|

市場調查報告書

商品編碼

1690188

數位貨運-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Digital Freight Forwarding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

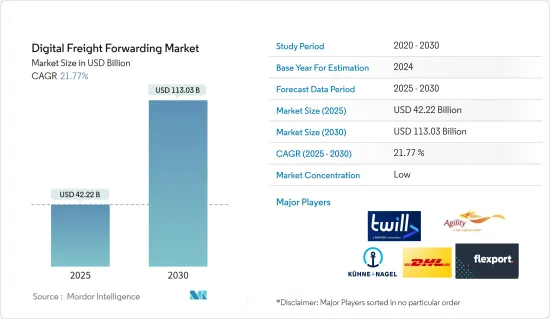

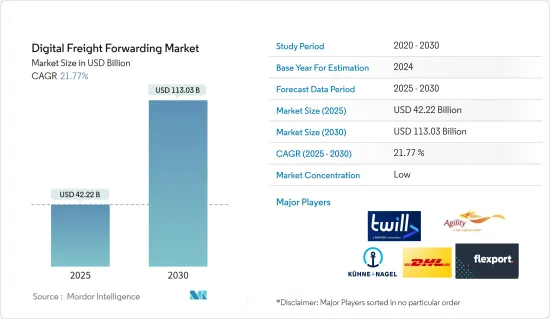

預計 2025 年數位貨運市場規模為 422.2 億美元,到 2030 年將達到 1,130.3 億美元,預測期內(2025-2030 年)的複合年成長率為 21.77%。

數位化仍然是當今經濟成長的主要驅動力之一。 convoy、Uber Freight 和 uShip 等公司正在推出新平台來填補物流行業的空白。數位貨運代理減少了手動流程。所有貨運報價都將在一個平台上提供,從而省去了數小時的對話和紙本記錄的麻煩。數位貨運代理的主要優勢包括即時報價、透明定價、費率和承運人比較、追蹤、簡單的文檔記錄等。物流業正在發展成為無紙化、數位化的產業,支持市場成長。

數位貨運市場趨勢

電子商務成長推動數位貨運市場

2019年,全球電子商務零售額達到約3.53兆美國,預計未來幾年電子商務銷售額將以更快的速度成長。網路購物是全球最受歡迎的線上活動之一,中國、印度和印尼等新興市場的國內和跨境電子商務蓬勃發展。這包括直接面對消費者的銷售以及電子產品、藥品和消費包裝商品的運輸。隨著網路普及,甚至產品製造商也逐漸從傳統貨運轉向數位貨運。數位貨運代理的主要優勢包括即時報價、透明定價、費率和承運人比較、追蹤和簡單的文檔記錄。

Flexport 引領數位貨運代理市場

Flexport 是一家位於舊金山的數位貨運代理公司和物流平台。該公司成立於 2013 年,其業務約一半來自海運,另一半來自空運。在 2017 年 9 月資金籌措後,Flexport 的估值達到 8 億美元。此輪融資由 DST Global主導,其他投資者包括 Founders Fund 和富國銀行。 2018年,該公司從主要企業順豐速運獲得1億美元投資。這使得 Flexport 的總資金籌措達到 3 億美元,估值超過 10 億美元。

該新興企業的銷售額約為 4 億美元,並且正在穩步成長。該公司每年運輸約 12 萬 TEU(二十英尺當量單位)的貨物,尤其專注於跨太平洋航線。該公司2019年的銷售收入達到8.6億美元,憑藉提供高品質的物流服務和分析報告,已成為數位貨運代理市場的領導者。

數位貨運行業概覽

數位貨運代理市場競爭激烈且高度分散,有許多公司在其中營運。數位貨運代理 (DFF) 使用數位平台提供比市場和連接提供者更廣泛的物流服務。 DFF 的核心價值提案是讓使用者在將貨物從 A 地運送到 B 地時獲得無縫的體驗,同時透過單一使用者介面在一個平台上聚合資訊。市場上現有的主要企業包括 Flexport、Twill、FreightHub、Fleet、InstaFreight、Transporteca、Kontainers、KN Freight Net、Turvo、iContainers、DHL Group、Kuehne+Nagel International AG、Agility Logistics Pvt。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

- 分析方法

- 研究階段

第3章執行摘要

第4章 市場洞察

- 當前市場狀況

- 價值鏈/供應鏈分析

- 投資場景

- 政府法規和舉措

- 線上貨運代理和數位平台的技術發展

- 電子商務物流與貨運代理概述

- 電子平台價值提案與競爭力

- COVID-19 市場影響

第5章市場動態

- 驅動程式

- 限制因素

- 機會

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第6章市場區隔

- 交通方式

- 土地

- 海上

- 航空

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 荷蘭

- 英國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 澳洲

- 印度

- 新加坡

- 馬來西亞

- 印尼

- 韓國

- 其他亞太地區

- 中東和非洲

- 南非

- 埃及

- 海灣合作理事會國家

- 其他中東和非洲地區

- 南美洲

- 巴西

- 智利

- 其他南美國家

- 北美洲

第7章競爭格局

- 市場集中度概覽

- 公司簡介

- Flexport

- Twill

- FreightHub

- Fleet

- InstaFreight

- Transporteca

- Kontainers

- KN Freight Net

- Turvo

- iContainers

- DHL Group

- Kuehne+Nagel International AG

- Agility Logistics Pvt. Ltd*

第8章 市場機會與未來趨勢

第9章 免責聲明

The Digital Freight Forwarding Market size is estimated at USD 42.22 billion in 2025, and is expected to reach USD 113.03 billion by 2030, at a CAGR of 21.77% during the forecast period (2025-2030).

Digitization is continuing to be one of the key drivers supporting growth of the current economy. Companies like convoy, Uber Freight and uShip are coming up with new platforms to fill in the gaps in the logistics industry. With Digital freight forwarding the manual process will be reduced. All the quotations for freight forwarding will be available at one platform without the hassle of hours of conversation and paper trails. The major benefits of digital freight forwarding include instant quotes, transparent pricing, comparison of rates and carriers, tracking, easy documentation and others. The logistics industry is developing to a paperless digitized industry supporting the growth of the market.

Digital Freight Forwarding Market Trends

Growth in E-Commerce driving Digital Freight Forwarding Market

In 2019, retail e-commerce sales worldwide amounted to around 3.53 trillion US dollars and e-retail revenues are projected to grow even further at a quicker pace in the coming few years. Online shopping is one of the most popular online activities worldwide, both domestic and cross-border e-commerce is booming in developing markets such as China, India, and Indonesia due to that reason. This encompasses not just direct-to-consumer retail, but also shipments of electronics, pharmaceuticals, and consumer packaged goods. With increasing access to internet even the manufacturers of products are gradually moving from traditional freight forwarding to digital freight forwarding. The major benefits of digital freight forwarding include instant quotes, transparent pricing, comparison of rates and carriers, tracking, easy documentation and others.

Flexport leading the Digital Freight forwarding market

Flexport is a San Francisco-based digital freight forwarder and logistics platform. Founded in 2013, the company has around half of its business in ocean freight and the other half in air freight. After its Series C round of funding in September 2017, Flexport had a valuation of $800 million. DST Global led this round; other investors include Founders Fund and Wells Fargo. In 2018, the company received USD 100 million from SF Express, a leading courier company in China. This brought Flexport's total funding to USD 300 million and its valuation to more than USD 1 billion.

The startup has a run-rate revenue of approximately USD 400 million and is growing steadily. It ships roughly 120,000 TEUs (20-foot equivalent units) annually, with a focus on transpacific trade lanes, where its shipment volume is the 20th largest on the transpacific eastbound route. It reached a revenue of USD 860 million in 2019 and became the leader in digital freight forwarding market as it provides high quality logistics service with added analytical reports.

Digital Freight Forwarding Industry Overview

The Digital Freight Forwarding Market is competitive and is highly fragmented with presence of many players. Digital freight forwarders (DFFs) use a digital platform to offer a broader range of logistics services than marketplaces and connectivity providers. DFFs build their core value proposition around a seamless user experience of shipping goods from one point to another while aggregating information on one platform with a single user interface. Some of the existing major players in the market include - Flexport, Twill, FreightHub, Fleet, InstaFreight, Transporteca, Kontainers, KN Freight Net, Turvo, iContainers, DHL Group, Kuehne + Nagel International AG and Agility Logistics Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Investment Scenarios

- 4.4 Government Regulations and Initiatives

- 4.5 Technology Development in Online Freight Forwarding and Digital Platforms

- 4.6 Overview on E-commerce Logistics and Freight Forwarding

- 4.7 Value Propositions of E-platforms Vs Competitors

- 4.8 Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.2 Restraints

- 5.3 Opportunities

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Mode of Transport

- 6.1.1 Land

- 6.1.2 Sea

- 6.1.3 Air

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.1.3 Mexico

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 France

- 6.2.2.3 Netherlands

- 6.2.2.4 United Kingdom

- 6.2.2.5 Italy

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 Australia

- 6.2.3.4 India

- 6.2.3.5 Singapore

- 6.2.3.6 Malaysia

- 6.2.3.7 Indonesia

- 6.2.3.8 South Korea

- 6.2.3.9 Rest of Asia-Pacific

- 6.2.4 Middle East & Africa

- 6.2.4.1 South Africa

- 6.2.4.2 Egypt

- 6.2.4.3 GCC Countries

- 6.2.4.4 Rest of Middle East & Africa

- 6.2.5 South America

- 6.2.5.1 Brazil

- 6.2.5.2 Chile

- 6.2.5.3 Rest of South America

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Flexport

- 7.2.2 Twill

- 7.2.3 FreightHub

- 7.2.4 Fleet

- 7.2.5 InstaFreight

- 7.2.6 Transporteca

- 7.2.7 Kontainers

- 7.2.8 KN Freight Net

- 7.2.9 Turvo

- 7.2.10 iContainers

- 7.2.11 DHL Group

- 7.2.12 Kuehne + Nagel International AG

- 7.2.13 Agility Logistics Pvt. Ltd*