|

市場調查報告書

商品編碼

1690731

真空斷路器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Vacuum Interrupter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

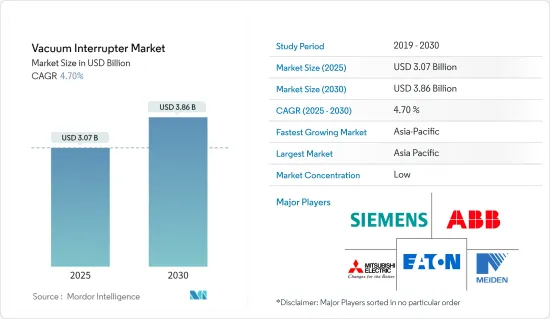

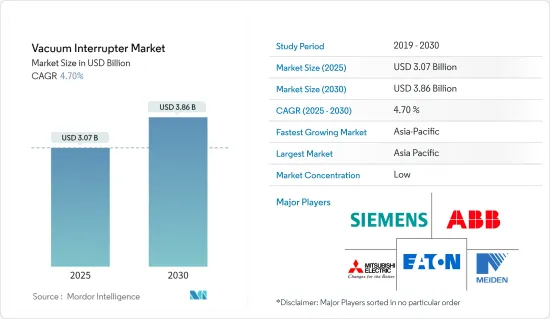

真空斷路器市場規模預計在 2025 年為 30.7 億美元,預計到 2030 年將達到 38.6 億美元,預測期內(2025-2030 年)的複合年成長率為 4.7%。

主要亮點

- 對安全配電的需求不斷增加,導致老化基礎設施的升級,從而推動了真空斷路器市場的需求。技術進步也推動了現有基礎設施的現代化,已開發國家和新興國家都投入大量資金升級基礎設施以滿足日益成長的電力需求。此外,能源領域的環境問題和永續性法規進一步推動了市場成長。

- 真空斷路器環保,採用優質材料製成,在維護和處置過程中可以安全處理。然而,真空斷路器的製造需要先進的技術,這阻礙了市場的成長。運輸過程中的損壞或故障可能導致真空損失,導致斷路器失效且無法在現場修復。此外,高壓應用真空斷路器的高成本進一步限制了市場的成長。

- 儘管面臨這些挑戰,但新冠疫情作為工業4.0發展的催化劑,推動了真空斷路器的技術創新,高效改善了能源消耗。全球領先的供應商正在創新其產品以滿足日益成長的真空斷路器需求,電力經銷商也在其網站上展示這些新產品。

真空斷路器市場趨勢

智慧電網基礎設施的成長將推動市場

- 在許多國家,電力基礎設施正在老化,需要比最初設計的性能更好。全球發電和輸電產業正在進行電網現代化改造,利用先進的技術、設備和控制手段使電網更加智慧、更具彈性。智慧電網能夠通訊和協同工作,以更有效率、更可靠地輸送電力。這些電網可以顯著減少停電持續時間和頻率,減輕風暴的影響,並在停電時快速恢復服務。

- 例如,美國能源局幾年前推出了電網現代化舉措(GMI)。這是塑造美國電網基礎設施未來的全面努力。

- 全球各地的已開發國家和新興國家政府擴大將智慧電網技術視為一項戰略基礎設施投資,以促進永續的長期經濟繁榮並有助於實現碳排放目標。預計這一趨勢將在不久的將來為參與智慧電網市場的公司創造商機。

- 真空中斷技術可以實現更好的控制,因為它可用於重複切換、故障保護、過流和短路保護。這種控制是自動化的,從而提高了效率。

- 此外,隨著越來越多的再生能源來源和分散式能源來源被納入智慧電網,監測和計量對於平衡供需至關重要。真空斷路器產業依賴關鍵基礎設施的擴建和電網自動化程度的提高。因此,智慧電網有望推動市場成長。

- 此外,美國能源局於 2022 年 9 月宣布了一項 105 億美元的智慧電網和其他升級計劃,以加強該國的電網。電網復原資金將以補助的形式提供,用於支持電網現代化活動,減少極端天氣和自然災害的影響。

亞太地區成長迅速

- 亞太地區的發電廠安裝計劃成長強勁,尤其是印度、日本和中國等主要國家。然而,該地區的許多公用事業公司在獲取新方法鋪設電力線路方面面臨挑戰,尤其是在都市區。

- 必須安裝新的負載開關設備來最佳化電力容量並實現可再生能源的整合,但氣體絕緣類型由於其使用壽命長、開關設備系統尺寸小而越來越受歡迎。隨著該地區各國重點關注大型可再生能源計劃,預計氣體絕緣類型將在各種類型的斷路器開關中變得更加流行。

- 例如,菲律賓近期根據第三輪公開競爭選擇程序(OCSP3)開放了可再生能源計劃申請,允許外資100%參與大型地熱探勘、開發和利用計劃。同樣,根據印尼國家電力公司 PLN 的電力供應產業計畫草案(RUPTL),印尼計劃在 2021 年至 2030 年期間將使用可再生能源的新建發電廠的比例從 30% 提高到 48%。

- 隨著該地區轉型的進展,智慧電網藍圖預計將變得更加普遍,同時分散式發電和公共產業IT 和分析市場的支出也將增加。印度有幾個農村地區無法獲得穩定的電力供應,最近的電氣化舉措預計將更加專注於向這些地區供電,從而增加對電路斷流器開關的需求。

- 此外,電力公司被迫將電網接入部署到偏遠地區,這是一個重大挑戰,因為他們沒有人力在停電期間訪問這些地方來打開斷路器開關或保險絲開關。遠端發電工程也促進了斷路器市場的成長。

真空斷路器產業概況

真空斷路器市場競爭激烈,已有老字型大小企業對其產品進行了大規模投資。進入市場的新玩家需要大量投資才能保持競爭優勢。強大的競爭策略將使公司能夠保持在市場中的地位。市場的主要企業包括伊頓公司、明電舍株式會社、三菱電機株式會社、西門子股份公司、ABB 和陝西寶光真空電氣設備有限公司。這些公司也採取了多種擴大策略來獲得競爭優勢。

2023年2月,武漢菲特電器為海外客戶生產的15.5KV、630A、31.5KA真空斷路器及自動複閉器順利通過荷蘭KEMA實驗室型式試驗。 5.5KV、630A、31.5KA是菲特的另一款真空斷路器,已通過國際知名實驗室的測試。測試標準為IEC 62271-111:2019/IEEE Std C37.60:2018標準。這樣的認證將保持客戶對公司產品的信心。

2023 年 2 月,ABB 在 2023 年 ELECRAMA 上推出了 ConVac Hoover Contractor,展示其電氣化和運動業務的創新。為確保電力傳輸的安全、智慧和永續性,ABB電氣業務提供從電線杆到插座的全套電氣設備、技術解決方案和服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 智慧電網基礎設施的成長

- 加強現有基礎設施的現代化和升級

- 市場限制/挑戰

- 高壓成本過高

第6章 市場細分

- 按應用

- 電路斷流器

- 接觸器

- 重合器

- 負荷開關

- 其他用途

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

第7章 競爭格局

- 公司簡介

- Eaton Corporation PLC

- Meidensha Corporation

- Mitsubishi Electric Corporation

- Siemens AG

- ABB Ltd

- Wuhan Feite Electric Co. Ltd

- Toshiba Corporation

- Shaanxi Joyelectric International Co. Ltd

- Kirloskar Electric Company Ltd

- Zhejiang Xuhong Vacuum Electricappiliance Co. Ltd

第8章 市場機會與未來趨勢

The Vacuum Interrupter Market size is estimated at USD 3.07 billion in 2025, and is expected to reach USD 3.86 billion by 2030, at a CAGR of 4.7% during the forecast period (2025-2030).

Key Highlights

- The increasing demand for safe and secure electrical distribution has led to the upgradation of outdated infrastructure, boosting the market demand for vacuum interrupters. Modernization work is also increasing in existing infrastructure due to technological advancements, with both developed and developing countries investing heavily in infrastructure upgrades to meet rising electricity demands. Additionally, environmental concerns and sustainability regulations in the energy sector are further driving the market growth.

- Vacuum interrupters are highly environmentally friendly, comprised of benign materials, and safe to handle during maintenance and disposal. However, the production of vacuum interrupters requires high technology, hindering the market growth. Transit damage or failure can cause a loss of vacuum, rendering the interrupter useless and impossible to repair on-site. Moreover, the high cost of vacuum interrupters for high-voltage applications further limits the market growth.

- Despite these challenges, the COVID-19 pandemic acting as a catalyst for Industry 4.0 developments led to innovations in vacuum interrupters, improving energy consumption with high-efficiency levels. Major global vendors are innovating their products, and electrical distributors are showcasing these new products on their websites to meet the growing need for vacuum interrupters.

Vacuum Interrupter Market Trends

Growth of Smart Electricity Grid Infrastructure to Drive the Market

- In many countries, electric infrastructure is aging, and it is being pushed to do more than it was originally designed for. Globally, the power generation and transmission sectors are witnessing a trend of modernizing the grid to make it smarter and more resilient using advanced technologies, equipment, and controls. Smart grids are able to communicate and work together to deliver electricity more efficiently and reliably. These grids can vastly reduce the duration and frequency of power outages, reduce storm impacts, and restore service at a faster rate when outages occur.

- For instance, the United States Department of Energy launched the Grid Modernization Initiative (GMI) a few years back. It is a comprehensive effort to help shape the future of the US grid infrastructure.

- Governments of both developed and emerging countries across the world are increasingly seeing smart grid technology as a strategic infrastructural investment that will enable sustainable long-term economic prosperity and aid them in achieving carbon emission reduction targets. This trend is expected to provide opportunities to the companies involved in the smart grid network market in the near future.

- Vacuum interrupter technology is used for repetitive switching, fault protection, overcurrent, and short-circuit protection; hence, it allows greater control. Such controls are automated for greater efficiency.

- Moreover, as more renewable and distributed energy sources are integrated into smart grids, monitoring and measurement become essential to balancing supply and demand. The vacuum interrupter industry depends on the extension of crucial infrastructures and the increase in grid automation. Therefore, smart grids are expected to drive market growth.

- Moreover, in September 2022, the US Department of Energy announced a USD 10.5 billion program for smart grids and other upgrades to strengthen the country's electricity grid. The grid resilience funding will be in the form of grants to support activities to modernize the grid to reduce the impacts due to extreme weather and natural disasters.

Asia-Pacific to Witness Significant Growth

- The Asia-Pacific region has experienced significant growth in power plant installation projects, particularly in major countries such as India, Japan, and China. However, many utilities in the region are facing challenges in acquiring new ways to install transmission lines, especially within urban areas.

- To optimize power capacity and enable the integration of renewable energy, new load break switches need to be installed, with the gas-insulated type gaining popularity due to its longer life cycles and smaller size of the switchgear system. As countries in the region focus on large-scale renewable energy projects, the gas-insulated type is expected to grow in popularity among the different types of circuit breaker switches.

- For example, the Philippines recently opened applications for renewable energy projects under the third Open and Competitive Selection Process (OCSP3), allowing for 100% foreign participation in large-scale geothermal exploration, development, and utilization projects. Similarly, Indonesia plans to increase the portion of new and renewable energy-based power plants from 30% to 48% within 2021-2030, according to a draft electric power supply business plan (RUPTL) of the state electricity company (PLN).

- As the region's transformation continues, smart grid roadmaps are expected to become more popular, along with increased spending in distributed generation and utility IT and analytics markets. The presence of several rural areas in India without a stable power supply and recent electrification initiatives are expected to increase the emphasis on providing power to these areas, contributing to the demand for circuit breaker switches.

- In addition, utilities face pressure to deploy remote grid access as a major agenda, as they cannot afford personnel to visit remote sites to open circuit break switches and fuse switches during outages. Remote power generation projects also contribute to the growth of the circuit switch markets.

Vacuum Interrupter Industry Overview

The vacuum interrupter market is highly competitive, with well-established players who have invested significantly in the product. New players entering the market require high investments to compete. Companies can sustain their position in the market through powerful competitive strategies. Some of the leading companies in the market include Eaton Corporation PLC, Meidensha Corporation, Mitsubishi Electric Corporation, Siemens AG, ABB, Shaanxi Baoguang Vacuum Electric Device Co., Ltd., and many others. These companies are also involved in several expansion strategies to gain a competitive advantage.

In February 2023, the 15.5 KV, 630 A, 31.5 KA vacuum interrupter produced by Wuhan Feite Electric Co. Ltd with the automatic recloser of overseas customers passed the type test in KEMA Laboratories in the Netherlands. 5.5 KV, 630 A, 31.5 KA is another vacuum interrupter from Feite company that has passed the test in the famous international laboratory. The test standard is IEC 62271-111: 2019/IEEE Std C37.60:2018 standard. Such type of certification would maintain the customer's trust in the company's products.

In February 2023, ABB introduced the ConVac Hoover Contractor at ELECRAMA 2023, showcasing innovations from its Electrification and Motion businesses. In order to ensure the safety, intelligence, and sustainability of electricity transmission, ABB's Electrification will offer a wide range of electrical equipment, technology solutions, and services ranging from poles to sockets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes of Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Smart Electricity Grid Infrastructure

- 5.1.2 Increasing Modernization and Upgrading of Existing Infrastructure

- 5.2 Market Restraint/Challenge

- 5.2.1 Excessive Cost at Higher Voltage

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Circuit Breaker

- 6.1.2 Contactor

- 6.1.3 Recloser

- 6.1.4 Load Break Switch

- 6.1.5 Other Applications

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia Pacific

- 6.2.4 Middle East and Africa

- 6.2.5 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Eaton Corporation PLC

- 7.1.2 Meidensha Corporation

- 7.1.3 Mitsubishi Electric Corporation

- 7.1.4 Siemens AG

- 7.1.5 ABB Ltd

- 7.1.6 Wuhan Feite Electric Co. Ltd

- 7.1.7 Toshiba Corporation

- 7.1.8 Shaanxi Joyelectric International Co. Ltd

- 7.1.9 Kirloskar Electric Company Ltd

- 7.1.10 Zhejiang Xuhong Vacuum Electricappiliance Co. Ltd