|

市場調查報告書

商品編碼

1690745

5G 設備 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)5G Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

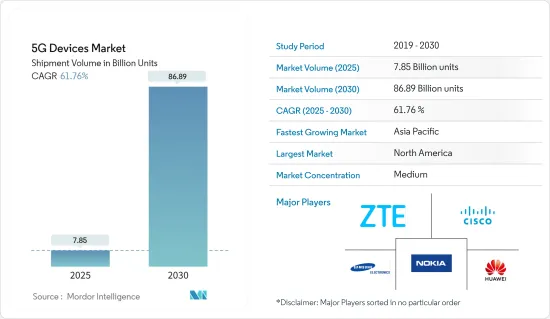

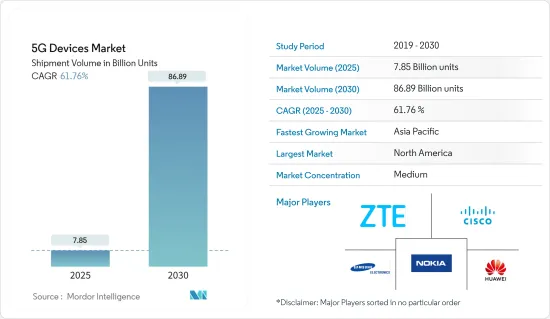

根據出貨量計算,5G 設備市場規模預計將從 2025 年的 78.5 億台擴大到 2030 年的 868.9 億台,預測期間(2025-2030 年)的複合年成長率為 61.76%。

5G技術將提供超高速的網路覆蓋,並藉助物聯網實現許多新應用。新冠疫情也減緩了 5G 的推出。

關鍵亮點

- 根據愛立信消費者實驗室去年的報告,去年 4 月至 7 月期間,他們對 37 個市場的 49,100 名客戶進行了線上訪談。入選訪談的受訪者代表了受訪市場中的 17 億網友和 4.3 億 5G 用戶,年齡從 15 歲到 69 歲不等。研究表明,下一波 5G 浪潮已經到來,早期採用者市場已經看到主流客戶開始接受這項技術。

- 預計連接性、數位應用和穿戴式技術的日益普及將推動 5G 設備市場參與企業的成長。此外,升級現有的支援基礎設施,包括數據機、塔和其他支援基礎設施,對新參與企業來說是一個巨大的機會。 5G技術的採用在全球多個區域市場收到了正面的訊號,因此,5G設備市場的成長預計將帶來巨大的機會。

- 各大晶片製造商也專注於開發5G設備組件,以促進這些設備在市場上的普及。這包括透過推出更多型號以供大眾採用而在大眾市場中競爭的晶片組供應商。去年 5 月,聯發科推出了 Dimensity 1050 mmWave SoC 及相關型號,重點在於突出其設備中的 5G 連接功能。

- 此外,新的用例、經營模式和設備成本下降正在推動物聯網的採用,從而導致全球連網設備和端點的數量增加。 5G 預計將提供海量機器通訊(mMTC),並支援數百億台網路設備的無線連線。現代通訊系統已經支援多種 MTC 應用。然而,mMTC 的大量設備數量和微小有效載荷尺寸需要新的概念和方法。 5G 將實現每平方公里約 100 萬台設備的密度。

- 然而,在許多地區,在全球範圍內運作和安裝支援基礎設施仍然是一個重大障礙。例如,去年9月,國際標準組織3GPP更新了5G規範的下一個版本“Release 17”,該版本發佈於前一年下半年。受疫情等因素影響,去年3月該版本發行暫停。這種延誤會導致公司供應鏈和其他活動的後續延誤。

- 新冠疫情的直接影響已波及各行各業,造成大規模裁員、失業率創歷史新高,並嚴重抑制了消費者支出。新冠肺炎疫情的蔓延導致供應鏈嚴重中斷,短期至中期阻礙了5G建設進程。因此,5G硬體將出現重大延遲,經濟放緩將帶來普遍影響。

5G設備市場趨勢

智慧型手機市場預計將出現最高成長

- 根據愛立信2021年行動報告,全球將推出約650款新型5G智慧型手機,佔所有5G機型的50%。智慧型手機提供的手持無線外形和 5G 存取的便利性幾乎無與倫比。雖然全球多個地區已經開始推出 5G,但其他一些地區仍未推出 5G,它們正準備推出支援 5G 的智慧型手機,以利用即將到來的 5G 服務。

- 預計不斷進步的技術以及對超高頻寬、超低延遲和大規模連接的需求將為市場提供成長機會。此外,預計在預測期內,能源管理和智慧家庭產品等整合物聯網 (IoT) 應用對高速資料連接的需求不斷成長將推動 5G 智慧型手機的普及。

- 為了跟上競爭激烈的市場格局,一些智慧型手機製造商正在根據區域市場反應制定策略發布計劃。去年 8 月,三星新一代 5G折疊式設備在不到 12 小時內的銷售額就達到 60 億印度盧比,隨後三星共用在印度市場推出更多智慧型手機。該公司計劃在明年印度推出 5G 之前推出該設備。

- 此外,市場參與企業正專注於為客戶提供高階 5G 智慧型手機體驗。例如,高通去年 5 月發布了驍龍 8 Gen 1 SoC,其時脈速度高達 3.2GHz,可用於旗艦智慧型手機。處理器搭載第四代驍龍X65 5G Modem-RF系統,可達到高達10 Gbps的5G速度。

- 這項市場發展正在推動 5G 智慧型手機市場的發展,吸引買家升級其非 5G 智慧型手機,以獲得最新、最快的全方位智慧型手機體驗。

預計北美將佔很大佔有率

- 該地區的服務供應商已經推出了商用5G服務,重點是行動寬頻。支援所有三個頻段的 5G 設備的推出將使該技術在該地區迅速普及。目前,5G 服務要么與 4G 服務整合,要么在客戶從有 5G 服務的區域移動到沒有 5G 服務的區域時進行 5G 到 4G 的切換。

- 根據愛立信2021年行動報告,2021年從4G到5G的過渡取得了顯著進展,新增5G用戶約6,400萬。預計今年底5G用戶數將達2.5億,到2027年將達4億,佔行動用戶的90%。

- 同樣,北美的固定無線接入 (FWA) 用戶數量成長最快,接受調查的服務供應商中近 60% 提供 FWA。此類區域性推出將有助於為5G部署提供基礎設施支持,涵蓋北美最大的新增用戶區域。

- 最近已推出多款產品,實現了全部區域的5G 連線。諾基亞去年 9 月宣布,正在擴大其工業用戶設備組合,以促進北美私人無線網路連接。其全新諾基亞 5G 工業現場路由器和加密狗、無線存取頻譜功能和諾基亞連接營運儀表板為部署和管理安全可靠的私人 4G/LTE 和 5G 無線提供了更多選擇。諾基亞的 5G 現場路由器和 5G 加密狗可部署在美國和加拿大的公民寬頻無線電服務 (CBRS) 3.5GHz 頻段。

5G設備產業概況

5G 設備市場競爭適中,由許多全球和地區參與企業組成。這些參與企業擁有相當大的市場佔有率,並致力於擴大基本客群。供應商專注於研發投資,以推出新的解決方案、策略夥伴關係和其他有機和無機成長策略,從而獲得競爭優勢。

- 2022 年 9 月 - HMD Global 在德國柏林舉行的 IFA 2022 上推出了擁有約 11 個 5G頻寬的全新 5G 智慧型手機諾基亞 X30,以及其他幾款諾基亞產品。

- 2022 年 8 月 - 巴帝電信 (Airtel) 宣布已與愛立信、諾基亞和三星簽署 5G 網路契約,將於 2022 年 8 月開始推出 5G。與三星的合作將於 2022 年開始,與現有合作夥伴諾基亞和愛立信一起提供 5G 裝置和解決方案。此次 5G夥伴關係是在印度電訊部舉辦的頻譜競標中,Airtel競標並獲得 900 MHz、1,800 MHz、2,100 MHz、3,300 MHz 和 26 GHz 的 19,867.8 MHZ 頻譜之後建立的。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 市場定義和範圍

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業相關人員分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 如何影響 5G 格局

第5章市場動態

- 市場促進因素

- 全球設備和端點數量持續成長

- 組件和設備層面的技術創新推動採用

- 智慧型手機使用量的增加和智慧型手機技術的不斷進步預計將推動市場

- 市場限制

- 缺乏監管和標準化

- 設計和營運挑戰

- 市場機會

- 工業部門的需求預計將增加

- 繼續努力在新興國家引入5G

- 5G時間表和5G設備的採用

- 5G及未來

- 主要行業法規政策

第6章 技術簡介

第7章 5G市場現狀

- 全球通訊業者數量 - 試驗和商業發布細分(2018 年第二季 - 第一季)

- 5G部署的國家覆蓋範圍—投資和商業化趨勢

- 總行動通訊基地台回程傳輸、宏蜂窩基地台和小型基地台基地台回程傳輸利用率(微波、衛星和 6 GHz 以下)

- 市場展望

第8章市場區隔

- 外形尺寸

- 模組

- CPE(室內/室外)

- 智慧型手機

- 熱點

- 筆記型電腦

- 工業級 CPE/路由器/閘道器

- 其他外形尺寸

- 頻譜支持

- 低於 6 GHz

- 毫米波

- 兩個頻譜帶

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第9章競爭格局

- 公司簡介

- ZTE Corporation

- Cisco Systems Inc

- Nokia Corporation

- Huawei Technologies Co. Ltd

- Samsung Electronics Co. Ltd

- Xiaomi Corporation

- Motorola Mobility LLC(Lenovo Group Limited)

- BBK Electronics Corporation

- Keysight Technologies Inc.

第10章投資分析

第11章 市場機會與未來趨勢

The 5G Devices Market size in terms of shipment volume is expected to grow from 7.85 billion units in 2025 to 86.89 billion units by 2030, at a CAGR of 61.76% during the forecast period (2025-2030).

5G technology will offer ultra-high-speed network coverage and enable numerous new applications with the help of IoT. Also, the COVID-19 pandemic has delayed the widespread deployment of 5G.

Key Highlights

- According to the last year's Ericsson ConsumerLab report, Online interviews were conducted with 49,100 customers in 37 markets between April and July last year. The respondents chosen for the interview represent the surveyed markets' online population of 1.7 billion customers and 430 million 5G users, who range in age from 15 to 69. According to studies, the next wave of 5G is already in motion, with mainstream customers starting to accept the technology in early adopter markets.

- The growing adoption of connectivity, digital applications, and wearable technology is expected to drive growth for players in the 5G devices market. Moreover, upgrading existing supporting infrastructure, including modems, towers, and other supporting infrastructure, will present significant opportunities for new players. The 5G devices market's growth is expected to drive significant opportunities as the adoption of 5G technology has received positive signals in several local markets worldwide.

- Major chip makers also focus on 5G device component development to boost device penetration in the market. This includes chipset vendors competing in volume-driven markets as they introduce more models for mass deployments. In May last year, MediaTek launched Dimensity 1050 mmWave SoC, and related models, to highlight 5G connectivity in devices.

- Also, emerging applications, business models, and falling device costs have driven IoT adoption, increasing the number of connected devices and endpoints globally. 5G offers massive machine-type communication (mMTC), poised to support tens of billions of network-enabled devices to be wirelessly connected. Modern communication systems already serve several MTC applications. However, the characteristic properties of mMTC, i.e., the massive number of devices and the tiny payload sizes, require novel concepts and approaches. 5G allows a density of approximately one million devices per square kilometer.

- However, the global operation and installation of the supportive infrastructure continue to be a significant hurdle in many areas. For instance, in September last year, the international standardization body, 3GPP, updated the next release of the 5G specification, Release 17, for the second half of the previous year. The release was frozen in March last year due to the pandemic and other reasons. Such delays create subsequent delays in companies' supply chains and other operational activities.

- The COVID-19 pandemic's immediate effects have been felt in every industry, causing widespread layoffs, record unemployment, and severely curtailing consumer spending. The spread of COVID-19 resulted in a significant supply chain disruption impeding the 5G buildout process in the short & medium term. The critical 5G hardware delays and general effects of the economic slowdown thus apply.

5G Devices Market Trends

Smartphone Segment is Expected to Witness the Highest Growth

- According to the Ericsson Mobility Report 2021, around 650 new 5G smartphones have been launched globally, accounting for 50% of all the 5G from all form factors. The handheld wireless form factor and convenience of 5G access offered by smartphones are nearly unmatched. As several parts of the world have already begun rolling out 5G, some untouched regions are preparing to receive 5G-enabled smartphone launches to leverage the upcoming 5G launch.

- The increasing technological advancements and growing demand for ultra-high bandwidth, ultra-low latency, and massive connectivity are expected to offer growth opportunities to the market. Moreover, the rising demand for high-speed data connectivity for integrated IoT (Internet of Things) applications, such as energy management and smart home products, is anticipated to propel the adoption of 5G smartphones over the forecast period.

- Several smartphone manufacturers adapt and plan strategic launches according to the local market responses to compete in the highly competitive landscapes. In August last year, Samsung shared plans to launch more smartphones in the Indian market after recording sales of INR 600 crore in less than 12 hours for its new generation 5G-enabled foldable devices. The company would launch the devices ahead of the 5G roll-out in India in the previous year.

- Further, the market players focus on providing customers with a high-end 5G smartphone experience. For instance, in May last year, Qualcomm launched Snapdragon 8 Gen 1 SoC, with clock speeds up to 3.2 GHz for major smartphone implementation. The processor features the fourth-generation Snapdragon X65 5G Modem-RF System, bringing 5G speeds of up to 10 Gbps.

- Such developments attract buyers to upgrade their non-5G smartphones to get the latest and fastest, all-around experience in their smartphone, driving the 5G smartphone market.

North America Expected to Hold a Significant Share

- Service providers in the region have already launched commercial 5G services focused on mobile broadband. The introduction of 5G devices that support all three spectrum bands will enable early adoption of the technology in the region. As of now, 5G services are integrated with 4G services or with hand-off from 5G to 4G when a customer moves from an area where 5G service is available to one where it is not.

- According to the Ericson Mobility Report 2021, around 64 million 5G subscriptions were added in 2021 as migration from 4G to 5G subscriptions picked up significantly. The number of 5G subscriptions is expected to reach 250 million at the end of the current year and 400 million by 2027, accounting for 90 percent of mobile subscriptions.

- Similarly, the report also mentioned North America registering the strongest increase in the number of fixed wireless access (FWA), with about 60% of all service providers surveyed offering FWA. Such regional launches boost the infrastructural support for the 5G roll-out, reaching maximum areas in North America for new users.

- Multiple product launches have enabled 5G connectivity across the region recently. In September last year, Nokia announced extending its Industrial portfolio of user equipment to facilitate private wireless network connectivity in North America. Its new Nokia 5G Industrial fieldrouter and dongle, radio access spectrum capabilities, and Nokia Connectivity Operations Dashboard would provide more options for deploying and managing secure, reliable private 4G/LTE and 5G wireless. The Nokia 5G fieldrouter and 5G dongle could be deployed in the US and Canada Citizen Broadband Radio Service (CBRS) 3.5 GHz spectrum.

5G Devices Industry Overview

The 5G devices market is moderately competitive and consists of many global and regional players. These players account for a considerable market share and focus on expanding their customer base. The vendors focus on the research and development investment in introducing new solutions, strategic partnerships, and other organic & inorganic growth strategies to earn a competitive edge over their counterparts.

- September 2022 - HMD Global launched the new Nokia X30 5G smartphone and a few more Nokia products at IFA 2022 in Berlin, Germany, featuring around eleven 5G bands.

- August 2022 - Bharti Airtel (Airtel) announced signing 5G network agreements with Ericsson, Nokia, and Samsung to commence 5G deployment in August 2022. The partnership with Samsung to supply 5G equipment and solutions would begin in 2022, along with the older partners, Nokia and Ericsson. The 5G partnerships would follow closely on the edge of spectrum auctions conducted by the Department of Telecom in India, where Airtel bid for and acquired 19867.8 MHZ spectrum in 900 MHz, 1800 MHz, 2100 MHz, 3300 MHz, and 26 GHz frequencies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Scope

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the 5G Landscape

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Sustained Increase in Number of Devices and Endpoints Worldwide

- 5.1.2 Technological Innovations at a Component and Device Level to Aid Adoption

- 5.1.3 Increasing use of Smart Phones and rising Technological advancement in the smart phones is expected to drive market.

- 5.2 Market Restraints

- 5.2.1 Regulatory and Standardization Delays

- 5.2.2 Design and Operational Challenges

- 5.3 Market Opportunities

- 5.3.1 Anticipated Rise in Demand from the Industrial Sector

- 5.3.2 Ongoing Efforts toward Introduction of 5G in Emerging Countries

- 5.4 5G Timeline and proliferation 5G enabled devices

- 5.5 5G and Beyond - The Path Ahead

- 5.6 Key Industry Regulations and Policies

6 TECHNOLOGY SNAPSHOT

7 5G ADOPTION MARKET LANDSCAPE

- 7.1 Number of Operators Worldwide - Breakdown by Trials and Commercial Launches (Q2'18 - Q1'20)

- 7.2 Country-level coverage on 5G Adoption - Investment and Commercialization Trends

- 7.3 Total Cell-site Backhaul, Macro, and Small Cell-site Backhaul Usage - In Percentage (Microwave, Satellite, Sub-6 GHz)

- 7.4 Market Outlook

8 MARKET SEGMENTATION

- 8.1 Form Factor

- 8.1.1 Modules

- 8.1.2 CPE (Indoor/Outdoor)

- 8.1.3 Smartphone

- 8.1.4 Hotspots

- 8.1.5 Laptops

- 8.1.6 Industrial Grade CPE/Router/Gateway

- 8.1.7 Other Form Factors

- 8.2 Spectrum Support

- 8.2.1 Sub-6 GHz

- 8.2.2 mmWave

- 8.2.3 Both Spectrum Bands

- 8.3 Geography

- 8.3.1 North America

- 8.3.1.1 United States

- 8.3.1.2 Canada

- 8.3.2 Europe

- 8.3.2.1 Germany

- 8.3.2.2 UK

- 8.3.2.3 France

- 8.3.2.4 Spain

- 8.3.2.5 Rest of Europe

- 8.3.3 Asia-Pacific

- 8.3.3.1 China

- 8.3.3.2 Japan

- 8.3.3.3 India

- 8.3.3.4 Australia

- 8.3.3.5 Rest of Asia-Pacific

- 8.3.4 Latin America

- 8.3.4.1 Brazil

- 8.3.4.2 Mexico

- 8.3.4.3 Argentina

- 8.3.4.4 Rest of Latin America

- 8.3.5 Middle East and Africa

- 8.3.5.1 UAE

- 8.3.5.2 Saudi Arabia

- 8.3.5.3 South Africa

- 8.3.5.4 Rest of Middle East and Africa

- 8.3.1 North America

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 ZTE Corporation

- 9.1.2 Cisco Systems Inc

- 9.1.3 Nokia Corporation

- 9.1.4 Huawei Technologies Co. Ltd

- 9.1.5 Samsung Electronics Co. Ltd

- 9.1.6 Xiaomi Corporation

- 9.1.7 Motorola Mobility LLC (Lenovo Group Limited)

- 9.1.8 BBK Electronics Corporation

- 9.1.9 Keysight Technologies Inc.