|

市場調查報告書

商品編碼

1690758

光纖布拉格光柵感測器-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Fiber Bragg Grating Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

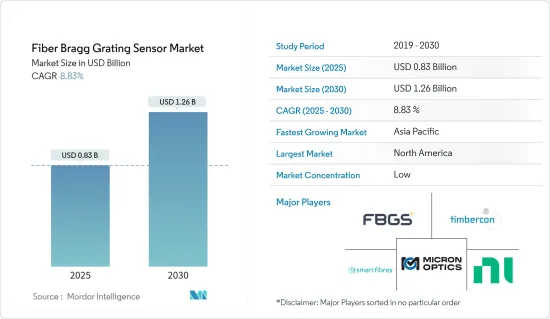

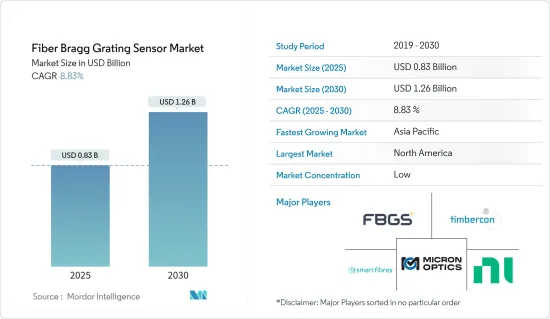

光纖布拉格光柵感測器市場規模預計在 2025 年為 8.3 億美元,預計到 2030 年將達到 12.6 億美元,預測期內(2025-2030 年)的複合年成長率為 8.83%。

關鍵亮點

- 光纖布拉格光柵 (FBG) 技術由於其易於製造、反射訊號強度相對較強以及操作靈活,已成為一種流行的溫度和應變測量光纖感測器。

- 光纖布拉格光柵感測器是透過沿著光纖長度週期性地調變光纖芯的屈光而形成的。透過仔細確定結構,可以為光纖添加各種感測功能。輸出的波長編碼特性透過將每個感測器分配到可用光源頻譜的不同波長範圍,可以使用分波多工(WDM) 技術。這種能力有利於市場成長,因為校準用於確定物理量和波長之間的對應關係,並且是影響感測器性能的關鍵因素之一。

- 此外,與其他感測器相比,它們更長的使用壽命也是支持市場成長的主要因素。根據同行評審開放獲取科學期刊出版商 Hindawi 稱,壽命預測模型顯示,在無應力條件下,光纖布拉格光柵 (FBG) 感測器的基本估計監測壽命約為 56 年,而在工作場所受到應力條件下,光纖布拉格光柵 (FBG) 基鋼絞線的壽命為 27 年。

- FBG 具有透過單一光纖測量應變、壓力和溫度等各種參數的固有能力,這增加了其在各個終端用戶行業的需求。此外,由大量相對低成本的FBG組成的多點感測陣列具有很高的設計彈性,使其成為各種感測應用的理想設備。

- 光纖布拉格光柵感測器在建築和航空領域比傳統的結構監測設備具有許多優勢。然而,某些使用案例的成本和技術限制對採用和成長構成了重大挑戰。

- 在受調查的市場中,新冠疫情的影響顯而易見。最初,嚴格的封鎖措施使得原料/零件的供應變得困難,從而擾亂了全球供應鏈。然而,隨著疫情情勢恢復正常以及主要終端用戶產業進一步擴大業務,預計後疫情時代對這些感測器的需求將會成長。

光纖布拉格光柵感測器市場趨勢

航太是 FBG 感測器成長最快的終端用戶

- 事實證明,光纖布拉格光柵感測器是需要高精度、遙感探測和輕型感測器的航太應用的理想選擇。該技術有多種應用,包括高壓感測、地面氣動測試設施、衝擊壓力感測、太空船監測和飛機複合材料的結構健康監測。

- 它們在航太工業的許多應用中也發揮著重要作用,主要是監測飛機機翼和機身疲勞。它也用於製造飛機和空間結構的智慧複合材料。此外,惡劣而複雜的操作環境是航太工業的特點,選擇能夠承受這種外部環境的極端影響並具有所需準確度、可靠性、精確度和重複性的合適感測器對於行業參與企業來說至關重要。

- 多家飛機製造商已成功應用了這項技術。例如,瑞典航太公司 SAAB 使用一種稱為過熱檢測系統 (OHDS) 的光纖感測器系統即時監控引氣管路,以偵測熱空氣洩漏。據該公司介紹,FBG感測器技術描述了實際的溫度測量,具有設定警報閾值、追蹤趨勢和實現智慧警報功能等特性。

- 此外,預計預測期內飛機製造的成長將推動市場成長。例如,根據日本航空飛機發展公司(JADC)的數據,空中巴士是最大的民航機製造商之一,去年交付了611 架飛機。預計在預測期內它將保持其成長軌跡。波音公司的主要競爭對手去年在全球持有中增加了 340 架噴射機。如此大規模的飛機製造將推動光纖布拉格光柵感測器市場的需求。

- 此外,各地區飛機持有的增加也有望推動航太工業對光纖布拉格光柵感測器市場的需求。例如,根據波音公司預測,到 2041 年,北美地區將以約 10,810 架飛機的數量位居世界最大飛機隊之列。

亞太地區預計將創下最快成長

- 預測期內,中國、印度、日本和韓國等新興經濟體的快速工業化將推動亞洲對光纖布拉格光柵感測器的需求。基於光纖布拉格光柵的溫度、壓力、應變等感測器廣泛應用於水處理服務、石油和天然氣、採礦和發電等製程控制產業。

- 中國、印度和印尼等國家的政府已採取舉措支持製造業成長,為市場成長創造了進一步的機會。例如,中國於2022年10月宣布了多項措施,以促進外商對製造業的投資。中國政府表示將為外國製造企業進出口提供便利,並在貿易和通關方面提供協助。根據國家統計局數據顯示,2022年9月份,中國規模工業增加價值年增6.3%。

- 該地區也是世界最大發電國的所在地,包括日本、印度和中國。例如,印度已於2022年成為世界第三大發電國。 (資料來源:世界人口評論)。根據IBEF預測,到2022會計年度,印度的發電能力將增加至近400吉瓦。

- 此外,由於光纖布拉格光柵感測器廣泛應用於飛機,印度民航業的成長也有望推動市場成長。根據印度品牌資產基金會 (IBEF) 的數據,國內航班約佔南亞空中交通的 69%。預計到2023年,印度機場容量將達到每年10億個航班。印度目前是世界第七大民航市場,預計未來十年內將成為第三大民航市場。

光纖布拉格光柵感知器產業概況

光纖布拉格光柵感測器市場呈現多元化特點,擁有 FBGS International NV、Smart Fibres Ltd、Micron Optics(Luna Innovations)、Timbercon Inc. 和 National Instruments Corporation 等知名參與企業。

2023 年 1 月,Technica Optical Components 成功製造出第一百萬個 FBG 感測器,取得了重要的里程碑。該公司提供廣泛的 FBG 產品,包括 FBG 感測器、FBG 陣列、電纜和 FBG 封裝感測器,使其成為光纖布拉格光柵感測器的領先供應商。

2022 年 12 月,Technica Optical Components 宣布推出一系列基於光纖布拉格光柵的溫度感測器,專為在低溫環境中運作而設計。這些感測器採用先進的一體式微結構設計,並針對極寒環境下的精確溫度測量進行了最佳化。該技術採用高精度、先進的低溫額定材料,並將 Technica 製造的 FBG 嵌入光纖芯中,從而形成具有卓越精度、解析度和可重複性的換能器配置。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 飛機上使用率增加

- 內建校準工件並延長使用壽命

- 市場限制

- 熱和橫向應變敏感性

第6章市場區隔

- 按類型

- 溫度感測器

- 應變感測器

- 壓力感測器

- 其他

- 按最終用戶產業

- 通訊

- 航太

- 建築基礎設施

- 能源動力

- 礦業

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章競爭格局

- 公司簡介

- FBGS International NV

- Smart Fibres Ltd

- Micron Optics(Luna Innovations)

- Timbercon Inc.

- National Instruments Corporation

- HBM Inc.(An HBK Company)

- Broptics Technology Inc.

- ITF Technologies

- Advanced Optics Solutions(AOS)GmbH

- Technica Optical Components LLC

第8章投資分析

第9章 市場機會與未來趨勢

The Fiber Bragg Grating Sensor Market size is estimated at USD 0.83 billion in 2025, and is expected to reach USD 1.26 billion by 2030, at a CAGR of 8.83% during the forecast period (2025-2030).

Key Highlights

- Fiber Bragg grating (FBG) technology is becoming a popular choice for optical fiber sensors for temperature or strain measurements because of their simple manufacture, relatively strong reflected signal strength, and operational flexibilities.

- A periodic modulation of the refractive index of the fiber core along the longitudinal direction forms fiber Bragg grating sensors. Various sensing functionalities can be added to the optical fiber by carefully determining the structure. The wavelength-encoded nature of the output allows the use of the wavelength division multiplexing (WDM) technique by assigning each sensor to a different wavelength range of the available light source spectrum. As calibration is used to determine the mapping relationship between the physical quantity and wavelength and is one of the critical factors affecting the sensor's performance, such a feature favors the market's growth.

- Furthermore, a longer lifetime than other sensors is another major factor supporting the market's growth. According to Hindawi, a publisher of peer-reviewed, open-access scientific journals, the life-prediction model indicates that the estimated monitoring life of an FBG sensor in an unstressed condition is about 56 and 27 years under the stressful situations that fiber Bragg grating (FBG)-based steel strands are subjected to in their working environment.

- Owing to their intrinsic capability to measure a variety of parameters, such as strain, pressure, temperature, and many others, along a single fiber, their demand has been increasing across various end-user industries. Additionally, these multi-point sensing arrays of many relatively low-cost FBGs also provide great flexibility of design, making them ideal devices to be adopted for a multitude of different sensing applications.

- Fiber Bragg grating sensors have many advantages over traditional and structural monitoring devices in the building and aviation sectors. However, cost and technological limitations in some use cases are among the significant factors challenging their widespread adoption and growth.

- A notable impact of the COVID-19 pandemic was observed in the market studied. During the initial phase, the manufacturers faced difficulties in securing the supply of raw materials/components due to stringent lockdown measures, which disrupted the supply chain globally. However, with the condition normalizing and major end-user industries expanding their operations further, the demand for these sensors is expected to grow during the post-COVID period.

Fiber Bragg Grating Sensor Market Trends

Aerospace to be Among the Fastest Growing End User for FBG Sensors

- Fiber Bragg grating sensors have proven ideal options in aerospace engineering-related applications requiring high precision, remote sensing, and lightweight sensors. This technology is used in a variety of applications, including high-pressure sensing, ground-based aerodynamic test facilities, shock pressure sensing, spacecraft monitoring, and structural health monitoring of aircraft composites.

- It also has significant uses in the aerospace industry, mainly for airplane wing monitoring, fuselage fatigue, and many others. Also, they have been used in smart composite manufacturing for aircraft and space structures. Furthermore, a harsh and complex operating environment characterizes the aerospace industry, and choosing a suitable sensor to withstand such external environment extremities and perform at the desired accuracy, reliability, precision, and repeatability is of prime importance for the players in the industry.

- Several aircraft-making companies are successfully using this technology. For instance, SAAB, a Swedish aerospace company, uses a Fiber Optic Sensor System Overheat Detection System (OHDS) for real-time monitoring of bleed air piping to detect hot air leakage. According to the company, FBG sensor technology provides actual temperature measurements with the ability to set alarm thresholds, trace trends, and introduce smart alarm functions.

- Furthermore, a rise in aircraft construction is expected to bolster the market's growth during the forecast period. For instance, according to Japan Aircraft Development Corporation (JADC), Airbus is one of the largest commercial aircraft manufacturers, delivering 611 jets last year. It is expected to maintain its growth trajectory during the forecast period. Boeing's main competitor added 340 jets to the global aircraft fleet last year. Such massive aircraft manufacturing will drive the demand for the Fiber Bragg Grating sensor market.

- The growing aircraft fleet size across various regions is also anticipated to drive the demand for the fiber Bragg grating sensors market in the aerospace industry. For instance, according to Boeing, the North American region is anticipated to lead the charts of the largest aircraft fleets in the world, with about 10,810 aircraft in its fleet by 2041.

Asia Pacific is Expected to Register Fastest Growth

- The demand for fiber Bragg grating sensors in Asia will increase over the forecast period due to rapid industrialization in emerging countries, such as China, India, Japan, and South Korea. Fiber Bragg grating-based sensors, such as temperature, pressure, strain, and others, are widely used in process control industries such as water treatment and services, oil and gas, mining, and power generation.

- The governments in countries such as China, India, and Indonesia, among others, are taking the initiative to support the manufacturing industry's growth, further creating growth opportunities for the market. For instance, in October 2022, China announced several measures to enable foreign investment in the manufacturing industry. The Chinese government stated that it would facilitate imports and exports of foreign-invested manufacturing firms and provide assistance regarding trade and customs clearance. According to the National Bureau of Statistics, China's industrial output increased by 6.3% year-on-year in September 2022.

- The region is also home to some of the largest power-generating countries in the world, like Japan, India, and China. For instance, India emerged as the third-largest electricity-generating country in the world in 2022. (Source: World Population Review). As per IBEF, in the financial year 2022, India's power generation capacity rose to nearly 400 gigawatts.

- Furthermore, the growing civil aviation industry in India will also fuel the market growth as fiber Bragg grating sensors are widely used in aircraft. According to the India Brand Equity Foundation (IBEF), domestic traffic contributes around 69% of the total airline traffic in South Asia. India's airport capacity is expected to handle 1 billion trips annually in 2023. India is currently the 7th largest civil aviation market in the world and is expected to become the third-largest civil aviation market within the next 10 years.

Fiber Bragg Grating Sensor Industry Overview

The Fiber Bragg grating sensor market is characterized by a diverse landscape, featuring prominent players such as FBGS International NV, Smart Fibres Ltd, Micron Optics (Luna Innovations), Timbercon Inc., and National Instruments Corporation. Market participants are strategically employing tactics like partnerships and acquisitions to bolster their product portfolios and establish a sustainable competitive edge.

In January 2023, Technica Optical Components marked a significant achievement by successfully manufacturing their one millionth FBG sensor. The company offers an extensive range of FBG products, encompassing FBG sensors, FBG arrays and cables, as well as FBG packaged sensors, positioning the company as a leading provider of fiber Bragg grating sensors.

In December 2022, Technica Optical Components introduced a new line of Fiber Bragg Grating-based Temperature Sensors engineered for operation in cryogenic environments. These sensors feature an advanced unibody micro-structured design, specifically optimized for precise temperature measurements in ultra-low temperature settings. The technology leverages high-precision, advanced cryogenic-rated materials and incorporates Technica-manufactured FBGs within the fiber cores to deliver a transducer configuration characterized by exceptional precision, resolution, and repeatability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Usage in the Aircraft

- 5.1.2 Built-in Calibration Artifacts and Longer Lifetime

- 5.2 Market Restraints

- 5.2.1 Thermal and Transverse Strain Sensitivity

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Temperature Sensor

- 6.1.2 Strain Sensor

- 6.1.3 Pressure Sensor

- 6.1.4 Other Types

- 6.2 By End-user Industry

- 6.2.1 Telecommunication

- 6.2.2 Aerospace

- 6.2.3 Construction and Infrastructure

- 6.2.4 Energy and Power

- 6.2.5 Mining

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 FBGS International NV

- 7.1.2 Smart Fibres Ltd

- 7.1.3 Micron Optics (Luna Innovations)

- 7.1.4 Timbercon Inc.

- 7.1.5 National Instruments Corporation

- 7.1.6 HBM Inc. (An HBK Company)

- 7.1.7 Broptics Technology Inc.

- 7.1.8 ITF Technologies

- 7.1.9 Advanced Optics Solutions (AOS) GmbH

- 7.1.10 Technica Optical Components LLC