|

市場調查報告書

商品編碼

1690207

塑膠射出成型:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Plastics Injection Molding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

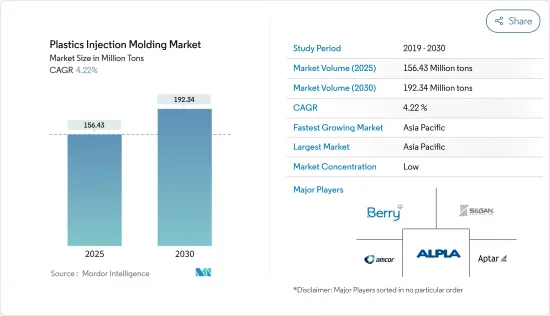

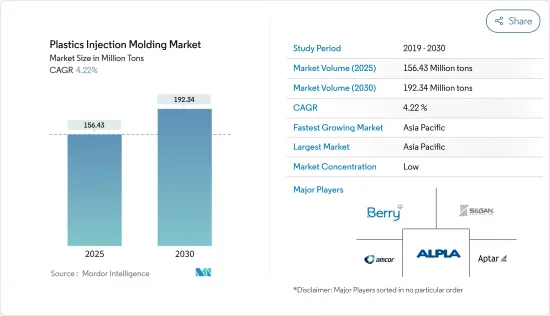

預計 2025 年塑膠射出成型市場規模將達到 615 萬噸,預計到 2030 年將達到 754 萬噸,預測期內(2025-2030 年)的複合年成長率為 4.18%。

在新冠疫情期間,射出成型需求有所下降,但所研究的市場已穩定恢復,達到疫情前的活動水準。

關鍵亮點

- 推動射出成型市場需求的關鍵因素是汽車應用的使用增加以及包裝產業的需求增加。此外,預計消費品和電子產品需求的成長將進一步刺激這項需求。

- 然而,進入射出成型市場的高初始成本以及 3D 列印等替代和新興技術的大力採用預計將阻礙市場成長。

- 另一方面,向輕量化和電動車製造的轉變以及醫療領域的新應用可能會為塑膠射出成型市場的成長帶來豐厚的機會。

- 亞太地區佔據全球塑膠射出成型市場主導地位,其中中國、印度和日本等國家佔最大消費量。

塑膠射出成型市場趨勢

包裝領域佔據市場主導地位

- 塑膠射出成型提供了許多解決方案,從散裝包裝到薄壁容器和瓶子形狀。這些解決方案廣泛應用於各個終端用戶產業的包裝用途。

- 塑膠成型不僅能提供多功能的包裝解決方案,還能減少塑膠消費量,被證明是經濟和生態的理想選擇。

- 世界各地的包裝產業正在快速發展和擴張。根據包裝和加工技術研究所(PMMI)發布的報告,2021年全球包裝產業總價值達422億美元。

- 這種成長主要得益於人口成長、對永續性關注、新興經濟體可支配收入的增加、新興經濟體零售業的成長以及對智慧包裝解決方案的需求的不斷成長。

- 例如,日本是全球最大、成長最快的電子商務市場之一,排名第三。預計到 2023 年,該國的收益將達到約 2,322 億美元,2023-2028 年的複合年成長率為 11.23%。預計該國電子商務行業的成長將推動對包裝解決方案的需求。

- 同樣,美國也是零售業的主要企業。全球十大零售公司中有五家總部位於美國。根據美國軟包裝協會的數據,軟包裝是美國第二大包裝領域,約有20%的市場佔有率。

- 此外,由於消費者對包裝食品和餐飲的需求不斷成長,以及新冠疫情后餐廳外帶的增加,到 2025 年,該國食品和飲料行業的收益可能達到 250 億美元。截至 2021 年,該產業價值約為 210 億美元,其中食品包裝佔所有軟包裝應用的 50% 以上。

- 因此,由於上述因素,預計包裝領域對塑膠射出成型的需求將激增。

亞太地區佔市場主導地位

- 由於中國、印度、日本和韓國等新興經濟體,預計亞太地區將在預測期內主導全球塑膠射出成型市場。

- 中國是亞太地區主要經濟體之一。預計未來幾年該國的包裝產業將實現強勁成長,到 2025 年的複合年成長率將達到 6.8% 左右。預計包裝產業的成長將推動對塑膠射出成型的需求。

- 同樣,中國汽車產業在2022年儘管面臨新冠疫情頻傳、半導體晶片短缺、地緣政治緊張局勢導致供應鏈中斷等諸多障礙,但仍實現了成長。

- 根據中國工業協會統計,2019年,我國汽車產銷分別完成2,702.1萬輛及2,686.4萬輛,與前一年同期比較分別成長3.4%及2.1%。汽車產業對塑膠射出成型的日益普及可能會在預測期內推動研究市場的需求。

- 此外,國內住宅建築業的成長預計將推動塑膠射出成型的需求。印度政府在 2022-23 年聯邦預算中為「總理安居計畫」撥款 4,800 億印度盧比(64.4 億美元),重申了實施「全民住宅」計畫的承諾,該計畫旨在 2022-23 年為都市區貧困階級建造 8,000 萬套經濟適用住宅。

- 過去幾年,亞太地區的電子產業穩步成長,其中中國、印度和日本引領市場競爭。日本電子情報技術產業協會(JEITA)發布的報告顯示,2021年日本電子產業總產值較上年增加近10%。

- 因此,由於上述因素,預計亞太地區將在預測期內主導全球塑膠射出成型市場。

塑膠射出成型行業概況

塑膠射出成型市場細分化,主要企業的市場佔有率較小。市場上的主要企業包括 Berry Global Inc.、AptarGroup, Inc.、Silgan Holdings Inc.、Amcor PLC 和 ALPLA。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 包裝產業需求不斷成長

- 消費品和電子產品需求旺盛

- 在汽車應用中的使用日益增多

- 限制因素

- 進入成本高且存在替代技術

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 原料類型

- 聚丙烯

- 丙烯腈丁二烯苯乙烯(ABS)

- 聚苯乙烯

- 聚乙烯

- 聚氯乙烯(PVC)

- 聚碳酸酯

- 聚醯胺

- 其他

- 應用

- 包裝

- 建築與施工

- 消費品

- 電子產品

- 汽車與運輸

- 醫療保健

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章競爭格局

- 併購、合資、合作與協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- ALPLA

- Amcor PLC

- AptarGroup Inc.(CSP Technologies)

- BERICAP

- Berry Global Inc.

- EVCO Plastics

- HTI Plastics

- IAC Group

- Magna International

- Quantum Plastics

- Silgan Holdings Inc.

- The Rodon Group

第7章 市場機會與未來趨勢

- 輕型汽車和電動車的採用

- 醫療領域的新應用

The Plastics Injection Molding Market size is estimated at 6.15 million tons in 2025, and is expected to reach 7.54 million tons by 2030, at a CAGR of 4.18% during the forecast period (2025-2030).

Although there was a dip in demand for injection molding during the COVID-19 pandemic, the studied market steadily recovered and reached pre-pandemic activity levels.

Key Highlights

- The major factors driving the demand for injection molding in the market are the increasing usage in automotive applications and the growing demand from the packaging industry. Additionally, increased consumer goods and electronics demand is anticipated to strengthen this demand further.

- However, the high initial costs associated with entering the injection molding market and the strong prevalence of alternative and emerging technologies like 3D printing are expected to hinder the market growth.

- On the flip side, the shift towards manufacturing lightweight and electrified vehicles and the emerging applications in the healthcare sector could open up lucrative opportunities for the growth of the plastics injection molding market.

- The Asia-Pacific region dominated the plastics injection molding market worldwide, with the largest consumption from countries such as China, India, and Japan.

Plastics Injection Molding Market Trends

Packaging Segment to Dominate the Market

- Plastic injection molding offers many solutions, from high-volume packaging to thin-wall containers and bottle molds. These solutions are extensively used in packaging purposes across various end-user industries.

- Besides providing versatile packaging solutions, plastic molding reduces plastic consumption, proving an ideal choice for economical and ecological reasons.

- The packaging industry across the globe is evolving and expanding at a rapid pace. According to a report published by the Association for Packaging and Processing Technologies (PMMI), the total value of the global packaging industry reached USD 42.2 billion in 2021.

- The growth was majorly led by the increasing population, growing sustainability concerns, rising disposable income in developing nations, growing retail sector in emerging economies, and increasing demand for smart packaging solutions.

- For instance, Japan stands in the 3rd position globally as one of the largest and fastest-growing e-commerce markets. The country is anticipated to generate revenue of around USD 232.20 billion by 2023 and is expected to grow at an average annual growth rate of 11.23% between 2023-28. The growing e-commerce sector in the nation is anticipated to strengthen the demand for packaging solutions.

- Similarly, the United States is the foremost company in the retail industry. Out of the top 10 largest retail companies in the world, five of them are based out of the United States. According to the Flexible Packaging Association of the United States, flexible packaging is the second-largest packaging segment in the country, with around 20% share in the market.

- Additionally, with the growing consumerism for packaged food and beverages in the country and the rise in restaurant takeaways in the aftermath of the COVID-19 pandemic, the revenue from the food and beverage industry could reach USD 25 billion by 2025. As of 2021, the industry is valued at around USD 21 billion, with food packaging accounting for over 50% of the total flexible packaging applications.

- Thus, owing to the factors above, the demand for plastic injection molding is anticipated to rise sharply in the packaging segment.

Asia-Pacific Region to Dominate the Market

- Due to emerging economies like China, India, Japan, and South Korea, the Asia-Pacific region is expected to dominate the global plastics injection molding market during the forecast period.

- China is one of the leading economies in the Asia-Pacific region. The packaging industry in the country is anticipated to register strong growth figures in the coming years, registering a CAGR of around 6.8% by 2025. The growth of the packaging industry is anticipated to augment the nation's demand for plastic injection molding.

- Similarly, China's automotive industry experienced growth in 2022, despite facing many obstacles, including the reoccurrence of frequent COVID-19 outbreaks, semiconductor chip shortages, and geopolitical tensions resulting in supply chain disruptions.

- According to China's Association of Automobile Manufacturers, the country recorded production and sales figures of 27.021 million and 26.864 million, respectively, an increase of 3.4% and 2.1% compared to the previous year. The growing adoption of plastic injection molding in the automotive industry could drive demand for the studied market during the forecast period.

- Additionally, demand for plastic injection molding is anticipated to be strengthened by the growing residential construction sector in the country. The Indian government, in its Union Budget 2022-23, allocated INR 48,000 crores (USD 6.44 billion) for its 'PM Aawas Yojana' scheme, reiterating its commitment to implementing 'Housing for All' which aims to build 80,00,000 affordable housing units for the urban and rural poor in FY 2022-23.

- The Asia-Pacific's electronic sector witnessed steady growth in the last several years, with China, India, and Japan leading the market race. According to the report published by the Japan Electronics and Information Technology Industries Association (JEITA), in 2021, the total production value of the electronics industry in Japan showcased a rise of nearly 10% from the previous year.

- Thus, the factors mentioned above indicate the Asia-Pacific region is set to dominate the global plastics injection molding market., during the forecast period.

Plastics Injection Molding Industry Overview

The plastics injection molding market is fragmented, with the top players accounting for a marginal market share. Some of the key companies in the market include Berry Global Inc, AptarGroup, Inc., Silgan Holdings Inc., Amcor PLC, and ALPLA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Packaging Industry

- 4.1.2 Favorable Demand from Consumer Goods and Electronics

- 4.1.3 Increasing Usage in Automotive Applications

- 4.2 Restraints

- 4.2.1 High Entry Cost and Presence of Alternative Technologies

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Raw Material Type

- 5.1.1 Polypropylene

- 5.1.2 Acrylonitrile Butadiene Styrene (ABS)

- 5.1.3 Polystyrene

- 5.1.4 Polyethylene

- 5.1.5 Polyvinyl Chloride (PVC)

- 5.1.6 Polycarbonate

- 5.1.7 Polyamide

- 5.1.8 Other Raw Materials

- 5.2 Applications

- 5.2.1 Packaging

- 5.2.2 Building and Construction

- 5.2.3 Consumer Goods

- 5.2.4 Electronics

- 5.2.5 Automotive and Transportation

- 5.2.6 Healthcare

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ALPLA

- 6.4.2 Amcor PLC

- 6.4.3 AptarGroup Inc. (CSP Technologies)

- 6.4.4 BERICAP

- 6.4.5 Berry Global Inc.

- 6.4.6 EVCO Plastics

- 6.4.7 HTI Plastics

- 6.4.8 IAC Group

- 6.4.9 Magna International

- 6.4.10 Quantum Plastics

- 6.4.11 Silgan Holdings Inc.

- 6.4.12 The Rodon Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Adoption of Lightweight Vehicles and Electric Vehicles

- 7.2 Emerging Applications in the Healthcare Sector