|

市場調查報告書

商品編碼

1690854

美國緊急照明:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)United States Emergency Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

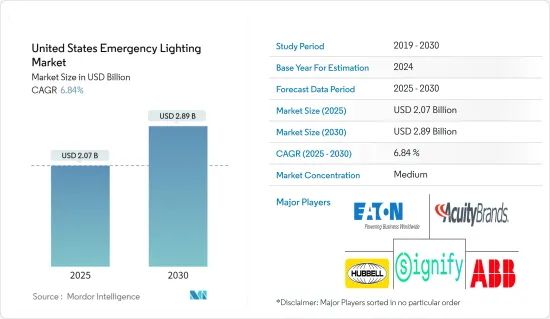

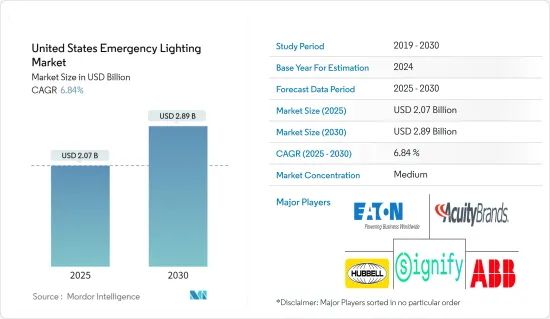

美國緊急照明市場規模預計在 2025 年為 20.7 億美元,預計到 2030 年將達到 28.9 億美元,在市場估計和預測期(2025-2030 年)內以 6.84% 的複合年成長率成長。

在新冠疫情爆發期間,市場出現生產停頓和供應鏈中斷,導致工業生產成長放緩,主要製造地的照明製造業產量下降。

關鍵亮點

- 緊急照明系統是建築物中最重要的安全系統之一。如果發生緊急情況,您可以按照緊急照明安全地停止事情並疏散建築物。緊急照明是一種獨立的備用系統,不依賴建築物內一般配電系統的運作。它必須始終可用。

- 美國是最大的緊急照明市場之一,主要受政府法規的推動。在美國,職業安全與健康管理局 (OSHA) 承認國家消防協會 (NFPA) 生命安全規範 (101) 的緊急照明標準,表明雇主如何滿足一般職責要求以確保職場的安全。這些標準要求所有逃生路線(包括走廊和通道)都安裝緊急照明。

- 根據美國建築師協會預測,未來五年建築支出預計將會增加。就近期預測而言,預計到 2020 年底美國非住宅建築市場將年增與前一年同期比較%(此預測可能受到 COVID-19 情境的影響)。

- 根據美國人口普查局的數據,美國住宅建築收入從 2010 年 1 月的 3 億美元增加到 2018 年 1 月的 6 億美元,而非住宅建築收入從 2010 年 1 月的 6 億美元增加到 2018 年 1 月的 8 億美元。建築業的這種成長預計將為住宅、商業和工業應用創造市場機會。

美國緊急照明市場趨勢

互聯系統和物聯網 (IoT) 的發展以及 LED 價格的下降正在推動市場

- 連接系統和物聯網 (IoT) 的發展,即整合到系統結構中的中央管理主機,透過為客戶提供控制、設施監控和補救服務的應用,對緊急照明市場產生了積極影響。

- 儘管具有方便用戶使用的自我檢查功能,但在大型商業建築中目視檢測緊急照明系統仍然容易出現人為錯誤。物聯網技術正在應用於此類應用中,以簡化現代緊急照明系統的維護和檢查。

- 物聯網技術的先決條件包括透過有線連接或無線技術為緊急照明系統添加網路連接。其結果是一個可以遠端監控和自我診斷的連接緊急照明系統。這項概念的發展始於20年前,但由於成本和技術複雜性,市場尚未做好準備。隨著智慧建築和完全整合的建築管理系統逐漸被接受,聯網緊急照明的概念在過去三年中重新流行起來。

- 工業環境中的 LED 可節省高達 70% 的能源,相關的緊急照明變得高度可控。此外,LED與安防產業的整合也日益加強。 LED 燈具效率更高,並且透過指示器(顯示穩定或閃爍的紅色或綠色 LED 來指示系統何時準備就緒)簡化了緊急照明的測試。這些是北美標準(例如 CSA C22.2 NO.141)所要求的。

- 專用 LED 驅動器和控制模組的開發為連接的緊急照明和建築系統提供了額外的可編程性,包括遠端維護和監控、調光、電力計量、資料收集和試運行。隨著越來越多的建築業主進行 LED維修以節約能源,使用具有無線通訊的智慧 LED 照明燈具維修是一種經濟有效的方法。

商業領域佔據主導市場佔有率

- 2020年,新冠疫情對商業建築建設產生了負面影響。然而,隨著未來幾年疫苗接種的快速推進,該行業有望反彈。

- 根據國家消防協會 (NPFA) 生命安全規範 101,全國所有商業建築都必須配備緊急和疏散照明。該規範每三年更新一次,旨在保護新建和現有設施中的居住者免受火災和其他危害。

- 此外,就亮度水平而言,商業建築的緊急照明在一個半小時內的任何時間都不應低於 6.5 勒克斯。此外,均勻度比率不得超過 40:1。照明系統必須由發電機或電池備用供電。這些規定仿照辦公大樓、餐廳、零售店和其他商業建築的緊急照明要求制定。

- 根據美國能源部 (DOE) 的數據,商業建築每平方英尺的平均千瓦時用電量約為 22.5 kWh/sq ft。在總消費量中,照明約佔 7 kWh/sq ft,僅次於冷藏和冷凍設備(8 kWh/sq ft)。商用照明的高能耗催生了對節能商用緊急照明的需求。

美國緊急照明產業概況

美國緊急照明市場競爭適中,新參與企業較多,主導市場佔有率較少。公司不斷創新並建立戰略夥伴關係以保持市場佔有率。

- 2021 年 2 月 - Accuity Brands Inc. 宣布將紐約數位代理商出售給 Illuminations Inc.。透過 Illuminations Inc.,該公司有絕佳的機會在全球最大的照明市場之一加強其品牌影響力。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概覽

- 技術簡介

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 市場促進因素

- 對節能照明系統和有利的政府法規的需求不斷增加

- LED產品價格下跌

- 市場問題

- 前期投資高,替代技術開發

- 法規政策

- COVID-19對緊急照明市場的影響

- 按應用程式對市場進行定性分析(待命與疏散路線 - 恐慌措施和標誌)

第5章市場區隔

- 類型

- 自主型

- 中央供給型

- 最終用戶

- 商用

- 工業的

- 教育機構

- 醫療保健

- 其他

第6章競爭格局

- 公司簡介

- Acuity Brands Inc.

- Eaton Corporation PLC

- ABB Ltd

- Hubbell Incorporated

- Signify NV(Including Cooper Lighting Solutions)

- Legrand SA

- Emerson Electric Co.

- Encore Lighting

- Myers Emergency Power Systems

- Larson Electronics

- Cree Inc.

- Digital Lumens Inc.

第7章投資分析

第8章:市場的未來

The United States Emergency Lighting Market size is estimated at USD 2.07 billion in 2025, and is expected to reach USD 2.89 billion by 2030, at a CAGR of 6.84% during the forecast period (2025-2030).

Amid the outbreak of COVID-19, the market was witnessing halting of production and disruption in the supply chain, leading to weakened growth of industrial output and the decline of light-manufacturing output across significant manufacturing hubs.

Key Highlights

- An emergency lighting system is one of the most critical safety systems in a building. It makes it possible to stop things safely and evacuate the building by following the exit lights in case of an emergency. Emergency lighting is a standalone backup system that does not depend on the functionality of the general electrical distribution system in the building. It must always be operational and ready for use.

- The United States is one of the largest markets for emergency lighting, primarily driven by government regulations. In the country, the Occupational Safety and Health Administration (OSHA) recognizes the National Fire Protection Association (NFPA) Life Safety Code (101) standards for emergency lighting as providing instructions for how employers can meet their general duty requirements for ensuring a safe workplace. These standards need all exit routes, including corridors, aisles, and the like, to have emergency lighting.

- As per the American Institute of Architects, construction spending is expected to grow over the next five years. Based on short-term projections, the US non-residential construction market is anticipated to grow to 2.4% by the end of 2020, as compared to the previous year (this forecast may have been affected by the COVID-19 scenario).

- According to the US Census Bureau, in the US residential construction sector, revenue increased from USD 0.3 billion in January 2010 to USD 0.6 billion in January 2018, and non-residential construction revenue increased from USD 0.6 billion in January 2010 to USD 0.8 billion in January 2018. Such growth in the construction sector is expected to create opportunities for the market across residential, commercial, and industrial applications.

US Emergency Lighting Market Trends

Development of Connected Systems and Internet of Things (IoT) and Declining Prices of LED to Drive the Market

- The development of connected systems and the Internet of Things (IoT), a central management console integrated into the system architecture, offers the customers control, the ability to monitor facilities, and apply remediation services, thus actively affecting the emergency lighting market.

- Despite the user-friendly self-testing feature, the task remains prone to human error to visually detect the emergency lighting system in a large commercial building. IoT technology is applied to simplify the maintenance and inspection of modern emergency lighting systems in such applications.

- It is done via wire-connection or wireless technology, with the prerequisite of adding network connectivity to the emergency lighting system. And the resultant is a connected emergency lighting system for remote monitoring and self-test. The concept development was done 20 years back, but the market was not ready due to cost and technology complexity. The growing and gradual acceptance of smart building and fully integrated building management systems has brought the connected emergency lighting concept back in the last three years.

- As LEDs in an industrial environment deliver savings up to 70%, the concerned emergency lights become highly controllable. Additionally, the integration of LEDs with the security industry is growing. LED luminaires are more efficient and simplify emergency lighting testing with indicators to display red or green solid or flashing LEDs for system readiness. These are required by standards such as CSA C22.2 NO. 141 in North America.

- Development of specialty LED drivers and control modules offer additional programmability to connected emergency lighting and building systems such as remote maintenance and monitoring, dimming, power metering, data collection, commissioning, to name a few. With more building owners contracting for LED retrofits to save energy, retrofitting with smart LED luminaires with on-board wireless communications is a cost-effective approach.

Commercial Sector to Dominate Market Share

- The COVID-19 pandemic negatively impacted the construction of commercial buildings in 2020. However, the industry is expected to bounce back in line with the rapid vaccination drive in the coming years.

- According to the National Fire Protection Association's (NPFA) Life Safety Code 101, all commercial buildings in the country must have emergency and exit path lighting. Every three years, the code is updated to ensure new and existing facilities offer protection from fire and other related hazards for occupants.

- In addition, when it comes to brightness levels, the commercial emergency lights must not fall below 6.5 lux at any point of time during the hour and a half mark. Furthermore, the uniformity ratio must not go above 40:1. The lighting system must have a power supply either from a generator or battery backup. Such regulations mold the requirements of emergency lights for office buildings, restaurants, retail stores, and other commercial buildings.

- According to the Department of Energy (DOE), the average number of kilowatt-hours per square foot for a commercial building is approximately 22.5 kWh/square foot. Out of the total consumption, the lighting solely accounts for roughly 7kWh/square foot, which is the second-highest post refrigeration and equipment (8kWh/square foot). The high level of energy consumption by commercial lighting is developing a need for energy-efficient commercial emergency lights.

US Emergency Lighting Industry Overview

The US emergency lighting market is moderately competitive, with new firms entering the market and few firms enjoying a dominant market share. The companies keep on innovating and entering strategic partnerships to retain their market share.

- February 2021 - Accuity Brands Inc. announced that it was selling New York Digital Agency to Illuminations Inc., which aligns with its ongoing transformation strategy to increase customer value and sustainably grow its business significantly. Through Illuminations Inc., the company has a tremendous opportunity to strengthen its brand presence in one of the largest lighting markets in the world.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Technology Snapshot

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Market Drivers

- 4.5.1 Increase in Need for Energy-efficient Lighting Systems and Favorable Government Regulations

- 4.5.2 Declining Prices of LED Products

- 4.6 Market Challenges

- 4.6.1 High Initial Investment and Development of Alternative Technologies

- 4.7 Regulations and Policies

- 4.8 Impact of COVID-19 on the Emergency Lighting Market

- 4.9 Qualitative Analysis of the Market by Application (Stand-by vs Escape Route - Anti-panic and Signage)

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Self-sustained

- 5.1.2 Centrally Supplied

- 5.2 End User

- 5.2.1 Commercial

- 5.2.2 Industrial

- 5.2.3 Educational

- 5.2.4 Healthcare

- 5.2.5 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Acuity Brands Inc.

- 6.1.2 Eaton Corporation PLC

- 6.1.3 ABB Ltd

- 6.1.4 Hubbell Incorporated

- 6.1.5 Signify NV (Including Cooper Lighting Solutions)

- 6.1.6 Legrand SA

- 6.1.7 Emerson Electric Co.

- 6.1.8 Encore Lighting

- 6.1.9 Myers Emergency Power Systems

- 6.1.10 Larson Electronics

- 6.1.11 Cree Inc.

- 6.1.12 Digital Lumens Inc.