PRO-6100、PRO-4100。與新型顏料墨水套裝「LUCIA PRO II」搭配使用,新的 12 色系列可提供 imagePROGRAF 印表機最高的相片列印品質。此次推出的產品滿足了人們對提高影像耐久性和耐光性的需求,提高了印刷品的長期存檔質量,同時也提供了新的環境效益。 imagePROGRAF PRO系列將在2024年德魯巴展會展出,佳能攤位位於8A展間B41-1至B41-8。

- 2023 年 12 月,惠普印度公司推出了新系列 36 吋 HP DesignJet 印表機,旨在滿足在混合環境中工作的建築、工程和施工 (AEC) 專業人士的列印需求。這些高品質的印表機旨在提供無論身在何處的無縫列印體驗。此外,這些設備可以幫助影印店更好地滿足其 AEC 客戶的需求。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場動態

- 市場促進因素

- 包裝、廣告和紡織業的需求不斷成長

- 印表機和油墨基礎的進步,例如在印刷中使用紫外線固化油墨和基於 CAD 的解決方案

- 市場限制

- 來自基於數位廣告的媒體的強大威脅。

第6章市場區隔

- 按類型

- 印表機

- 噴墨印表機

- 以碳粉為基礎的印表機

- 軟體服務

- 印表機

- 按油墨類型

- 水性油墨

- 溶劑墨水

- UV固化油墨

- 熱昇華墨水

- 按最終用戶產業

- 服裝紡織品

- 招牌

- 廣告

- 裝飾

- CAD 和技術印刷

- 其他

- ***按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 亞洲

- 澳洲和紐西蘭

- 北美洲

第7章競爭格局

- 公司簡介

- Hewlett-Packard

- Canon Inc.

- Seiko Epson Corporation

- Mimaki Engineering Co. Ltd

- Roland DG Corporation

- Ricoh Company Ltd

- Agfa-Gevaert NV

- Kyocera Corporation

第8章投資分析

第9章:市場的未來

The Large Format Printers Market size is estimated at USD 10.48 billion in 2025, and is expected to reach USD 12.97 billion by 2030, at a CAGR of 4.36% during the forecast period (2025-2030).

Key Highlights

- Advertising, packaging, and textiles are the key industries that contribute to revenue growth in the global market space. Various national and international brands and corporations utilize large format printers to assist them in their out-of-home advertising effort. Moreover, the large size of the media makes it visible from a distance. Advertising using large hoardings, banners, signages, and building wraps is used to attract the target audience and subsequently increase their sales and revenue.

- A large format printer is essentially used for printing large designs and materials that cannot be printed using the standard printer due to their large size. These printers are sometimes referred to as 'wide format printers.' Large format printers are used for various printing needs that require the print to be done on a substrate with larger dimensions. These printers are ideal solutions for printing textiles, signages, CAD and technical printing, advertisement posters, and others.

- The advancement in printing technologies and the availability of various inks in the market have increased the number of applications of large format printers, which, in turn, is resulting in the growth of the market. Further, the growing emphasis on large and technical graphics is estimated to propel the market growth between 2024 and 2029.

- Large format printers are primarily used for printing signages, contributing to the market revenue in 2024. Signages are a key form of outdoor advertising efforts of businesses or corporations and are highly useful for marketing the products, services, and the company. Additionally, indoor signages are used for various marketing and non-marketing purposes, including POS advertising and signages with warnings and directions. Technological advancements over time led to the development of printers that offer increased speed and productivity of printing. As such, the growing customer emphasis on quick printing services is satisfied by these fast-processing printers.

- The growing localized nature of the market resulted in an increased demand for short-run packaging. It enables the companies to provide niche packaging to specialty product manufacturers or local retailers, enabling the end users to go after new markets and increase their sales revenues. These printers find their applications in large format packaging across various industrial sectors, including food and beverage, electrical and electronics, leisure, and furniture. Continuous growth and increasing demand for products from these sectors are anticipated to bolster the demand for large format printers between 2024 and 2029.

- Large format printers require high initial installation, operating costs, and maintenance investments. Large-format printing necessitates the use of a variety of printing materials. Furthermore, large format printers consume a lot of electricity, and the high running costs of large format printers are largely due to the printers' design complexity and high ink prices, which restrict the market growth.

Large Format Printers (LFP) Market Trends

The Use of UV-curable inks and CAD-based solutions is Expected to boost the Market Demand

- Packaging and textiles are the key industries contributing to revenue growth in the global market. Various national and international brands and corporations utilize large format printers to assist them in their out-of-home advertising effort. Moreover, the large size of the media makes it visible from a distance. Advertising using large hoardings, banners, signages, and building wraps attracts the target audience and subsequently increases its sales and revenue.

- Folding cartons, flexible packaging, and label printing are the three packaging applications that require printing and cutting, with folding cartons adding a few more processes to the file preparation (structural CAD files) and finishing (die-cutting, folding, and gluing). Moreover, the consumption of carton boards is expected to drive the growth of the market. According to Suzano, a Brazilian multinational company with a 100-year history, the demand for carton boards is expected to increase further over the next decade, reaching 66 million tons by 2032, up from 56 million tons in 2024.

- Technological advancements in printers have led to the development of large format printers in various aspects. One of these aspects is producing a good quality print in less time. The increasing demand for faster turnaround times from end users has encouraged the market players to develop printers capable of producing print quickly. Moreover, automated processes in several printers have eliminated the need for manual intervention in printing, thereby shortening the entire printing process.

- Continuous technological advancements are crucial for customer expansion and the company's continued growth. Several companies are continuously increasing their efforts to manufacture advanced printers. For instance, in February 2024, Canon launched three new imagePROGRAF GP Series (GP-526S/546S/566S) printers using the new LUCIA PRO II pigment ink for the Asia-Pacific market.

- Moreover, the advent of UV-curable inkjet printers transformed the market. UV curing inks are entirely formulated inks that remain in the liquid state unless exposed to intense UV light for curing. These inks do not contain solvents and, therefore, do not get absorbed into the substrates for drying. As such, the ink is dried after curing. This type of ink provides high-quality images with less time and cost. UV-curable ink can cater to many applications, driving the market for large format printers.

- Computer-aided Design (CAD) printers are complex and require precise and accurate printing technology, especially when printing on larger formats, as the designs are easily visible. These designs are primarily used by architects and engineers who design complex, large-scale structures. Companies are introducing new products in the market that specifically cater to such printing applications.

- For instance, in February 2023, Canon India expanded its printing portfolio by introducing the ImagePrograf TC-20. This is the company's first desktop four-color pigment ink large format printer with A1 plus capability. The TC-20 is designed to meet the versatile needs of today's architects. It is sleek and compact, making it suitable for small workspaces or home offices. Despite its size, the TC-20 delivers vibrant, colorful, and high-quality output for large designs and blueprints. Therefore, such printing technologies are expected to drive market growth between 2024 and 2029.

Asia-Pacific is Expected to be the Fastest Growing Segment in the Market

- Asia Pacific is one of the most important markets for large format printers worldwide. Countries such as China, India, and Japan are the key contributors to the region's global share. The region is also anticipated to register the fastest growth between 2024 and 2029.

- The COVID-19 pandemic severely impacted the economies across the region. With markets completely shut down for several months during 2020, industries such as retail, automotive, and BFSI, among others, witnessed drastic changes concerning how customers engage with the brands and products. Besides, digital commerce also saw growth. According to the India Brand Equity Foundation, the e-commerce market in India is expected to grow to USD 111.40 billion by 2025. As such, the growing digitalization across key economies in Asia-Pacific is anticipated to impede the growth of the regional large format printer market.

- There is a high demand for large-format printers in Asia-Pacific due to their increasing use in graphics printing, apparel and textile printing, computer-aided design (CAD), and technical printing applications. Asia Pacific is considered a major growth engine for the global economy. Countries like Japan and South Korea have already developed strong economies, and China has been the world's fastest-growing economy for the past two decades.

- Additionally, Asia-Pacific is a significant producer of apparel and textiles, and this sector is expected to grow steadily in the region. There is likely to be significant growth in the market for large format printers, particularly in advertising and signage applications in India, driven by its booming economy.

Large Format Printers (LFP) Market Overview

The large format printer market is moderately consolidated, with a majority share acquired by a few global players. High investments in R&D, new product launches, market initiatives, mergers and acquisitions, partnerships, and collaborations are the prime growth strategies adopted by companies to sustain the competition. Key players in the market are Canon, HP Inc., Ricoh, and Epson.

- In January 2024, Canon introduced an improved series of its popular 12-color imagePROGRAF PRO large format printers. The new series is designed for the photography and fine art markets and includes three models: the 60"/1524mm imagePROGRAF PRO-6600, the 44"/1118mm PRO-4600, and the 24"/610mm PRO-2600, replacing the imagePROGRAF PRO-6100, PRO-4100, and PRO-2100, respectively. Along with a new pigment ink set, LUCIA PRO II, the new 12-color series offers the highest photo print quality of any imagePROGRAF printer. This launch addresses the demand for greater image durability and light resistance to improve long-term print storage while providing new environmental benefits. The imagePROGRAF PRO series is expected to be showcased at Drupa 2024 on the Canon stand in Hall 8A, B41-1 - B41-8.

- In December 2023, HP India launched a new range of 36-inch HP DesignJet printers designed to meet the printing needs of architecture, engineering, and construction (AEC) professionals who work in a hybrid environment. These high-quality printers aim to provide a seamless printing experience, irrespective of location. Additionally, these devices will help copy shops better serve the needs of AEC customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products or Services

- 4.3.5 Intensity of competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand from Packaging, Advertising, and Textile Industries

- 5.1.2 Printer and Ink-based Advancements, Such as the Use of UV- Curable Inks and CAD -based Solutions in Printing

- 5.2 Market Restraints

- 5.2.1 Strong Threat from Digital Advertising-Based Media, as It Allows for Greater Flexibility and Engagement

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Printers

- 6.1.1.1 Inkjet-based Printers

- 6.1.1.2 Toner-based Printers

- 6.1.2 Allied Software and Services

- 6.1.1 Printers

- 6.2 By Ink Type

- 6.2.1 Aqueous Ink

- 6.2.2 Solvent Ink

- 6.2.3 UV-curable Ink

- 6.2.4 Dye Sublimation Ink

- 6.3 By End-user Industry

- 6.3.1 Apparel and Textiles

- 6.3.2 Signage

- 6.3.3 Advertising

- 6.3.4 Decor

- 6.3.5 CAD and Technical printing

- 6.3.6 Other End-user Industries

- 6.4 ***By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Hewlett-Packard

- 7.1.2 Canon Inc.

- 7.1.3 Seiko Epson Corporation

- 7.1.4 Mimaki Engineering Co. Ltd

- 7.1.5 Roland DG Corporation

- 7.1.6 Ricoh Company Ltd

- 7.1.7 Agfa-Gevaert NV

- 7.1.8 Kyocera Corporation