|

市場調查報告書

商品編碼

1690882

石墨氈:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Graphite Felt - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

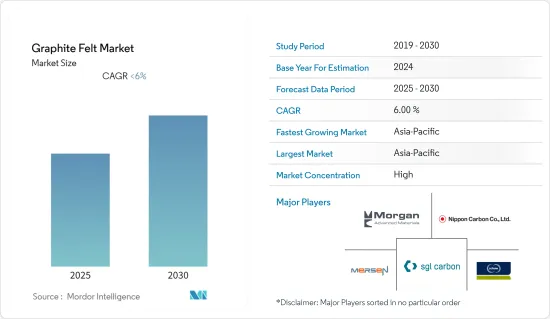

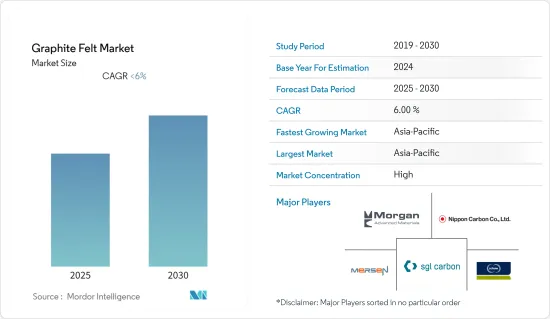

預計預測期內石墨氈市場複合年成長率將高達 6%。

新冠疫情爆發導致全球實施全國封鎖,擾亂了製造業活動、供應鏈並導致生產停頓,對 2020 年的市場產生了負面影響。然而,情況在 2021 年開始復甦,預測期內市場恢復了成長軌跡。

短期內,預計工業應用需求的增加和亞太地區工業化程度的提高將推動所調查市場的需求。

然而,製造碳氈的高成本可能會阻礙市場成長。

可再生能源需求的不斷成長可能會在未來幾年為市場創造機會。

石墨氈市場趨勢

增加絕緣部分的使用

石墨氈具有柔軟、有彈性、耐高溫、耐火隔熱材料的特性,是一種優良的隔熱材料。它可以在真空或受保護的氣氛環境中運行溫度高達~3,000°C。

石墨氈產品因其化學惰性、耐熱性、低熱導率、低電導率、低熱膨脹率、低摩擦係數、低X光和電子束吸收係數等化學和物理特性而受到高度重視。

此外,這些產品還可用於粗鋼生產、鋁生產、石油化學、化學加工、冶金工業和陶瓷工業等各個領域,滿足隔熱材料的需求。對高產量比率性能的持續關注正推動這些行業在極端溫度下運作工藝,從而對性能更佳的石墨氈等高溫絕緣產品產生了需求。

2021年全球粗鋼產量為19.505億噸,較2020年的18.804億噸成長3.7%。

隨著韓國工業對化學品的需求不斷成長,石化業也提供了投資機會,許多公司都處於主導。例如,2019年7月,GS能源與樂天化學計畫合資興建一座石化工廠。兩家公司將投資 6.77 億美元在 2023 年前建立該工廠,這可能會進一步刺激所研究市場的需求。

石墨氈專門設計用於高溫真空和惰性氣體爐的隔熱材料。爐子主要用作中央暖氣供應系統的關鍵部件。它們被永久安裝,透過空氣、蒸氣或熱水等中間流體的運動為室內空間提供熱量。

因此,預計所有上述因素都會對所研究市場的需求產生重大影響。

中國主導亞太市場

在亞太地區,中國是最大的生產基地,各終端用戶產業對石墨氈的需求不斷增加。

根據國家統計局數據,2021年中國工業增加價值與前一年同期比較2020年的31.3兆元年增9.6%,佔全球製造業產出的30%。

根據世界鋼鐵組織的數據,2021年中國粗鋼產量為10.328億噸,較2020年下降3%。此外,以產量排名前十大鋼鐵製造商中有七家是中國企業。主要企業有中國寶武集團、河鋼集團、沙鋼集團、鞍鋼集團、建龍集團、首鋼集團、山東鋼鐵集團等。

中國政府決定2021年將單位GDP消費量降低3%,以排放排放。由於鋼鐵業是主要污染源,中國工業和資訊化部計劃將減少鋼鐵產量作為減少排放的最有效途徑。這可能會對所研究的市場產生負面影響。

此外,中國生產了全球約64%的石墨,佔全球鈷精製產業的80%。對於電池生產的第二階段來說,結果也是相同的。中國最大的兩家電池公司寧德時代(CATL)和比亞迪(BYD)佔了32%的市場。

此外,中國也是全球最大的電子設備製造基地。根據ZVEI Dia Elektroindustrie統計,2020年中國電子產業規模約24.3億美元,預計2021年和2022年將與前一年同期比較11%和8%。此外,預計2021年中國半導體銷售額將達到1,829.3億美元,這將是一個龐大的石墨氈市場。

因此,預計所有上述因素都將對該國所研究市場的需求產生重大影響。

石墨氈行業概況

全球石墨氈市場是一個部分整合的市場,主要企業之間競爭激烈,以搶佔大部分市場佔有率。市場的主要企業(不分先後順序)包括 SGL Carbon、Morgan Advanced Materials、Nippon Carbon、MERSEN GRAPHITE 和 Schunk Carbon Technology。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 工業應用和能源效率需求增加

- 亞太地區工業化的崛起

- 限制因素

- 碳氈製造高成本

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 原料類型

- 聚丙烯腈(PAN)

- 人造絲

- 石油瀝青

- 應用

- 隔熱材料

- 電池

- 半導體

- 其他用途(吸收劑、汽車排氣管內襯)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率分析**/排名分析

- 主要企業策略

- 公司簡介

- Anssen Metallurgy Group Co. Ltd

- Av Carb LLC

- Beijing Great Wall Co. Ltd

- Carbon Composites Inc.

- CeraMaterials

- CFCCARBON Co. Ltd

- CGT Carbon GmbH

- Chemshine Carbon Co. Ltd

- CM Carbon.

- HPMS Graphite

- Liaoning Jingu carbon material Co. Ltd

- Mersen Graphite

- Morgan Advanced Materials

- Nippon Carbon Co. Ltd

- Schunk Carbon Technology

- SGL Carbon

- Sinotek Materials Co. Ltd

第7章 市場機會與未來趨勢

- 可再生能源需求不斷成長

The Graphite Felt Market is expected to register a CAGR of less than 6% during the forecast period.

Due to the COVID-19 outbreak, nationwide lockdown around the globe, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory during the forecast period.

Over the short term, increasing demand for industrial applications and growing industrialization in the Asia-Pacific region are likely to drive the demand for the market studied.

On the flip side, the high cost associated with carbon felt manufacturing would somehow hinder the market growth.

Increasing demand for renewable energy is likely to create opportunities for the market in the coming years.

Graphite Felt Market Trends

Increasing Applications from Heat Insulation Segment

Graphite Felt has the properties of soft, flexible high-temperature refractory insulation, making it a good thermal insulator. It works in a vacuum and protected atmosphere environments up to ~3,000°C.

Graphite felt products are appreciated for their chemical and physical properties such as chemically inert, thermal resistance, low thermal and electrical conductivity, low thermal expansion coefficient, low friction coefficient, and low coefficient of absorption of X-rays and electrons.

Moreover, these products can be used in different fields, including crude steel production and aluminum production, petrochemical industry, chemical processing industry, metallurgy industry, and ceramic industry, catering to the needs of insulation. The continuous focus on high yield performance pushes these industries to operate their processes toward extreme temperatures and consequently creates a demand for high-temperature insulating products such as graphite felts, having improved performance.

The global production of crude steel stood at 1,950.5 million tons in 2021, registering an increase of 3.7% compared to 1880.4 million tons in 2020, which is expected to enhance the demand for the market studied from heat insulation application.

With the increasing industrial demand for chemicals in South Korea, the petrochemical industry is also offering investment opportunities, with a few companies taking the initiative. For instance, in July 2019, GS Energy and Lotte Chemical planned to build a petrochemical plant as a joint venture. The companies invested USD 677 million for the construction of the plant by 2023, which is likely to further enhance the demand for the market studied.

Graphite felt is specifically designed to perform as a thermal insulator for high-temperature vacuum and inert gas furnaces, among other applications. Furnaces are mostly used as a major component of a central heating system. These are permanently installed to provide heat to an interior space through intermediary fluid movement, which may be air, steam, or hot water.

Therefore, all the aforementioned factors are expected to significantly impact the demand for the market studied.

China to Dominate the Market in the Asia-Pacific Region

In the Asia-Pacific region, China is the largest production base in the region, with increasing demand from various end-user industries for graphite felt.

According to the National Bureau of Statistics, China's value-added industrial output went up 9.6 percent year on year in 2021, up from 31.3 trillion Yuan in 2020, which accounted for ~30% of the world's manufacturing output.

According to World Steel Organisation, China's crude steel production stood at 1032.8 million tons in 2021, which decreased by 3% compared to 2020. Furthermore, 7 of the top 10 steel producers by volume of production were from China. The country's leading steel companies are China Baowu Group, HBIS Group, Shagang Group, Ansteel Group, Jianlong Group, Shougang Group, and Shandong Steel Group.

The government of China has decided to cut down the energy consumption per GDP by 3% in 2021 in order to reduce emissions. Since the iron and steel industry is a major polluter, China's Ministry of Industry and Information Technology has planned to cut steel output as the most effective way to cut emissions. This is likely to have a negative impact on the market studied.

Furthermore, China produces approx. 64% of the world's graphite and captures 80% of the world's cobalt refining industry. In the second stage, battery manufacturing, the results are the same. Two leading Chinese battery giants, Contemporary Amperex Technology (CATL) and Build Your Dreams (BYD), control 32% of the market.

Moreover, China has the world's largest electronics production base. According to ZVEI Dia Elektroindustrie, the electronics industry of China is about USD 2,430 million in 2020 and is forecasted to grow at 11% and 8% Y-o-Y in 2021 and 2022. Furthermore, semiconductor sales in China reached USD 182.93 billion in 2021, thus providing a huge market for graphite felt.

Therefore, all the aforementioned factors are expected to significantly impact the demand for the market studied in the country.

Graphite Felt Industry Overview

The global graphite felt market is a partially consolidated market with intense competition among the top players to capture the major share in the market. Some of the major key players (not in any particular order) in the market include SGL Carbon, Morgan Advanced Materials, Nippon Carbon Co. Ltd, MERSEN GRAPHITE, and Schunk Carbon Technology, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Industrial Applications and Energy Efficiency

- 4.1.2 Growing Industrialization in the Asia-Pacific Region

- 4.2 Restraints

- 4.2.1 High Cost Associated With Carbon Felt Manufacturing

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Raw Material Type

- 5.1.1 Polyacrylonitrile (PAN)

- 5.1.2 Rayon

- 5.1.3 Petroleum Pitch

- 5.2 Application

- 5.2.1 Heat Insulation

- 5.2.2 Batteries

- 5.2.3 Semiconductors

- 5.2.4 Other Applications (absorptive materials, automotive exhaust linings)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anssen Metallurgy Group Co. Ltd

- 6.4.2 Av Carb LLC

- 6.4.3 Beijing Great Wall Co. Ltd

- 6.4.4 Carbon Composites Inc.

- 6.4.5 CeraMaterials

- 6.4.6 CFCCARBON Co. Ltd

- 6.4.7 CGT Carbon GmbH

- 6.4.8 Chemshine Carbon Co. Ltd

- 6.4.9 CM Carbon.

- 6.4.10 HPMS Graphite

- 6.4.11 Liaoning Jingu carbon material Co. Ltd

- 6.4.12 Mersen Graphite

- 6.4.13 Morgan Advanced Materials

- 6.4.14 Nippon Carbon Co. Ltd

- 6.4.15 Schunk Carbon Technology

- 6.4.16 SGL Carbon

- 6.4.17 Sinotek Materials Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Renewable Energy