|

市場調查報告書

商品編碼

1690817

歐洲設施管理:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Europe Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

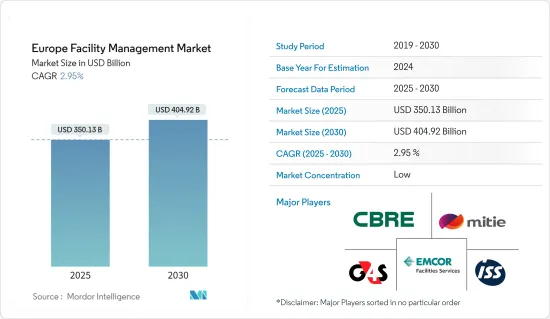

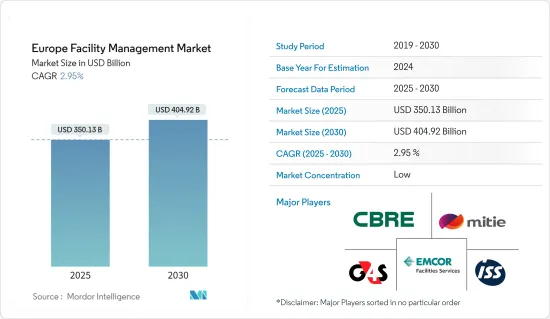

歐洲設施管理市場規模預計在 2025 年為 3,501.3 億美元,預計到 2030 年將達到 4,049.2 億美元,在市場估計和預測期(2025-2030 年)內複合年成長率為 2.95%。

就成熟度和複雜度而言,歐洲被認為是設施管理服務最大的外包市場之一。

關鍵亮點

- 雖然規模較小的本地企業專注於單一合約和單一服務解決方案,但該地區的設施管理企業卻與各大洲和國家的知名供應商簽訂了合併合約。跨國公司和其他公司選擇在多個國家設有分支機構的服務供應商,為其各個分店提供單一合約的便利。然而,區域動態日益推動著將設施管理與企業房地產結合的選擇。

- 此外,設施管理 (FM) 涵蓋組織的基礎設施管理、策略、建築管理程序以及職場的整體和諧。該系統標準化了組織的服務並簡化了程序,而設施管理服務則負責其餘事務。

- 在過去十年中,許多在歐洲營運的服務供應商都致力於擴大其業務,以利用對 FM 服務日益成長的需求,特別是由於當前外包非核心功能的趨勢。 2023 年 10 月,OCS 收購了 Accuro,這是一家專門提供教育和醫療保健領域關鍵設施管理服務的英國公司。該集團表示,這筆交易將使 Accuro 得以成長和發展,與 OCS 的合併將為其員工創造新的機會,使他們能夠提高能力並提供更好的服務。

歐洲設施管理市場的趨勢

商業建築領域預計將佔據較大的市場佔有率

- 該投資公司主要關注歐洲住宅或商用房地產市場。商業建築是一種相當吸引人的本地投資形式,因為它們提供了豐厚的利潤機會。預計這一趨勢將在預測期內推動歐洲設施管理市場的成長。投資商業房地產通常可以增加現金流潛力並提高投資回報率。

- 歐洲設施管理市場正在見證該地區供應商和商業組織之間的大量合作。例如,2023 年 4 月,英國電信集團與世邦魏理仕延長了協議,為其在英國的 7,500 多處房產組合提供設施和計劃管理服務,以支援 80,000 多名英國電信集團和 Openreach 員工。合約延期將使目前的夥伴關係延長至2026年,並實現新水準的合作和服務交付。

- 同樣,2023 年 1 月,ISS UK&I 延長並擴大了與 Virgin Media O2 的設施管理合約。這標誌著合資夥伴關係進入了一個令人興奮的新階段,為英國一些最大的娛樂和電訊公司提供支持,並協調設施服務的交付。該合約將使 ISS 能夠為 Virgin Media O2 的英國基礎設施提供全面的設施管理服務,並將所有國內技術業務和綜合辦公室組合結合起來,以提高業務效率和服務品質。

- 人們對智慧建築和其他物聯網技術設施的興趣日益濃厚,為市場供應商實施基於物聯網的設施管理提供了各種機會,從而推動了歐洲智慧商業建築的發展。 2023年5月,Planon宣布與SAP建立策略夥伴關係,為企業提供房地產和設施管理的完整解決方案。因此,最佳化房地產投資組合管理有利於企業組織和商用房地產公司,提高建築的永續性。此次合作將結合 Planon 和 SAP 市場領先的 ERP 功能,實現更全面的流程和技術整合。

- 這些將新建和現有商業建築轉變為智慧建築的數位化趨勢將有助於提高房地產價值並增強設施管理人員和業主的能力。由於對各種內部和外包設施管理客製化解決方案的需求不斷增加,德國的設施管理服務產業正在成長。各大城市商業建築和住宅數量的不斷增加,導致全國對設施管理服務的需求不斷增加。基礎設施的快速發展和對綜合設施管理服務的日益關注可能會對設施管理市場產生積極影響。

- 儘管混合工作模式盛行,但投資者對擁有長期租戶的現代化辦公室仍表現出濃厚的興趣。提高相關人員和經濟從汽車行業向其他行業的多元化可能會增加該地區對設施管理服務的需求。

巨量資料幫助設施管理團隊提高效率並降低成本

- 過去幾年,設施管理迅速發展,為歐洲產業帶來了廣泛的變化。由於資料、顛覆、不斷發展的設施和新的工作場所概念等趨勢的日益流行,該地區的設施管理市場正在經歷模式轉移。

- 各個領域都已成功外包設施管理,包括公共部門、零售、專業服務、醫療保健、技術、物流、製造和教育。 FM 服務根據其類型、公司規模和業務部門關注不同的領域。這並不是一種放諸四海皆準的方法。有些組織可能只需要單一服務解決方案供應商,而其他大型企業可能尋求提供完整設施管理解決方案的配套服務。巨量資料等資料分析工具可以幫助幾乎任何規模的組織及其參與。

- 歐洲市場正在尋求從內部提供轉向配套服務,並轉向單一合約下的綜合設施管理方法。這種全面的設施管理方法提供了一系列服務和長期契約,增加了附加價值,促進了更好的品質和規模經濟,並增加了對需要專業知識的外包服務的需求。

- 隨著先進創新技術的開發,未來設施管理組織對大規模資料的投資可能會增加。建立完整的物聯網系統、建立分析技能以及利用 AR 和 AI 可能會增強 BDA 投資。 FM 組織需要與科技公司、顧問和高等教育機構合作,以擴展企業級使用的應用程式。

- 據Cloudscene稱,2023年,德國擁有522個資料中心,是歐洲資料中心數量最多的國家之一。此外,德國的網路普及率為93.1%。這些統計數據顯示資料處理能力的潛在發展,主要由巨量資料等工具推動。設施經理確保資料中心始終可存取、安全且運作最佳。巨量資料等技術的出現使得部署足夠的資料中心儲存成為必要。

歐洲設施管理產業概況

歐洲設施管理市場細分化,參與者規模各異。隨著各組織持續進行策略性投資以抵銷當前的經濟放緩,市場預計將出現多起合作、合併和收購。該地區的客戶正在使用 FM 服務來提高其業務營運的便利性,並透過節能設施管理服務來應對能源危機。

- 2023 年 12 月,世邦魏理仕全球工作場所解決方案 (GWS) 與英國領先的鐵路製造商阿爾斯通延長了長期設施管理夥伴關係,將阿爾斯通廣泛而多樣化的國內產品組合合併為一份協議。延長的夥伴關係關係將使世邦魏理仕和 GWS 為阿爾斯通在英國各地的主要生產和維護站點提供多方面的設施管理服務,包括技術服務、清潔和廢棄物管理。

- 2023 年 7 月,G4S 消防與保全團隊宣布計劃與 Briggs & Forrester 合作進行英國三個備受矚目的重大房地產計劃。約克的 Cocoa Works、倫敦的 Park Street 135 號和利茲的 Phoenix 將是集辦公、零售和住宅於一體的綜合體,並將圍繞永續性和城市復興進行建設。作為這三個計劃的系統供應商,G4S 透過供應和安裝消防和生命安全設備來支援這些目標。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 歐洲硬設施管理 (MEP) 和軟設施管理 (服務) 的主要市場趨勢

- 新冠疫情及其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- FM 商品化程度不斷提高

- 最佳化工作場所並重新專注於生產力

- 市場問題

- 利潤率下降,宏觀環境持續變化

第6章市場區隔

- 按設施管理類型

- 內部設施管理

- 外包設施管理

- 單調頻

- 捆綁調頻

- 整合調頻

- 按最終用戶

- 商業大廈

- 零售

- 政府和公共機構

- 製造業和工業

- 其他

- 國家

- 英國

- 德國

- 法國

- 義大利

- 西班牙

第7章競爭格局

- 公司簡介

- CBRE Group

- Mitie Group PLC

- Emcor Facilities Services WLL

- Atlas FM Ltd

- G4S Facilities Management UK Limited

- ISS Global

- JLL Limited

- Engie FM Limited Cofely AG

- Andron Facilities Management

- Kier Group PLC

- Vinci Facilities Limited

- Compass Group

- Sodexo Facilities Management Services

- Aramark Corporation

- OKIN Facility(OKIN Group)

- Atalian Servesr(Atalian Global Services)

- Apleona GmbH

第8章投資分析

第9章:市場的未來

The Europe Facility Management Market size is estimated at USD 350.13 billion in 2025, and is expected to reach USD 404.92 billion by 2030, at a CAGR of 2.95% during the forecast period (2025-2030).

Europe is considered one of the biggest outsourced markets for facility management services in terms of maturity and sophistication.

Key Highlights

- The small local companies focus on single contracts and single-service solutions, whereas the region's facility management businesses operate with integrated contracts from prominent vendors across continents and countries. These include multinational companies choosing service providers with a presence in multiple countries due to the convenience offered under a single contract for various branches. However, due to the regional dynamics, more options are cropping up to combine facility management and corporate real estate.

- Additionally, facility management (FM) covers infrastructure management for an organization, strategies, procedures for managing buildings, and general harmonization of the workplace. This system standardizes services and streamlines procedures for an organization, with the facility management service taking care of the rest.

- Over the past decade, many service providers that have operations in Europe have been concentrating on growing their presence to leverage the growing demand for FM services, particularly due the current trend of outsourcing non-core functions. In October 2023, OCS acquired Accuro, a UK company specializing in critical facility management services in education and healthcare. The group stated that the agreement allows Accuro to grow and develop, creating new opportunities for its staff when integrated with OCS, enabling them to improve their capabilities and provide better services.

Europe Facility Management Market Trends

The Commercial Buildings Segment is Expected to Hold a Significant Market Share

- Investment firms mainly focus on the residential or commercial property markets in Europe. Commercial buildings are an appealing form of regional investment as they offer lucrative opportunities. This trend will likely aid the growth of the facility management market in Europe during the forecast period. Commercial investments lead to higher cash flow potential and often provide better ROI.

- The facility management market in Europe is observing many partnerships between vendors and commercial entities in the region. For instance, in April 2023, BT Group extended its agreement with CBRE to provide facilities and project management services to its UK portfolio of more than 7,500 properties to support over 80,000 BT Group and Openreach colleagues. The contract extension will extend the current partnership until 2026 to achieve a new and improved level of cooperation and service delivery.

- Similarly, in January 2023, ISS UK&I extended and expanded its facilities management contract with Virgin Media O2. It took the partnership through a new and exciting phase after the joint venture, supporting one of the United Kingdom's largest entertainment and telecoms firms to align the facilities service delivery. The contract allows ISS to provide total facilities management services in Virgin Media O2's UK infrastructure, with all national technical operations and a combined office portfolio being aligned to achieve operating efficiencies and enhanced service quality.

- The rising interest in establishing smart buildings and other IoT technologies provides various opportunities for market vendors to introduce IoT-based facility management and boost the growth of smart commercial buildings in Europe. In May 2023, Planon announced its strategic partnership with SAP to provide companies with a complete solution in real estate and facility management. As a result, optimized management of their real estate portfolios will benefit corporate organizations and commercial property firms and improve the sustainability of construction. This collaboration combines Planon with SAP's market-leading ERP capabilities to create a more comprehensive integration of processes and technologies.

- Such digitalization trends of transforming new and old commercial buildings into smart buildings help boost property values and support facility managers and property owners. Germany's facility management service industry is growing due to the rising demand for customized solutions for different in-house and outsourced facility management. The growing number of commercial and residential buildings in major cities leads to the demand for facility management services nationwide. Rapid infrastructure development and the growing focus on integrated facility management services may influence the facility management market positively.

- Investors are highly interested in modern offices with long-term tenants despite the trend of hybrid working. The growing business acumen among industry players and economic diversification from automobile industries to other avenues will likely increase the demand for facility management services in the region.

Big Data is Helping Facility Management Teams Aim for Efficiency and Cost Savings

- Over the past several years, facility management has evolved rapidly, leading to widespread changes in the European industry. The region's facility management market is undergoing a paradigm shift due to the growing popularity of trends related to data, disruption, evolving amenities, and new workplace concepts.

- Various sectors, including the public sector, retail, professional services, healthcare, technology, logistics, manufacturing, and education, have successfully used the outsourced FM. FM services focus on varied areas, depending on their type, the size of the company, and the sector in which it operates. It is not a one-size-fits-all approach. While some organizations only require a single service solution provider, other big organizations look for bundled services offering complete facility management solutions. These services also differ based on the type and amount of data generated by client organizations, with data analytics tools like Big Data helping almost all sizes of organizations and their contracts.

- The European market aims to shift from in-house delivery of services to bundled services and further toward the integrated facilities management approach with single contracts. This integrated FM approach offers a range of services and longer-term contracts, adding value, driving better quality and economies of scale, and boosting the demand for outsourced services that require specialist expertise.

- Future significant data investments by FM organizations will likely increase as they develop advanced and innovative technologies. The companies may enhance BDA investments by creating complete IoT systems, establishing analytical skills, and utilizing AR and AI. FM organizations need to partner with technology companies, consultants, and institutions offering higher education to scale up the applications for enterprise-level usage.

- As per Cloudscene, in 2023, Germany had 522 data centers, which accounted for one of the highest numbers of data centers in Europe. Germany's internet literacy rate also accounted for 93.1%. Such statistics indicate the potential development of data processing capabilities, mainly driven by tools like Big Data. Facility managers ensure a data center is always accessible and secure and operates optimally. The emergence of technologies like Big Data necessitates the deployment of ample data center storage.

Europe Facility Management Industry Overview

The facility management market in Europe is fragmented, with diverse firms of different sizes. This market is expected to witness several partnerships, mergers, and acquisitions as organizations continue to invest strategically in offsetting the present slowdowns being experienced. The clients in this region are employing FM services to increase the ease of their business operations and tackle the energy crisis through energy-efficient facility management services.

- December 2023: CBRE Global Workplace Solutions (GWS) and the United Kingdom's leading rail manufacturer, Alstom, extended their long-term facility management partnership, consolidating Alstom's extensive and varied national portfolio under one contract. Under the extended partnership, CBRE and GWS will provide a multi-faceted facilities management service for Alstom's critical production and maintenance hubs across the United Kingdom, including technical services, cleaning, and waste management.

- July 2023: The G4S Fire and Security team announced their plan of working with Briggs & Forrester on three large, high-profile real estate projects in the United Kingdom. The Cocoa Works in York, 135 Park Street in London, and Phoenix in Leeds will provide a mix of office, retail, and residential space, which will be built based on sustainability and urban regeneration. G4S is the systems provider for the three projects to support these objectives by providing and installing fire and life safety equipment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Key Market Trends in Hard (MEP) and Soft (Service) FM in Europe

- 4.4 Impact of the COVID-19 Pandemic and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Trend Toward Commoditization of FM

- 5.1.2 Renewed Emphasis on Workplace Optimization and Productivity

- 5.2 Market Challenges

- 5.2.1 Diminishing Profit Margins and Ongoing Changes in Macro-environment

6 MARKET SEGMENTATION

- 6.1 By Type of Facility Management Type

- 6.1.1 Inhouse Facility Management

- 6.1.2 Outsourced Facility Management

- 6.1.2.1 Single FM

- 6.1.2.2 Bundled FM

- 6.1.2.3 Integrated FM

- 6.2 By End User

- 6.2.1 Commercial Buildings

- 6.2.2 Retail

- 6.2.3 Government and Public Entities

- 6.2.4 Manufacturing and Industrial

- 6.2.5 Other End Users

- 6.3 Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Spain

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 CBRE Group

- 7.1.2 Mitie Group PLC

- 7.1.3 Emcor Facilities Services WLL

- 7.1.4 Atlas FM Ltd

- 7.1.5 G4S Facilities Management UK Limited

- 7.1.6 ISS Global

- 7.1.7 JLL Limited

- 7.1.8 Engie FM Limited Cofely AG)

- 7.1.9 Andron Facilities Management

- 7.1.10 Kier Group PLC

- 7.1.11 Vinci Facilities Limited

- 7.1.12 Compass Group

- 7.1.13 Sodexo Facilities Management Services

- 7.1.14 Aramark Corporation

- 7.1.15 OKIN Facility (OKIN Group)

- 7.1.16 Atalian Servesr ( Atalian Global Services)

- 7.1.17 Apleona GmbH