|

市場調查報告書

商品編碼

1690901

離網太陽能-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Off-Grid Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

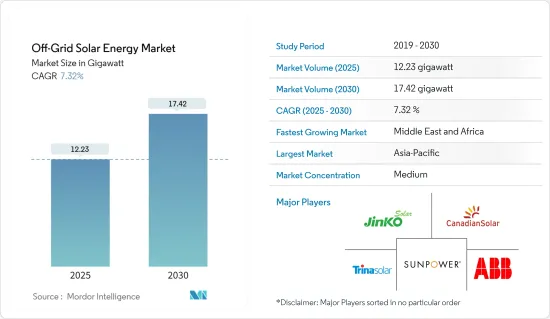

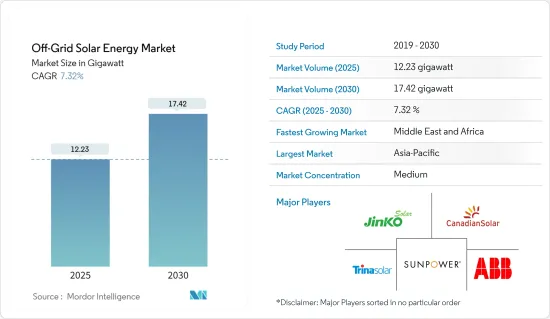

離網太陽能市場規模預計在 2025 年達到 12.23 吉瓦,預計到 2030 年將達到 17.42 吉瓦,預測期內(2025-2030 年)的複合年成長率為 7.32%。

關鍵亮點

- 從長遠來看,太陽能電池板和電池價格的下降預計將推動市場發展。

- 另一方面,高昂的安裝成本和不充分的維護阻礙了市場的成長。

- 然而,美國、英國、德國、中國和印度等國家已製定雄心勃勃的目標,增加可再生在其能源結構中的比重。這些國家的政府還計劃在未來幾年透過安裝住宅和離網太陽能發電系統來增加可再生能源的佔有率。預計這些將在離網太陽能發電市場創造龐大的機會。

- 預計亞太地區將主導市場成長,主要原因是印度和中國缺乏中央電網和可靠的電力供應導致電力需求增加。

離網太陽能市場趨勢

商業和工業領域預計將主導市場

- 商業和工業領域採用離網太陽能系統主要是由中央電網供電不可靠地區的中小型企業推動的。與柴油發電機相比,具有整合電池的離網太陽能系統為商業和工業營業單位提供了一種有效且廉價的電源備用方法。

- 截至2023年,全球離網裝置容量將為496萬千瓦,而2022年為455萬千瓦,成長率接近9.01%。預計這一成長率在預測期內將繼續上升。

- 離網太陽能發電系統為商業和工業領域提供了許多優勢,包括不會因柴油供應鏈延遲而帶來麻煩、噪音和污染更少、以及政府提供優惠的激勵和補貼。

- 此外,對於一些工業營業單位來說,當電源切斷、生產中斷時,可能需要數小時才能使系統和設備恢復在線,從而導致巨大的停機時間和財務損失。因此,電源備援在工業領域得到廣泛的應用。

- 此外,在持續的以色列-加薩戰爭中,電網在衝突開始後迅速崩壞,迫使醫院依賴柴油發電機。由於能夠突破以色列封鎖的燃料供應有限,醫院很快就變得幾乎無法正常業務並提供必要的醫療服務。

- 然而,離網可再生系統,特別是太陽能電池板和電池儲存的組合,有可能徹底改變醫療保健產業。離網太陽能可望為都市區醫院提供更有效率、更可靠的備用電源,同時也能為電網無法覆蓋的設施提供電力。

- 如上所述,預計商業和工業部門將在預測期內佔據市場主導地位。

亞太地區將主導市場成長

- 近年來,住宅和商用領域的太陽能裝置一直在穩步成長。這是由於太陽能發電工程的資本成本下降以及隨著該領域的成熟,競爭對手之間的競爭日益激烈。

- 中國是全球最大的光電和光熱市場。到2023年,中國總設備容量將達到609GW。

- 因此,到2023年,現有的住宅和商用建築將被要求安裝屋頂太陽能發電系統。政府規定至少有一定比例的建築物必須安裝太陽能光電系統。大約 676 個縣的政府建築(至少 50%)、公共建築(40%)、商業建築(30%)和農村建築(20%)必須安裝太陽能屋頂系統。

- 太陽能是印度一個快速發展的產業。截至2023年12月31日,該國太陽能發電裝置容量為7,310萬千瓦,到2023年,印度太陽能發電量將位居世界第四。

- 印度不斷成長的工業活動正在推動對綠能的需求,以減少碳排放。因此,屋頂太陽能發電設施正成為企業自力更生的有力選擇,預計將擴大印度的屋頂太陽能發電市場。

- 國家太陽能計畫(NSM)的目標是實現 2GW 的離網太陽能發電。在該任務的第一階段(2010-2013 年),目標是 200 MWp,但已批准 253 MWp。第二階段(2013-2017年)的目標是500MWp,但已批准713MWp。在離網和分散式太陽能發電利用計畫第三階段下,118兆瓦的目標得以維持,但不包括根據PM KUSUM計畫安裝的太陽能水泵和根據電力部的「Saubhagya」計畫安裝的太陽能家用燈。

- 2023 年 1 月,該國貿易和工業部 (MOTIE)核准了一項期待已久的太陽能電池組件回收計畫。新法規將在各國主要地區建立統一的資料收集系統。目標是使廢棄面板的回收/再利用率達到80%以上,符合現行的歐盟標準。預計此類政府計劃將進一步降低該國太陽能電池板的價格,並使其與一系列離網產品一起供應。

- 考慮到上述情況,預計預測期內太陽能光電價格下跌和能源價格上漲將推動該地區市場的發展。此外,政府的支持政策和獎勵可能有助於離網太陽能市場在未來幾年充分發揮其潛力。

離網太陽能產業概況

離網太陽能市場比較分散。市場的主要企業(不分先後順序)包括 ABB Ltd、Canadian Solar Inc.、JinkoSolar Holding、SunPower Corporation 和 Trina Solar Ltd.。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 裝置容量及2029年預測

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 太陽能板成本下降、效率提高

- 限制因素

- 安裝和維護成本高

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場區隔

- 最終用戶

- 住宅

- 商業和工業

- 2029 年市場規模與需求預測(按地區)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 義大利

- 英國

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 韓國

- 日本

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 南非

- 阿拉伯聯合大公國

- 奈及利亞

- 阿曼

- 埃及

- 阿爾及利亞

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- ABB Ltd.

- Schneider Electric Infrastructure Ltd

- Canadian Solar Inc.

- JinkoSolar Holding Co. Ltd

- SunPower Corporation

- Trina Solar Ltd

- LONGi Green Energy Technology Co. Ltd

- JA Solar Holding

- Sharp Corporation

- Tesla Inc.

- 其他知名公司名單

- 市場排名分析

第7章 市場機會與未來趨勢

- 太陽能製造的技術進步

簡介目錄

Product Code: 72370

The Off-Grid Solar Energy Market size is estimated at 12.23 gigawatt in 2025, and is expected to reach 17.42 gigawatt by 2030, at a CAGR of 7.32% during the forecast period (2025-2030).

Key Highlights

- Over the long term, factors like decreasing the price of solar panels and batteries are expected to drive the market.

- On the other hand, high installation costs and poor maintenance practices hinder the market's growth.

- However, countries like the United States, the United Kingdom, Germany, China, and India have set ambitious targets to increase the renewable share in their energy mix. Governments across these nations have also planned to increase the renewable energy share by deploying residential and off-grid solar PV systems in the coming years. These are expected to create enormous opportunities for the off-grid solar energy market.

- Asia-Pacific is expected to dominate the market growth, primarily due to the increasing demand for electricity due to the lack of a central grid and reliable electricity supply, mainly in India and China.

Off-Grid Solar Energy Market Trends

The Commercial and Industrial Segments are Expected to Dominate the Market

- The usage of off-grid solar energy systems in the commercial and industrial segments has been mainly driven by small and medium enterprises in regions with unreliable electricity supply by the central grid system. Battery-integrated off-grid solar systems have become an effective and cheaper method of power backup for commercial and industrial entities compared to diesel generators.

- As of 2023, the global off-grid installed capacity was at 4.96 GW compared to 4.55 GW in 2022, registering a growth rate of almost 9.01%. This growth rate is expected to increase during the forecast period.

- Off-grid solar systems have many advantages for the commercial and industrial segments in terms of no hassle of diesel supply chain delays, less noise and pollution, and favorable government policies and subsidies.

- In addition, once the power is cut off and production is disrupted in several industrial entities, it may take hours to bring the systems and equipment back online, leading to huge downtime and financial losses. Therefore, electricity backup is extensively used in the industrial segment.

- Moreover, with the ongoing Israel-Gaza war, the electricity grid swiftly collapsed after the start of the war, leaving hospitals dependent on diesel generators. With only limited supplies of fuel permitted to pass through the Israeli blockade, it soon became almost impossible to carry out operations and deliver essential healthcare services.

- However, off-grid renewable systems, particularly solar panels combined with battery storage, can be a game changer for the healthcare industry. Off-grid solar offers the promise of bringing power to facilities still out of reach of electricity grids while providing a more efficient and reliable backup supply in urban hospitals.

- As mentioned above, the commercial and industrial segments will dominate the market during the forecast period.

Asia-Pacific to Dominate the Market Growth

- In recent years, there has been a steady increase in solar PV installation in the residential and commercial segments. This is due to reduced capital costs for solar projects and increased competition among competitors as the segments mature.

- China is the world's largest photovoltaics and solar thermal energy market. In 2023, the country had a total installed capacity of 609 GW of solar energy.

- Accordingly, by 2023, the existing residential or commercial buildings were required to install a rooftop solar PV system. Under the government's mandate, a minimum percentage of buildings will be essential to install solar PV systems. The solar PV rooftop systems need to be installed on government buildings (at least 50%), public structures (40%), commercial buildings (30%), and rural buildings (20%) across approximately 676 counties.

- Solar power is a fast-developing industry in India. The country's solar installed capacity was 73.10 GW as of December 31, 2023. Solar power generation in India ranked fourth globally in 2023.

- Due to the rise of industrial activity in India, the demand for clean electricity is increasing to mitigate carbon emissions. As a result, rooftop solar installations would provide a robust option for enterprises to become self-reliant, which is expected to increase the rooftop solar market in India.

- Under the National Solar Mission (NSM), a target of 2 GW was kept for off-grid solar PV applications. During Phase I of the mission (2010-2013), the target was 200 MWp, but 253 MWp was sanctioned. In Phase II (2013-2017), the target was 500 MWp, but 713 MWp was sanctioned. Under Phase III of the Off-grid and Decentralised Solar PV Applications Program, a target of 118 MW has been kept, excluding solar pumps to be installed under the PM KUSUM Scheme and solar home lights taken up under the 'Saubhagya' Scheme of the Ministry of Power.

- In January 2023, the country's Ministry of Trade, Industry, and Energy (MOTIE) approved a long-awaited scheme for solar module recycling. The new regulations set up a uniform system for collecting data in the main regions of each country. It aims to ensure a waste panel recycling/reuse rate of more than 80%, which aligns with current EU levels. Such government schemes are expected to lower the prices of solar panels further in the country, thus making it feasible to use them with different off-grid products.

- Therefore, owing to the above points, declining solar PV prices and increasing energy prices in the region are expected to drive the market during the forecast period. Also, supportive policies and incentives from the government will help the off-grid solar energy market to realize its full potential in the coming years.

Off-Grid Solar Energy Industry Overview

The off-grid solar energy market is fragmented. Some of the key players in the market (in no particular order) include ABB Ltd, Canadian Solar Inc., JinkoSolar Holding Co. Ltd, SunPower Corporation, and Trina Solar Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Falling Costs and Rising Efficiencies of Solar Photovoltaic Panels

- 4.5.2 Restraints

- 4.5.2.1 High Installation And Maintenance Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 End-User

- 5.1.1 Residential

- 5.1.2 Commercial and Industrial

- 5.2 Geography [Market Size and Demand Forecast till 2029 (for regions only)]

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 Italy

- 5.2.2.4 United Kingdom

- 5.2.2.5 Spain

- 5.2.2.6 NORDIC

- 5.2.2.7 Turkey

- 5.2.2.8 Russia

- 5.2.2.9 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 South Korea

- 5.2.3.4 Japan

- 5.2.3.5 Malaysia

- 5.2.3.6 Thailand

- 5.2.3.7 Indonesia

- 5.2.3.8 Vietnam

- 5.2.3.9 Rest of Asia-Pacific

- 5.2.4 Middle East and Africa

- 5.2.4.1 Saudi Arabia

- 5.2.4.2 Qatar

- 5.2.4.3 South Africa

- 5.2.4.4 United Arab Emirates

- 5.2.4.5 Nigeria

- 5.2.4.6 Oman

- 5.2.4.7 Egypt

- 5.2.4.8 Algeria

- 5.2.4.9 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Colombia

- 5.2.5.4 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd.

- 6.3.2 Schneider Electric Infrastructure Ltd

- 6.3.3 Canadian Solar Inc.

- 6.3.4 JinkoSolar Holding Co. Ltd

- 6.3.5 SunPower Corporation

- 6.3.6 Trina Solar Ltd

- 6.3.7 LONGi Green Energy Technology Co. Ltd

- 6.3.8 JA Solar Holding

- 6.3.9 Sharp Corporation

- 6.3.10 Tesla Inc.

- 6.4 List of Other Prominent Companies (Company Name, Headquarters, Revenue, Relevant Products and Services, Operating Sector, Recent Trends, Technology or Projects, Contact Details, etc.) (In Brief Tabular Format)

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Solar PV Manufacturing

02-2729-4219

+886-2-2729-4219