|

市場調查報告書

商品編碼

1690750

印尼資料中心市場:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Indonesia Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

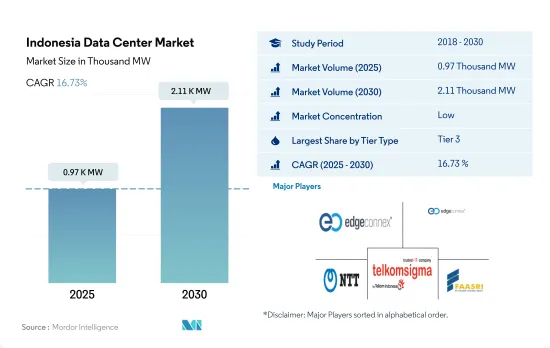

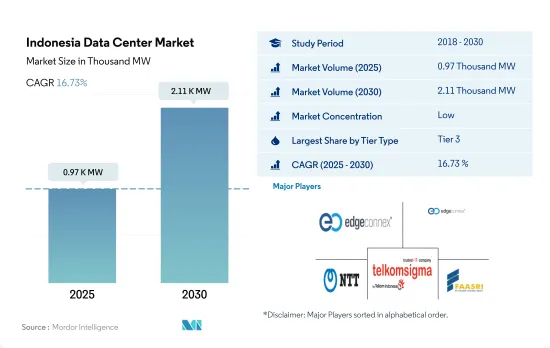

預計2025年印尼資料中心市場規模為970kW,2030年將達2,110kW,複合年成長率為16.73%。

預計 2025 年主機託管收益將達到 6.751 億美元,2030 年將達到 18.882 億美元,預測期內(2025-2030 年)的複合年成長率為 22.84%。

到 2023 年,按數量計算,3層級資料中心將佔據大部分佔有率,而 4層級資料中心將在整個預測期內佔據主導地位。

- 2022年印尼資料中心市場中, 層級 3細分市場佔有率超過50%。預計其複合年成長率將達到 15%,到 2029 年將達到 652.6 兆瓦。另一方面,預計到 2029 年, 層級 4 部分將實現 25.9% 的更高成長率。在資料中心設施中實施標準有助於最大限度地減少佔地面積,同時提高設施效率。這就是為什麼客戶更喜歡擁有額外冗餘設施進行備份的資料中心。

- 層級和二級設施的需求正在下降,因為它們無法滿足越來越多企業不間斷的服務需求。越來越多的全球企業集團要求全天候業務永續營運服務,逐漸改變對層級和四級資料中心的偏好。

- 截至 2022 年,印尼約有 25 個層級資料中心設施,其次是 8 個層級資料中心。 PT DCI Indonesia Tbk 的 JK1 設施是全國首個於 2013 年獲得層級 4 認證的資料中心。此後,NTT 和 Digital Edge (Singapore) Pte Ltd 已受邀在該國建置層級 4資料中心。由於客戶需求不斷增加,預計未來幾年層級和層級資料中心的建設將會增加。

印尼資料中心市場趨勢

市場對價格實惠的 5G 智慧型手機的需求不斷成長,從而帶動智慧型手機銷售成長。

- 隨著 4G 服務在印尼全國普及,5G 也將於 2021 年推出,印尼的智慧型手機用戶群正在穩定成長。預計到 2021 年,用戶群將從 2016 年的 1.07 億增加到 1.7 億,過去一段時期的複合年成長率為 9.7%。智慧型手機普及率成長了兩倍多,從 2016 年的 43% 成長到 2021 年的 72%。

- 4G 網路的改進和 5G 技術的出現預計將進一步推動該國智慧型手機的普及。 2022年,350-450美元價格分佈的5G智慧型手機獲得了顯著支撐。從客戶觀點來看,這些智慧型手機與同價格分佈的4G 智慧型手機相比,具有更好的性能和連接性,並且支援未來 5G。

- 4G 和 5G 智慧型手機以及廉價資料包的成長預計將促進公民的資料消費,從而對印尼資料中心市場產生積極影響。隨著智慧型手機銷量的增加,平均螢幕時間將從 2016 年的 45 分鐘增加到 2022 年的 5 小時。智慧型手機使用模式的這種變化也受到各種數位應用程式易用性的推動,而這些應用程式最終依靠雲端或資料中心來提供服務。例如,BFSI 部門從透過智慧型手機在全國範圍內提供數位服務中受益匪淺。到2022年,超過70%的銀行交易將透過智慧型手機進行。 BFSI 是資料中心的主要終端使用者之一,預計未來幾年將增加對主機託管服務的投資。因此,預計預測期內該國智慧型手機用戶的增加將對印尼資料中心市場產生積極推動作用。

印尼政府《2021-2024年數位印尼藍圖》提振市場需求

- 到 2022 年,FTTx 連線的平均寬頻速度將達到 21.2Mbps,而銅纜的平均寬頻速度為 12.6Mbps。印尼政府起草了《2021-2024年數位印尼藍圖》,重點發展國家數位基礎設施。這將在預測期內提高光纖和銅纜的平均寬頻速度。

- 到 2021 年,該國固定寬頻連線數量將達到 1,240 萬,其中 77% 的用戶平均網路速度將達到 10Mbps 或更高。印尼的寬頻網路價格昂貴且速度慢。該國由17,000個島嶼組成,各島嶼之間(主要在東部島嶼)的經濟發展和連通性存在差異,這對提供統一的寬頻連接造成了重大瓶頸。為了彌補這一差距,印尼政府於 2019 年完成了 Palapa Ring計劃,為七個島嶼(蘇門答臘島、爪哇島、加里曼丹島、努沙登加拉島、蘇拉威西島、馬魯古群島和巴布亞島)提供了可靠的寬頻連接。

- 該國對網際網路日益成長的需求正推動企業建立新的網路。 2022 年 9 月,印尼通訊業者Indosat Ooredoo Hutchison (IOH) 宣布將以 Indosat HiFi 品牌推出光纖到府 (FTTH) 服務,擴大其服務組合。

- 網際網路對於資料中心的平穩運行至關重要,預計在預測期內,平均寬頻速度(尤其是 FTTH)的提高以及該國東部地區數位基礎設施的改善將導致該國資料中心建設計劃進一步集中。

印尼資料中心產業概況

印尼資料中心市場較為分散,前五大企業佔19.81%。市場的主要企業是 EdgeConneX Inc.、EdgeConneX Inc.、NTT Ltd、PT Sigma Tata Sadaya 和 PT。 Faasri Utama Sakti。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 市場展望

- 負載能力

- 占地面積

- 主機代管收入

- 安裝機架數量

- 機架空間利用率

- 海底電纜

第5章 產業主要趨勢

- 智慧型手機用戶數量

- 每部智慧型手機的資料流量

- 行動資料速度

- 寬頻資料速度

- 光纖連接網路

- 法律規範

- 印尼

- 價值鍊和通路分析

第6章市場區隔

- 熱點

- 大雅加達

- 其他中東和非洲地區

- 資料中心規模

- 大規模

- 超大規模

- 中等規模

- 超大規模

- 小規模

- 層級類型

- 1層級和2級

- 層級

- 層級

- 吸收量

- 未使用

- 使用

- 按主機託管類型

- 超大規模

- 零售

- 批發的

- 按最終用戶

- BFSI

- 雲

- 電子商務

- 政府

- 製造業

- 媒體與娛樂

- 電信

- 其他

第7章競爭格局

- 市場佔有率分析

- 商業狀況

- 公司簡介

- BDx Data Center Pte Ltd

- Digital Edge (Singapore) Holdings Pte Ltd

- EdgeConneX Inc.

- EdgeConneX Inc.

- NTT Ltd

- Nusantara Data Center

- Princeton Digital Group

- PT CBN Nusantara

- PT DCI Indonesia Tbk

- PT Sigma Tata Sadaya

- PT. Faasri Utama Sakti

- PT. Supra Primatama Nusantara

- Space DC Pte Ltd

第8章:CEO面臨的關鍵策略問題

第9章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 全球市場規模和DRO

- 資訊來源及延伸閱讀

- 圖表清單

- 關鍵見解

- 資料包

- 詞彙表

The Indonesia Data Center Market size is estimated at 0.97 thousand MW in 2025, and is expected to reach 2.11 thousand MW by 2030, growing at a CAGR of 16.73%. Further, the market is expected to generate colocation revenue of USD 675.1 Million in 2025 and is projected to reach USD 1,888.2 Million by 2030, growing at a CAGR of 22.84% during the forecast period (2025-2030).

Tier 3 data center accounted for majority share in terms of volume in 2023, and Tier 4 is expected to dominate through out the forecasted period

- The tier 3 segment had a market share of over 50% in the Indonesian data center market in 2022. It is further projected to register a CAGR of 15% to reach an IT load capacity of 652.6 MW by 2029. On the other hand, the tier 4 segment is expected to witness the highest growth of 25.9% by 2029. Implementation of standards in the data center facilities ensures minimal downtown while increasing the efficiency of facilities. Therefore, data centers with additional redundant equipment in place for backup are preferred by customers.

- Tier 1 & 2 facilities are losing their demand as they are incompetent in fulfilling the growing uninterrupted services of businesses. The growing number of global conglomerates has given rise to business continuity services 24*7, which has gradually shifted the preference toward tier 3 and 4 data centers.

- As of 2022, there were nearly 25 tier 3 data center facilities in the country, followed by eight tier 4 data centers. PT DCI Indonesia Tbk's JK1 facility was the first data center in the country to receive the Tier 4 certification in 2013. Since then, NTT and Digital Edge (Singapore) Pte Ltd have had to build tier 4 data centers in the country. The growing demand from customers is expected to drive the construction of tier 3 and 4 data centers in the country in the coming years.

Indonesia Data Center Market Trends

Rising demand for 5G smartphones at reasonable price led to increased sales in smartphones, this would create data center demand

- Smartphone users in Indonesia are witnessing steady growth owing to the availability of 4G services nationwide and the launch of 5G in 2021. The user base reached 170 million in 2021 from 107 million in 2016, exhibiting a CAGR of 9.7% during the historical period. Smartphone penetration more than tripled from 43% in 2016 to 72% in 2021.

- Improvement in the 4G network and the launch of 5G technology are touted to drive smartphone penetration in the country further. 5G smartphones in the price bracket of USD 350-450 gained major traction in 2022. From the customer's perspective, these smartphones offer better performance and connectivity, and 5G support makes them future-ready compared to 4G smartphones in the same price segment.

- This growth in 4G and 5G smartphones and affordable data packs are projected to drive data consumption among the populace, thus impacting the Indonesian data center market positively. As more smartphones were sold, average screen time increased from 45 minutes in 2016 to 5 hours in 2022. This change in smartphone usage patterns is also triggered by the ease of services by various digital apps, which ultimately rely on either cloud or data centers to provide their services. For instance, the BFSI segment has majorly benefited by providing digital services in the country via smartphones. In 2022, over 70% of banking transactions were carried out via smartphones. BFSI, one of the country's major end users of data centers, is projected to invest more in colocation services in the coming years. Therefore, the growing smartphone user base in the country is predicted to positively drive the Indonesian data center market during the forecast period.

"Digital Indonesia Roadmap 2021-2024 launched by Indonesian Government boost the market demand

- The average broadband speed over FTTx connection stood at 21.2 Mbps in 2022 compared to 12.6 Mbps via copper cables. The government drafted the "Digital Indonesia Roadmap 2021-2024," which focuses on digital infrastructure improvement in the country. It is touted to boost the average broadband speed over fiber and copper cable during the forecast period.

- The fixed broadband connections in the country reached 12.4 million in 2021, where 77% of the user base experiences had an average speed of >= 10 Mbps. The broadband network in Indonesia is expensive and slow due to the high price and the low quality of internet connectivity. The country comprises 17,000 islands with a disparity in economic development and connectivity between islands, a major bottleneck in providing uniform broadband connectivity, primarily in eastern islands. To address this disparity, the Indonesian government completed the Palapa Ring Project in 2019, with seven island groupings (Sumatra, Jawa, Kalimantan, Nusa Tenggara, Sulawesi, Maluku, and Papua) connected with stable broadband connectivity.

- The growing demand for the internet in the country drives companies to establish new networks. In September 2022, Indonesian operator Indosat Ooredoo Hutchison (IOH) announced to broaden its service portfolio by launching a fiber-to-the-home (FTTH) service, branded Indosat HiFi, as it looks to capitalize on the growing demand for high-speed internet access at home.

- With the internet being the primary requirement for the smooth operation of any data center and the rise in average broadband speed, predominantly FTTx, and with improvement in digital infrastructure in the eastern region of the country, data center construction projects are expected to be more focused in the country during the forecast period.

Indonesia Data Center Industry Overview

The Indonesia Data Center Market is fragmented, with the top five companies occupying 19.81%. The major players in this market are EdgeConneX Inc., EdgeConneX Inc., NTT Ltd, PT Sigma Tata Sadaya and PT. Faasri Utama Sakti (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 MARKET OUTLOOK

- 4.1 It Load Capacity

- 4.2 Raised Floor Space

- 4.3 Colocation Revenue

- 4.4 Installed Racks

- 4.5 Rack Space Utilization

- 4.6 Submarine Cable

5 Key Industry Trends

- 5.1 Smartphone Users

- 5.2 Data Traffic Per Smartphone

- 5.3 Mobile Data Speed

- 5.4 Broadband Data Speed

- 5.5 Fiber Connectivity Network

- 5.6 Regulatory Framework

- 5.6.1 Indonesia

- 5.7 Value Chain & Distribution Channel Analysis

6 MARKET SEGMENTATION (INCLUDES MARKET SIZE IN VOLUME, FORECASTS UP TO 2030 AND ANALYSIS OF GROWTH PROSPECTS)

- 6.1 Hotspot

- 6.1.1 Greater Jakarta

- 6.1.2 Rest of Indonesia

- 6.2 Data Center Size

- 6.2.1 Large

- 6.2.2 Massive

- 6.2.3 Medium

- 6.2.4 Mega

- 6.2.5 Small

- 6.3 Tier Type

- 6.3.1 Tier 1 and 2

- 6.3.2 Tier 3

- 6.3.3 Tier 4

- 6.4 Absorption

- 6.4.1 Non-Utilized

- 6.4.2 Utilized

- 6.4.2.1 By Colocation Type

- 6.4.2.1.1 Hyperscale

- 6.4.2.1.2 Retail

- 6.4.2.1.3 Wholesale

- 6.4.2.2 By End User

- 6.4.2.2.1 BFSI

- 6.4.2.2.2 Cloud

- 6.4.2.2.3 E-Commerce

- 6.4.2.2.4 Government

- 6.4.2.2.5 Manufacturing

- 6.4.2.2.6 Media & Entertainment

- 6.4.2.2.7 Telecom

- 6.4.2.2.8 Other End User

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Landscape

- 7.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.3.1 BDx Data Center Pte Ltd

- 7.3.2 Digital Edge (Singapore) Holdings Pte Ltd

- 7.3.3 EdgeConneX Inc.

- 7.3.4 EdgeConneX Inc.

- 7.3.5 NTT Ltd

- 7.3.6 Nusantara Data Center

- 7.3.7 Princeton Digital Group

- 7.3.8 PT CBN Nusantara

- 7.3.9 PT DCI Indonesia Tbk

- 7.3.10 PT Sigma Tata Sadaya

- 7.3.11 PT. Faasri Utama Sakti

- 7.3.12 PT. Supra Primatama Nusantara

- 7.3.13 Space DC Pte Ltd

- 7.4 LIST OF COMPANIES STUDIED

8 KEY STRATEGIC QUESTIONS FOR DATA CENTER CEOS

9 APPENDIX

- 9.1 Global Overview

- 9.1.1 Overview

- 9.1.2 Porter's Five Forces Framework

- 9.1.3 Global Value Chain Analysis

- 9.1.4 Global Market Size and DROs

- 9.2 Sources & References

- 9.3 List of Tables & Figures

- 9.4 Primary Insights

- 9.5 Data Pack

- 9.6 Glossary of Terms