|

市場調查報告書

商品編碼

1690894

中東和北非金融科技 -市場佔有率分析、行業趨勢與統計、成長預測(2025-2030 年)MENA Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

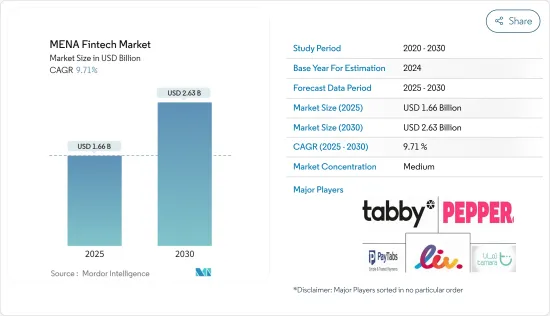

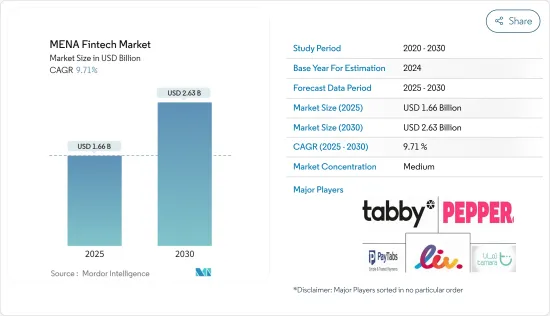

預計 2025 年中東和北非金融科技市場規模為 16.6 億美元,到 2030 年將達到 26.3 億美元,預測期內(2025-2030 年)的複合年成長率為 9.71%。

中東地區的金融科技領域正在快速發展。付款處理商、金融科技公司和平台正在顛覆傳統的金融格局,並滲透到國內和全球市場。這一成長的一個關鍵驅動力是該地區對技術的快速接受。

據報道,中東和北非地區,特別是阿拉伯聯合大公國、沙烏地阿拉伯、巴林和埃及,是金融科技資金籌措的中心。這些國家佔該地區投資的99%。在金融科技領域,付款解決方案處於領先地位,佔總投資的 42%,並擁有高達 152% 的年成長率。報告也預測,到2030年,中東地區將成立超過45家金融科技新興企業,每家估值超過10億美元,其中沙烏地阿拉伯將處於領先地位。

截至 2023 年,中東和北非地區擁有超過 250 家金融科技新興企業,預計到 2025 年將超過 250 家。中東和北非地區強大的創業生態系統使金融科技公司成為解決該地區緊迫金融障礙的關鍵參與企業。

在全球充滿挑戰的金融環境中,中東和北非的金融科技產業表現出比其他產業更強的韌性。儘管全球景氣衰退,利率上升和技術中斷,但中東和北非地區金融科技業的總資金籌措年減 47%,至 4.84 億美元。不過,該板塊的SEED估值保持穩定,證實了其穩定性。

中東和北非金融科技市場趨勢

數位和無現金付款的成長推動了市場成長

在整個中東地區,數位付款、即時跨境付款、先買後付 (BPL) 服務和數位銀行佔據市場主導地位。在政府推動和經濟數位化的推動下,中東和北非 (MENA) 地區的數位付款正在激增。中東和北非地區超過 85% 的金融科技公司專注於付款和匯款服務。

Gpay、Apple Pay、Samsung Pay等全球付款巨頭的進入,促進了數位錢包在中東和北非地區的普及。值得注意的是,阿拉伯聯合大公國已成為全球轉向無現金社會的領導者。資料顯示,阿拉伯聯合大公國70%的中小企業已經實施無現金系統或計畫在2024年前實施。

Visa 的最新資料凸顯了阿拉伯聯合大公國在採用無現金社會方面的先鋒立場。值得注意的是,52% 的阿拉伯聯合大公國消費者已經採用或計劃在 2024 年轉向無現金生活方式,高於 41% 的全球平均水平。在電子商務領域,信用卡佔據核心地位並佔交易的大部分。另一方面,根據 FIS Global Payments Wallet 的數據,簽帳金融卡佔了 11% 的市場佔有率。此外,包括行動錢包在內的線上付款佔總交易額的 24%,鞏固了其作為阿拉伯聯合大公國第二大最受歡迎的付款方式的地位。

阿拉伯聯合大公國主導金融科技市場

預計 2024 年阿拉伯聯合大公國金融科技領域的投資將激增 92%,交易價值預計到 2028 年將翻倍。這一成長受到多種因素的推動,包括阿拉伯聯合大公國的戰略地理位置、當地人對金融科技解決方案日益成長的興趣以及對外國直接投資 (FDI) 的吸引力。

阿拉伯聯合大公國政府正透過稅收優惠政策積極獎勵綠色金融科技措施。此舉旨在促進創新、加強經濟成長並強調該國對環境永續性的承諾。阿拉伯聯合大公國已成為金融服務供應商的青睞之地,包括加密貨幣交易所和外匯/差價合約仲介。阿拉伯聯合大公國是世界上成長最快的經濟體之一,政府正在採取政策支持創新和吸引投資。這些措施包括為外國投資者提供稅收優惠,以及針對性廣告宣傳,重點是宣傳該國的投資潛力和負擔得起的生活水準。

中東和北非地區金融科技產業概況

中東和北非金融科技市場細分程度適中。全球各地的公司都在這一領域投入大量資金。中東和北非市場有許多金融科技公司,儘管市場佔有率很小。金融科技平台的採用和升級到新技術的需求導致公司之間的競爭加劇。由於疫情和城市的興起,人們開始接受新的支付方式和非接觸式支付方式。創新和技術進步加快。一些主導市場的主要企業包括 Tamara、Rib、Pepper、Paytab、Tabby 和 Salwa。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態與洞察

- 市場概覽

- 市場促進因素

- 客戶對電子商務和行動銀行平台的需求不斷增加

- 網路普及率和智慧型手機普及率的提高持續推動市場成長

- 市場限制

- 資料隱私問題

- 網路安全風險日益增加

- 市場機會

- 增加對金融科技新興企業的投資

- 機器人顧問將繼續成長

- 產業吸引力-波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 市場創新洞察

- 深入了解政府法規和政策

- COVID-19 市場影響

第5章市場區隔

- 按服務提案

- 匯款和付款

- 儲蓄和投資

- 數位借貸和貸款市場

- 線上保險和保險市場

- 其他服務提案

- 按國家

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 巴林

- 卡達

- 伊朗

- 埃及

- 以色列

- 其他中東和北非國家

第6章競爭格局

- 市場集中度概覽

- 公司簡介

- Tamara

- Liv.

- Pepper

- PayTabs

- Tabby

- Sarwa

- Ila Bank

- Bayzat

- Eureeca

- Cwallet*

第7章 市場機會與未來趨勢

第8章 免責聲明和出版商

The MENA Fintech Market size is estimated at USD 1.66 billion in 2025, and is expected to reach USD 2.63 billion by 2030, at a CAGR of 9.71% during the forecast period (2025-2030).

The Middle East is witnessing a surge in its fintech sector. Payment processors, fintech firms, and platforms are disrupting the traditional financial landscape, penetrating both domestic and global markets. A key driver behind this growth is the region's swift embrace of technology.

According to a report, the MENA region, particularly the United Arab Emirates, Saudi Arabia, Bahrain, and Egypt, is the epicenter of fintech funding. These nations accounted for a staggering 99% of the region's investments. Within the fintech sector, payment solutions took the lead, capturing 42% of all investments and boasting a remarkable annual growth rate of 152%. The report also predicts the launch of over 45 fintech startups, each valued at USD 1 billion or more, in the Middle East by 2030, with Saudi Arabia spearheading this trend.

As of 2023, the MENA region boasted over 250 fintech startups, a number projected to surge beyond 250 by 2025. MENA's robust entrepreneurial ecosystem positions fintech as a key player in tackling the region's pressing financial hurdles.

In the face of a challenging global financial landscape, MENA's fintech industry showcased resilience, outpacing other sectors. Despite a global economic downturn marked by rising interest rates and technological disruptions, MENA's fintech sector witnessed a 47% Y-o-Y dip in total funding, settling at USD 484 million. However, the sector's SEED valuation remained steady, underscoring its stability.

MENA Fintech Market Trends

Rising Digital & Cashless Payments is Driving the Growth of The Market

Across the Middle East, digital payments, cross-border instant payments, BPL (buy-now-later) services, and digital banking reign the market. The MENA region witnesses a surge in digital payments, bolstered by government backing and a push towards a digital economy. Over 85% of fintech firms in the MENA region focus on payment and transfer services.

The entry of global payment giants like Gpay, Apple Pay, and Samsung Pay fueled a surge in the adoption of digital wallets in MENA. Notably, the United Arab Emirates has emerged as a frontrunner in the global shift towards cashless societies. Data suggests that 70% of SMEs in the UAE have already embraced or are poised to adopt cashless systems by 2024.

Recent data from Visa underscores the UAE's pioneering stance in adopting a cashless society. A notable 52% of UAE consumers, outpacing the global average of 41%, are either already embracing or planning to transition to a cashless lifestyle by 2024. Within the e-commerce realm, credit cards take center stage, dominating the landscape and accounting for the majority of transactions. Debit cards, on the other hand, make up 11% of the market, as highlighted by FIS Global Payments Wallet. Additionally, online payments, including mobile wallets, constitute a significant 24% of the total transaction value, solidifying its position as the UAE's second most popular payment method.

UAE is Dominating the Fintech Market

Investment in the UAE's fintech sector has surged by an impressive 92% in 2024, with projections indicating a doubling of transaction value by 2028. This surge is underpinned by multiple factors, including the UAE's strategic geographic location, a rising appetite for fintech solutions among locals, and its allure for foreign direct investment (FDI).

The UAE government is actively incentivizing green finTech initiatives through tax benefits. This move aims to foster innovation, bolster financial growth, and underscore the nation's commitment to environmental sustainability. The UAE, particularly, is emerging as a favored destination for financial service providers, including cryptocurrency exchanges and FX/CFD brokers. With one of the world's swiftest-growing economies, the UAE's government has embraced policies that champion innovation and attract investments. These measures span tax incentives for foreign investors and targeted ad campaigns highlighting the nation's investment potential and affordable living.

MENA Fintech Industry Overview

The MENA fintech market is moderately fragmented. Companies from all over the world are investing heavily in this segment. In the MENA market, there are many fintech companies with smaller market shares. The adoption of fintech platforms and the need to upgrade to new technology increases the competition among companies. Due to the pandemic and the rise of cities, people started to accept new methods of payment and contactless gateways. Innovation and technological progress accelerated. Some of the major players dominating the market include Tamara, Liv., Pepper, PayTabs, Tabby, and Sarwa.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Customers' Growing Need for E-Commerce and Mobile Banking Platforms

- 4.2.2 Rising Internet Penetration & Adoption of Smartphones will Continue to Lead the Growth of the Market

- 4.3 Market Restraints

- 4.3.1 Data Privacy Concerns

- 4.3.2 Increasing Cybersecurity Risks

- 4.4 Market Opportunities

- 4.4.1 Rising Investments in Fintech Startups

- 4.4.2 Robo-Advisors Will Continue to Grow in the Future

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights of Technology Innovations in the Market

- 4.7 Insights on Government Regulations and Industry Policies

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Service proposition

- 5.1.1 Money Transfer and Payments

- 5.1.2 Savings and Investments

- 5.1.3 Digital Lending & Lending Marketplaces

- 5.1.4 Online Insurance & Insurance Marketplaces

- 5.1.5 Other Service Propositions

- 5.2 By Country

- 5.2.1 United Arab Emirates

- 5.2.2 Saudi Arabia

- 5.2.3 Bahrain

- 5.2.4 Qatar

- 5.2.5 Iran

- 5.2.6 Egypt

- 5.2.7 Israel

- 5.2.8 Rest of MENA

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Tamara

- 6.2.2 Liv.

- 6.2.3 Pepper

- 6.2.4 PayTabs

- 6.2.5 Tabby

- 6.2.6 Sarwa

- 6.2.7 Ila Bank

- 6.2.8 Bayzat

- 6.2.9 Eureeca

- 6.2.10 Cwallet*