|

市場調查報告書

商品編碼

1690724

印度零售燃料:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)India Retail Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

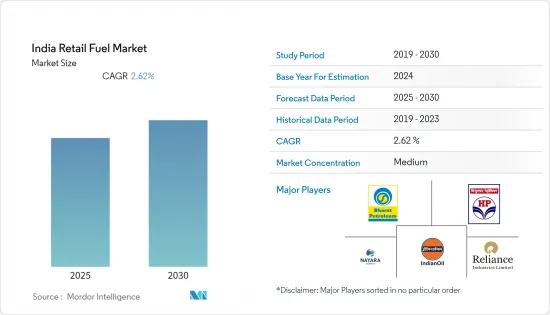

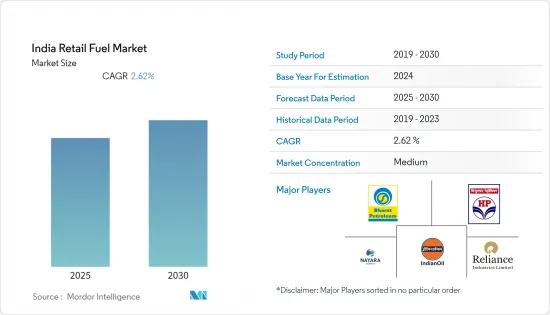

預計預測期內印度零售燃料市場的複合年成長率將達到 2.62%。

從中期來看,預計政府的支持措施和不斷成長的燃料需求將在預測期內推動市場發展。

然而,預計原油價格波動加劇將阻礙預測期內的市場成長。

燃料分銷網路的擴張預計將為印度零售燃料市場創造重大機會。

印度零售燃料市場趨勢

公共業務部門預計將佔據市場主導地位

- 印度石油公司(IOC)、巴拉特石油有限公司(BPCL)和印度斯坦石油有限公司(HPCL)等石油和天然氣領域的公共部門企業(PSU)歷史悠久,在市場上佔有重要地位。政府擁有這些石油公司並對該行業享有相當大的控制權。

- 國有企業擁有完善的基礎設施網路,包括加油站、管道、終端和倉儲設施。國有企業正在將燃料配送到更廣泛的地區,特別是偏遠和農村地區,使全國各地的消費者更容易獲得燃料。

- 2023年2月,國營精製和零售商印度石油有限公司(IOCL)宣布,計劃在2023會計年度向西孟加拉邦投資2,544萬美元。該公司表示,這項投資將用於擴大和開發更環保的零售燃料基礎設施。截至 2022 年,環保汽車燃料已在全國 275 家零售店有售,但該公司計劃在 2024 年底將這一數量增加到 1,000 多家。

- 此外,國有企業通常能夠透過政府措施控制燃料價格。這使我們能夠保持有競爭力的價格並穩定燃料成本,為消費者提供穩定性。

- 據印度石油天然氣部稱,2022 年 4 月至 2023 年 4 月期間,印度石油產品總消費量增加了 6% 以上。其中很大一部分歸功於國營企業零售商。

- 此外,PSU 在市場上贏得了可靠性、安全性和品質的聲譽。國有企業長期存在以及政府的支持增強了消費者的信心,這可能會影響他們對燃料供應商的選擇。

- 因此,鑑於上述情況,PSU 很可能在預測期內佔據市場主導地位。

汽車保有量的增加可能促進市場成長

- 印度道路上行駛的車輛數量的增加是零售燃料市場的主要驅動力。可支配收入的增加和都市化導致汽車持有激增,從而導致燃料需求增加。

- 路上的汽車越多,燃料需求就越大。隨著汽車保有量的增加,汽油和柴油等零售燃料的消費量也增加。這將轉化為燃料零售商銷售的增加,從而推動市場成長。

- 車輛保有量的增加直接意味著燃料零售商的商機增加。路上的汽車越多,代表人們去加油站的次數越多,增加了零售燃料市場的銷售和收益。

- 根據印度汽車工業協會預測,2021-2022年印度汽車銷售量將成長20%以上,銷售量將增加。

- 此外,BMW在 2023 年 5 月宣布,準備在不久的將來將 X3 M40i 引入印度,有興趣的客戶現在就可以預訂這款高性能 SUV。 X3 M40i 將配備與 BMW M340i 相同的動力傳動系統,包括 3.0 升六缸渦輪汽油引擎。

- 因此,如上所述,預計在預測期內,汽車銷售的成長將主導市場。

印度零售燃料產業概況

印度零售燃料市場適度整合。該市場的主要企業(不分先後順序)包括印度石油有限公司、巴拉特石油公司、印度斯坦石油有限公司、納亞拉能源有限公司和信實工業有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 至2028年的市場規模及需求預測(單位:千噸)

- 印度各公司零售店數量(2013-2022 年)

- 印度各邦和各公司的零售店數量(2022 年)

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 汽車持有增加

- 政府舉措

- 限制因素

- 油價波動

- 驅動程式

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 擁有者

- 公部門

- 私部門

- 最終用戶

- 公共部門

- 私部門

第6章競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Indian Oil Corporation Ltd

- Bharat Petroleum Corp. Ltd

- Hindustan Petroleum Corporation Limited

- Nayara Energy Limited

- Reliance Industries Limited

- Shell PLC

- TotalEnergies SA

第7章 市場機會與未來趨勢

- 擴大分銷網路

The India Retail Fuel Market is expected to register a CAGR of 2.62% during the forecast period.

Over the medium term, supportive government policies and increasing demand for fuels are expected to drive the market during the forecasted period.

On the other hand, the increasing fluctuations in crude oil prices are expected to hinder the market's growth during the forecasted period.

Nevertheless, the increasing fuel distribution network is expected to create huge opportunities for the India retail fuel market.

India Retail Fuel Market Trends

The Public Sector Undertakings Segment is Expected to Dominate the Market

- Public Sector Undertakings (PSUs) in the oil and gas sector, such as Indian Oil Corporation (IOC), Bharat Petroleum Corporation Limited (BPCL), and Hindustan Petroleum Corporation Limited (HPCL), have long been established and have a strong presence in the market. The government owns these PSUs and enjoys significant control over the sector.

- PSUs have a well-developed infrastructure network, including fuel stations, pipelines, terminals, and storage facilities. They have a wider reach, especially in remote and rural areas, ensuring better availability of retail fuel to consumers across the country.

- In February 2023, Indian Oil Corporation Limited (IOCL), a state-owned refiner and oil retailer, announced that the company plans to invest USD 25.44 million in FY2023 in West Bengal. The company announced that the investment was made to expand and develop the infrastructure for greener retail fuels. As of 2022, the green auto fuel is available at 275 retail outlets across the country, but the company plans to increase the number to more than 1,000 by the end of 2024.

- Furthermore, PSUs often have more control over fuel pricing, as government policies guide them. This allows them to maintain competitive pricing and stabilize fuel costs, offering stability to consumers.

- According to the Ministry of Petroleum and Natural Gas, India, the total consumption of petroleum products in India increased by more than 6% between April 2022 and April 2023. The majority of these shares were from PSU retail outlets.

- Additionally, PSUs have built a reputation for reliability, safety, and quality in the market. Their long-standing presence and government backing instill a sense of trust among consumers, which can influence their choice of fuel provider.

- Therefore, as per the above points, PSUs will likely dominate the market studied during the forecasted period.

Rise in Car Penetration May Help the Market Grow

- The increasing number of vehicles on Indian roads is a significant driving factor for the retail fuel market. Rising disposable incomes and urbanization have led to a surge in vehicle ownership, leading to higher fuel demand.

- More cars on the road mean a higher demand for fuel. As the number of car owners increases, there is a corresponding increase in the consumption of retail fuels such as gasoline and diesel. This leads to greater sales volume for fuel retailers, driving the market growth.

- The growth in car penetration directly translates to increased revenue opportunities for fuel retailers. More vehicles on the road mean more frequent visits to fuel stations, resulting in higher sales and revenue generation for the retail fuel market.

- According to the Society of Indian Automobile Manufacturers, vehicle sales in India increased by more than 20% between 2021 and 2022, signifying increased sales, consequently leading to increased demand for retail fuels in the country.

- Furthermore, in May 2023, BMW announced that it is preparing to introduce the X3 M40i in India in the near future, and interested customers can already book this high-performance SUV. The X3 M40i will feature the same powertrain as the BMW M340i, which consists of a 3.0-liter six-cylinder turbocharged petrol engine.

- Therefore, as per the points discussed above the increase in car sales is expected to dominate the market during the forecasted period.

India Retail Fuel Industry Overview

The India Retail Fuel Market is moderately consolidated. Some of the key players in this market (in no particular order) include Indian Oil Corporation Ltd, Bharat Petroleum Corp. Ltd, Hindustan Petroleum Corporation Limited, Nayara Energy Limited, and Reliance Industries Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in Thousand Tons, till 2028

- 4.3 Company-wise Retail Outlets in India, 2013-2022

- 4.4 State-wise and Company-wise Retail Outlets in India, 2022

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Growing Vehicle Ownership

- 4.7.1.2 Government Initiatives

- 4.7.2 Restraints

- 4.7.2.1 Volatile Crude Oil Prices

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Ownership

- 5.1.1 Public Sector Undertakings

- 5.1.2 Private Owned

- 5.2 End User

- 5.2.1 Public Sector

- 5.2.2 Private Sector

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Indian Oil Corporation Ltd

- 6.3.2 Bharat Petroleum Corp. Ltd

- 6.3.3 Hindustan Petroleum Corporation Limited

- 6.3.4 Nayara Energy Limited

- 6.3.5 Reliance Industries Limited

- 6.3.6 Shell PLC

- 6.3.7 TotalEnergies SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion of Distribution Network