|

市場調查報告書

商品編碼

1690860

智慧型手機相機鏡頭:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Smartphone Camera Lens - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

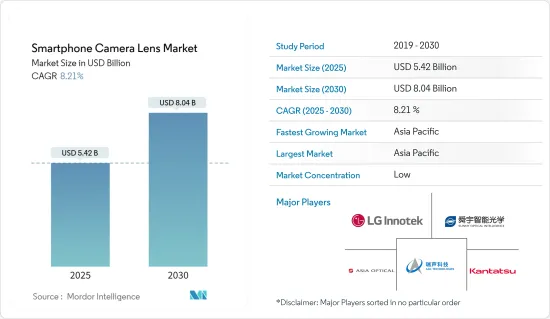

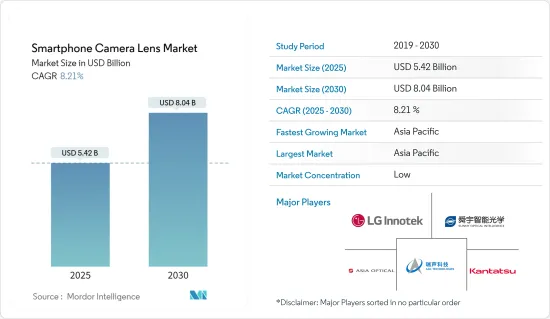

預計 2025 年智慧型手機相機鏡頭市場規模為 54.2 億美元,到 2030 年將達到 80.4 億美元,預測期內(2025-2030 年)的複合年成長率為 8.21%。

市場正在見證與智慧型手機使用的不同類型鏡頭相關的各種進步。各大智慧型手機廠商都在開發搭載多鏡頭的智慧型手機,包括長焦鏡頭、微距鏡頭、超廣角鏡頭以及其他類型的鏡頭。

關鍵亮點

- 智慧型手機相機鏡頭是內建於智慧型手機相機模組的光學元件。這些鏡頭與感測器和影像處理演算法相結合,用於捕捉照片和影片。鏡頭通常由多個玻璃或塑膠元件以特定方式排列組成,以實現所需的光學性能。透過組合具有不同焦距和功能的多個鏡頭,智慧型手機使用者無需使用外部附件即可捕捉各種影像。

- 隨著智慧型手機技術的快速發展,相機鏡頭的採用率正在不斷提高,促使市場參與企業透過產品創新、擴張活動、合併、收購、聯盟和夥伴關係投資該技術。例如,2023年1月,三星電子發布了其最新的影像感測器ISOCELL HP2,解析度為2億像素。三星表示,該鏡頭是其像素技術的改進,旨在提高其高階智慧型手機的影像品質。

- 區域經濟成長和新興市場可支配收入的提高導致全球智慧型手機需求激增。隨著每代智慧型手機的推出,相機性能都有新的進步。消費者在購買新手機時越來越重視手機相機的品質。這就是製造商投資提高行動電話相機鏡頭性能的原因。

- 過去幾年,智慧型手機市場銷售持續下滑。造成這一下降的因素有幾個,包括客戶需求減弱、經濟不確定性和全球通貨膨脹。

- 新冠疫情的爆發對市場造成了顯著的打擊,各國政府採取的封鎖等各種防控措施對工業成長產生了顯著的影響。結果,我們看到市場放緩,尤其是在疫情初期。新冠疫情影響了全球智慧型手機的銷售。這種情況也給該行業帶來了一些挑戰。封鎖和經濟不確定性消費者削減非必要開支,進而導致智慧型手機需求下降。

智慧型手機相機鏡頭市場趨勢

多鏡頭智慧型手機的普及和先進相機技術的引入正在推動市場

- 隨著最新技術的推出,智慧型手機也不斷更新。新款智慧型手機的賣點通常是其全新升級的相機。這種能力對於硬體技術的持續改進產生了巨大的需求。如今,人們不再只注重使用傳統相機,而是更注重用行動電話拍照。

- 隨著人工智慧的進步,智慧型手機正在經歷包括多相機出現在內的技術創新。隨著智慧型手機的推出,多鏡頭智慧型手機在市場上獲得了巨大的歡迎,許多品牌開始推出配備四鏡頭甚至五鏡頭的機型。智慧型手機中多個相機的加入使得新功能的發展成為可能,例如變焦、更好的 HDR(高動態範圍)、肖像模式、3D 選項和低照度捕捉選項。

- 鏡頭市場也正在開拓一些先進的相機技術。例如,夜間模式功能允許使用者在低照度條件下拍攝高品質的照片。採用先進的演算法和影像處理技術,降低雜訊,增強細節,使影像更明亮、更清晰。

- 光學影像防手震、計算攝影和支援人工智慧的相機功能(例如,透過調整曝光、顏色和其他參數來最佳化相機設定和提高影像品質)也可能推動對更好鏡頭的需求。

亞太地區將迎來巨大成長

- 亞太地區是智慧型手機製造活動的重要中心,需要穩定的相機鏡頭供應。該地區的消費者越來越喜歡使用配備高解析度相機的智慧型手機來拍攝照片和影片。這種需求的成長推動了對智慧型手機先進相機鏡頭的需求。

- 亞太地區是智慧型手機最重要的市場之一,主要得益於其高度發展的通訊產業和龐大的基本客群。根據中國國家統計局的數據,2022年中國智慧型手機產量約16億支。 2022年中國將成為全球最大的智慧型手機生產國。 2021年和2020年的智慧型手機產量分別為16.7億支和14.7億支。據IBEF稱,印度是全球最大的行動電話出口國之一。該國的目標是到 2026 會計年度生產價值 3,000 億美元的電子產品。智慧型手機製造被視為實現這一雄心勃勃目標的關鍵。

- 該地區對先進行動網路的投資正在不斷增加。中國、印度、日本、澳洲、新加坡和韓國等國家正在增加對發展國內通訊市場的投資。預計此舉將推動該地區市場的發展。原料的易得性、低廉的設置和人事費用也促使許多公司在亞太地區建立生產基地。

- 印度、中國、韓國和台灣等國家和地區對智慧型手機和其他電子產品的需求不斷成長,也鼓勵許多公司在亞太地區設立工廠。例如,全球智慧型手機設備品牌 OPPO 最近在印度設立了一個智慧型手機製造部門。

智慧型手機相機鏡頭產業概況

智慧型手機相機鏡頭市場細分化,存在眾多大型和小型公司。主要參與企業包括 LG Innotek、舜宇光學科技(集團)有限公司、亞洲光學股份有限公司、瑞聲科技和 Kantatsu(夏普公司)。這些公司不斷創新新產品並與其他公司建立策略夥伴關係以維持市場佔有率。

- 2023 年 6 月 - LG Innotek 宣布將向其位於越南海防的生產子公司投資 9.95 億美元,以擴大相機模組生產線。此次投資的目的是擴大某些相機模組的生產能力,例如蘋果 iPhone 的相機模組。越南新廠預計於2024年下半年完工,2025年開始量產。

- 2023 年 4 月 - 天才電子光學 (GSEO) 專注於開發創新產品和解決方案。公司將向需要改進的供應商提出建議並監督實施過程。業內人士稱,該公司是定於 2023 年發布的 iPhone 系列的潛在供應商,包括潛望鏡鏡頭。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 多鏡頭智慧型手機的普及和先進相機技術的引入

引進先進的相機技術

- 市場限制

- 智慧型手機銷售放緩,價格競爭加劇

第6章市場區隔

- 按地區

- 亞太地區

- 美洲

- 歐洲

- 其他

第7章競爭格局

- 供應商排名分析

- 公司簡介

- LG Innotek

- Sunny Optical Technology(Group)Company Limited

- Asia Optical Co. Inc.

- AAC Technologies

- Kantatsu Co. Ltd(Sharp Corporation)

- SEKONIX Co. Ltd

- Genius Electronic Optical(GSEO)

- Largan Precision Company Limited

- Kinko Optical Co. Ltd

- Haesung Optics Co. Ltd

- Ofilm Group Co. Ltd

- Samsung Electro-Mechanics Co. Ltd

第8章投資分析與機會

The Smartphone Camera Lens Market size is estimated at USD 5.42 billion in 2025, and is expected to reach USD 8.04 billion by 2030, at a CAGR of 8.21% during the forecast period (2025-2030).

The market is witnessing various advancements related to the different types of lenses being used in smartphones. Various smartphone manufacturers are developing smartphones with multiple cameras that include other types of lenses, including telephoto lenses, macro lenses, and ultra-wide-angle lenses.

Key Highlights

- The lenses of smartphone cameras refer to the optical components integrated into the camera modules of smartphones. These lenses combine with sensors and image-processing algorithms to capture photos and videos. A single lens typically comprises multiple glass or plastic elements arranged in a specific configuration to achieve the desired optical performance. Combining multiple lenses with different focal lengths and functionalities helps smartphone users capture a wide range of images without using external attachments.

- With rapidly increasing technological developments in smartphones, the adoption of camera lenses has been continuously rising, thereby pushing the market players to invest in this technology through product innovations, expansion activities, mergers, acquisitions, collaborations, and partnerships. For instance, in January 2023, Samsung Electronics announced the launch of its latest image sensor, the ISOCELL HP2, which entails a 200-megapixel resolution. According to Samsung, the lens will offer improved pixel technology for better image quality in its premium smartphones.

- Growing regional economies and rising disposable incomes in emerging markets have led to a surge in the global demand for smartphones. With each new generation of smartphones, there are new advancements in the capabilities of the cameras. Consumers increasingly prioritize the quality of a phone's camera while purchasing a new one. Thus, manufacturers are investing in improving the performance of camera lenses in mobile phones.

- Over the recent years, the smartphone market has witnessed a decline in sales. Several factors have contributed to this decline, including reduced demand from customers, economic uncertainties, and global inflation.

- The outbreak of the COVID-19 pandemic has left a notable dent in the market as various containment measures taken by governments across multiple countries, such as the implementation of lockdowns, significantly impacted the growth of the industry. As a result, a slowdown was witnessed in the market, especially during the initial phase of the pandemic. The COVID-19 pandemic impacted the global sales of smartphones. This situation also posed several challenges to the industry. Lockdowns and economic uncertainties led to consumers spending less on non-essential products, thereby resulting in a decrease in the demand for smartphones.

Smartphone Camera Lens Market Trends

Increasing Popularity of Multiple Camera Smartphones and the Introduction of Advanced Camera Technologies will Drive the Market

- Smartphones are being continuously updated with the incorporation of the latest technologies. A central selling point of new smartphones is often a new and improved camera. This feature generates heavy demand to improve this hardware technology on a continuous basis. Nowadays, people are more focused on clicking pictures on their phones instead of using conventional cameras for the same.

- As artificial intelligence continues to advance, smartphones are witnessing innovations, including the emergence of multiple cameras. With the introduction of smartphones, when multi-camera smartphones gained enormous market traction, many brands began to introduce quad-camera or five-camera models. Multiple cameras in smartphones have enabled the development of new features, such as zoom, better HDR (high dynamic range), portrait modes, 3D options, and low-light photography options.

- The lens market is also witnessing the development of several advanced camera technologies. For instance, the night mode feature enables users to capture high-quality photos in low-light conditions. It uses advanced algorithms and image processing techniques to reduce noise and enhance details, thereby resulting in brighter and clearer images.

- Optical image stabilization, computational photography, and AI-powered camera features, like optimizing camera settings and enhancing image quality by adjusting exposure, color, and other parameters, are also likely to drive the demand for better lenses.

Asia-Pacific will Witness Significant Growth

- The Asia-Pacific region is a significant hub for smartphone manufacturing activities, which require a steady supply of camera lenses. Consumers in the region are showing an increased preference for smartphones with high-resolution cameras for capturing photos and videos. This growth in demand is leading to an increased need for advanced camera lenses for smartphones.

- The Asia-Pacific region has been one of the most significant markets for smartphones, primarily due to the highly developing telecom sector and the large customer base. According to the National Bureau of Statistics of China, in 2022, the production volume of smartphones in China was almost 1.6 billion units. China was the world's largest smartphone producer in 2022. In 2021 and 2020, the recorded volumes of smartphone production were 1.67 units and 1.47 billion units, respectively. According to IBEF, India is one of the leading exporters of cell phones. The country aims to produce electronics worth USD 300 billion by FY 2026. Manufacturing smartphones would be the key to achieving this ambitious goal.

- The region is increasingly investing in advanced mobile networks. Countries like China, India, Japan, Australia, Singapore, and South Korea are increasingly investing in developing their domestic telecom markets. This move is expected to drive the market in the region. The availability of raw materials and the low costs of establishment and labor have also motivated many companies to establish their production centers in the Asia-Pacific region.

- The growing demand for smartphones and other electronic products in countries such as India, China, the Republic of Korea, and Taiwan is encouraging many companies to set up their factories in the Asia-Pacific region. For instance, OPPO, a global smartphone and device brand, recently established a smartphone manufacturing unit in India.

Smartphone Camera Lens Industry Overview

The smartphone camera lens market is fragmented due to the presence of many large and small players. Some of the major players are LG Innotek, Sunny Optical Technology (Group) Company Limited, Asia Optical Co. Inc., AAC Technologies, and Kantatsu Co. Ltd (Sharp Corporation). These companies keep innovating new products and entering strategic partnerships with other firms to retain their market shares.

- June 2023 - LG Innotek announced an investment worth USD 995 million in its Hai Phong production subsidiary in Vietnam to expand its camera module production line. The purpose of the investment is to expand the production capacity of specific camera modules, such as the camera module of Apple's iPhone. The construction of the new plant in Vietnam is expected to be completed in the second half of 2024, and it will start mass production in 2025.

- April 2023 - Genius Electronic Optical (GSEO) focuses on developing innovative products and solutions. The company recommends suppliers wherever improvements are needed and monitors their implementation processes. The company was named by industry sources as a potential supplier for the upcoming iPhone series in 2023, which included periscope lenses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Popularity of Multiple Camera Smartphones and the Introduction of

Advanced Camera Technologies

- 5.2 Market Restraints

- 5.2.1 Slow Down of Smartphone Sales and Increasing Pricing Competition

6 MARKET SEGMENTATION

- 6.1 By Geography

- 6.1.1 Asia-Pacific

- 6.1.2 Americas

- 6.1.3 Europe

- 6.1.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 VENDOR RANKING ANALYSIS

- 7.2 Company Profiles

- 7.2.1 LG Innotek

- 7.2.2 Sunny Optical Technology (Group) Company Limited

- 7.2.3 Asia Optical Co. Inc.

- 7.2.4 AAC Technologies

- 7.2.5 Kantatsu Co. Ltd (Sharp Corporation

- 7.2.6 SEKONIX Co. Ltd

- 7.2.7 Genius Electronic Optical (GSEO)

- 7.2.8 Largan Precision Company Limited

- 7.2.9 Kinko Optical Co. Ltd

- 7.2.10 Haesung Optics Co. Ltd

- 7.2.11 Ofilm Group Co. Ltd

- 7.2.12 Samsung Electro-Mechanics Co. Ltd