|

市場調查報告書

商品編碼

1690756

西班牙宅配、快捷郵件和小包裹(CEP)-市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Spain Courier, Express, and Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

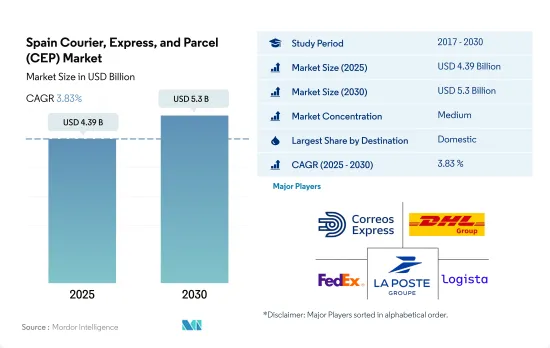

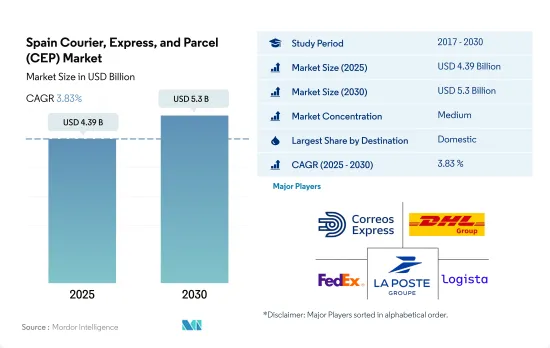

西班牙宅配、快捷郵件和小包裹(CEP) 市場規模預計在 2025 年為 43.9 億美元,預計到 2030 年將達到 53 億美元,預測期內(2025-2030 年)的複合年成長率為 3.83%。

由於電子商務的蓬勃發展和網際網路零售購買量的增加,CEP 市場預計將出現積極成長。

- 西班牙2022年共有郵政和宅配公司21992家,隨著商業和貿易的擴大,就業機會也大幅增加。因此,到2022年,西班牙將有85,992名員工在郵政和宅配行業工作。此外,西班牙的郵政和宅配業務銷售額在歐盟25個國家中排名第五。 DHL 將於 2023 年在其馬德里倉庫啟用新的小包裹分揀系統,每小時可處理 25,000 個包裹。該倉庫將作為國際樞紐,集中管理往返加那利群島的貨物運輸。

- 2024年2月,UPS在西班牙薩拉戈薩開設了全新的最先進的包裹分揀和遞送中心,進一步加強了其在西班牙的網路。包裝中心佔地超過 4,000平方公尺,配備先進的加工技術,每小時可處理 3,000 個包裹,比以前的處理能力提高了 30%。巴塞隆納設施的建造成本為 4,000 萬歐元(4,269 萬美元),其中心面積超過 24,000平方公尺,每小時可分揀多達 22,000 個包裹。

西班牙宅配、快捷郵件和小包裹(CEP)市場的趨勢

西班牙政府加大基礎建設投資,帶動運輸及倉儲業發展

- 2024年5月,建設計畫再次被提起。西班牙政府已聘請國有工程公司 Ineco 對該計劃進行最新的可行性研究和成本估算。初步估計,建造該隧道的成本在 53.3 億美元至 106.7 億美元之間,預計將從歐洲和非洲的貸款機構資金籌措。西班牙與摩洛哥之間最短路線14公里,但海水深度約1,000米,施工難度高。正在考慮的替代方案長度約為 28 公里,但更易於管理,深度不到 300 公尺。目前的計畫是建造一條隧道,未來可以選擇增加第二條平行隧道。該隧道將供客運和貨運列車使用。

- 西班牙於 2024 年 6 月撥款 24.7 億美元用於加強西班牙北部的鐵路基礎設施,這是對阿斯圖裡亞斯地區 30.9 億美元投資的一部分。其中,23.5億美元將分配給預計2030年完工的歐盟計劃。同時,由西班牙運輸部監督的7.4495億美元的開發案預計將於2050年完工。 2024年10月,西班牙核准了一項三方協議,將在巴塞隆納港建造一個新的南部鐵路入口,耗資超過8.0565億美元。

為因應燃油價格上漲,西班牙政府已對2022年的零售價格實施每公升0.20美元的補貼折扣。

- 西班牙的燃料價格一直呈持續上漲趨勢,到 2024 年 4 月,每公升汽油的平均價格上漲至 1.78 美元,連續第三個月上漲 0.96%,讓人想起 10 月中旬的水平。同時,柴油價格為每公升 1.66 美元,第四週上漲近 0.6%。此外,自 2024 年初以來,汽油價格飆升了 9.25%,而柴油價格僅小幅上漲了近 4.5%。

- 燃料價格以及食品成本最近成為人們關注的焦點,對西班牙人的家庭預算產生了重大影響。到 2024 年底,每公升 95 辛烷值汽油的價格預計將達到 1.49 美元左右,柴油的價格預計將達到 1.38 美元左右。燃料價格預期下跌的主要原因是石油市場供應和需求都在下降。國際能源總署(IEA)預測,石油消費量將從2023年第三季的每天280萬桶大幅下降至2024年的每天110萬桶。

西班牙宅配、快捷郵件和小包裹(CEP)產業概況

西班牙宅配、快捷郵件和小包裹(CEP) 市場適度整合,市場主要企業:Correos Express、DHL 集團、FedEx、La Poste 集團(包括 SEUR)和 Logista(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 人口統計

- 按經濟活動分類的GDP分佈

- 按經濟活動分類的GDP成長

- 通貨膨脹率

- 經濟表現及概況

- 電子商務產業趨勢

- 製造業趨勢

- 交通運輸倉儲業GDP

- 出口趨勢

- 進口趨勢

- 燃油價格

- 物流績效

- 基礎設施

- 法律規範

- 西班牙

- 價值鍊和通路分析

第5章市場區隔

- 銷售目的地

- 國內的

- 國際的

- 送貨速度

- 快捷郵件

- 非快捷郵件

- 模型

- 企業對企業(B2B)

- B2C

- 消費者對消費者(C2C)

- 運輸重量

- 重型貨物

- 輕型貨物

- 中等重量貨物

- 運輸方式

- 航空郵件

- 路

- 其他

- 最終用戶

- 電子商務

- 金融服務(BFSI)

- 醫療保健

- 製造業

- 一級產業

- 批發零售(線下)

- 其他

第6章 競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Correos Express

- DHL Group

- FedEx

- GEODIS

- 法國郵政集團(包括 SEUR)

- Logista

- MRW

- Paack

- Szendex

- United Parcel Service of America, Inc.(UPS)

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 技術進步

- 資訊來源及延伸閱讀

- 圖表清單

- 關鍵見解

- 資料包

- 詞彙表

簡介目錄

Product Code: 71426

The Spain Courier, Express, and Parcel (CEP) Market size is estimated at 4.39 billion USD in 2025, and is expected to reach 5.3 billion USD by 2030, growing at a CAGR of 3.83% during the forecast period (2025-2030).

Positive growth is expected in CEP markets owing to e-commerce boom and increasing internet retail purchases

- In Spain, there were 21,992 postal and courier activity companies in 2022. The number of employment opportunities has significantly increased along with the expanding businesses in operation and trade volumes. As a result, in 2022, 85,992 employees worked in the Spanish postal and courier activities sector. Also, Spain was fifth out of 25 EU countries in terms of revenue for its postal and courier activities. In alignment, DHL, opened a new parcel classification system in its warehouse in Madrid in 2023 which can process 25,000 packages/hour. It functions as an international hub and centralizes merchandise movements with the Canary Islands.

- In February 2024, UPS inaugurated its latest package sorting and delivery center in Zaragoza, Spain, further enhancing its domestic network within the country. Spanning over 4,000 sqm, the new facility has advanced processing technology enabling it to handle 3,000 packages per hour, marking a 30% increase from its predecessor. This launch followed several recent investments in Spain, including EUR 40 million (USD 42.69 million) hub in Barcelona covering more than 24,000 sqm, capable of sorting up to 22,000 packages per hour, representing one of UPS's largest commitments to the Spanish market.

Spain Courier, Express, and Parcel (CEP) Market Trends

Developing transport and storage sector fueled by growing infrastructure investments by Spanish Government

- In May 2024, plans to build a rail tunnel under the Strait of Gibraltar to connect Spain and Morocco were revived. The Spanish government hired state-owned engineering firm Ineco to update the feasibility study and cost estimates for the project. Initial estimates suggest the tunnel could cost between USD 5.33 billion and USD 10.67 billion, with funding expected from European and African lending institutions. The shortest route between Spain and Morocco is 14 km, but the sea is about 1000 m deep there, making construction difficult. Alternatives being considered are around 28 km long but at a more manageable depth of less than 300 meters. The current plan is for a single-bore tunnel, with the option to add a second parallel tunnel in the future. This tunnel would be used by both passenger and freight trains.

- In June 2024, Spain allocated USD 2.47 billion to enhance rail infrastructure in northern Spain, part of a broader USD 3.09 billion investment in Asturias. Out of this total, USD 2.35 billion is earmarked for EU projects slated for completion by 2030. Meanwhile, developments overseen by Spain's Ministry of Transport, with a budget of USD 744.95 million, are targeted for a 2050 finish. In October 2024, Spain greenlit a tripartite agreement to construct a new southern rail entrance to the Port of Barcelona, with expenses exceeding USD 805.65 million.

Owing to high fuel prices, a discount of USD 0.2 per liter was applied to the retail price as a subsidy by the Spanish government in 2022

- Spain has witnessed a consistent uptrend in fuel prices, with the average cost of a liter of petrol climbing to USD 1.78 by April 2024, marking a 0.96% increase for three consecutive months, reminiscent of mid-October levels. Diesel prices, on the other hand, stood at USD 1.66 per liter, reflecting an uptick of nearly 0.6% in the fourth week of the month. Moreover, gasoline prices have surged by 9.25% since the start of 2024, while diesel has seen a more modest increase of close to 4.5%.

- Fuel prices have been a major concern recently, along with food costs, significantly impacting Spaniards' budgets. By the end of 2024, the price of a liter of 95-octane gasoline is expected to be around USD 1.49, and diesel around USD 1.38. The main reason for this expected drop in fuel prices is the oil market, which is seeing a decline in both supply and demand. The International Energy Agency predicts that oil consumption will fall sharply, from 2.8 million barrels per day in the third quarter of 2023 to 1.1 million in 2024.

Spain Courier, Express, and Parcel (CEP) Industry Overview

The Spain Courier, Express, and Parcel (CEP) Market is moderately consolidated, with the major five players in this market being Correos Express, DHL Group, FedEx, La Poste Group (including SEUR) and Logista (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Logistics Performance

- 4.11 Infrastructure

- 4.12 Regulatory Framework

- 4.12.1 Spain

- 4.13 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes Market Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed Of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode Of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Correos Express

- 6.4.2 DHL Group

- 6.4.3 FedEx

- 6.4.4 GEODIS

- 6.4.5 La Poste Group (including SEUR)

- 6.4.6 Logista

- 6.4.7 MRW

- 6.4.8 Paack

- 6.4.9 Szendex

- 6.4.10 United Parcel Service of America, Inc. (UPS)

7 KEY STRATEGIC QUESTIONS FOR CEP CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219