|

市場調查報告書

商品編碼

1690879

物聯網設備 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)IoT Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

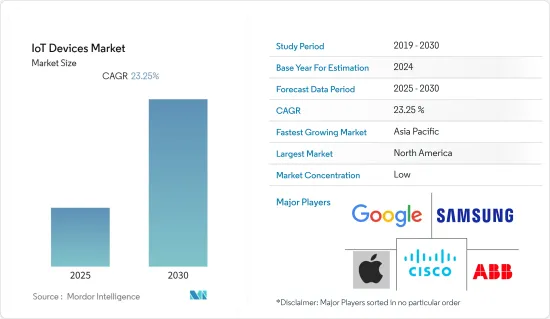

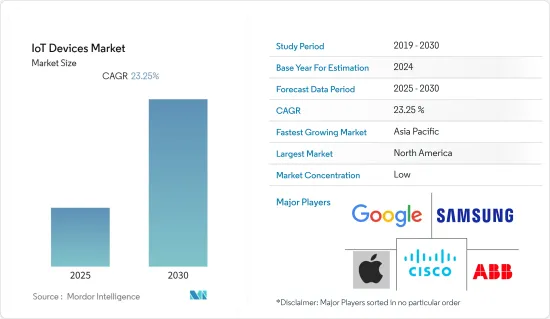

預計物聯網設備市場在預測期內的複合年成長率將達到 23.25%

關鍵亮點

- 物聯網設備可以從更快的資料傳輸中受益。物聯網的採用和發展依賴5G這一趨勢。該技術預計速度可達 10Gbps。物聯網的分析和其他功能將隨著資料交換的速度和可訪問性而進步。 5G 憑藉其低延遲和高容量,有望徹底改變物聯網設備的運作和通訊方式。

- 各個領域對連網型設備的日益普及正在對所研究的市場產生積極的影響。愛立信預計,大規模物聯網連線數量將增加一倍,達到近2億。愛立信表示,到 2027 年底,40% 的蜂巢式物聯網連接可能將是寬頻物聯網,其中大部分將由 4G 連接。然而,隨著 5G 新無線電 (NR) 在新舊頻段的引入,該領域的吞吐資料速率預計將大幅提高。

- 物聯網 (IoT) 需要可靠的連接和通訊來建立適當的資料共用網路。消費者的需求為通訊業者和開發商提供了廣泛的連接技術選擇。

- 開放標準對於 RFID 和 GSM 等無線通訊技術以及機器對機器通訊(M2M) 的成功至關重要。如果沒有全球認可的標準,RFID 和 M2M 解決方案向物聯網 (IoT) 的擴展就無法達到全球規模。快速建立可互通標準的需求被認為是部署物聯網應用的關鍵要素。如果物聯網設備的採用無法廣泛推廣,這可能會阻礙物聯網設備的使用。

- 在 COVID-19 疫情期間,物聯網被廣泛用於監測患者健康狀況。例如,2020 年 4 月,SPHCC 宣布正在使用藍牙物聯網產品和解決方案供應商 Cassia Network 的閘道器以及 VivaLNK 的醫療穿戴式感測器來監測 COVID-19 患者。 Cassia 的網路管理工具 IoT Access Controller 將由醫護人員用來監控病患並提供更即時的生命徵象可見度。 Cassia 的閘道器允許近 40 個低功耗藍牙裝置同時配對和連接,提供覆蓋 SPHCC 多個房間所需的遠距連接。

物聯網設備市場趨勢

醫療物聯網應用領域預計將佔據相當大的市場佔有率

- 互聯醫療設備市場是新興醫療產業之一,由於依賴物聯網技術,該市場在過去十年中持續成長。這項特點使其更接近工業4.0範式。在互聯醫療設備領域,技術整合的機會貫穿設備的整個生命週期,從製造、維護到使用。二十多年來,消費者醫療保健領域一直堅決抵制顛覆該產業的創新浪潮。人工智慧 (AI) 和機器學習 (ML) 等技術對於進一步釋放互聯醫療的可能性至關重要。

- 根據美國疾病管制中心的報告,出生時的平均壽命一直在穩定上升,從2017年的73.3歲增加到2022年的目標74.4歲。這一成長大部分是由於嬰兒死亡率的下降。研究顯示,美國的預期壽命連續第三年下降至78.6歲。人們追求健康的生活方式以保持健康並注意飲食習慣。人類行為的這些變化預計將增加對連網醫療設備的需求。

- 此外,由於久坐不動的生活方式、不健康的飲食和肥胖,部分新興和已開發國家的糖尿病患者數量正在增加,促使市場參與企業開發智慧和穿戴式醫療設備。 Beta Bionics 開發了一款完全整合的醫療穿戴設備,可全天候自主管理第 1 型糖尿病患者的血糖值。目前正處於臨床測試階段,尚未上市銷售。

- IoMT 應用的例子包括檢測不規則或過低心率的心率監測器,以及智慧胰島素筆和血糖儀等糖尿病設備。

- 智慧型設備的廣泛使用、醫療保健領域對資料分析的需求不斷成長、智慧型裝置的價格實惠以及智慧連網型設備和穿戴式裝置的市場滲透等因素正在推動醫療物聯網設備市場的成長。根據思科年度網路報告,到今年底,連網設備和連線的數量將從2018年的184億增加到近300億。到 2023 年,物聯網設備將佔所有連網裝置的 50%(147 億),高於 2018 年的 33%(61 億)。

- 另一方面,引入物聯網設備的成本、醫療機構因引進物聯網設備而產生的安全疑慮等因素,正在阻礙醫療物聯網設備的發展。

亞太地區預計將佔據主要市場佔有率

- 亞太地區是人工智慧和物聯網等技術進步的早期採用者。這些新興經濟體為工業自動化的應用提供了關鍵的市場優勢,因為它們免去了重建傳統自動化系統和投資機械的麻煩。

- 廣泛採用的關鍵因素包括該地區各國政府正在推行的智慧國家計劃以及製造業和物流業當前推動的工業 4.0。此外,高光纖連接、資料中心、海底電纜等有利的基礎設施以及通訊業者對低功耗和 5G 網路的投資將進一步推動物聯網的採用。

- 製造業是亞太地區的重點產業。在這一趨勢中發揮關鍵作用的中國經濟正在經歷快速變革時期,因為人事費用飆升,傳統的移工模式變得永續性。這些趨勢正在推動中國經濟將自動化引入部分製造流程。

- 物聯網是開發、生產和物流鏈中新技術方法的核心——稱為智慧工廠自動化——進一步推動了該地區工業自動化的應用。

- 此外,自動化過程的通訊支援使製造商更容易採用它。感測器組件、更快的網路、高品質的診斷軟體、具有高可靠性和安全分層存取的靈活介面以及錯誤糾正選項正在幫助該地區提高生產力、確保持續的高品質交貨並最大限度地降低生產成本。

物聯網設備產業概覽

物聯網設備市場高度分散。知名參與企業包括蘋果、Google(Alphabet)和三星電子(Samsung Electronics Co. Ltd.)。該市場的參與企業正在採取聯盟、合資和收購等策略來增強其產品供應並獲得永續的競爭優勢。

2022 年 11 月,三星印度推出了一款支援物聯網 (IoT) 的新型空氣清淨機。新的空氣清淨機系列包括 AX46 和 AX32 兩種型號,只需按一下按鈕即可操作,保證去除 99.97% 的奈米級顆粒、超細灰塵、細菌和過敏原。它還可以輕鬆去除甲醛等潛在有害的揮發性有機化合物(VOC),確保顧客呼吸到更乾淨的空氣。此外,三星將於 2022 年 8 月推出 SmartThings Home Life,升級後的 Family Hub 將將全球客戶連接到智慧生活解決方案生態系統,擴展他們的家庭生活體驗。

2022年9月,霍尼韋爾與沙烏地阿拉伯公共投資基金(PIF)和STC集團(STC)的合資企業物聯網技術公司(IoT-squared)簽署了一份合作備忘錄(MoU),以推動物流平台、永續城市和技術領域的發展,推動沙烏地阿拉伯的數位化。該戰略合作備忘錄支持沙烏地阿拉伯「2030願景」的目標,即發展智慧城市並提高社會對科技的採用。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業相關人員分析

- 物聯網生命週期分析

第5章市場動態

- 市場促進因素

- 關鍵領域對互聯/智慧物聯網設備的需求穩定成長

- 軟體創新和改進的連接性將推動市場成長(由於更換週期縮短)

- 市場限制

- 不同平台之間通訊協定缺乏標準化

- 資料安全和隱私問題阻礙了物聯網設備的廣泛採用

- 產業法規-ISO/IEC JTC、ETSI、ITU 等。

- 定價分析

第6章 技術簡介

- 物聯網的演變

- 預計推動採用的主要顛覆性技術分析

- 物聯閘道器鍵組件分析

第7章市場區隔

- 按應用程式類型

- 互聯智慧家居

- 醫療物聯網

- 聯網汽車

- 智慧城市

- 工業IoT

- 個人物聯網

- 其他使用類型

- 按連線類型

- WPAN

- WLAN

- LPWA

- 蜂窩/M2M

- 其他連線類型

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第8章競爭格局

- 公司簡介

- Apple Inc.

- ABB Limited

- Cisco Systems Inc

- Google Inc.(Alphabet)

- Samsung Electronics Co. Limited

- LG Electronics

- Siemens AG

- Honeywell International Inc.

- Sony Corporation

- Amazon.com, Inc.

- Robert Bosch GMBH

第9章投資分析

第10章:市場的未來

The IoT Devices Market is expected to register a CAGR of 23.25% during the forecast period.

Key Highlights

- IoT devices might benefit more from data transmission speeds. IoT adoption and development are reliant on 5G as a trend. Predictive speeds of up to 10Gbps are possible with this technology. IoT networks' analysis and other capabilities will advance, along with the speed and accessibility of data exchange. 5G will revolutionize how IoT equipment operates and communicates with lower latency rates and more capacity.

- The growing trend of adopting connected devices in various sectors positively influences the market studied. According to Ericsson, the number of massive IoT connections is expected to have doubled, reaching nearly 200 million. According to Ericsson, by the end of 2027, 40% of cellular IoT connections will likely be broadband IoT, with 4G connecting most of them. However, with the introduction of 5G New Radio (NR) in the old and new spectrum, throughput data rates are expected to increase substantially for this segment.

- The Internet of Things (IoT) requires dependable connectivity and communications to establish proper data-sharing networks. Due to consumer demand, operators and developers have a wide selection of connectivity technologies.

- Open standards are critical enablers for the success of wireless communication technologies, such as RFID or GSM, and, in general, for any machine-to-machine communication (M2M). Without globally recognized standards, the expansion of RFID and M2M solutions to the Internet of Things (IoT) cannot reach a global scale. The need for faster setting of interoperable standards has been recognized as an essential factor for deploying IoT applications. It may hinder the usage of IoT devices if the implementation does not gain significant traction.

- IoT is significantly being utilized for monitoring patients' health status during the COVID-19 pandemic. For instance, in April 2020, SPHCC announced that it is using Bluetooth IoT products and solutions provider Cassia Network's gateways and VivaLNK's medical wearable sensors to monitor COVID-19 patients. Cassia's IoT Access Controller, a network management tool, is used by medical staff to monitor patients and provide a better real-time view of their vitals. Cassia's gateways allow almost 40 Bluetooth low-energy devices to be paired and connected simultaneously while giving the long-range connectivity required to cover several rooms in the SPHCC.

IoT Devices Market Trends

Medical IoT Application Segment is Expected to Hold Significant Market Share

- The market for connected medical devices is one of those new medical industries that has consistently grown over the last decade, given its dependency on IoT technologies. This feature brings it closer to Industry 4.0 paradigms. In the world of connected medical devices, opportunities for technological integration exist throughout the device's lifecycle, from manufacturing and maintenance to use. For over two decades, consumer-facing healthcare has steadfastly resisted the wave of innovations that have been disrupting industries. This means that the industry is ripe for disruption, and technologies like Artificial Intelligence (AI) and Machine Learning (ML) will be vital to unlocking greater connected healthcare possibilities.

- According to the US Centers for Disease and Prevention report, the overall life expectancy at birth is steadily increasing, with a target of 74.4 years by 2022, up from 73.3 years in 2017. Most of the increase is due to lower infant mortality. According to the same survey, life expectancy in the United States has dropped for the third year in a row to 78.6 years. People strive toward a healthy lifestyle to keep fit and monitor their eating habits. Such changes in people's behavior will increase the demand for connected medical devices.

- Moreover, due to inactive lifestyles, unhealthy diets, and obesity, some emerging and developed regions are witnessing a rising number of diabetic patients, encouraging market players to develop smart wearable medical devices. Beta Bionics developed a fully integrated medical wearable device that can autonomously manage blood sugar levels 24/7 for type 1 diabetes. Currently, it is in the state of clinical testing and unavailable for sale.

- Examples of IoMT applications include an electrocardiogram monitor that will detect irregular heartbeats or rates that are too low and diabetes devices such as smart insulin pens and glucose meters.

- Factors such as increased adoption of smart devices, rising demand for data analytics in the health sector, availability of smart devices at affordable pieces, and the market penetration of smart connected devices and wearables provide impetus to the market growth of Medical IoT devices. According to Cisco's Annual Internet Report, by the end of the current year, there will be close to 30 billion network-connected devices and connections, up from 18.4 billion in 2018. By 2023, IoT devices will make up 50% (14.7 billion) of all networked devices, up from 33% (6.1 billion) in 2018.

- On the flip side, factors such as the cost to implement IoT devices can be difficult, and health organizations' security concerns due to the implementation of IoT devices hinder the growth of medical IoT devices.

Asia Pacific is Expected to Hold Significant Market Share

- Asia Pacific has been an early adopter of technological advancements like AL and IoT. In these developing economies, the market poses a key advantage in implementing industrial automation since it is not tormented with rebuilding legacy automation systems and machine investments.

- Some critical factors for the widespread adoption include the Smart Nation initiatives driven by the governments of the various countries in the region and the current Industry 4.0 drive in the manufacturing and logistics sectors. Also, favorable infrastructures, such as high fiber connectivity, data centers, submarine cables, and operators' investments in low-power and 5G networks, are likely to drive the adoption of IoT further.

- Manufacturing serves as a significant industry in the Asia Pacific. As a significant contributor, the Chinese economy is undergoing a rapid transformation as labor costs have risen and the conventional model of migrant workers has lost sustainability. Such trends have pushed the economy to adopt automation as a part of manufacturing processes.

- IoT, being at the center of new technological approaches for development, production, and the entire logistics chain (otherwise known as smart factory automation), has further driven the adoption of industrial automation in the region.

- Moreover, the communications support for automated processes has facilitated easier adoption among manufacturers. Sensor components, faster networks, quality diagnostic software, and flexible interfaces with high levels of reliability and secured hierarchical access, along with error-correction options, have added productivity, continued quality deliveries, and minimized the cost of manufacturing in the region.

IoT Devices Industry Overview

The IoT devices market is highly fragmented. Some prominent players include Apple Inc., Google Inc. (Alphabet), and Samsung Electronics Co. Limited. Players in the market are adopting strategies such as partnerships, joint ventures, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In November 2022, Samsung India unveiled its new Internet of Things (IoT)-enabled air purifiers. The new air purifier line contains two models, AX46 and AX32, with a one-button operation and guarantees to remove 99.97% of nano-sized particles, ultrafine dust, germs, and allergies. They also claim to easily remove potentially hazardous volatile organic compounds (VOCs), such as formaldehyde, ensuring that customers breathe clean air. Furthermore, Samsung announced SmartThings Home Life in August 2022, and the updated family hub links customers worldwide to an ecosystem of smarter living solutions that expand their home life experience.

In September 2022, Honeywell and Internet of Things Technologies Company (IoT-squared), a joint venture between Saudi Arabia's Public Investment Fund (PIF) and STC Group (STC), signed a Memorandum of Understanding (MoU) to advance the fields of logistics platforms, sustainable cities, and technologies which would drive the digitalization in Saudi Arabia. The strategic MoU supports the goals established in Saudi Vision 2030 for smart city development and expanding technology adoption in society.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Stakeholder Analysis

- 4.4 IoT Lifecycle Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Steady Growth in Demand for Connected/Smart IoT Devices in Key Segments

- 5.1.2 Software Innovations and Improvements in Connectivity Technologies to drive market growth (by Lowering Replacement Cycle)

- 5.2 Market Restraints

- 5.2.1 Lack of Standardization of Communication Protocol across Different Platforms

- 5.2.2 Issues Related to Security and Privacy of Data to Hinder the Adoption of IoT Devices

- 5.3 Industry Regulations - ISO/IEC JTC, ETSI, ITU, etc.

- 5.4 Pricing Analysis

6 TECHNOLOGY SNAPSHOT

- 6.1 Evolution of IoT

- 6.2 Analysis of Key Disruptive Technologies Expected to Aid Adoption

- 6.3 Analysis of Major IoT Components

7 MARKET SEGMENTATION

- 7.1 By Application Type

- 7.1.1 Connected and Smart Home

- 7.1.2 Medical IoT

- 7.1.3 Connected Car

- 7.1.4 Smart Cities

- 7.1.5 Industrial IoT

- 7.1.6 Personal IoT

- 7.1.7 Other Application Type

- 7.2 By Connectivity Type

- 7.2.1 WPAN

- 7.2.2 WLAN

- 7.2.3 LPWA

- 7.2.4 Cellular/M2M

- 7.2.5 Other Connectivity Type

- 7.3 By Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia Pacific

- 7.3.4 Latin America

- 7.3.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Apple Inc.

- 8.1.2 ABB Limited

- 8.1.3 Cisco Systems Inc

- 8.1.4 Google Inc. (Alphabet)

- 8.1.5 Samsung Electronics Co. Limited

- 8.1.6 LG Electronics

- 8.1.7 Siemens AG

- 8.1.8 Honeywell International Inc.

- 8.1.9 Sony Corporation

- 8.1.10 Amazon.com, Inc.

- 8.1.11 Robert Bosch GMBH