|

市場調查報告書

商品編碼

1690834

美國和歐洲的可重複使用塑膠可回收運輸包裝:市場佔有率分析、產業趨勢和成長預測(2025-2030 年)United States and Europe Reusable Plastic Returnable Transport Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

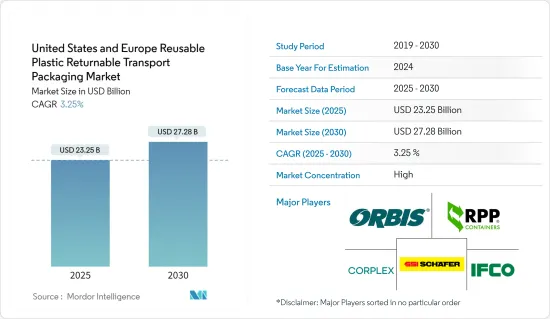

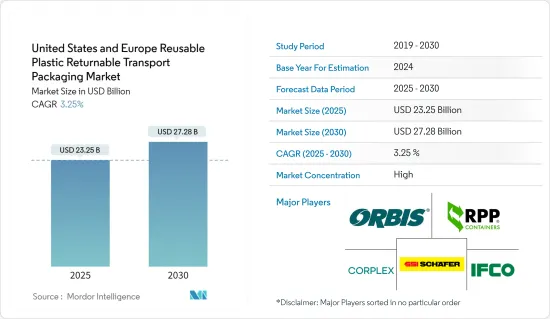

美國和歐洲可重複使用塑膠可回收運輸包裝市場規模估計和預測到 2025 年將達到 232.5 億美元,預計到 2030 年將達到 272.8 億美元,在預測期內(2025-2030 年)的複合年成長率為 3.25%。

在物流行業,採用永續可回收包裝正在降低整個企業的物流包裝成本並創造市場需求。

關鍵亮點

- 使用 RPC 的好處包括降低成本和減少供應鏈浪費,從而直接節省收益、保護品質和新鮮度、最佳化整個供應鏈、透過防止包裝浪費來減少對環境的影響,這些都是推動市場成長的因素。

- 預計在預測期內,進出口商品需求的增加,加上美國和歐洲電子商務產業的成長,將顯著推動市場成長。根據美國人口普查局的數據,2021年美國貨物進口總額為28,329億美元,出口總額為17,546億美元。

- 然而,可重複使用塑膠 RTP 的採用在很大程度上取決於整個供應鏈的相關人員對其好處的認知。根據Orbis公司的調查,46%的供應鏈主管認為流程變革的阻力是阻礙供應鏈績效的主要因素。因此,業內人士缺乏接受度對所研究市場的成長構成了挑戰。

- 研究地區的政府也強調使用可重複使用和可回收的替代包裝,以實現廢棄物的循環經濟,這是促進研究市場成長的關鍵因素之一。歐盟委員會正在加強立法力度,減少固態廢棄物,促進循環經濟。

- 市場上的幾家主要企業正在開發利用技術進步的解決方案來提高業務效率。例如,2022年4月,CHEP與BXB Digital合作,透過物聯網(IoT)開發數位解決方案,以提高其客戶供應鏈的業務效率。 CHEP 的可重複使用托盤和貨櫃將在南歐各地配備追蹤裝置,從而提高平台及其運輸產品的可視性。

- COVID-19疫情影響了全球必需和非必需商品及服務的國際貿易和供應鏈。疫情導致的工業生產下降對市場成長產生了重大影響。

美國和歐洲可重複使用塑膠可回收運輸包裝的市場趨勢

托盤佔據主要市場佔有率

- 塑膠托盤用於存放和運輸整車產品。其輪廓全塑膠結構可保護產品免受釘子、鐵鏽和碎片(常見於木棧板)造成的損壞。這推動了美國對顆粒的需求。

- 此外,可重複使用的包裝可避免美工刀、訂書機和破損的木棧板造成的傷害。 Big 5 Corporation 是一家大型運動用品零售商,在美國西部擁有 240 家門市,該公司已開始使用嵌套塑膠托盤,以消除因木棧板散落而造成的人員傷害和設備損壞。此舉改善了人體工學,使設施更加清潔,提高了工人的生產效率並節省了倉庫空間。

- 食品和製藥行業的各類零售商正在用塑膠托盤取代木棧板,因為衛生和安全是這兩個行業的首要任務,而且公司正在透過在倉庫中採用自動化技術來滿足需求,因為變形的木棧板可能會阻塞機械輸送機。例如,法國最大的食品零售商之一最近在其物流業務中取代了木棧板,並且正在增加塑膠托盤的庫存。為了連接 29 個倉庫和 1,600 家超級市場的內部流動,該運輸公司購買了 33 萬個 Kramer CS1 塑膠托盤。

- 該地區的公司不斷推出 HDPE 塑膠托盤以滿足最終用戶的需求。例如,2021 年 9 月,Craemer Group 宣布推出 TC3-5 Palgrip,這是一款全封閉塑膠托盤,配有完全防滑的頂層,將安全和衛生放在首位。頂部和底部甲板由高密度聚苯乙烯(HDPE) 塑膠製成,完全封閉,非常適合衛生優先的操作。

快速成長的食品和飲料終端用戶市場

- 在食品和飲料行業,RTP包裝用於整個供應鏈,包括將食品和飲料原料從農場運送到加工廠。 RTP 包裝解決方案(例如塑膠食品托盤)可在整個供應鏈的加工、儲存和分銷應用中保護飲料瓶和罐。可重複使用的塑膠容器(RPC)在美國和歐洲設計和使用,用於包裝和運輸生鮮食品從農場和食品加工廠到零售店和食品服務業。

- 在歐洲,就飲料而言,跨境產品流動包括牛奶、水、乳製品、啤酒、軟性飲料和葡萄酒的運輸。根據歐盟的一項研究,超過 90% 的非葡萄酒飲料在其生產國消費。然而,歐盟市場上的大量葡萄酒跨越國界,以散裝貨櫃的形式出口到消費國。

- 一些歐洲國家正致力於回收各種類型的包裝。此前,可回收塑膠運輸包裝並未納入政府包裝方法,但近年來這種包裝已開始被納入。例如,德國包裝方法於2021年7月進行了修訂,從2022年7月起,如果您有商業包裝,包括B2B運輸包裝、商業包裝、可回收包裝等,您將需要在LUCID入口網站上註冊。

- 價值鏈內的各種夥伴關係關係等市場發展正在推動該地區的市場成長。例如,2021 年 2 月,供應鏈解決方案公司 CHEP 宣布與可口可樂歐洲合作夥伴 (CCEP) 簽訂一份新的五年契約,在 2025 年 4 月之前為西歐全部區域供應共享托盤。

美國和歐洲可重複使用塑膠可回收運輸包裝產業概況

美國和歐洲可重複使用塑膠可回收運輸包裝市場細分,市場參與企業在高度競爭的環境中營運,並不斷升級產品系列以保持其地位。

- 2021 年 8 月 - Sohner Kunststofftechnik 在其折疊式大型行李架系列中增加了兩種大尺寸標準解決方案:MegaPack ALPHA 1500 x 800 x 800 和 MegaPack BETA 1800 x 800 x 800。這些塑膠容器適用於運輸大量相對較輕的汽車零件,例如座椅框架、面板和線路。

- 2021 年 11 月-Tosca 推出新產品 NeRa Pallet。重型塑膠托盤可嵌套、架設和堆疊,為您的整個自動化分銷供應鏈帶來突破性的效率。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響

第5章市場動態

- 市場促進因素

- 有利的政府法規

- 自動化增加了對可重複使用塑膠 RTP 的需求

- 市場限制

- 各相關人員對流程變革的抵制

- 替代材料的可用性

- 市場機會

- 電子商務食品領域的需求不斷成長

第6章 全球RTP產業趨勢概述

第7章市場區隔

- 按產品

- 可重複使用的塑膠容器

- 調色盤

- 瓦楞紙箱面板

- IBC

- 板條箱和手提袋

- 其他

- 按最終用戶產業

- 飲食

- 車

- 耐久財

- 工業(包括化學品)

- 其他最終用戶

- 按地區

- 美國

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 歐洲其他地區(義大利、波蘭等)

第8章競爭格局

- 公司簡介

- IFCO Systems

- Corplex Corporation

- Schaefer Systems International Inc.

- RPP Containers

- Orbis Corporation(Menasha Corporation)

- Friedola TECH GmbH(Con-Pearl)

- Sohner Plastics LLC

- Tosca Ltd

- Sustainable Transport Packaging(Reusable Transport Packaging)

- CABKA

- Auer

- Wisechemann

- Soehner

- Duro-Therm

- Conteyor

- KTP

- Wellplast

- Kiga

- WI Sales

第9章投資分析

第10章:投資分析市場未來展望

The United States and Europe Reusable Plastic Returnable Transport Packaging Market size is estimated at USD 23.25 billion in 2025, and is expected to reach USD 27.28 billion by 2030, at a CAGR of 3.25% during the forecast period (2025-2030).

Adopting sustainable returnable packaging in the logistics industry to reduce the cost of their logistics packaging across their operations creates demand in the market.

Key Highlights

- The benefits of using RPC, such as lower cost and less wasteful supply chain that delivers savings directly to the bottom line, protect quality and freshness, optimizes the overall supply chain reducing environmental impact by preventing packaging waste, are the factors propelling the growth of the market.

- The increasing demand for the export and import of goods, coupled with the growing e-commerce industry in the United States and Europe, is expected to drive the growth of the market significantly during the forecast period. According to the US Census Bureau, the total imports and exports of goods in the United States accounted for USD 2,832.9 billion and USD 1,754.6 billion, respectively, in 2021.

- However, adopting reusable plastic RTP largely depends on the stakeholders across the supply chain realizing its benefits. According to a survey by Orbis Corporation, 46% of the supply chain executives mentioned resistance to process change as the major factor that may impede their supply chain performance. Thus, the lack of acceptance from people in the industry poses a challenge to the growth of the studied market.

- The governments in the studied regions are also emphasizing using reusable and recyclable packaging alternatives to enable a waste-free and circular economy, which is one of the important factors contributing to the growth of the studied market. The European Commission has increased its legislative efforts to reduce solid waste and promotes a circular economy.

- Several key players in the market are developing solutions with technological advancements to increase their operational efficiency. For instance, in April 2022, CHEP, in partnership with BXB Digital, developed digital solutions based on the Internet of Things (IoT) that seek to increase the operational efficiency of their customers' supply chains. A set of CHEP's reusable pallets and containers have been equipped with track and trace devices across Southern Europe to increase visibility over the platforms and the products transported on them.

- The COVID-19 outbreak affected international trade and the supply chains of essential and non-essential goods and services worldwide. The decline in industrial production due to the pandemic significantly affected the growth of the market.

Reusable Plastic Returnable Transport Packaging in the US & Europe Market Trends

Pallets to Account for Major Market Share

- Plastic pallets are used to store and ship full loads of products. Their contoured, all-plastic structure protects the product from damage from nails, rust, or splinters (commonly found in wood pallets). This factor is driving the demand for these pellets in the United States.

- In addition, reusable packaging eliminates injuries from box cutters, staples, and broken wooden pallets. Big 5 Corporation, a major sporting goods retailer with 240 stores in the Western United States, shifted to nestable plastic pallets, which eliminated injuries and equipment damage from wood pallets falling apart. This move improved ergonomics, made for cleaner facilities, increased worker productivity, and saved space in the warehouse.

- Various retailers from the food and pharmaceutical industries are replacing wooden pallets with plastic pallets due to sanitation and safety are top priorities in both sectors and the adoption of automation technology in the company's warehouse is catering to the demand because deformed wooden pallets threaten to block the mechanical conveyor belts. For instance, recently, one of France's largest food retailers has replaced its wooden pallet in its logistics operations and is now building up its inventory of plastic pallets. For the internal flow of goods between its 29 warehouses and 1,600 supermarkets in the chain, the freight forwarder has purchased 330,000 Craemer CS1 plastic pallets.

- Companies in the region are constantly launching HDPE Plastic pallets to meet the end-user needs. For instance, in September 2021, Craemer Group announced the launch of TC3-5 Palgrip, the completely closed plastic pallet with a fully anti-slip coated top deck that puts safety and hygiene at the forefront. It is made from high-density polyethylene (HDPE) plastic, perfect for hygienic-first operations since the top and bottom decks are completely closed.

Food and Beverage End-user Vertical to Grow Significantly

- In the food and beverage industry, RTP packaging is used throughout the supply chain, such as for transporting food and beverage raw materials from farms to processing plants. RTP packaging solutions such as plastic food pallets protect beverage bottles and cans during processing, storage, and distribution applications throughout the supply chain. Reusable Plastic Containers (RPCs) are designed and used for packing and transporting perishable food items from farm and food processing facilities to retail and food service establishments in the United States and Europe.

- In Europe, considering beverages, cross-border product flows include transportation of milk, water, dairy products, beer, soft drinks, and wine. According to the European Union Study, except wine, all the other beverages are consumed by more than 90% in the country where they are produced. However, a substantial amount of wine travels across borders in the EU-internal market while a large amount of that is exported in bulk containers in the area of consumption.

- Several countries in Europe are emphasizing on recycling of various types of packaging. Earlier, returnable transport plastic packaging was not included in the packaging laws by the national governments; however, in recent years, they have included this packaging also. For instance, in July 2021, the German Packaging Act was amended, which made it mandatory to register in the LUCID portal from July 2022 if any business place packaging, including B2B transport packaging, commercial packaging, and returnable packaging, among others.

- Market developments such as various partnerships within the value chain are helping the market growth in the region. For instance, in February 2021, CHEP, a supply chain solutions company, announced a new five-year contract with Coca-Cola European Partners (CCEP), which will be in effect until April 2025, to supply pooled pallets across the Western Europe region.

Reusable Plastic Returnable Transport Packaging in the US & Europe Industry Overview

The US and European Reusable Plastic Returnable Transport Packaging Market is fragmented, as the market players are operating in a highly competitive landscape and are continuously upgrading their product portfolio in order to hold their positions.

- August 2021 - Sohner Kunststofftechnik added two large-format standard solutions to its range of foldable large load carriers MegaPack ALPHA 1500 x 800 x 800 and MegaPack BETA 1800 x 800 x 800. These plastic containers are appropriate for shipping high-volume automotive components with relatively low weights, such as seat frames, paneling, and wiring.

- November 2021 - Tosca introduced a new product NeRa Pallet. It is a nestable, rackable, and stackable heavy-duty plastic pallet that can deliver game-changing efficiencies throughout the automated distribution supply chain.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Favorable Governmental Regulations

- 5.1.2 Automation to Increase the Demand for Reusable Plastic RTP

- 5.2 Market Restraints

- 5.2.1 Resistance to Process Change by Various Stakeholders

- 5.2.2 Availability of Alternative Materials

- 5.3 Market Opportunities

- 5.3.1 Increasing Demand from E-commerce Food Sector

6 SUMMARY ON GLOBAL RTP INDUSTRY TRENDS

7 MARKET SEGMENTATION

- 7.1 By Product

- 7.1.1 Reusable Plastic Containers

- 7.1.2 Pallets

- 7.1.3 Corrugated Boxes and Panels

- 7.1.4 IBCs

- 7.1.5 Crates and Totes

- 7.1.6 Other Product Types

- 7.2 By End-user Vertical

- 7.2.1 Food and Beverage

- 7.2.2 Automotive

- 7.2.3 Consumer Durables

- 7.2.4 Industrial (including Chemicals)

- 7.2.5 Other End-user verticals

- 7.3 By Geography

- 7.3.1 United States

- 7.3.2 Europe

- 7.3.2.1 United Kingdom

- 7.3.2.2 Germany

- 7.3.2.3 France

- 7.3.2.4 Spain

- 7.3.2.5 Rest of Europe (Italy, Poland, etc.)

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 IFCO Systems

- 8.1.2 Corplex Corporation

- 8.1.3 Schaefer Systems International Inc.

- 8.1.4 RPP Containers

- 8.1.5 Orbis Corporation (Menasha Corporation)

- 8.1.6 Friedola TECH GmbH (Con-Pearl)

- 8.1.7 Sohner Plastics LLC

- 8.1.8 Tosca Ltd

- 8.1.9 Sustainable Transport Packaging (Reusable Transport Packaging)

- 8.1.10 CABKA

- 8.1.11 Auer

- 8.1.12 Wisechemann

- 8.1.13 Soehner

- 8.1.14 Duro-Therm

- 8.1.15 Conteyor

- 8.1.16 KTP

- 8.1.17 Wellplast

- 8.1.18 Kiga

- 8.1.19 WI Sales