|

市場調查報告書

商品編碼

1690700

全球溶劑:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Global Solvents - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

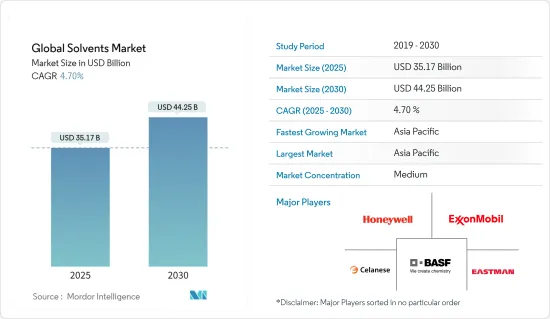

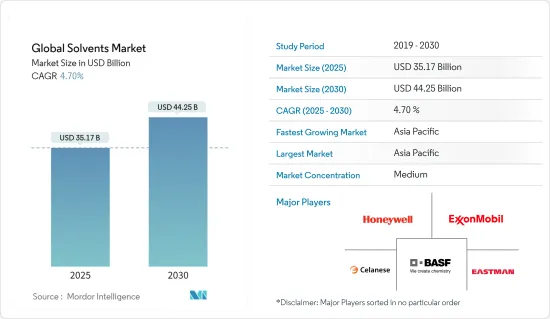

預計 2025 年全球溶劑市場規模為 351.7 億美元,到 2030 年將達到 442.5 億美元,預測期內(2025-2030 年)的複合年成長率為 4.7%。

溶劑市場受到新冠疫情的影響,生產和運輸放緩,油漆和被覆劑、聚合物和黏合劑等行業因防控措施和經濟中斷而被迫推遲生產。不過,2021年情況有所好轉,市場恢復了成長軌跡。

主要亮點

- 短期內,油漆和塗料行業需求的激增以及減少VOC排放的嚴格規定是推動研究市場需求的主要因素。

- 然而,高生產成本、溶劑性能問題以及化學溶劑的有害影響預計會阻礙市場成長。

- 然而,氧基工業溶劑的發展和生物基產品需求的增加預計將為市場帶來新的機會。

- 預計亞太地區將主導全球市場,其中大部分需求來自中國和印度。

溶劑市場趨勢

油漆和被覆劑領域佔據市場主導地位

- 溶劑在油漆和被覆劑配方中至關重要,對其性能和應用有重大影響。

- 溶劑有助於溶解油漆和被覆劑中的樹脂、顏料和其他成分,形成均勻的混合物,以便能夠平滑均勻地塗抹油漆或被覆劑。

- 酮基溶劑因其黏度低、固態含量高而受到業界的青睞。酯類溶劑有兩種用途:作為油漆硬化劑和作為工業清洗。

- 生物基溶劑可溶解油漆和被覆劑中的黏合劑和顏色,確保一致性。乙二醇醚酯用於裝飾塗料和噴漆中,以防止過早乾燥。

- 溶劑控制油漆和被覆劑的黏度,使其更易於塗抹和平整。

- 根據世界油漆和塗料工業協會(WPCIA)的預測,2023年全球油漆和塗料市場規模預計將達到1,855億美元,與前一年同期比較成長3.2%。成長主要歸因於建築、汽車和製造業的需求成長。

- 此外,WPCIA資料顯示,亞太地區將成為全球最大的油漆和被覆劑生產地,到 2023 年將佔全球產量的 54.7%,其次是歐洲(19.6%)、北美(15.6%)、拉丁美洲(6.4%)和中東和非洲(3.6%)。因此,預計油漆和塗料行業的擴張將推動所研究的市場。

- 美國是世界上最大、技術最先進的經濟體之一。這種主導地位使該國成為油漆和塗料市場的熱點之一。美國是世界主要的油漆和塗料生產國之一,擁有超過1,400家製造商。

- 根據美國塗料協會的數據,2023年美國油漆和塗料產業的產量將達到約13.1億加侖。此外,預計到2024年,該產業的產量將超過13.4億加侖。 PPG、宣偉公司、艾仕得塗料系統、RPM公司和鑽石塗料是美國領先的油漆和被覆劑製造商和供應商。

- 法國油漆和塗料行業的最新發展表明對溶劑的需求不斷成長。一個值得注意的例子是 PPG 投資 1700 萬美元建設的航太應用支援中心 (ASC),該中心於 2023 年 12 月在法國圖盧茲開業。該中心將為各種飛機提供航太材料的填充和包裝,包括被覆劑和密封劑。

- 鑑於這些動態,預計未來幾年油漆和塗料領域對溶劑的需求將推動市場成長。

亞太地區佔市場主導地位

- 由於黏合劑、油漆和被覆劑、個人護理、藥品和其他應用等不同應用領域的消費量不斷增加,亞太地區佔據了全球溶劑市場的大部分佔有率。這一趨勢使該地區成為未來幾年的市場領導。

- 溶劑在油漆和被覆劑的配製中至關重要。溶劑可溶解、分散和穩定成分,並調整黏度和流動性以實現光滑的表面。隨著主要製造商擴大生產能力以及油漆和塗料行業的發展,對溶劑的需求將會增加。

- 根據歐洲塗料協會報道,中國作為世界塗料工業基地,擁有1萬家塗料生產公司。尤其是立邦塗料、阿克蘇諾貝爾、PPG工業等大公司都在中國設立了製造地。

- 根據中國塗料工業協會統計,2023年中國塗料產量將達357.72億噸,與前一年同期比較增4.5%。出口量飆升 19.6% 至 262,000 噸,而國內消費量成長 4.2% 至 35,663 萬噸,證實了該行業的強勁成長。

- 製造商正在建設新工廠並擴大現有工廠的產能。這些策略性舉措正在增加對油漆和塗料的需求,並支持市場成長。

- 例如,2024 年 1 月,Bergere Paints India 宣布計劃在奧裡薩邦的一個新的待開發區綜合體投資超過 100 億印度盧比(約 1.206 億美元)。預計這項大膽的投資將在不久的將來提振對油漆和被覆劑的需求,從而使研究市場受益。

- 溶劑在黏合劑配方中至關重要,可確保材料有效黏合。黏合劑產業的擴建計劃預計將推動市場成長。

- 例如,2023年6月,漢高股份公司宣布將在中國山東省煙台化學工業園區開設新的黏合劑生產工廠。透過此次擴建計劃,該公司旨在中國生產耐衝擊黏合劑產品,以支持市場成長。

- 在化妝品中,溶劑有助於溶解和穩定成分。隨著該地區化妝品行業的發展,對溶劑的需求預計也會增加。

- 根據中國國家統計局的報告,過去十年化妝品產業迅速擴張。預計2023年中國化妝品零售額將達到約4,141.7億元(約584億美元),較上年略有成長。

- 韓國是全球十大美容市場之一,因其創新、使用天然成分和精美包裝而受到讚譽。根據食品藥物安全部(MFDS)的資料,韓國化妝品出口額預計在2023年達到85億美元,穩居世界第四位。

- 在製藥領域,溶劑促進了活性藥物成分 (API) 和藥物的製造過程。該地區的製藥業正在崛起,對溶劑的需求預計將會成長。

- 印度製藥業以向全球供應價格合理的優質藥品而聞名,並且正在經歷快速的科學進步。根據政府預測,該產業的市場規模預計將從目前的 500 億美元飆升至 2030 年的 1,300 億美元和 2047 年的 4,500 億美元。預計這種成長將在預測期內推動製藥製造對溶劑的需求。

- 鑑於這些動態,未來幾年亞太地區對溶劑的需求可能會上升。

溶劑產業概況

溶劑市場部分整合。主要公司包括伊士曼化學公司、BASF公司、埃克森美孚公司、霍尼韋爾國際公司和塞拉尼斯公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 油漆和塗料行業需求快速成長

- 嚴格監管,最大限度減少VOC排放

- 其他促進因素

- 限制因素

- 製造成本高和溶劑性能問題

- 化學溶劑的有害影響

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按原料

- 生物基溶劑

- 石化溶劑

- 按類型

- 氧基溶劑

- 碳氫化合物

- 鹵化溶劑

- 按應用

- 膠水

- 畫

- 個人護理

- 製藥

- 聚合物製造

- 其他用途(印刷油墨、殺蟲劑、金屬清洗)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- ADM

- Arkema

- Ashland

- BASF SE

- Bharat Petroleum Corporation Limited

- Celanese Corporation

- Dow

- Eastman Chemical Company

- Exxon Mobil Corporation

- Gandhar Oil Refinery(India)Limited

- GROUPE BERKEM

- Honeywell International Inc.

- Huntsman International LLC

- INEOS

- LyondellBasell Industries Holdings BV

- Sasol Limited

- Shell PLC

- Solvay

第7章 市場機會與未來趨勢

- 氧基工業溶劑的開發

- 對生物基產品的需求不斷增加

- 其他機會

The Global Solvents Market size is estimated at USD 35.17 billion in 2025, and is expected to reach USD 44.25 billion by 2030, at a CAGR of 4.7% during the forecast period (2025-2030).

The solvents market was negatively impacted by the COVID-19 pandemic as there was a slowdown in production and mobility wherein industries such as paints and coatings, polymers, and adhesives, etc., were forced to delay their production due to containment measures and economic disruptions. However, the conditions recovered in 2021, restoring the market's growth trajectory.

Key Highlights

- Over the short term, surging demand from the paints and coatings sector and stringent regulations in place to minimize VOC emissions are the major factors driving the demand for the market studied.

- However, high manufacturing costs, performance issues of solvents, and detrimental effects of chemical solvents are expected to hinder the market's growth.

- Nevertheless, the development of oxygenated-based industrial solvents and increasing demand for bio-based products are expected to create new opportunities for the market studied.

- Asia-Pacific is expected to dominate the global market, with the majority of demand coming from China and India.

Solvents Market Trends

Paints and Coatings Segment to Dominate the Market

- Solvents are integral to formulating paints and coatings, significantly influencing their performance and applications.

- Solvents help to dissolve the resin, pigment, and other components of the paint or coating, creating a uniform mixture and ensuring that the paint or coating can be applied smoothly and evenly.

- Ketones are favored in the industry for their low-viscosity properties and high solid content. Ester solvents serve a dual purpose: acting as hardeners in paints and functioning as industrial cleaners.

- Bio-based solvents dissolve binders and colors in paints and coatings and ensure consistency. Glycol ether esters are incorporated into decorative and spray paints to prevent premature drying.

- Solvents adjust the viscosity of paints and coatings, facilitating easier application and leveling, which is especially crucial for spray or brush-on coatings.

- According to the Worlds Paint and Coatings Industry Association (WPCIA), the global paint and coatings market achieved a valuation of USD 185.5 billion in 2023, marking a 3.2% increase from the prior year. This uptick was largely fueled by heightened demand across the construction, automotive, and manufacturing sectors.

- Furthermore, Asia-Pacific is the largest producer of paint and coatings globally, accounting for 54.7% of global production in 2023, followed by Europe (19.6%), North America (15.6%), Latin America (6.4%), and Middle East and Africa (3.6%) as per the data from WPCIA. Thus, expansion in the paints and coatings industry is anticipated to drive the market studied.

- The United States represents one of the largest and most technologically advanced economies globally. This dominant position enabled the country to become one of the hotspots for the paints and coatings market. It is one of the top global paints and coatings producers, with more than 1,400 manufacturing companies.

- According to the American Coatings Association, the paint and coatings industry's production volume in the United States was approximately 1.31 billion gallons in 2023. Moreover, the industry's production is estimated to surpass 1.34 billion gallons in 2024. PPG, Sherwin-Williams Company, Axalta Coating Systems, RPM Inc., and Diamond Paints are a few major paints and coatings manufacturers and suppliers in the United States.

- Recent developments in the French paints and coatings industry hint at a growing demand for solvents. A notable example is PPG's USD 17 million aerospace application support center (ASC), inaugurated in Toulouse, France, in December 2023. This center provides filling and packaging for aerospace materials, encompassing coatings and sealants for diverse aircraft.

- Given these dynamics, the paints and coatings sector is expected to see a rising demand for solvents, driving the market's growth in the coming years.

Asia-Pacific to Dominate the Market

- Asia-Pacific commands a significant portion of the global solvents market, driven by rising consumption across diverse applications, including adhesives, paints and coatings, personal care, pharmaceuticals, and other applications. This trend positions the region as a likely market leader in the coming years.

- In the formulation of paints and coatings, solvents are essential. They dissolve, disperse, and stabilize components, adjusting viscosity and flow to ensure a smooth finish. With major manufacturers expanding production capacities and the paints and coatings sector growing, the demand for solvents is set to rise.

- China, a global hub for industrialization, boasts a staggering 10,000 coatings manufacturers, as reported by European Coatings. Notably, major players like Nippon Paint, AkzoNobel, and PPG Industries have established manufacturing bases in the country.

- Figures from the China Coatings Industry Association revealed that in 2023, China's coatings production hit 35,772 million tons, a 4.5% increase from the previous year. Exports surged by 19.6% to 262,000 tons, while domestic consumption rose by 4.2% to 35,663 million tons, underlining the sector's robust growth.

- Manufacturers are either setting up new plants or ramping up the capacities of their existing facilities. These strategic moves bolster the demand for paints and coatings and underpin the market growth.

- For instance, in January 2024, Berger Paints India announced plans to inject over INR 1,000 crore (~ USD 120.6 million) into a new greenfield composite plant in Odisha, focusing on decorative and industrial paints. This bold investment is poised to catalyze the demand for paints and coatings in the near future, thus benefiting the market studied.

- Solvents are pivotal in adhesive formulations, ensuring effective bonding of materials. The expansion projects in the adhesives industry are expected to boost market growth.

- For instance, in June 2023, Henkel AG & Co. KGaA announced that it would be opening a new manufacturing facility for adhesives in Yantai Chemical Industry Park in Shandong Province, China. The company aims to manufacture high-impact adhesive products in China through this expansion project, thereby supporting the market's growth.

- In the cosmetics sector, solvents are instrumental in dissolving and stabilizing ingredients. As the cosmetic industry in the region flourishes, the demand for solvents is expected to rise.

- The National Bureau of Statistics of China reported that the cosmetics sector has expanded rapidly over the past decade. In 2023, retail cosmetics sales in China reached approximately CNY 414.17 billion (~USD 58.4 billion), marking a modest uptick from the prior year.

- South Korea ranks among the top ten global beauty markets and is celebrated for its innovation, use of natural ingredients, and attractive packaging. According to the Ministry of Food and Drug Safety (MFDS) data, South Korea's cosmetics exports hit USD 8.5 billion in 2023, securing the fourth position globally.

- In the pharmaceutical sector, solvents facilitate processes in manufacturing active pharmaceutical ingredients (APIs) and drug products. With the region's pharmaceutical industry on the rise, the demand for solvents is set to grow.

- The Indian pharmaceutical industry, renowned for supplying affordable, high-quality medicines globally, is witnessing rapid scientific advancements. Government projections estimate the industry's value will soar from USD 50 billion today to USD 130 billion by 2030 and an ambitious USD 450 billion by 2047. Such growth is anticipated to drive the demand for solvents in pharmaceutical drug production during the forecast period.

- Given these dynamics, the demand for solvents in Asia-Pacific is poised for an upswing in the coming years.

Solvents Industry Overview

The solvents market is partially consolidated in nature. The major players include Eastman Chemical Company, BASF SE, Exxon Mobil Corporation, Honeywell International Inc., and Celanese Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Surging Demand from the Paints & Coatings Sector

- 4.1.2 Stringent Regulations in Place to Minimize VOC Emissions

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Manufacturing Costs and Performance Issues of Solvents

- 4.2.2 Detrimental Effects of Chemical Solvents

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Source

- 5.1.1 Bio-based Solvents

- 5.1.2 Petrochemical-based Solvents

- 5.2 By Type

- 5.2.1 Oxygenated Solvents

- 5.2.2 Hydrocarbon Solvents

- 5.2.3 Halogenated Solvents

- 5.3 By Application

- 5.3.1 Adhesives

- 5.3.2 Paints and Coatings

- 5.3.3 Personal Care

- 5.3.4 Pharmaceuticals

- 5.3.5 Polymer Production

- 5.3.6 Other Applications (Printing Inks, Agricultural Chemicals, and Metal Cleaning)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ADM

- 6.4.2 Arkema

- 6.4.3 Ashland

- 6.4.4 BASF SE

- 6.4.5 Bharat Petroleum Corporation Limited

- 6.4.6 Celanese Corporation

- 6.4.7 Dow

- 6.4.8 Eastman Chemical Company

- 6.4.9 Exxon Mobil Corporation

- 6.4.10 Gandhar Oil Refinery (India) Limited

- 6.4.11 GROUPE BERKEM

- 6.4.12 Honeywell International Inc.

- 6.4.13 Huntsman International LLC

- 6.4.14 INEOS

- 6.4.15 LyondellBasell Industries Holdings BV

- 6.4.16 Sasol Limited

- 6.4.17 Shell PLC

- 6.4.18 Solvay

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Oxygenated Based Industrial Solvents

- 7.2 Increasing Demand for Bio-based Products

- 7.3 Other Opportunities