|

市場調查報告書

商品編碼

1690807

越南紙包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Vietnam Paper Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

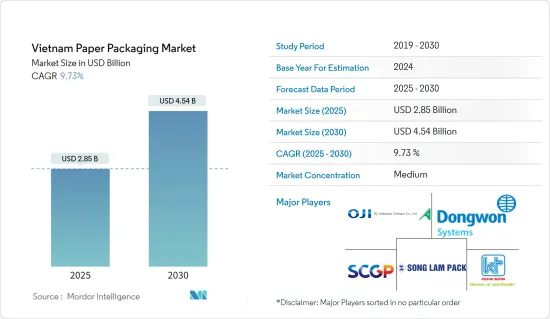

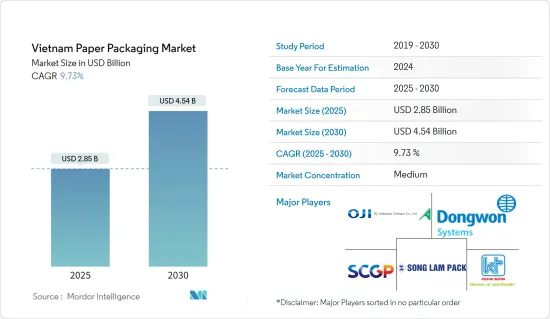

預計 2025 年越南紙包裝市場規模將達到 28.5 億美元,預計到 2030 年將達到 45.4 億美元,預測期內(2025-2030 年)的複合年成長率為 9.73%。

預計越南紙包裝市場在預測期內將大幅擴張,未來幾年預計多家公司的銷售額將會增加。預計該國穩定的經濟狀況和較高的都市化將推動紙質包裝形式的普及。

關鍵亮點

- 越南是一個願意為世界各地各行各業生產且國內購買力快速成長的國家。這反映了包裝行業的成長,並且與該國的經濟狀況相符。

- 包裝產品的製造商來自各國。許多人對投資東南亞感興趣,而越南是他們的投資目的地。泰國製造商預見了投資該產業的機會。例如,ProPak Vietnam 2023吸引了來自30多個國家和地區的400家參展商,包括美國、英國、法國、德國、義大利、丹麥、波蘭、荷蘭、澳洲、奧地利、比利時、日本、參展、新加坡、中國當地和台灣。展品包括先進的包裝、加工、製藥技術、低溫運輸物流、倉儲、編碼、標記、標籤和檢測設備。

- 越南是東南亞國家之一,其包裝食品、食品飲料和化妝品市場持續成長,對紙包裝的需求很高。此外,個人護理、醫療、居家醫療和零售等不斷發展的行業正在推動紙質包裝應用的成長。

- 同樣,該自由貿易協定也為越南包裝和包裝紙出口到稅收優惠市場提供了機會。在某些應用中使用迷你瓦楞紙箱使得瓦楞紙箱擴大了其在穀物盒和外帶食品包裝等市場中的佔有率。

- 此外,有組織的食品加工部門在連接全國農業和製造業方面發揮著至關重要的作用,對GDP的貢獻巨大,對國家經濟的貢獻也很大。預計在預測期內,食品和飲料產業將推動該國對紙質包裝的需求。

- 越南沒有足夠的森林資源來滿足其國內紙張生產的需求。越南的造紙原料大部分依賴進口,導致成本上升,影響了其在全球市場的競爭力。

越南紙包裝市場趨勢

瓦楞紙箱產業顯著成長

- 越南的目標是在未來五年內實現電子商務銷售額的兩位數年成長。根據越南政府電子商務發展策略的資料,到2025年,越南9,600萬人口中將有一半以上進行線上購物。這樣的預測可能會導致電子商務領域對瓦楞紙箱的需求增加。

- 越南電子產業是越南發展最快、最重要的產業之一。跨國公司主導著該行業,在過去十年中推動了越南的貿易量並為其 GDP 做出了貢獻。

- 電子產品含有各種易碎物品,需要小心運送。因此這些產品的紙板包裝需要具備一定的保護功能。隨著電子產業的擴張,對運輸過程中保護電子產品的包裝材料的需求也隨之增加。瓦楞紙箱因其保護功能和緩衝易碎貨物的能力而非常適合此用途。

- 越南美容產業正出現韓國美容和多步驟清潔等趨勢,以解決痤瘡、毛孔粗大和黑眼圈等護膚問題。大多數越南護膚消費者喜歡一步式護膚程序,但近年來,隨著兩步和三步護膚程序變得越來越流行,一步式護膚程序已失去了吸引力。

- 多步驟的護膚程序通常涉及使用多種產品,每種產品都有特定的用途。瓦楞紙箱可以客製化,以使所有這些不同的產品井然有序且具有視覺吸引力。瓦楞紙箱的客自訂內襯、隔板和隔間可讓您將不同的護膚品分開存放,同時還能改善整體外觀。

食品飲料業佔市場佔有率較大

- 過去幾年,食品和飲料包裝行業見證了電子商務的發展和基於應用程式的宅配業務的快速普及帶來的好處。越南加入的自由貿易協定也成為經濟成長的催化劑。

- 食品包裝產業的成長導致該國對紙質包裝的需求增加。據估計,由紙製成的環保產品在食品包裝行業中具有成長潛力,可以取代一次性塑膠產品。

- 據食品加工和包裝解決方案公司利樂公司稱,越南流質食品市場在過去三年中實現了 6% 的健康複合年成長率。預計未來三年也將出現類似的成長,而亞太地區的年增率為 4%,全球整體成長率為 3%。

- 隨著收入增加和營養意識提高,越南人民對乳製品的購買量持續增加。乳製品供應鏈上的各個相關人員都在積極變革和創新。分銷管道也得到了改善,尤其是隨著電子商務的興起。

- 越南是酒精飲料(尤其是啤酒)利潤豐厚的市場,但正在發生的動態變化表明對更健康軟性飲料的需求日益成長。此外,茶、果菜汁汁等健康飲品也自然越來越受歡迎。

- 據越南統計總局稱,到2023年,越南的食品和飲料消費量預計將達到470億美元,而2018年為260億美元。零售店、超級市場、餐廳、咖啡館和食品飲料宅配服務的擴張通常伴隨著食品和飲料消費的擴大。這些機構嚴重依賴紙質包裝解決方案來包裝和向客戶展示他們的產品。隨著食品和飲料產業的擴大,對紙質包裝產品的需求也不斷增加。

越南紙包裝產業概況

越南的紙包裝市場正在變得半固體。主要市場參與企業包括 Song Lam Trading & Packaging Production、SCG Vietnam(SCG Packaging)、Hanh Packaging、Oji Interpack Vietnam 和 Khang Thanh。

- 2023 年 12 月 - SCGP 收購 Starprint Vietnam JSC 70% 的股份,後者是越南領先的優質膠印折疊紙盒包裝製造商,主要客戶是國內和跨國公司。此次收購將增強 SCGP 的包裝解決方案能力,以服務其在東協不斷成長的基本客群。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場動態

- 市場促進因素

- 電子商務領域的需求增加

- 越南是最大的外包中心之一,預計將推動快速消費品和電子等關鍵產業的市場需求

- 塑膠包裝監管趨嚴促使供應商轉向紙質替代品

- 市場問題

- 造紙產能下降,海外加工材料供應減少

第6章 當前貿易情勢-進出口分析

- 紙和紙板

- 廢紙

第7章 越南國家分析

- 主要宏觀經濟指標分析

- 監管和法律狀況

- 經濟成長的主要貢獻產業

- 外商進入越南的關鍵條件

第8章越南紙包裝產業展望

第9章市場區隔

- 按類型

- 紙板

- 瓦楞紙板原紙

- 依產品類型

- 折疊式紙盒

- 瓦楞紙箱

- 最終用戶產業

- 飲食

- 醫療保健

- 個人護理

- 工業的

第10章 競爭格局

- 公司簡介

- Song Lam Trading & Packaging Production Co. Ltd

- Minh Viet Packaging One Member Co. Ltd(Dongwon Systems)

- Tetra Pak International SA

- Oji Interpack Vietnam Co. Ltd

- Khang Thanh Co. Ltd

- Hanh Packaging Co. Ltd

- SCG Vietnam Co. Ltd(SCG Packaging)

- Binh Minh Pat Co. Ltd

- Bien Hoa Packaging Joint Stock Company(Rengo Co. Ltd)

- HC Packaging Vn Company Limited

- Starprint Vietnam Jsc

- Viet Thang Package Co. Ltd

- Doanket Commercial And Packaging Production Company Limited

第11章 市場的未來

The Vietnam Paper Packaging Market size is estimated at USD 2.85 billion in 2025, and is expected to reach USD 4.54 billion by 2030, at a CAGR of 9.73% during the forecast period (2025-2030).

The paper packaging market in Vietnam is expected to expand significantly during the forecast period, with several companies expecting sales growth in the coming years. The country's stable economic situation and high urbanization rate are expected to drive the use of paper packaging formats.

Key Highlights

- Vietnam is a country that is ready to produce for various industries worldwide and has a rapidly increasing domestic purchasing power. This reflects the growth of the packaging industry and is in line with the country's economic conditions.

- There are manufacturers of packaging products from different nations. Many are interested in investing in Southeast Asia, with Vietnam as the destination. Thai manufacturers foresee the opportunity to invest in this industry. For instance, ProPak Vietnam 2023 attracted 400 exhibitors from more than 30 countries and territories, including the United States, United Kingdom, France, Germany, Italy, Denmark, Poland, the Netherlands, Australia, Austria, Belgium, Japan, South Korea, Singapore, mainland China, and Taiwan. It showcased advanced packaging, processing, pharmaceutical technologies, cold chain logistics, warehousing, coding, marking, labeling, and testing equipment.

- Vietnam is a consistently growing market for packaged foods, bottled beverages, and cosmetics in Southeast Asia, so the demand for paper packaging is significant. In addition, the application of paper packaging has been increasing due to growing industries, such as personal care, healthcare, homecare, and retail.

- Similarly, free trade agreements have also offered opportunities to export Vietnam's packaging and packaging paper to tax-incentive markets. Utilizing mini-flute corrugated boxes in some applications has allowed corrugated boxes to expand their presence in markets, like cereal boxes and carryout food packaging.

- The organized food processing sector has also been a meaningful link between the agriculture and manufacturing businesses across the country, contributing to the GDP and significantly adding to the national economy. The food and beverage industry is anticipated to boost the demand for paper packaging in the country during the forecast period.

- Vietnam does not have sufficient forest resources to meet the country's paper production needs. Most raw materials for paper production in Vietnam are imported, which increases costs and affects the country's competitiveness in the global market.

Vietnam Paper Packaging Market Trends

The Corrugated Boxes Segment to Witness Significant Growth

- Vietnam is aiming for a double-digit annual growth rate in the turnover of e-commerce over the next five years. According to the Vietnamese government's data on e-commerce development strategy, over half of Vietnam's 96 million people are set to shop online by 2025. Such projections would lead to higher demand for corrugated boxes in the e-commerce sector.

- The country's electronics industry is one of Vietnam's fastest-growing and crucial industries. Multinational organizations dominate it, have increased the country's trade volume, and contributed to its GDP in the past decade.

- Electronic products include a wide range of fragile products and require extra shipping care. Thus, the corrugated packaging of these goods requires a protective feature. As the electronics industry expands, there is a parallel increase in the demand for packaging materials to protect electronic products during transit. Corrugated boxes are well-suited for this purpose due to their protective features and ability to cushion fragile items.

- Trends like K-beauty and multi-step cleansing to address skincare concerns, such as acne, large pores, and dark under eyes, are increasing in the Vietnamese beauty industry. Most skincare shoppers in Vietnam still prefer a one-step skincare routine, although it recently lost its appeal while two-step and three-step routines have gained popularity.

- Multi-step skincare routines often involve using several products, each serving a specific purpose. Corrugated boxes can be customized to accommodate these various products in an organized and visually appealing manner. Custom inserts, dividers, and compartments within corrugated boxes can help keep different skincare items separate while also enhancing the overall presentation.

The Food and Beverages Industry to Hold Significant Market Share

- Over the past few years, the food and beverage packaging industry witnessed gains from the development of e-commerce and the rapid spread of app-based delivery businesses. The free trade agreements that Vietnam participated in were another catalyst for growth.

- The growth in the food packaging industry resulted in the increased demand for paper packaging in the country. It is also estimated that eco-friendly products made from paper have the potential for growth in the food packaging industry to replace disposable plastic products.

- According to Tetra Pak, a food processing and packaging solutions company, the liquid food market in Vietnam registered a healthy 6% compound annual growth rate over the last three years. It is projected to grow similarly during the next three years, compared to the 4% yearly growth in Asia-Pacific and 3% globally.

- With higher income and better nutrition awareness, Vietnamese people have sustainably increased their purchase of dairy products. All the dairy supply chain stakeholders have been actively changing and innovating. Distribution channels have also been improved, especially with the thriving of e-commerce.

- Although Vietnam is a lucrative market for alcoholic beverages, especially beer, a dynamic shift occurred, showing a growing demand for healthy soft drinks. Moreover, naturally, healthy beverages, such as tea and fruit or vegetable juices, have been gaining popularity.

- According to the General Statistics Office of Vietnam, the consumption of food and beverages in Vietnam was USD 47 billion in 2023, compared to 2018, which was USD 26 billion. The expansion of retail outlets, supermarkets, restaurants, cafes, and food delivery services often accompanies the growth in food and beverage consumption. These establishments rely heavily on paper packaging solutions to package and present their products to customers. As the food and beverage sector expands, so does the demand for paper packaging products.

Vietnam Paper Packaging Industry Overview

The Vietnamese paper packaging market is semi-consolidated. Some major market players include Song Lam Trading & Packaging Production, SCG Vietnam Co. Ltd (SCG Packaging), Hanh Packaging Co. Ltd, Oji Interpack Vietnam Co. Ltd, and Khang Thanh Co. Ltd.

- December 2023 - SCGP acquired a 70% stake in Starprint Vietnam JSC, a leading premium offset folding carton packaging manufacturer in Vietnam with key customer bases as domestic and multinational profiles. This acquisition will enhance SCGP's packaging solutions capabilities to serve an enlarging customer base in ASEAN.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand from the E-commerce Sector

- 5.1.2 Vietnam as One of the Largest Outsourcing Hubs Expected to Aid the Market Demand From Key Verticals, Such as FMCG and Electronics

- 5.1.3 Stringent Regulations on Plastic Packaging to Prompt Vendors to Switch to Paper-based Alternatives

- 5.2 Market Challenges

- 5.2.1 Low Paper Production Capacity and Decline in Foreign Processed Material Supply

6 CURRENT TRADE SCENARIO - EXIM ANALYSIS

- 6.1 Paper And Paperboard

- 6.2 Recovered Paper

7 VIETNAM COUNTRY ANALYSIS

- 7.1 Analysis of Key Macro-economic Indicators

- 7.2 Regulatory and Legal Landscape

- 7.3 Major Industries Contributing to the Economic Growth

- 7.4 Key Imperatives for Foreign Companies to Establish Presence in Vietnam

8 VIETNAM PACKAGING INDUSTRY OUTLOOK

9 MARKET SEGMENTATION

- 9.1 By Types

- 9.1.1 Carton Board

- 9.1.2 Containerboard

- 9.2 By Product Types

- 9.2.1 Folding Cartons

- 9.2.2 Corrugated Boxes

- 9.3 End-user Industry

- 9.3.1 Food and Beverage

- 9.3.2 Healthcare

- 9.3.3 Personal Care and Household Care

- 9.3.4 Industrial

10 COMPETITIVE LANDSCAPE

- 10.1 Company Profiles

- 10.1.1 Song Lam Trading & Packaging Production Co. Ltd

- 10.1.2 Minh Viet Packaging One Member Co. Ltd (Dongwon Systems)

- 10.1.3 Tetra Pak International SA

- 10.1.4 Oji Interpack Vietnam Co. Ltd

- 10.1.5 Khang Thanh Co. Ltd

- 10.1.6 Hanh Packaging Co. Ltd

- 10.1.7 SCG Vietnam Co. Ltd (SCG Packaging)

- 10.1.8 Binh Minh Pat Co. Ltd

- 10.1.9 Bien Hoa Packaging Joint Stock Company (Rengo Co. Ltd)

- 10.1.10 HC Packaging Vn Company Limited

- 10.1.11 Starprint Vietnam Jsc

- 10.1.12 Viet Thang Package Co. Ltd

- 10.1.13 Doanket Commercial And Packaging Production Company Limited