|

市場調查報告書

商品編碼

1690749

中東資料中心:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Middle East Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

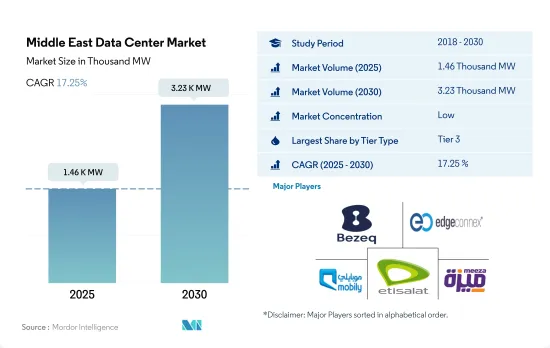

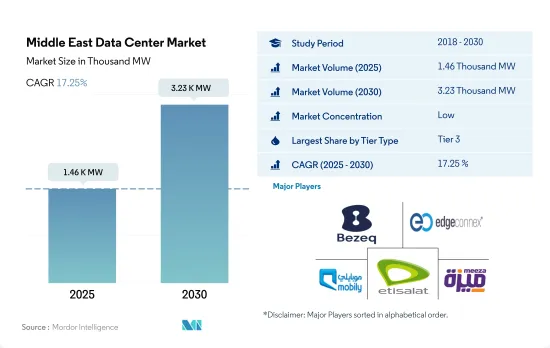

預計 2025 年中東資料中心市場規模為 1,460 千瓦,到 2030 年將達到 3,230 千瓦,複合年成長率為 17.25%。

預計主機託管收益將在 2025 年達到 15.763 億美元,到 2030 年將達到 47.029 億美元,預測期內(2025-2030 年)的複合年成長率為 24.44%。

2023 年, 層級 3資料中心將佔據大部分市場佔有率,而層級 4 資料中心在預測期內將快速成長

- 在中東,層級市場憑藉其顯著的功能優勢,目前佔據了大部分市場佔有率。這些層級具有高水準的冗餘度以及多種電源和冷卻路徑。 層級 3資料中心的運轉率約為 99.982%,每年停機時間為 1.6 小時。隨著邊緣和雲端連接的採用率不斷提高,預計層級 3 細分市場將進一步成長。

- 中東市場的層級 3 部分將在 2022 年以 464.68 MW 的 IT 負載容量運作。在預測期內(2022-2029 年),IT 負載容量預計將從 2023 年的 621.78 MW 成長到 2029 年的 1,214.86 MW,複合年成長率為 11.81%。

- 預計層級細分市場的複合年成長率最快,為 26.51%。一些新興國家正致力於獲得層級 4 認證,以受益於所有組件的完全容錯和冗餘。鑑於這些優勢,新興國家也擴大採用層級 4 區域。

- 5G應用的實施需要資料中心等數位基礎設施的發展。最近,全天候業務永續營運服務的擴展導致越來越多的全球企業對 3層級和 4 級資料中心的偏好日益增加。資料對於 BFSI 公司來說是一個至關重要的元素,因為市場對資料儲存和保護有嚴格的法律規定。 BFSI 產業的特徵是數位化。由於各種銀行應用程式的使用不斷增加,BFSI 領域的資料呈指數級成長。

到 2023 年,阿拉伯聯合大公國將佔據最大佔有率,而沙烏地阿拉伯將在整個預測期內經歷最快的成長。

- 預計未來幾年中東地區資料中心市場的投資將會成長。有幾個因素推動了該地區資料中心的擴張。該地區政府的智慧城市願景正在推動現代社區建設方式的轉變。未來的城市在數位科技的推動下,預計將產生大量資料。最佳化資料擷取、儲存和處理是關鍵。

- 家庭資料的興起和5G網路的出現將推動對社區資料中心的需求,以加快資料傳輸。海灣合作理事會等某些司法管轄區的資料主權法規不確定,將推動資料中心投資。這凸顯了銀行等機構在國內保存客戶資料的重要性。

- 阿拉伯聯合大公國在建立強大、有競爭力的數位經濟的競賽中處於領先地位,這使其成為該地區資料中心的首選地點。根據 Arcadis 的資料中心位置指數,阿拉伯聯合大公國憑藉其「成熟的光纖寬頻網路」在行動寬頻普及率方面位居榜首。同時,獲得建築許可證的便利性和新的智慧城市概念使其成為資料中心投資的熱門位置。

- 沙烏地阿拉伯於2021年7月啟動了一項耗資180億美元的策略,旨在建立全國性的海量資料中心網路。根據沙烏地阿拉伯通訊與資訊技術部介紹,首批投資合作夥伴包括當地公司海灣資料中心、Al-Moammar資訊系統和沙烏地阿拉伯FAS控股。

中東資料中心市場趨勢

行動用戶數量的增加和5G人口覆蓋範圍的擴大將推動市場成長

- 過去二十年,海灣合作理事會國家的資訊通訊技術使用發生了顯著變化,數位基礎設施的發展對向用戶提供的服務產生了重大影響。與世界其他地區相比,該地區的網路和通訊服務最為普遍,其中海灣合作理事會的網路用戶比例最高,為 98.21%,而全球平均為 63%。

- 在海灣合作理事會國家,行動用戶總數約佔總人口的137.66%,高於全球約55%的平均值。海灣合作理事會地區的ICT服務正在快速發展,新的商業行動服務供應商不斷湧入,導致用戶數量激增。中東地區約三分之二的無線網路營運商推出5G網路,擴大了全部區域。大部分中東國家已推出商用4G服務。

- OTT 消費的增加也增加了每部智慧型手機的資料流量。例如,Etisalat 於 2013 年發布了其 Life TV iOS 應用程式,一年後它超越 MBC 的 Shahid TV 應用程式成為中東下載次數最多的應用程式。 OSN 已宣布向非付費電視用戶推出 Go。中東地區在超高速網路存取和成本方面存在顯著差異。各種 OTT 平台的推出和速度的提高可能會推動對機架空間的需求並增加中東的資料中心數量。

優先發展5G、數位付款等數位化措施以及吸引大量勞動力流動人口將刺激市場需求。

- 在向知識密集型經濟體轉型的過程中,阿拉伯聯合大公國和沙烏地阿拉伯政府優先考慮 5G 等數位化措施。在數位付款等國家消費措施的推動下,智慧型手機正主導數位化生活方式的轉變。該地區商務和休閒旅遊的快速復甦,加上黃金簽證等慷慨的長期簽證政策,正在刺激從房地產到新興企業等各個領域的投資,支持智慧型手機市場在短期內強勁復甦。國際賽事,特別是2022年在卡達舉行的國際足總世界杯,也可能為鄰國的各個商業領域創造機會。

- 該地區極其富裕,儘管它接收了大量的勞工移民,對大眾市場產品產生了新的需求。除土耳其外,中東地區佔全球銷售額的一半以上。在智慧型手機領域,蘋果和三星佔據市場主導地位,合計佔總合貨量的約 96%。

- 中東的設備啟動量預計將與前一年同期比較增,到 2022 年平均成長 23%。伊拉克和埃及等較大的市場是這項擴張的主要驅動力,因為儘管它們目前擁有龐大的用戶群,但仍在繼續成長。由於智慧型手機和 5G 設備的廣泛應用,原始資料量預計會增加。智慧型手機用戶的增加可能會帶來更多的資料和網路使用量。將會需要更多的資料中心,並且區域利用率的提高可能會導致對儲存和處理資料所需的伺服器的需求增加。

中東資料中心產業概況

中東資料中心市場較為分散,前五大企業佔36.27%。市場的主要企業有:Bezeq International General Partner Ltd、EdgeConneX Inc.、Etihad Etisalat Company (Mobily)、Etisalat 和 MEEZA

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 市場展望

- 負載能力

- 占地面積

- 主機代管收入

- 安裝的機架數量

- 機架空間利用率

- 海底電纜

第5章 產業主要趨勢

- 智慧型手機用戶數量

- 每部智慧型手機的資料流量

- 行動資料速度

- 寬頻資料速度

- 光纖連接網路

- 法律規範

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 價值鍊和通路分析

第6章市場區隔

- 資料中心規模

- 大規模

- 超大規模

- 中等規模

- 超大規模

- 小規模

- 層級類型

- 1層級和2級

- 層級

- 層級

- 吸收

- 未使用

- 使用

- 按主機託管類型

- 超大規模

- 零售

- 批發的

- 按最終用戶

- BFSI

- 雲

- 電子商務

- 政府

- 製造業

- 媒體與娛樂

- 電信

- 其他

- 國家

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

第7章競爭格局

- 市場佔有率分析

- 商業狀況

- 公司簡介.

- Bezeq International General Partner Ltd

- Bynet Data Communications Ltd

- EdgeConneX Inc.

- Electronia

- Etihad Etisalat Company(Mobily)

- Etisalat

- Gulf Data Hub

- HostGee Cloud Hosting Inc.

- Injazat

- Khazna Data Center

- MedOne IC-1(1999)Ltd

- MEEZA

第8章:CEO面臨的關鍵策略問題

第9章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 全球市場規模和DRO

- 資訊來源及延伸閱讀

- 圖表清單

- 關鍵見解

- 資料包

- 詞彙表

The Middle East Data Center Market size is estimated at 1.46 thousand MW in 2025, and is expected to reach 3.23 thousand MW by 2030, growing at a CAGR of 17.25%. Further, the market is expected to generate colocation revenue of USD 1,576.3 Million in 2025 and is projected to reach USD 4,702.9 Million by 2030, growing at a CAGR of 24.44% during the forecast period (2025-2030).

Tier 3 data centers accounts for majority market share in 2023, Tier-4 is the fastest growing in forecasted period

- The tier 3 segment currently holds the majority of the market share in the Middle East due to the significant advantages of its features. These tiers have a high level of redundancy and multiple power and cooling paths. The tier 3 data centers have an uptime of around 99.982%, resulting in 1.6 hours of downtime per year. With the increased adoption of edge and cloud connectivity, the tier 3 segment is expected to grow further.

- The tier 3 segment of the Middle Eastern market operated at an IT load capacity of 464.68 MW in 2022. During the forecast period (2022-2029), the IT load capacity is expected to grow from 621.78 MW in 2023 to 1,214.86 MW in 2029, with a CAGR of 11.81%.

- The tier 4 segment is expected to record the fastest CAGR of 26.51%. Several developing countries are focusing on getting Tier 4 certifications to benefit from complete fault tolerance and redundancy for all components. Due to such advantages, even developing countries are adopting tier 4 zones.

- The development of digital infrastructures such as data centers is required to implement 5G applications. More recently, the expansion of 24/7 business continuity services has increased the preference for tier 3 and 4 data centers due to the growing number of global companies. Data is an essential component of BFSI companies due to the stringent laws governing data storage and protection in the market. The BFSI sector is defined by digitalization. Due to the growing usage of various banking applications, data in the BFSI sector is growing exponentially.

UAE accounted for majority share in terms of volume in 2023, Saudi Arabis is fastest growing throughout the forecasted period

- In the coming years, the Middle East region is expected to increase its investment in the data center market. Several factors are facilitating the expansion of data centers in the area. The region's governments' smart city ambitions are driving a shift in how modern communities are built. Cities of the future, supported by digital technologies, are expected to generate massive amounts of data. It is critical to optimize data capture, storage, and processing.

- Domestic data growth and the emergence of 5G networks drive demand for localized data centers to speed up data transfer. Uncertain data sovereignty regulations in certain jurisdictions, including the GCC, drive data center investments. This emphasizes the importance of organizations such as banks retaining customer data within the country.

- The United Arab Emirates has been a prime location for data centers in the region as one of the frontrunners in the race to establish a robust and competitive digital economy. According to Arcadis' Data Centre Location Index, the UAE's "well-established fiber broadband network" helped the country secure the top spot for mobile broadband penetration. At the same time, the ease of obtaining construction permits and new smart city initiatives make it an emerging location for data center investment.

- Saudi Arabia launched a USD 18 billion strategy in July 2021 to establish a nationwide network of large-scale data centers. According to the Saudi Ministry of Communications and Information Technology, the first batch of investment partners includes local firms Gulf Data Hub, Al-Moammar Information Systems, and Saudi FAS Holding.

Middle East Data Center Market Trends

Growing number of mobile users and expanding 5G population coverage across the regional countries boosts the market growth

- The GCC countries have experienced substantial changes in ICT use over the past two decades, resulting in a considerable impact on the services offered to users due to developing digital infrastructure. Internet and telecommunications services are much more common in the region than they are globally, especially in GCC, with the proportion of internet users to the total population in GCC reaching 98.21%, compared to the global average of 63%, which is practically the highest in all geographic areas.

- In GCC, the total number of mobile users makes up roughly 137.66% of the population, compared to the global average of about 55%. ICT services in the GCC region are developing quickly due to the region's continued influx of new commercial mobile service providers, causing a sharp rise in the number of users. Around two-thirds of wireless network operators in the Middle East launched 5G networks, expanding 5G population coverage across the regional countries. The majority of Middle Eastern countries have already implemented commercial 4G services.

- The increasing OTT consumption also boosted data traffic for each smartphone. For instance, Etisalat released its Life TV iOS app in 2013, a year after MBC's Shahid TV app surpassed it as the most downloaded Middle Eastern app. OSN revealed the debut of Go for non-pay TV users. In the Middle East, there are large regional differences in the accessibility and cost of super-fast networks. The deployment of various OTT platforms and speed improvements may result in a greater demand for rack space, leading to a rise in the number of data centers in the Middle East.

Prioritizing digital initiatives, such as 5G, digital payment and attracting sizable population of working immigrants boost the market demand

- To shift toward a knowledge-based economy, the UAE and Saudi Arabian governments are prioritizing digital initiatives, such as 5G. Due to state-wide consumer initiatives like digital payment, smartphones are leading the move to a digital lifestyle. The region's quick rebound of business and leisure travel, as well as permissive long-term visa policies like Golden Visas, which are stimulating investments across sectors from real estate to start-ups, are supporting the robust smartphone market recovery in the short term. International events, especially the FIFA World Cup in Qatar in 2022, may also present opportunities for various corporate sectors in neighboring nations.

- Though the region is attracting a sizable population of working immigrants, creating fresh demand for mass-market products, it is extremely wealthy. The Middle East accounts for more than half of global sales value except for Turkey. Apple and Samsung are the market leaders in the smartphone segment, accounting for approximately 96% of shipping volume combined.

- Device activations in the Middle East increased Y-o-Y, growing by an average of 23% in 2022. Larger markets like Iraq and Egypt, which continued to grow despite having enormous current user bases, were the main drivers of this expansion. The amount of raw data is expected to increase due to smartphone penetration and the use of 5G devices. The number of smartphone users may lead to the use of more data and the internet. The need for more data centers and higher regional utilization rates may boost the demand for the servers required to store and process the data.

Middle East Data Center Industry Overview

The Middle East Data Center Market is fragmented, with the top five companies occupying 36.27%. The major players in this market are Bezeq International General Partner Ltd, EdgeConneX Inc., Etihad Etisalat Company (Mobily), Etisalat and MEEZA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 MARKET OUTLOOK

- 4.1 It Load Capacity

- 4.2 Raised Floor Space

- 4.3 Colocation Revenue

- 4.4 Installed Racks

- 4.5 Rack Space Utilization

- 4.6 Submarine Cable

5 Key Industry Trends

- 5.1 Smartphone Users

- 5.2 Data Traffic Per Smartphone

- 5.3 Mobile Data Speed

- 5.4 Broadband Data Speed

- 5.5 Fiber Connectivity Network

- 5.6 Regulatory Framework

- 5.6.1 Israel

- 5.6.2 Saudi Arabia

- 5.6.3 United Arab Emirates

- 5.7 Value Chain & Distribution Channel Analysis

6 MARKET SEGMENTATION (INCLUDES MARKET SIZE IN VOLUME, FORECASTS UP TO 2030 AND ANALYSIS OF GROWTH PROSPECTS)

- 6.1 Data Center Size

- 6.1.1 Large

- 6.1.2 Massive

- 6.1.3 Medium

- 6.1.4 Mega

- 6.1.5 Small

- 6.2 Tier Type

- 6.2.1 Tier 1 and 2

- 6.2.2 Tier 3

- 6.2.3 Tier 4

- 6.3 Absorption

- 6.3.1 Non-Utilized

- 6.3.2 Utilized

- 6.3.2.1 By Colocation Type

- 6.3.2.1.1 Hyperscale

- 6.3.2.1.2 Retail

- 6.3.2.1.3 Wholesale

- 6.3.2.2 By End User

- 6.3.2.2.1 BFSI

- 6.3.2.2.2 Cloud

- 6.3.2.2.3 E-Commerce

- 6.3.2.2.4 Government

- 6.3.2.2.5 Manufacturing

- 6.3.2.2.6 Media & Entertainment

- 6.3.2.2.7 Telecom

- 6.3.2.2.8 Other End User

- 6.4 Country

- 6.4.1 Israel

- 6.4.2 Saudi Arabia

- 6.4.3 United Arab Emirates

- 6.4.4 Rest of Middle East

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Landscape

- 7.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.3.1 Bezeq International General Partner Ltd

- 7.3.2 Bynet Data Communications Ltd

- 7.3.3 EdgeConneX Inc.

- 7.3.4 Electronia

- 7.3.5 Etihad Etisalat Company (Mobily)

- 7.3.6 Etisalat

- 7.3.7 Gulf Data Hub

- 7.3.8 HostGee Cloud Hosting Inc.

- 7.3.9 Injazat

- 7.3.10 Khazna Data Center

- 7.3.11 MedOne I.C.-1 (1999) Ltd

- 7.3.12 MEEZA

- 7.4 LIST OF COMPANIES STUDIED

8 KEY STRATEGIC QUESTIONS FOR DATA CENTER CEOS

9 APPENDIX

- 9.1 Global Overview

- 9.1.1 Overview

- 9.1.2 Porter's Five Forces Framework

- 9.1.3 Global Value Chain Analysis

- 9.1.4 Global Market Size and DROs

- 9.2 Sources & References

- 9.3 List of Tables & Figures

- 9.4 Primary Insights

- 9.5 Data Pack

- 9.6 Glossary of Terms