|

市場調查報告書

商品編碼

1690198

物聯網中的人工智慧 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)AI In IoT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

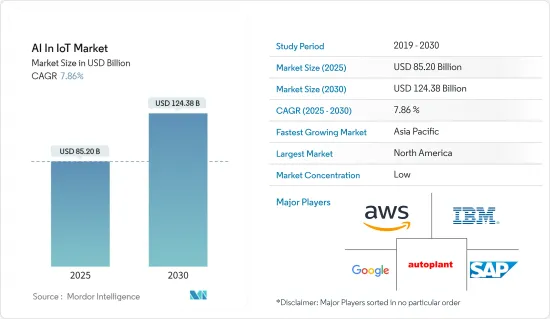

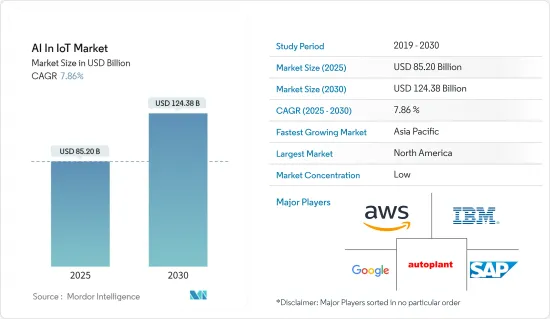

預計2025年物聯網人工智慧市場規模為852億美元,預計到2030年將達到1,243.8億美元,預測期內(2025-2030年)的複合年成長率為7.86%。

高效處理物聯網設備產生的大量即時資料的需求、對性能管理設備不斷成長的需求以及減少停機時間和維護成本的需求是推動市場成長的主要因素。

主要亮點

- 物聯網技術是各個組織數位轉型不可或缺的一部分,從而使他們能夠透過建構和追蹤新的經營模式來升級現有流程。隨著越來越多的公司將物聯網視為業務成功的關鍵推動因素,物聯網的採用率正在上升。人工智慧和物聯網這兩種技術的結合將創造出能夠模擬理性行為並在很少或完全不需要人工干預的情況下支援決策的智慧機器。越來越重視對物聯網設備產生的資料進行有效管理,以獲得有價值的見解和即時監控以改善客戶體驗,這是市場的主要成長要素。

- 零售業正在利用基於物聯網的雲端 AI 來增強客戶體驗計劃並創造更多以客戶為中心的產品。例如,在智慧零售環境中,具有電腦視覺功能的攝影系統可以使用臉部辨識來識別進門的顧客。例如,假設系統偵測到許多千禧世代正在造訪您的商店。在這種情況下,您可以推送針對這一人群的產品廣告和店內特價商品,以幫助推動銷售。

- 此外,許多公司正在從內部部署人工智慧轉向雲端,因為低延遲和即時追蹤可以縮短交付時間,這可能會在預測期內推動市場成長。例如,Amazon Echo亞馬遜推出了託管雲端平台Web Services IoT,使裝置能夠安全地連接到雲端應用程式和其他裝置。 2021 年 2 月,IBM 和 Red Hat 宣布開展新的合作,利用混合雲旨在為製造商和工廠營運商提供開放、靈活且更安全的解決方案,從工業IoT的營運資料中獲取混合雲端價值。

- 然而,技術純熟勞工的短缺和對資料安全的日益擔憂是限制調查市場成長的主要因素。人工智慧和物聯網從使用者和客戶收集敏感和重要的資料,因此確保資料的安全並交到可靠的人手中至關重要。然而,安全性一直是個技術問題,因為使用者永遠不知道何時有人會試圖存取我們的個人敏感資料,這限制了市場的成長。

- 在冠狀病毒大流行期間,組織獲得可擴展、可靠和安全的運算能力是當前市場成長的一些關鍵驅動力,無論是用於關鍵的醫療保健業務,還是用於學生繼續學習,還是用於前所未有的數量的員工在家在線保持高效工作。醫院網路、製藥公司和研究機構正在使用支援人工智慧的物聯網設備來照顧患者、尋找治療方法、減輕 COVID-19 的影響等等。所有上述因素都在短期內加速市場成長率,並有望在長期內進一步提高市場成長率。

物聯網人工智慧的市場趨勢

醫療保健產業可望推動市場強勁成長

- 醫療保健組織可以收集和分析高頻物聯網 (IoT) 感測器資料和電腦視覺 (AI),以提高人類在做出診斷和治療決策以及協助臨床醫生治療疾病等任務中的表現。常規的身體活動能力和平衡能力評估是一項常規醫療保健活動,透過結合物聯網和人工智慧技術,該活動具有巨大的轉變潛力。利用物聯網,醫療保健提供者可以進行定量、一致和可重複的測試,同時以更少的步驟簡化評估。

- 測試和儲存疫苗(包括 COVID-19 疫苗)的醫院、診所、製藥公司和學術機構目前無法了解其冰箱的即時狀態和性能。這增加了基於物聯網的疫苗物流和安全預測性維護的需求。物聯網還可以提高診斷準確性、實現遠端患者監控、減少後續觀察需求、縮短等待時間、識別重症患者以及追蹤醫療設備。

- 此外,人工智慧和物聯網的創新可以幫助醫院充分利用電腦斷層掃描和病患生命徵像等資料。這些系統使醫生能夠遠端監控患者的健康狀況,並識別需要緊急治療的患者,即使他們不在醫院內。物聯網還可以提高某些疾病(如乳癌和肺癌)的診斷準確性。

- 智慧醫院正在利用物聯網技術和機器人技術開創醫療支援和治療的新時代。各種專為醫療保健領域設計的物聯網設備和應用程式正在湧現,包括用於遠端醫療遠端醫療諮詢和監控的感測器和應用程式。在這方面,物聯網正在透過即時病患監測(健身追蹤器、智慧型穿戴裝置、緊急按鈕等)、透過智慧影像分析進行進階診斷以及機器人手術來幫助改善醫療保健。這些應用程式有助於收集人類預防措施、早期檢測和藥物治療的資料。

- 隨著物聯網技術的日益普及,智慧醫療趨勢預計將顯著成長。例如,2022年12月,電腦硬體製造商華碩在台灣醫療健康博覽會上發表了其智慧醫療解決方案。華碩智慧醫療的主題成為華碩展會上展出的各種產品數位轉型的催化劑。涵蓋的主題包括推動台灣醫療機構數位化的社區健康管理、精準醫療和遠端醫療趨勢。此外,AI演算法和物聯網設備也協助醫院管理本地醫療,使其能夠透過數位轉型從本地醫院轉型為現代化醫院。

預計北美將佔據主要市場佔有率

- 北美是市場佔有率較大的關鍵地區之一,這得益於汽車和運輸、製造、零售和醫療保健等許多行業廣泛採用人工智慧和物聯網技術,這也是該地區研究市場成長的原因之一。北美是研究新興終端用戶產業人工智慧和物聯網應用開發的領先地區之一。據思科稱,截至 2022 年,美國和加拿大的人均設備和連接數量將位居世界第一。

- 北美企業的製造平台正在進行數位轉型,這為該國物聯網製造領域的人工智慧解決方案提供者創造了機會。這使得這些公司能夠控制其製造設施中的能源和水的使用,使其設備更具彈性同時減少廢棄物,並在生產線上即時檢查產品品質。提供可擴展的預測品質、預測性維護、控制發布和非接觸式操作將有助於使整個地區的工廠生產更加永續性。

- 許多全球公司正在與市場供應商合作,將基於人工智慧的 IIoT 整合到他們的生產線中,從而推動市場成長。例如,2022年9月,寶潔與微軟簽署了一項多年夥伴關係協議,以實現寶潔數位化製造基礎設施的現代化。根據夥伴關係關係,工業物聯網 (IIoT)、數位雙胞胎、資料和人工智慧將加速向客戶交付並提高客戶滿意度,同時提高生產力並降低成本。

- 該地區是許多全球物聯網和人工智慧供應商和提供者的所在地,主要來自美國。該國還擁有高科技生態系統,該地區的車輛越來越以軟體為導向。當人工智慧與物聯網結合時,設備可以分析資料、做出決策並根據資料採取行動,而無需人工干預。特斯拉的自動駕駛汽車就是人工智慧和物聯網協同工作的一個例子。透過融入人工智慧,自動駕駛汽車將能夠預測車輛和行人在不同情況下的行為。例如,它會評估道路狀況、天氣和最佳速度,每次旅程都會變得更聰明。

- 該行業在北美的成長潛力也體現在許多美國人工智慧平台和軟體製造商正在與物聯網解決方案供應商合作以增加市場佔有率這一事實上。

物聯網產業人工智慧概述

物聯網人工智慧市場競爭激烈,國內外公司多。該市場由多家公司組成,包括微軟、 銷售團隊、AWS、SAP SE、Oracle和 IBM 公司。每個公司的品牌識別對市場都有重大影響。由於強大的品牌意味著卓越的業績,老字型大小企業有望佔據優勢。提供先進的人工智慧解決方案和持續升級的供應商可能會成為買家的熱門選擇。

2023年6月,亞馬遜網路服務公司宣布了一項新計畫-AWS生成式人工智慧創新中心,旨在幫助客戶成功開發和部署智慧人工智慧解決方案。透過該計劃,AWS 將投資 1 億美元,將 AI 和 MLAWS 專家與全球客戶聯繫起來,以幫助他們構思、設計或推出新的生成式AI產品、服務和流程。

2023 年 5 月,SAP 和 Google Cloud 宣布推出廣泛的開放資料產品,旨在簡化業務資料格局並釋放其強大力量。透過此產品,客戶可以使用 SAP Datasphere 解決方案和 Google 的數據雲來建立端到端資料雲,從而在整個企業內提取資料,讓企業即時查看其整個資料資產,並最大限度地提高其 SAP Cloud 投資的價值。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 產業影響評估

第5章市場動態

- 市場促進因素

- 巨量資料量不斷成長

- 透過有效管理物聯網設備產生的資料獲得有價值的見解

- 市場限制

- 資料安全和隱私問題

第6章市場區隔

- 按組件

- 平台

- 應用程式管理

- 連線管理

- 設備管理

- 服務

- 託管服務

- 專業服務

- 軟體

- 資料管理

- 網路頻寬管理

- 即時串流分析

- 遠端監控

- 安全功能

- 邊緣解決方案

- 平台

- 按行業

- 銀行、金融服務和保險(BFSI)

- 資訊科技和電訊

- 能源和公共產業

- 衛生保健

- 製造業

- 其他終端使用者產業(交通運輸、政府、零售)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Amazon Web Services Inc.(Amazon Inc.)

- IBM Corporation

- Autoplant Systems India Pvt. Ltd

- SAP SE

- Google LLC(Alphabet Inc.)

- Microsoft Corporation

- Oracle Corporation

- Salesforce.com Inc.

- PTC Inc.

- SAS Institute Inc.

- General Electric Company

- Hitachi Ltd

第8章投資分析

第9章:市場的未來

The AI In IoT Market size is estimated at USD 85.20 billion in 2025, and is expected to reach USD 124.38 billion by 2030, at a CAGR of 7.86% during the forecast period (2025-2030).

The need to efficiently process vast volumes of real-time data generated from IoT devices, the growing demand for performance management appliances, and the need to reduce downtime and maintenance costs are the primary factors driving the market's growth.

Key Highlights

- IoT technology is essential for various organizations to digitally transform, thus, empowering them to upgrade the existing processes by creating and tracking new business models. More and more companies view IoT as an important element for business success, thus increasing its adoption. AI and IoT, both technologies, when combined, are creating intelligent machines that simulate rational behavior and support decision-making with little or no human interference. The growing emphasis on effective management of data generated from IoT devices to gain valuable insights and real-time monitoring to curate an enhanced customer experience are the key growth drivers for the market.

- The retail industry is leveraging cloud AI in IoT-based services to augment customer experience programs and generate more customer-oriented products. For instance, in a smart retail environment, a camera system outfitted with computer vision capabilities can use facial recognition to recognize customers when they walk through the door. Suppose the system detects most customers walking into the store are Millennials. In that case, it can push out product advertisements or in-store specials that appeal to that demographic, therefore driving sales.

- Furthermore, most companies are shifting to the cloud from on-premise AI, owing to faster delivery time with low latency and real-time tracking, likely to foster the studied market growth during the forecast period. For instance, Amazon Echo Amazon has introduced Web Services IoT, a managed cloud platform and lets devices connect securely to cloud applications and other devices. In February 2021, IBM and Red Hat announced a new collaboration to use a hybrid cloud designed to deliver an open, flexible, and more secure solution for manufacturers and plant operators that will drive real-time value from operations data from industrial IoT.

- However, the lack of a skilled workforce and growing concerns regarding data security are some major factors restraining the studied market growth. It is crucial to ensure that the data is secure and in safe hands because AI and IOT collect sensitive and essential data from their users or clients. But since users have no idea when someone would attempt to access our private and sensitive data, security is always a concern with technology and restricting the market growth.

- During the spread of Coronavirus, the ability for organizations to access scalable, dependable, and highly secure computing power, whether for vital healthcare work, to help students continue learning, or to keep unprecedented numbers of employees online and productive from home are some of the critical factors owing to the growth of the market in this situation. Hospital networks, pharmaceutical companies, and research labs are using AI-enabled IoT devices to care for patients, explore treatments, and mitigate the impacts of COVID-19 in many other ways. All of the above factors have accelerated the market's growth rate in the short run and are expected to augment it further in the long term.

AI in IoT Market Trends

Healthcare Sector Expected to Witness Robust Market Growth

- Healthcare organizations can improve human performance on tasks such as diagnostic or therapeutic decisions, supporting clinicians in treating diseases, etc., by collecting and analyzing high-frequency Internet of Things (IoT) sensor data and computer vision (AI). Routine physical assessments of mobility and balance are usual healthcare activities with significant potential to be transformed by combining IoT and AI technologies (IoT). With IoT, care providers can simplify assessment using fewer steps while making the test quantitative, consistent, and reproducible.

- Hospitals, clinics, pharmaceuticals, and academic institutes testing and storing vaccines, such as COVID-19 vaccines, still lack visibility on their refrigerators' real-time state and performance. Due to this, there is an increasing need for IoT-based predictive maintenance for vaccine logistics and safety. IoT can also improve diagnostic accuracy and remote patient monitoring, reduce the need for follow-up visits, reduce wait times, identify critical patients, and track medical equipment.

- Furthermore, innovations in AI and IoT allow hospitals to take full advantage of data, like CT scans and records of patient vitals. These systems enable doctors to monitor patient health remotely, even when not in the building, and identify which patients need immediate attention. IoT can also boost the accuracy of diagnoses for certain diseases like breast and lung cancer.

- Smart hospitals are utilizing IoT-connected technologies and robotics to deliver a new age of health support and treatment. There is an emergence of various IoT devices and applications designed for the healthcare sector, including sensors and apps for telemedicine consultations and remote healthcare monitoring. In this regard, IoT is helping to improve healthcare via real-time patient monitoring (fitness trackers, smart wearables, panic buttons, etc.), advanced diagnostics through smart image analysis, and robotic surgery. These applications help collect data to provide preventive measures for a person, early detection, and drug administration.

- Smart healthcare trends are expected to grow significantly as a result of the rising adoption of IoT technologies. For instance, in December 2022, ASUS, a computer hardware manufacturer, unveiled smart healthcare solutions at the Taiwan Healthcare+ Expo. The ASUS Smart Healthcare theme encouraged digital change as various products were displayed at the ASUS exhibit. The community health management, precision health, and telemedicine trends which are driving the digitization of Taiwan's medical institutions were addressed. Moreover, AI algorithms and IoT devices also helped hospitals manage community health, allowing them to transition from community hospitals to modern hospitals through digital transformation.

North America Is Anticipated To Hold Major Market Share

- North America is one of the major regions with significant market share because of the wide-scale adoption of AI and IoT technologies in many industries, like automotive and transportation, manufacturing, retail, and healthcare, which is one reason for the growth of the market studied in this region. North America is one of the leading regions with research into developing AI and IoT applications in new end-user industries. According to Cisco, the United States and Canada have the highest average per capita devices and connections as of 2022.

- The manufacturing platform of North American companies has undergone a digital transformation which is creating an opportunity for the AI solution providers in the manufacturing of IoTs in the country, which has been enabling these companies to control energy and water usage in manufacturing facilities, boost equipment resilience while reducing waste, and check product quality in real-time on the production line. Providing scalable predictive quality, predictive maintenance, controlled release, and touchless operations would be helpful in increasing the sustainability of production in the region's plants.

- Many global companies are partnering with market vendors to integrate AI-based IIoT into their production lines, fueling the market's growth. For instance, in September 2022, P&G and Microsoft signed a multiyear partnership agreement to revamp P&G's digital manufacturing infrastructure. According to the partnerships, the industrial internet of things (IIoT), digital twin, data, and AI would accelerate product delivery to customers and boost customer satisfaction while increasing productivity and lowering costs.

- The region has many global IoT and AI-based vendor providers, especially in the United States. In addition, the country has a high-tech ecosystem, and the region's automobiles have become increasingly software-oriented. When AI is coupled with the IoT, the devices can analyze data, make decisions, and act on that data without human interference. Tesla's self-driving cars are examples of AI and IoT working in tandem. With the incorporation of AI, self-driving cars predict the behavior of cars and pedestrians in various circumstances. For instance, they can determine road conditions, weather, and optimal speed and get smarter with each trip.

- The industry's potential for growth in North America is reflected in the fact that many American AI platforms and software manufacturers collaborate with IoT solution providers to improve their market share in the area.

AI in IoT Industry Overview

The AI in IoT market is highly competitive owing to the presence of a large number of players in the market operating in domestic and international markets. The market comprises several players, such as Microsoft, Salesforce, AWS, SAP SE, Oracle, and IBM Corporation. The brand identity associated with the companies has a major influence on the market. As strong brands are synonymous with good performance, long-standing players are expected to have the upper hand. The vendors offering advanced AI solutions and continuous upgrades in their offerings may be the popular choice for buyers.

In June 2023, Amazon Web Services, Inc. announced the AWS Generative AI Innovation Centre, a new program designed to assist customers with their successful development and deployment of intelligent artificial intelligence solutions, has been announced. In the program, AWS will invest USD 100 million to connect AI and MLAWS experts with customers around the world so that they can imagine, design, or launch new generative artificial intelligence products, services, and processes.

In May 2023, SAP and Google Cloud announced an extensive offering of open data, intending to simplify the business data landscape and release its power. This offering enables customers to create an end-to-end data cloud that brings data from across the enterprise landscape using the SAP Datasphere solution and Google's Data Cloud so that businesses can view their entire data estate in real-time and maximize the value of their SAP Cloud investments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Big Data Volume

- 5.1.2 Effective Management of Data Generated From IoT Devices to Gain Valuable Insights

- 5.2 Market Restraints

- 5.2.1 Data Security and Privacy Issues

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Platform

- 6.1.1.1 Application Management

- 6.1.1.2 Connectivity Management

- 6.1.1.3 Device Management

- 6.1.2 Services

- 6.1.2.1 Managed Services

- 6.1.2.2 Professional Services

- 6.1.3 Software

- 6.1.3.1 Data Management

- 6.1.3.2 Network Bandwidth Management

- 6.1.3.3 Real-time Streaming Analytics

- 6.1.3.4 Remote Monitoring

- 6.1.3.5 Security

- 6.1.3.6 Edge Solution

- 6.1.1 Platform

- 6.2 By End-user Vertical

- 6.2.1 Banking, Financial Services, and Insurance (BFSI)

- 6.2.2 IT and Telecom

- 6.2.3 Energy and Utilities

- 6.2.4 Healthcare

- 6.2.5 Manufacturing

- 6.2.6 Other End-user Verticals (Transport and Mobility, Government, and Retail)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Web Services Inc. (Amazon Inc.)

- 7.1.2 IBM Corporation

- 7.1.3 Autoplant Systems India Pvt. Ltd

- 7.1.4 SAP SE

- 7.1.5 Google LLC (Alphabet Inc.)

- 7.1.6 Microsoft Corporation

- 7.1.7 Oracle Corporation

- 7.1.8 Salesforce.com Inc.

- 7.1.9 PTC Inc.

- 7.1.10 SAS Institute Inc.

- 7.1.11 General Electric Company

- 7.1.12 Hitachi Ltd