|

市場調查報告書

商品編碼

1690797

工業雷射系統-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Industrial Laser System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

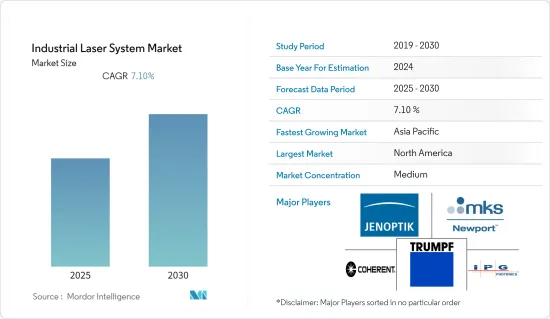

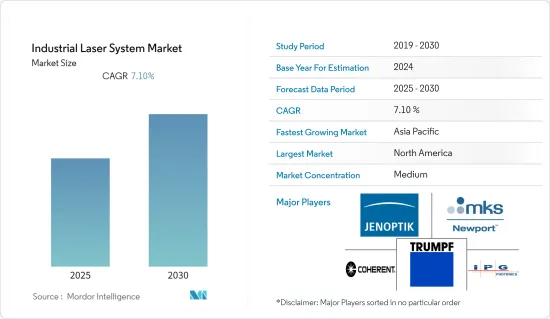

預計工業雷射系統市場在預測期內的複合年成長率將達到 7.1%

關鍵亮點

- 隨著工業 4.0 和工業IoT的出現,工業環境中的各種技術進步,例如工業自動化、工業機器人和 3D 列印,預計將推動雷射系統在工業中的應用。製造業和其他產業對精度的需求也刺激了終端用戶產業採用雷射解決方案。

- 雷射在各行各業中都有多種不同形式和類型的應用,但最大的應用領域是在材料加工領域。根據《Laser Focus World》報道,光纖雷射光源主要用於材料加工,其次是直接二極體雷射。

- 隨著自動化程度的提高和精密製造需求的增加,雷射的應用和需求越來越高。該公司正在將現有的製造流程與雷射和雷射系統的多項技術進步相結合,以提高生產力並保持競爭優勢。

- 此外,由於疫情增加了對數控系統和製程自動化的需求,推動了對用於鑽孔、切割和打標的雷射機器的需求,預計全球對自動化的投資將進一步加速。根據瑞銀預測,到2021年,流程自動化預計將佔據全球自動化投資的很大佔有率,達到740億美元。

- 對基於雷射的解決方案的需求不斷成長,推動著各個供應商擴大其產品陣容。例如,MKS Instruments Inc. 推出了 Spectra-Physics Talon 355-45,這是一款高功率紫外線雷射器,可加快紫外線處理速度,同時顯著降低每個零件的成本。非常適合 PC 板、電子元件、半導體、平板顯示器、鋰離子電池、家用電子電器、清潔能源和其他高要求應用的 LED 的工業製造。

- COVID-19 危機迫使企業遵守嚴格的要求,以確保其員工和客戶的持續安全。因此,對自動化的需求呈指數級成長。這很可能成為不久的將來值得關注的趨勢。

- 在此情況下,全球製造業收益和利潤大幅下滑,導致員工和工人大幅減少,工業生產活動整體損失。

- 政府認為食品飲料和製藥等行業很少是必要的。然而,製造業受到疫情嚴重影響,損失慘重,供應鏈和原物料採購面臨前所未有的挑戰。

- 然而,工業雷射系統應用於多個終端用戶產業,包括航太和國防、汽車、醫療和半導體。在汽車領域,安裝的雷射系統主要用於切割和焊接應用。這提高了生產力,減少了停機時間並顯著降低了製造成本。此外,在航太和國防工業領域,我們廣泛的製造能力涵蓋金屬加工、連接和塗層的所有環節。

工業雷射系統市場趨勢

半導體電子領域預計將實現強勁成長

- 基於雷射的設備在半導體製造和加工中發揮著至關重要的作用。晶圓製造中常用的兩種雷射是近紅外線(NIR)雷射和綠光雷射。 NIR 雷射用途廣泛,適用於半導體製造等許多機械應用。這些都是有效的,因為能量範圍直接對應於執行晶圓所需標記所需的頻譜場。

- 綠色雷射是二次諧波產生(也稱為倍頻)過程的結果。這項技術有助於將兩張照片合併起來,創造一張能量增加一倍的新照片。這可以在保持雷射相干性的同時放大功率。雷射打標有助於整個市場的晶圓可追溯性和可讀性,是晶圓製造的必要步驟。

- 全球對矽晶圓的需求正在快速成長,預計當前包括汽車在內的各行業的晶片短缺將推動需求成長。根據國際半導體設備與材料協會(SEMI)發布的資料,2020年全球矽晶圓需求量為124.1億平方英寸,高於上年的118.1億平方英寸。繼 2019 年需求低迷和市場整體波動之後,預計未來幾年全球市場將因電子產品需求成長而加速成長。

- 雷射設備應用的很大一部分是半導體加工和PCB加工。該設備用於去除製程、黏附製程、檢查、測量和修改製程。使用雷射可以提高產量比率和吞吐量,降低破損/晶粒品質的風險,避免無殘留顆粒,並且具有成本效益。預計奈秒和皮秒型雷射將佔據大部分市場,其次是二氧化碳、飛秒和準分子雷射。

- 在半導體產業之外,雷射設備在電子製造過程中有著廣泛的應用。對於微鑽孔等雷射應用,IPG Photonics 等知名供應商提供了重要的產品。隨著物聯網、工業物聯網和智慧家庭解決方案的興起,製造過程中對雷射的需求預計將快速成長。

- 隨著技術創新降低智慧型手機更換率以及 5G 普及的加速,預計未來幾年對 5G 智慧型手機和連網型設備的需求將會成長。

- 根據愛立信2021年6月的報告,目前已有超過160家通訊服務供應商推出了5G服務,超過300款5G智慧型手機型號已經發布或投入商用。報告預計,2021年底,全球將有5億5G用戶。截至2020年底,智慧型手機在行動電話合約的普及率將達到76%,智慧型手機用戶數將達到60億。預計未來四年內這一數字將達到 77 億,其中智慧型手機在行動用戶中的普及率將達到 88%。

- 預計電子產品需求的加速成長將增加對基於雷射的製造和檢測設備的需求,從而影響對半導體設備的需求。

預計北美將佔很大佔有率

- 由於製造業、航太和汽車等各領域的技術進步,預計市場將由北美主導。 IPG Photonics 和 Coherent Inc. 等供應商在北美都有業務。

- 預計北美公司產品推出將促進該地區的成長。例如,2021 年 8 月,Coherent Inc. 推出了其 ExactWeld IP 聚合物焊接技術。 ExactWeld IP 是一種聚合物焊接方法,可產生無變形和無顆粒的巨大焊接。該系統包括熱感視覺檢查、用於零件識別和偏移校正的內建視覺系統以及用於提高製程穩定性和一致性的自動雷射功率校準模組。

- 許多公司,尤其是中小型企業(SME)和新興企業,已經開始資金籌措來創造尖端雷射技術解決方案。例如,致力於將亞利桑那大學的發現、產品、技術和服務商業化的 UAVenture Capital Fund 已投資 DeUVe Photonics Inc. 以推進技術,使該公司能夠主導新興和現有的深紫外線雷射市場。

- 為了提高生產力並保持競爭優勢,該公司正在將當前的製造流程與雷射和雷射系統的技術進步相結合。例如,2020年1月,通快集團收購了專門從事中空光纖的法國雷射技術公司GLOphotonics。這種光纖可以使雷射更有效率、更快速地從光源傳輸到所需位置,且不會造成任何功率損失。

- 由於對高功率和緊湊功率的需求,光纖雷射業務預計將成長。光纖雷射器的出色可靠性有望推動北美工業雷射產業的發展。

工業雷射系統產業概況

工業雷射系統市場競爭激烈,供應商眾多。市場似乎相當集中。除了最大的供應商外,還有各種迎合不同市場的小型本地供應商。市場上的供應商將研究、創新和產品開發作為其成長策略的優先事項。隨著這些發展,各公司正在加強在這一領域的影響力。由於這是一個資本密集型市場,收益規模較小的公司退出門檻較高,幾乎總是被收益更強的公司收購。適度的企業集中度和市場整合進一步加劇了競爭企業之間的敵意。

- 2022 年 1 月 - TRUMPF 與位於亞琛的 Fraunhofer Lab ILT 建立夥伴關係,後者是一家生產尖端雷射束源和領先光學元件系統的製造商。透過此次合作,兩家公司將推動雷射材料沉積的研究,並加速該技術的引進。

- 2021 年 3 月-II-VI Incorporated 以 63 億美元收購 Coherent Inc.。 II-VI 將透過現金和股票交易收購 Coherent Inc. 的所有已發行股。 Coherent Inc. 是全球領先的雷射、基於雷射的技術和基於雷射的系統解決方案提供商。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 產業價值鏈分析

- COVID-19 的市場評估

第5章市場動態

- 市場促進因素

- 與傳統替代方案相比,精度和準確度更高

- 組件小型化

- 市場限制

- 雷射合規性

第6章市場區隔

- 依雷射類型

- 纖維

- 固態

- CO2

- 其他雷射器

- 按應用

- 斷開

- 焊接

- 標記

- 鑽孔

- 其他應用(表面處理、積層製造)

- 按最終用戶產業

- 半導體電子

- 車

- 航太和國防

- 醫療保健

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- JENOPTIK AG

- Newport Corporation

- TRUMPF GmbH+Co. KG

- Coherent Inc.

- IPG Photonics Corporation

- ACSYS Lasertechnik US Inc.

- nLIGHT Inc.

- Han's Laser Technology Co. Ltd

- II-VI Incorporated

第8章投資分析

第9章:市場的未來

The Industrial Laser System Market is expected to register a CAGR of 7.1% during the forecast period.

Key Highlights

- The various technological advancements in an industrial environment, like industrial automation, industrial robots, 3D Printing, etc., due to the advent of Industry 4.0 and Industrial IoT, are expected to boost the adoption of laser systems in industries. The demand for precision in manufacturing and other industries is also adding to the adoption of laser solutions in the end-user industries.

- Lasers find applications in various industries in different forms and types, but a prominent share of their application lies in material processing. According to Laser Focus World, optical fiber laser sources are being used mainly for material processing, followed by Direct Diode Laser.

- With the proliferation of automation and growing demand for precision manufacturing, lasers are witnessing higher application and demand. Companies are integrating the existing manufacturing processes with several technological advancements across lasers and laser systems to enhance productivity and stay ahead of the competition.

- In addition, the global investment in automation is expected to accelerate even further due to the conditions created by the pandemic resulting in higher demand for CNC systems and process automation, where the demand for laser-based equipment for drilling, cutting, and marking is increasing. According to UBS, by 2021, the global automation investment specific to process automation was expected to command a prominent share at USD 74.0 billion.

- Due to the growing demand for laser-based solutions, various vendors are looking to expand their product offerings. For instance, MKS Instruments Inc. launched the spectra-physics Talon 355-45, a high-power UV laser that results in faster UV processing at a significantly lower cost per part. It is ideal for the industrial manufacturing of PC boards, electronic components, semiconductors, flat panel displays, lithium-ion batteries, and LEDs for consumer electronics, clean energy, and other demanding applications.

- The impact of the COVID-19 crisis has forced businesses to adhere to strict requirements to ensure the ongoing safety of their employees and customers alike. As a result, the need for automation has witnessed a sudden spike. This could be observed as a notable trend in the foreseeable future.

- Under these circumstances, manufacturing industries worldwide witnessed a significant decline in revenue and profits, leading to a significant cut down of employees and workers and an overall loss to industrial production activities.

- Few industries, such as food and beverage and pharmaceutical, were deemed essential by governments. However, the manufacturing industry shrunk significantly due to the pandemic as the industry faced unprecedented challenges in the supply chain and procurement of raw materials, which resulted in significant losses for manufacturers.

- However, industrial laser systems are being adopted in several end-user industries, such as aerospace and defense, automotive, medical, and semiconductor, amongst others. In the automotive sector, laser systems deployed are used mainly for cutting and welding applications. This enables higher productivity and reduction of downtime while substantially reducing manufacturing costs. Also, in the aerospace and defense industry, extensive manufacturing capabilities encompass all areas of metal fabrication, joining, and coating.

Industrial Laser Systems Market Trends

Semiconductor and Electronics Segment Is Expected To Grow Significantly

- Laser-based equipment plays a vital role in the manufacturing and processing of semiconductors; two of the widely used lasers in wafer manufacturing are near-infrared (NIR) and green lasers. NIR Lasers are versatile and suitable for many machine applications like semiconductor creation. They are effective because of the energy range that falls squarely within the spectral field needed to make wafers' necessary markings.

- Green lasers are the result of second-harmonic generation processes, also called frequency doubling. This technology helps combine two photos to make a new one with twice the energy. This amplifies the power while conserving the coherence of the laser. Laser marking helps in the traceability and readability of wafers across the market and is one of the necessary steps in wafer manufacturing.

- The global demand for silicon wafers is increasing at a rapid pace, with a shortage of chips in various industries currently, such as automotive, which is expected to fuel the demand. According to data published by Semiconductor Equipment and Materials International, in 2020, the global silicon wafer demand stood at 12.41 billion square inches, which was 11.81 billion square inches during the previous year. Since the slump in demand and overall market demand fluctuation faced in 2019, the global market is expected to witness accelerated growth in the coming years, augmented by growing demand for electronics.

- A prominent share of the application of laser equipment is in semiconductor processing and PCB processing. This equipment is used for the removal process, bonding process, inspection, metrology, and reforming process; the use of lasers results in higher yields and throughput, reduces the risk of breakage/die quality, avoids particles with no residue, and is cost-effective. Nanosecond and Picosecond types of lasers are expected to command a prominent share of the market, followed by CO2, Femtosecond, and Excimer, in that order.

- Apart from the semiconductor industry, the application of laser equipment in the electronics manufacturing process is significant. Laser applications like micro-drilling where prominent vendors, such as IPG Photonics, have significant product offerings. With the proliferation of IoT, IIoT, and smart home solutions, the demand for lasers is expected to increase rapidly in the manufacturing process.

- With the reduced replacement rate of smartphones due to innovation and the growing push toward the adoption of 5G, the demand for smartphones and connected devices capable of 5G connectivity are expected to witness high demand over the coming years.

- According to Ericsson's June 2021 report, over 160 communications service providers launched 5G services, and over 300 5G smartphone models were announced or launched commercially; the report estimated half a billion 5G users across the world by the end of 2021. At the end of 2020, smartphone penetration among mobile phone subscriptions stood at 76%, with 6 billion smartphone subscriptions, and it is expected to reach 7.7 billion within the next four years, with smartphones reaching 88% penetration among mobile users.

- Such accelerated demand in electronics is expected to increase the demand for laser-based manufacturing and inspection equipment and impact the demand for semiconductor equipment.

North America is Expected to Hold Significant Share

- The market is expected to be dominated by North America due to technological improvements in various sectors, including manufacturing, aerospace, and automotive. Similarly, the site is home to several significant vendors, including IPG Photonics and Coherent Inc.

- Increasing product launches by companies in the North American region are expected to contribute to the region's growth. For instance, in August 2021, the ExactWeld IP polymer welding technology was introduced by Coherent. ExactWeld IP is a polymer welding method that generates enormous volumes of distortion- and particle-free welds. A Thermal Vision Check, an incorporated vision system for component identification or offset correction, and an automated laser power calibration module for improved process stability and consistency are all included in the system.

- Many businesses, particularly small and medium-sized enterprises (SMEs) and startups, have started raising large sums of money to create cutting-edge laser technological solutions. For instance, UAVenture Capital Fund, based in Tuscan and committed to the commercialization of discoveries, products, technologies, and services from the University of Arizona, invested in DeUVe Photonics Inc. to advance its technology, allowing the business to dominate emerging and established deep UV laser markets.

- In order to increase productivity and remain ahead of the competition, businesses are fusing current manufacturing processes with technical advancements in lasers and laser systems. For instance, in January 2020, TRUMPF Group acquired GLOphotonics, a French laser technology company focused on hollow-core fibers. The fiber enables more efficient and quick laser light transportation from the source to the intended location without compromising power.

- The business of fiber lasers is expected to grow due to the requirement for high-output power and compact power. The great dependability of fiber lasers is expected to propel the industrial laser industry in North America.

Industrial Laser Systems Industry Overview

The Industrial Laser Systems Market is highly competitive, owing to the presence of multiple vendors. The market appears to be moderately concentrated. It is home to some of the largest vendors as well as various smaller regional vendors operating and catering to their markets. Vendors in the market are prioritizing research, innovation, and product development as their growth strategy. Such developments enabled the companies to increase their presence in the space. As it is a highly capital-intensive market, the smaller revenue companies are subjected to higher barriers to exit and, in most cases, get acquired by high-revenue companies. Moderate firm concentration and the consolidated state of the market further intensify the competitive rivalry.

- January 2022 - TRUMPF established a partnership with Fraunhofer Institute for Laser Technology ILT, an Aachen-based manufacturer of cutting-edge laser beam sources and superior optical parts and systems. Through this partnership, it hopes to advance laser material deposition research and hasten the technology's introduction.

- March 2021 - II-VI Incorporated acquired Coherent Inc. in a USD 6.3 billion deal. II-VI will acquire all outstanding Coherent shares in a cash and stock transaction. Coherent Inc. is one of the world's leading providers of lasers, laser-based technologies, and laser-based system solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Enhanced Precision and Accuracy over Conventional Alternatives

- 5.1.2 Miniaturization of Component Parts

- 5.2 Market Restraints

- 5.2.1 Regulation Compliance Associated with Laser Usage

6 MARKET SEGMENTATION

- 6.1 By Type of Laser

- 6.1.1 Fiber

- 6.1.2 Solid-state

- 6.1.3 CO2

- 6.1.4 Other Types of Lasers

- 6.2 By Application

- 6.2.1 Cutting

- 6.2.2 Welding

- 6.2.3 Marking

- 6.2.4 Drilling

- 6.2.5 Other Applications (Surface treatment, Additive manufacturing)

- 6.3 By End-user Industry

- 6.3.1 Semiconductor and Electronics

- 6.3.2 Automotive

- 6.3.3 Aerospace and Defense

- 6.3.4 Medical

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 JENOPTIK AG

- 7.1.2 Newport Corporation

- 7.1.3 TRUMPF GmbH + Co. KG

- 7.1.4 Coherent Inc.

- 7.1.5 IPG Photonics Corporation

- 7.1.6 ACSYS Lasertechnik US Inc.

- 7.1.7 nLIGHT Inc.

- 7.1.8 Han's Laser Technology Co. Ltd

- 7.1.9 II-VI Incorporated