|

市場調查報告書

商品編碼

1690709

彈性地板:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Resilient Flooring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

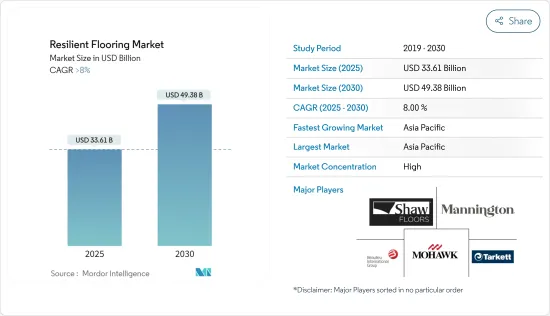

彈性地板市場規模預計在 2025 年為 336.1 億美元,預計到 2030 年將達到 493.8 億美元,預測期內(2025-2030 年)的複合年成長率將超過 8%。

新冠疫情對彈性地板市場產生了不利影響。全國性的封鎖和嚴格的社會疏散措施導致全球住宅和商業建設活動暫停,從而影響了彈性地板市場。然而,新冠疫情過後,限制措施解除後市場已恢復良好。由於全球商業和住宅建設活動的增加,市場強勁反彈。

彈性地板在商業場所的應用日益增多,以及對豪華乙烯基彈性地板的需求不斷增加,預計將推動彈性地板市場的發展。

人們對製造地板對環境的影響以及其他地板產品供應的日益擔憂預計將阻礙市場成長。

預計在預測期內,彈性地板技術的不斷創新將為市場創造機會。

亞太地區佔據最大的市場,由於中國、印度和日本等國家的消費量不斷增加,預計在預測期內將成為成長最快的市場。

彈性地板市場趨勢

住宅領域佔據市場主導地位

- 彈性地板密度高、不吸水,且表面有彈性,行走舒適。此外,彈性地板比其他地板所需的維護更少。因此,住宅對彈性地板的需求正在增加。

- 彈性地板比非彈性地板便宜得多,而且相對耐用,因此對於住宅和商業建築來說是一種相對經濟的選擇。住宅建築地板和製造流程越來越注重客製化,這對住宅建築建設對彈性地板日益成長的需求產生了重大影響。

- 亞太地區和北美是全球住宅最繁忙的兩個地區。在北美,美國和加拿大等國家的住宅建設活動不斷增加,推動了彈性地板市場的發展。根據美國人口普查局的數據,預計 2022 年美國年度住宅建築產值將達到 9,080 億美元,而 2021 年為 8,020 億美元。

- 同樣,在加拿大,新的住宅計劃預計將推動該國彈性地板市場的發展。 2023 年第一季,加拿大住宅量將達到 64,042 套,而 2023 年第一季為 46,851 套。

- 同樣,歐洲的住宅也在興起。德國是該地區最大的住宅市場。受住宅建設活動增加的推動,該國的建築業持續成長。例如,根據歐盟統計局的數據,預計2022年建築業收入將達到1,140億美元,2024年將達到1,254億美元。

- 因此,由於上述因素,預計住宅應用領域將在預測期內主導彈性地板市場。

亞太地區佔市場主導地位

- 預計預測期內亞太地區將主導彈性地板市場。由於中國、日本和印度等新興國家的住宅,對彈性地板的需求不斷成長,加上其在商業領域的應用日益廣泛,預計將推動該地區對彈性地板的需求。

- 中國是該地區最大的建築市場之一。根據中國國家統計局的數據,建築業產值將從 2021 年的 29.3 兆元(4.2 兆美元)成長至 2022 年的 31.2 兆元(4.5 兆美元)。預計到 2030 年,中國的建築業支出將接近 13 兆美元。

- 此外,該國可支配收入的增加也推動了購物中心、飯店和辦公室等豪華商業中心的發展。中國是購物中心建設的領先國家之一。中國目前約有4,000家購物中心,預計到2025年將有7,000家購物中心開幕。此外,武漢佛山東外灘中心T1等辦公空間的建設預計將促進中國市場的開發。預計建設將於 2021 年第三季開始,並於 2025 年第四季完工。

- 同樣,在印度,2023-2024 年預算為二線和三線城市每年分配 12.18 億美元的城市基礎設施發展基金。這將確保城市基礎設施的品質。這也將導致住宅和商業建築的需求增加,從而推動彈性地板市場的發展。

- 根據《世界建築2030》(由全球建築展望和牛津經濟研究院出版)預測,到2030年,東南亞的建築市場規模預計將超過1兆美元,這將推動住宅建築對彈性地板的需求。

- 由於上述因素,預計亞太地區彈性地板市場在研究期間將大幅成長。

彈性地板行業概況

彈性地板市場因其性質而部分整合。市場的主要企業包括(不分先後順序)Beaulieu International Group、Mannington Mills Inc.、Mohawk Industries、Shaw Industries Group Inc. 和 Tarkett。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 擴大彈性地板在商業設施中的使用

- 豪華乙烯基彈性地板需求不斷成長

- 其他促進因素

- 限制因素

- 人們越來越擔心地板生產對環境的影響

- 其他地板產品的供應情況

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 類型

- 乙烯基地板

- 聚氯乙烯(PVC)

- 填充材

- 乙烯基片材和地板

- 橡膠地板

- 油氈地板

- 其他(軟木地板、乙烯基複合地磚等)

- 應用

- 商業的

- 住宅

- 設施

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AWI Licensing LLC

- Ardex Endura

- Beaulieu International Group

- Forbo Flooring Systems

- Gerflor.

- Interface, Inc

- Mannington Mills, Inc.

- Milliken & Company

- Mohawk Industries

- Nora

- Polyflor Ltd

- Shaw Industries Group, Inc

- Tarkett

- Unilin

第7章 市場機會與未來趨勢

- 彈性地板的創新日益增多

- 其他機會

The Resilient Flooring Market size is estimated at USD 33.61 billion in 2025, and is expected to reach USD 49.38 billion by 2030, at a CAGR of greater than 8% during the forecast period (2025-2030).

The COVID-19 pandemic had negatively impacted the resilient flooring market. The nationwide lockdowns and strict social distancing measures had resulted in a halt in residential and commercial construction activities across the globe, thereby affecting the market for resilient flooring. However, post-COVID pandemic, the market recovered well after the restrictions were lifted. The market recovered significantly, owing to the increasing commercial and residential construction activities across the world.

The increasing application of resilient flooring at commercial places and the increasing demand for luxury vinyl resilient flooring are expected to drive the market for resilient flooring.

The increasing concern over environmental impact during the manufacturing of flooring materials and the availability of other flooring products are expected to hinder the market's growth.

The increasing innovations in resilient flooring are expected to create opportunities for the market during the forecast period.

The Asia-Pacific region represents the largest market and is also expected to be the fastest-growing market over the forecast period, owing to the increasing consumption from countries such as China, India, and Japan.

Resilient Flooring Market Trends

Residential Application Segment to Dominate the Market

- The resilient flooring system is denser and non-absorbent and ensures a pliant surface that makes walking comfortable. Additionally, resilient flooring also ensures less maintenance than other flooring. Thus, the demand for resilient flooring is increasing in residential buildings.

- Resilient flooring is a lot cheaper than non-resilient, and its comparably durable nature makes it a relatively cost-effective option for residential homes and commercial buildings. The increasing focus on customization in the flooring of residential buildings and manufacturing processes had a significant impact on the growing demand for resilient flooring from residential building construction.

- The Asia-Pacific and North America are the most significant regions for residential construction globally. In North America, residential construction activities are increasing in countries like the United States and Canada, which are driving the market for resilient flooring. According to the US Census Bureau, the annual value of residential construction output in the United States was valued at USD 908 billion in 2022, compared to USD 802 billion in 2021.

- Similarly, in Canada, new residential construction projects are expected to drive the country's market for resilient flooring. The number of new housing starts in Canada is registered at 64,042 units in Q2, 2023, compared to 46,851 units started in Q1, 2023.

- Similarly, in Europe, residential construction activities are increasing. Germany is the largest market for residential construction in the region. The country's construction industry has been growing and is driven by increasing new residential construction activities. For instance, according to Eurostat, the building construction revenue is registered at USD 114 billion in 2022 and is expected to reach USD 125.4 billion by 2024.

- Hence, owing to the factors mentioned above, the residential application segment is expected to dominate the resilient flooring market during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the resilient flooring market during the forecast period. The rising demand for resilient flooring from residential building construction and growing application in the commercial sector in developing countries like China, Japan, and India is expected to drive the demand for resilient flooring in this region.

- China is one of the largest construction markets in the region. According to the National Bureau of Statistics of China, the value of construction output accounted for CNY 31.2 trillion (USD 4.5 trillion) in 2022, up from CNY 29.3 trillion (USD 4.2 trillion) in 2021. China is expected to spend nearly USD 13 trillion on buildings by 2030.

- Furthermore, the increasing disposable income in the country has triggered the growth of lavish commercial spaces like malls, hotels, offices, etc. China is one of the leading countries in the construction of shopping centers. China has almost 4,000 shopping centers, while 7,000 more are estimated to be open by 2025. Moreover, the construction of office spaces such as Wuhan Fosun Bund Center T1 in China is expected to boost the market studied. Construction work started in Q3 2021 and is forecasted to complete in Q4 2025.

- Similarly, in India, as per the Budget of 2023-2024, a dedicated amount of USD 1,218 million per annum has been allocated through urban infra-development funds for Tier II and Tier III cities. This will result in the creation of quality urban infrastructure. This will also translate to higher demand for housing and commercial construction activities, thereby driving the market for resilient flooring.

- According to Global Construction 2030 (published by Global Construction Perspectives and Oxford Economics), Southeast Asia's construction market is anticipated to exceed USD 1 trillion by 2030, which in turn boosts the demand for resilient flooring in residential building construction.

- Owing to the above-mentioned factors, the market for resilient flooring in the Asia-Pacific region is projected to grow significantly during the study period.

Resilient Flooring Industry Overview

The resilient flooring market is partially consolidated in nature. Some of the major players in the market include (not in any particular order) Beaulieu International Group, Mannington Mills Inc., Mohawk Industries, Shaw Industries Group Inc., and Tarkett.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Application of Resilient Flooring at Commercial Places

- 4.1.2 Increasing Demand for Luxury Vinyl Resilient Flooring

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Increasing Concern Over Environmental Impact During Manufacturing of Flooring Materials

- 4.2.2 The Availability of Other Flooring Products

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Vinyl Flooring

- 5.1.2 Poly Vinyl Chloride (PVC)

- 5.1.3 Fillers

- 5.1.4 Vinyl Sheet Flooring

- 5.1.5 Rubber Flooring

- 5.1.6 Linoleum Flooring

- 5.1.7 Others (Cork Flooring, Vinyl Composite Tiles, etc.)

- 5.2 Application

- 5.2.1 Commercial

- 5.2.2 Residential

- 5.2.3 Institutional

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AWI Licensing LLC

- 6.4.2 Ardex Endura

- 6.4.3 Beaulieu International Group

- 6.4.4 Forbo Flooring Systems

- 6.4.5 Gerflor.

- 6.4.6 Interface, Inc

- 6.4.7 Mannington Mills, Inc.

- 6.4.8 Milliken & Company

- 6.4.9 Mohawk Industries

- 6.4.10 Nora

- 6.4.11 Polyflor Ltd

- 6.4.12 Shaw Industries Group, Inc

- 6.4.13 Tarkett

- 6.4.14 Unilin

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Innovations in Resilient Flooring

- 7.2 Other Opportunities