|

市場調查報告書

商品編碼

1690788

東南亞火力發電-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Southeast Asia Thermal Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

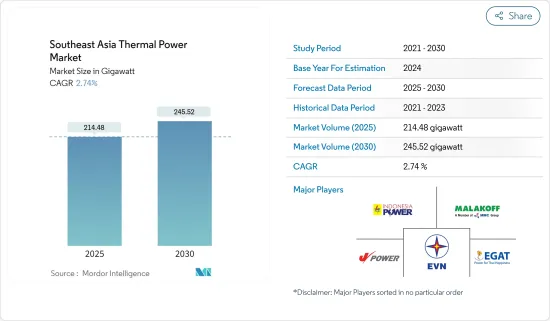

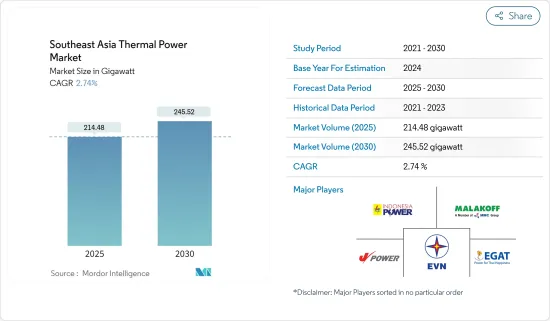

東南亞火力發電市場規模預計在2025年為214.48吉瓦,預計到2030年將達到245.52吉瓦,預測期內(2025-2030年)的複合年成長率為2.74%。

由於供應鏈中斷,東南亞火力發電市場受到新冠疫情的不利影響。然而,預計市場將在 2021 年復甦,並在預測期內實現穩步成長。

預計預測期內,電力需求的增加和電力產業投資的增加將推動東南亞火力發電市場的成長。例如,該地區的電力需求預計將在未來 30 年內大幅成長,到 2050 年將達到 2,690兆瓦時 (TWh)。預計印尼、越南、泰國和菲律賓將在預測期內創下最高的電力需求。

然而,可再生能源領域的快速成長預計將抑制東南亞火力發電市場的成長。預計2019年至2040年間東南亞能源需求將成長三分之二,這將推動對新能源發電和輸電的大規模投資,為火力發電創造充足的市場機會。

印尼是東南亞最大的經濟體之一,2021 年發電量創下歷史新高。預計該國將在即將實施和計劃實施的發電工程發電工程中佔據市場主導地位。

東南亞火力發電市場趨勢

燃煤發電廠佔據市場主導地位

東南亞各國電力需求的不斷成長以及發電煤炭價格的低廉將使發電煤炭在預測期內佔據主導地位。

印尼是電力產業的主要市場。儘管目標是到 2025 年將可再生能源在發電中的佔有率提高到 23%,但正在進行和計劃中的產能擴張計劃預計將導致熱能,尤其是煤炭發電的增加。

越南、泰國和印尼等國家的燃煤發電量持續增加。 2014年印尼煤炭發電量將達119.5TWh,2021年將增加至190TWh。

國際能源總署預測,在既定政策情境下,東南亞對煤炭的初級能源需求預計將在 2030 年成長至 2.16 億噸油當量,在 2040 年成長至 2.70 億噸油當量。

由於環境問題以及人們對天然氣和可再生能源的興趣日益濃厚,燃煤發電廠的成長率正在放緩。然而,運作和運作的發電廠預計將推動燃煤發電市場的成長。

印尼佔市場主導地位

印尼是東南亞最大的經濟體和電力大國,其發電嚴重依賴石化燃料,主要是褐煤和煙煤。儘管與煤炭不同,天然氣預計仍將是該國能源結構的重要組成部分。

該國的發電嚴重依賴石化燃料,主要是天然氣,其次是煤炭和石油。根據英國石油統計報告,2021年煤炭將佔總發電量的61.4%,其次是天然氣,佔18.2%。

截至 2021 年 5 月,該國自 2015 年以來一直實施一項計劃,向國家電網增加約 35 吉瓦的燃煤發電廠。除了這3500萬千瓦外,還有一項並行計劃,將向電網增加7000萬千瓦的燃煤發電工程。煤炭發電使用量高的主因是該國煤炭蘊藏量,為東南亞最高,達348.7億噸。 2021年10月,三菱發電廠在印尼的Muara Karang發電廠開始一台500兆瓦天然氣燃氣渦輪機的商業運作。

在各種傳統火力發電來源中,2021 年的大部分能源來自煤炭。煤炭將佔傳統火力發電的約66%,到2021年發電量將達190兆瓦時(TWh)。

隨著電力需求的增加,發電量也增加。印尼2021年的發電量將達到310TWh。需求的增加將導致新計畫的增加,預計這將在預測期內推動所研究市場的成長。

東南亞火力發電產業概況

東南亞火電市場區隔程度適中。市場的主要企業(不分先後順序)包括泰國電力局、印尼電力公司、電力發展公司、越南電力公司和馬拉科夫Group Limited。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概述

- 介紹

- 裝置容量及至2027年預測(單位:MW)

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 按來源

- 油

- 天然氣

- 煤炭

- 其他(生質能源、核能)

- 按週期

- 開放式循環

- 封閉式循環

- 按地區

- 印尼

- 泰國

- 馬來西亞

- 越南

- 菲律賓

- 其他東南亞地區

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Indonesia Power PT

- Electric Power Development Co. Ltd

- Malakoff Corporation Berhad

- Electricity Generating Authority of Thailand

- Siemens AG

- Vietnam Electricity

- General Electric Company

- Vietnamese National Coal and Mineral Industries Holding Limited

第7章 市場機會與未來趨勢

The Southeast Asia Thermal Power Market size is estimated at 214.48 gigawatt in 2025, and is expected to reach 245.52 gigawatt by 2030, at a CAGR of 2.74% during the forecast period (2025-2030).

The Southeast Asian thermal power market was adversely affected by the COVID-19 pandemic due to disruptions in the supply chain. However, the market rebounded in 2021, and it is expected to grow steadily during the forecast period.

The rising power demand and increasing investments in the power industry are expected to drive the Southeast Asian thermal power market's growth during the forecast period. For instance, the electricity demand in the region is expected to increase significantly over the next three decades and is expected to reach 2,690 terawatt-hours (TWh) by 2050. Indonesia, Vietnam, Thailand, and the Philippines are expected to register the highest electricity demand during the forecast period.

However, the rapid growth in the renewable energy sector is expected to restrain the growth of the Southeast Asian thermal power market. The energy demand in Southeast Asia is expected to grow by two-thirds between 2019 and 2040, thereby leading to massive investment in new energy generation and transmission, creating ample market opportunities for thermal power generation.

Indonesia is one of the largest economies in Southeast Asia and witnessed the highest power generation in 2021. The nation is expected to dominate the market with upcoming and planned thermal power projects.

Southeast Asia Thermal Power Market Trends

Coal-Based Thermal Power Plants to Dominate the Market

The rising power demand across different nations in Southeast Asia and the affordability of coal for power generation are resulting in the dominance of coal for power generation during the forecast period.

Indonesia is the leading market for the power sector. Despite its goals to increase the renewable share in electricity generation to 23% by 2025, the electricity generation from thermal energy, especially coal, is expected to increase due to ongoing and planned capacity expansion plans.

Countries like Vietnam, Thailand, and Indonesia are witnessing a continuous increase in electricity generation from coal. Indonesia produced 119.5TWh of electricity from coal in 2014, which rose to 190 TWh in 2021.

According to the IEA, coal's primary energy demand in Southeast Asia in the Stated Policies Scenario is expected to rise to 216 Mtoe in 2030 and 270 Mtoe in 2040.

The growth rate of coal-based thermal plants is decreasing due to environmental concerns and increasing interest in natural gas and renewable energy. However, the already operating plants and a few upcoming plants are expected to drive the coal thermal power market's growth.

Indonesia to Dominate the Market

Indonesia, the largest economy in Southeast Asia and an electricity sector, is highly dependent upon fossil fuels for electricity production, mainly lignite and bituminous coal. Although not the same as coal, natural gas is also expected to remain an integral part of the country's energy mix.

The country's electricity generation is heavily reliant on fossil fuels, mainly natural gas, followed by coal and oil. According to BP Statistical Review, in 2021, coal had a share of 61.4% in total electricity generation, followed by natural gas at 18.2%.

As of May 2021, the country has had an ongoing program since 2015 of adding around 35 GW of coal-fired power plants to its national grid. Added to 35 GW, there's a parallel program to add 7 GW of coal power projects to the grid. The high usage of coal for power generation has been mainly due to the country's high amount of coal reserves at 34.87 billion tons, the highest in Southeast Asia. In October 2021, Mitsubishi Power started commercial operations of a 500-megawatt natural gas turbine in Indonesia's Muara Karang Power Plant; thus, such projects are expected to drive the thermal power market.

Out of the various sources of generating conventional thermal power, most of the energy came from coal in 2021. Coal contributed approximately 66% to the traditional thermal power electricity generation, producing 190 terawatt-hours (TWh) of electricity in 2021.

With increasing power demand, power generation is also growing. Indonesia generated 310 TWh of electricity in 2021. The growing demand is in resulting in new projects, which are expected to drive the growth of the market studied during the forecast period.

Southeast Asia Thermal Power Industry Overview

The Southeast Asia thermal power market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include the Electricity Generating Authority of Thailand, Indonesia Power PT, Electric Power Development Co. Ltd, Vietnam Electricity, and Malakoff Corporation Berhad, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definiton

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Installed Capacity and Forecast in MW, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Source

- 5.1.1 Oil

- 5.1.2 Natural Gas

- 5.1.3 Coal

- 5.1.4 Other Sources (Bioenergy and Nuclear)

- 5.2 By Cycle

- 5.2.1 Open Cycle

- 5.2.2 Closed Cycle

- 5.3 By Geography

- 5.3.1 Indonesia

- 5.3.2 Thailand

- 5.3.3 Malaysia

- 5.3.4 Vietnam

- 5.3.5 Philippines

- 5.3.6 Rest of South East Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.4 Indonesia Power PT

- 6.5 Electric Power Development Co. Ltd

- 6.6 Malakoff Corporation Berhad

- 6.7 Electricity Generating Authority of Thailand

- 6.8 Siemens AG

- 6.9 Vietnam Electricity

- 6.10 General Electric Company

- 6.11 Vietnamese National Coal and Mineral Industries Holding Limited