|

市場調查報告書

商品編碼

1690694

歐洲醫藥物流-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Europe Pharmaceutical Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

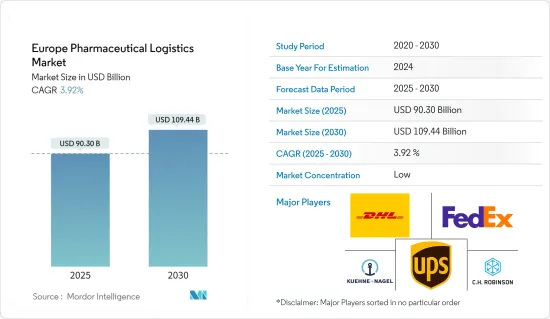

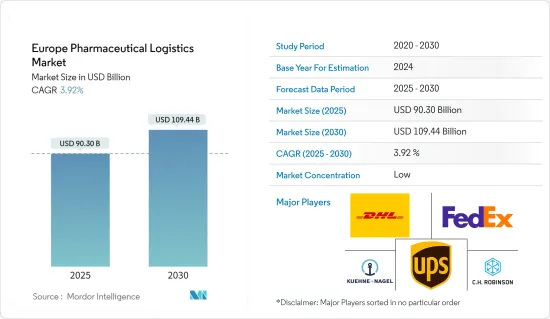

預計2025年歐洲醫藥物流市場規模為903億美元,預計2030年將達到1,094.4億美元,預測期內(2025-2030年)的複合年成長率為3.92%。

歐洲對醫藥物流的需求主要受到藥品和疫苗需求不斷成長的推動,這得益於新冠疫情以及大型製藥企業的投資增加。研發製藥業在恢復歐洲經濟成長和確保在日益激烈的全球經濟競爭中保持競爭力方面發揮關鍵作用。歐洲將在2022年投資445億歐元(484.34億美元)研發。此外,從上游到下游,直接僱用約86.5萬人,間接創造的就業機會約為目前的三倍。

製藥業對細胞療法、疫苗和血液製品的需求不斷成長,推動了該地區醫藥物流市場的成長。醫藥領域對逆向物流的需求不斷增加、對溫度敏感藥品的需求不斷成長以及 RFID 技術在醫藥物流中的使用不斷增加是歐洲醫藥物流市場未來的趨勢。

預計藥品銷售額的成長將推動醫療物流市場的成長。隨著藥品被儲存並運輸到藥房、藥局等,這將增加對運輸和醫療物流的需求。

歐洲醫學物流市場趨勢

歐洲生物製藥銷售額成長

歐洲是全球第二大生物製藥市場。人口成長和疾病的傳播正在推動市場發展。接受度和開放度、用於治療和治癒疾病的生物製藥的易於獲取以及與藥物治療相關的周到性正在推動歐洲市場的發展。為了確保全部區域患者能夠獲得安全且負擔得起的藥品,並幫助歐洲製藥業保持創新和全球領先地位,歐盟委員會就擬議的歐洲藥品戰略啟動了公眾諮詢。

製藥商越來越重視產品品質和靈敏度。複雜的生物藥物、荷爾蒙療法、疫苗的開發以及複雜蛋白質的運輸等因素需要特定的結果,而這些結果需要專門的運輸和倉儲。藥品及醫療設備溫控物流屬於醫藥物流產業的一部分。此外,對有效的低溫運輸物流服務以維持貨物品質的需求日益成長,推動了醫藥物流市場的成長。

製藥業的低溫運輸供應鏈和物流正在不斷發展,變得更加具有策略性和可靠性。高價值醫藥產品主要透過分銷鏈中的低溫運輸解決方案運輸,從而推動市場成長。

德國醫藥出口成長

據德國貿易投資署(GTAI)稱,德國是歐洲最大、世界第四大醫藥市場。該國被認為是全球製藥生產強國之一,其豐富的熟練勞動力使製藥公司能夠專注於其他複雜且具有挑戰性的產品,例如生物學名藥,同時保持良好的製造品質。

2023年德國人口約8,450萬,是歐盟人口最多的國家。德國市場表現優於義大利、法國和英國市場。德國在全球的醫藥總分配金額佔全球製藥業的5.9%。德國擁有超過510家製藥公司和超過670家生技公司。疫情開始時,生產的藥品和製藥設備價值 311 億歐元(331 億美元)。

出口額從 2002 年的 500 億歐元(535 億美元)成長到 2022 年的 2,870 億歐元(307 億美元)。與 2021 年(2,350 億歐元)相比,2022 年的總額成長了 22%。 2002 年至 2022 年間,進口額從 320 億歐元(340 億美元)增至 1,120 億歐元(119 億美元),從 2021 年(1,000 億歐元)到 2022 年成長約 12%。

歐洲醫藥物流產業概況

歐洲醫藥物流市場競爭激烈,細分化程度較高,既有區域市場參與者,也有國際市場參與企業。該市場有幾家大型企業,包括 DHL Supply Chain、FedEx、Kuehne+Nagel International AG、聯合包裹服務公司和 CH Robinson。主要企業包括 Eurotranspharma、Center Specialties Pharmaceutiques、PostNL Pharma & Care 和 Trans-o-Flex Schnell-Lieferdienst GmbH。這些公司正在將自動化、人工智慧、機器學習(AI 和 ML)、區塊鏈和運輸管理系統等下一代物流解決方案引入其服務中,以提高供應鏈生產力、降低成本並避免錯誤。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

- 分析方法

- 研究階段

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 政府法規和舉措

- 產業技術趨勢

- COVID-19 市場影響

- 價值鏈/供應鏈分析

第5章市場動態

- 市場促進因素

- 歐洲一般成藥需求不斷成長

- 製藥公司擴大製造活動

- 市場限制

- 與運送訂單相關的高成本

- 市場機會

- 醫療保健領域對居家醫療設備和即時援助的需求增加

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第6章市場區隔

- 按產品

- 學名藥

- 品牌藥物

- 按操作

- 低溫運輸運輸

- 非低溫運輸運輸

- 按應用

- 生物製藥

- 化學品和製藥

- 交通方式

- 航空

- 鐵路

- 路

- 海運

- 按地區

- 德國

- 英國

- 荷蘭

- 法國

- 義大利

- 西班牙

- 波蘭

- 比利時

- 瑞典

- 其他歐洲國家

第7章競爭格局

- 市場集中度概覽

- 公司簡介

- DHL

- FedEx

- Kuehne+Nagel International AG

- United Parcel Service

- CH Robinson

- CEVA Logistics

- DB Schenker

- Agility Logistics

- Eurotranspharma

- CSP*

- 其他公司

第8章 市場機會與未來趨勢

第9章 附錄

The Europe Pharmaceutical Logistics Market size is estimated at USD 90.30 billion in 2025, and is expected to reach USD 109.44 billion by 2030, at a CAGR of 3.92% during the forecast period (2025-2030).

The demand for pharmaceutical logistics in Europe is mainly driven by the increasing demand for drugs and vaccines, fueled by the COVID-19 pandemic and increasing investments by leading pharmaceutical firms. In order to restore economic growth in Europe and ensure the continued competitiveness of an increasingly competitive world economy, the R&D pharmaceutical sector plays a vital role. Europe invested EUR 44,500 million (USD 48,434 million) in research and development in 2022. It also directly employs about 865,000 people and indirectly generates about three times as many jobs as it now does, upstream and downstream.

Increasing demand for cellular therapies, vaccines, and blood products in the pharmaceutical industry is driving the growth of the region's pharmaceutical logistics market. The increase in demand for reverse logistics in the pharmaceutical sector, the rise in demand for temperature-sensitive pharmaceutical drugs, and the increase in the use of RFID technologies for pharmaceutical logistics are upcoming trends in the European pharmaceutical logistics market.

The growing pharmaceutical sales are expected to propel the growth of the healthcare logistics market. Increasing sales of pharmaceuticals are expected to boost the demand for logistics as the pharmaceutical products or drugs should be stored and transported to pharmacies, drug stores, and others, thus increasing the demand for transportation or healthcare logistics.

Europe Pharmaceutical Logistics Market Trends

Biopharma Sales in Europe is Increasing

Europe is the second-biggest biopharmaceuticals market in the world. The increasing populace and persistent sicknesses are boosting market development. The reception and openness, accessibility of biopharmaceuticals for treating and concluding illnesses, and mindfulness connected with medication have boosted the European market. To ensure the availability of secure and affordable medicines throughout the region for patients and to support the European pharmaceutical industry's ability to remain an innovator and a world leader, the European Commission established a public consultation on its proposed European drug strategy.

Pharmaceutical manufacturers increasingly focus on product quality and sensitivity. Factors such as the development of complex biological-based medicines and shipments of hormone treatments, vaccines, and complex proteins require specific results that require specialized transportation and warehousing. Temperature-controlled logistics of pharmaceutical products and medical devices is a part of the healthcare logistics industry. Moreover, the increase in the need for effective cold-chain logistics services to maintain the quality of goods fuels the growth of the pharmaceutical logistics market.

Cold chain supply chains and logistics for the pharmaceutical industry are evolving to be more strategic and reliable. High-value pharmaceutical products are mainly shipped via cold chain solutions across the entire distribution network, thus driving the market's growth.

Pharmaceutical Exports From Germany Are Increasing

Germany is the largest pharmaceutical market in Europe and the fourth-biggest in the world, as per Germany Trade and Invest (GTAI). The country is considered one of the global driving points for pharmaceutical production, and its large skilled labor force allows pharmaceutical companies to focus on other complex and challenging products, such as biosimilars, while keeping up with good manufacturing quality.

The population of Germany in 2023 was almost 84.5 million inhabitants, making it the most populated country in the European Union. The German market is ahead of the Italian, French, and Great Britain markets. Germany's total global pharmaceutical value allocation accounted for 5.9% of the global pharmaceutical industry. Germany has more than 510 pharmaceutical companies and more than 670 biotech companies. The manufactured medicines and pharma equipment were valued at EUR 31.1 billion (USD 33.1 billion) at the beginning of the pandemic.

Exports increased from EUR 50 billion (USD 53.5 billion) in 2002 to EUR 287 billion (USD 30.7 billion) in 2022. Compared to 2021 (EUR 235 billion), the 2022 total represented an increase of 22%. Imports rose from EUR 32 billion (USD 34 billion) to EUR 112 billion (USD 11.9 billion) between 2002 and 2022, rising by almost 12% from 2021 (EUR 100 billion) to 2022.

Europe Pharmaceutical Logistics Industry Overview

The European pharmaceutical logistics market is highly competitive and fragmented and consists of regional and international market players. A few existing significant players in the market include DHL Supply Chain, FedEx, Kuehne + Nagel International AG, United Parcel Service, and CH Robinson. Some major domestic players include Eurotranspharma, Centre Specialties Pharmaceutiques, PostNL Pharma & Care, and Trans-o-Flex Schnell-Lieferdienst GmbH. These companies are implementing next-generation logistics solutions in their services, such as automation, artificial intelligence, machine learning (AI and ML), blockchain, transportation management systems, and others, to increase supply chain productivity, reduce costs, and avoid errors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Government Regulations and Initiatives

- 4.3 Technological Trends in the Industry

- 4.4 Impact of COVID-19 on the Market

- 4.5 Value Chain / Supply Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Over the Counter Drugs Across the European Region

- 5.1.2 Growing Manufacture Activity from Pharmaceutical Companies

- 5.2 Market Restraints

- 5.2.1 High Cost Associated with the Transportation Ordered

- 5.3 Market Opportunities

- 5.3.1 Increasing Demand for Home Healthcare Devices and Fast Track Assistance in the Healthcare Sector

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Generic Drugs

- 6.1.2 Branded Drugs

- 6.2 By Operation

- 6.2.1 Cold Chain Transport

- 6.2.2 Non-cold Chain Transport

- 6.3 By Application

- 6.3.1 Biopharma

- 6.3.2 Chemical Pharma

- 6.4 By Transportation

- 6.4.1 Airways

- 6.4.2 Railways

- 6.4.3 Roadways

- 6.4.4 Seaways

- 6.5 By Geography

- 6.5.1 Germany

- 6.5.2 United Kingdom

- 6.5.3 The Netherlands

- 6.5.4 France

- 6.5.5 Italy

- 6.5.6 Spain

- 6.5.7 Poland

- 6.5.8 Belgium

- 6.5.9 Sweden

- 6.5.10 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 DHL

- 7.2.2 FedEx

- 7.2.3 Kuehne+Nagel International AG

- 7.2.4 United Parcel Service

- 7.2.5 C.H. Robinson

- 7.2.6 CEVA Logistics

- 7.2.7 DB Schenker

- 7.2.8 Agility Logistics

- 7.2.9 Eurotranspharma

- 7.2.10 CSP*

- 7.3 Other Companies