|

市場調查報告書

商品編碼

1690161

網路加密-市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Network Encryption - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

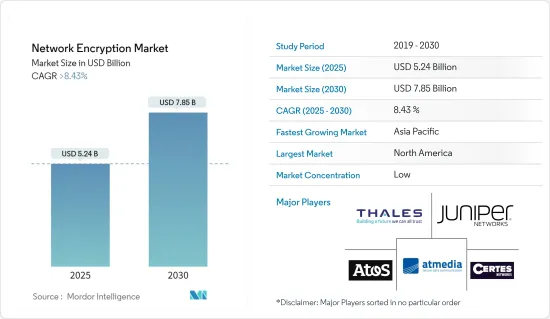

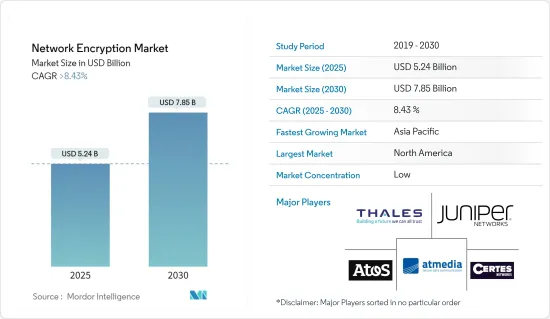

網路加密市場規模預計在 2025 年為 52.4 億美元,預計到 2030 年將達到 78.5 億美元,預測期內(2025-2030 年)的複合年成長率將超過 8.43%。

網路加密的成長主要是由於組織對資料安全和隱私的日益關注。

關鍵亮點

- 網際網路、雲端運算的發展以及日益增多的網路攻擊正在推動對更安全的資料通訊和儲存的需求。此外,越來越多的政府法規(例如《一般資料保護規範》(GDPR)和《支付卡產業資料安全標準》(PCI DSS))要求組織實施安全的資料傳輸方法,進一步推動了網路加密的發展。

- 此外,各個終端用戶產業在業務中採用基於物聯網 (IoT) 的解決方案,推動了對加密的需求,以保護透過物聯網網路傳輸的資料,從而支持市場的成長。

- 隨著新的加密演算法和更好的加密軟體的出現,網路加密產業得到了發展。例如,量子電腦有可能破解傳統的加密方法,因此使用量子電腦無法破解的加密演算法變得越來越重要。

- 部署加密解決方案可能很困難且成本高昂,尤其是對於 IT 資源較少的企業而言。對於某些組織來說,購買、配置和培訓員工使用和維護加密解決方案的成本可能是不使用加密解決方案的原因。此外,有些加密演算法存在技術問題,不適合企業網路。預計這些挑戰將對預測期內的市場成長構成挑戰。

- 影響市場成長的最重要因素是網路安全漏洞的增加、許多組織擴大採用雲端技術,以及對滿足不斷變化的監管標準以實現更好的資料保護的需求日益成長。

- COVID-19 疫情對網路加密貨幣市場產生了重大影響。隨著在家工作趨勢的持續成長,對安全的遠距工作解決方案的需求也隨之增加。隨著在家工作的興起,公司需要安全可靠的虛擬私人網路 (VPN) 和遠端桌面解決方案來保護敏感的公司資料。這導致對網路加密產品和服務的需求激增,推動了該行業的成長。此外,為了因應與疫情相關的網路攻擊和安全漏洞的增加,企業增加了對網路安全的投資。

網路加密市場的趨勢

電訊和 IT 領域預計將佔據主要市場佔有率

- 推動全球IT和通訊產業走向網路加密的關鍵因素包括雲端使用範圍的擴大、光纖通訊投資的增加、網路資料外洩的增加以及政府監管的嚴格。

- 此外,私有網路的日益普及、網路自動化趨勢以及 5G 網路的部署預計將大幅增加網路流量,需要更先進的安全措施。網路加密保證了網路上敏感資料的安全,並開啟了新的機會。

- 根據VIAVISION統計,截至2023年4月,美國是5G網路覆蓋城市最多的國家,共有503個城市,其次是中國,共有356個城市涵蓋5G網路。

- 智慧工廠、智慧交通系統、5G及更高版本的行動電話網路、物聯網、分散式帳本技術和量子安全通訊等新興資訊通訊技術需要技術和組織措施來應對各種威脅和風險。

- 5G技術的引入可能會導致連接到網路的物聯網(IoT)設備數量增加,為駭客發動更廣泛、更複雜的攻擊提供新的機會。據愛立信稱,預計行動資料總流量將從 2023 年的每月 26EB 增加到 2029 年的每月 73EB,複合年成長率為 19%。所有這些因素都在推動通訊供應商擴大網路自動化的範圍,從而刺激研究市場的需求。

- 此外,全球保全服務的創新擴展和採用進一步推動了對網路加密技術的需求。通訊威脅來自於產業中典型的基於 IP 的威脅與傳統技術的結合。隨著5G技術的進步,威脅面將會擴大,為攻擊者提供更多機會。因此,電信業者的網路安全團隊正在尋找利用新技術和自動化來簡化工作流程的方法,以便在面對新威脅和越來越多的警報時保持領先於攻擊者。

預計北美將佔據較大的市場佔有率

- 北美是一個技術設備精良的地區。美國和加拿大等新興經濟體佔據主要市場佔有率,為各種規模的企業遵守政府法規提供了合適的平台。

- 北美政府有法規要求在傳輸中保護敏感資料。這增加了對滿足這些監管要求的網路加密解決方案的需求。

- 此外,2023 年 9 月,量子安全加密領域的全球領導者之一 Arqit Quantum Inc. 和全球值得信賴的數位基礎設施網路安全專家 Exclusive Networks North America 宣布就 Arqit 專有的對稱金鑰協定平台達成協議。加入 Networks 的供應商和通路合作夥伴組合能夠提供 Arqit 的技術來防禦當前和未來的網路威脅,包括量子運算帶來的風險。

- 隨著該地區高科技產業的不斷發展,對網路加密解決方案的需求也日益增加。這是因為雲端運算已經變得如此普遍,以至於公司希望在敏感資料往返雲端時對其進行保護。公司也投入大量資金進行研發,以開發更先進的網路加密方法。這些投資正在促進該行業的發展。

- 雖然最近修訂的《EARN IT 法案》對強加密技術提出了質疑,但《合法存取加密資料法案》(LAEDA)卻直接攻擊了數百萬人每天所依賴的保護個人和國家安全的工具。

網路加密產業概況

網路加密市場較為分散,有多位參與企業活躍。該市場的大型企業正致力於透過策略合作計畫擴大海外基本客群,以增加市場佔有率和盈利。 Thales Trusted CyberTechnologies、Atos SE、Juniper Networks, Inc.、Certes Networks, Inc.、Senetas Corporation Ltd.、Viasat Inc.、Raytheon Technologies Corporation、Securosys SA. 和 Packetlight Networks 是當今市場上的一些主要企業,他們正在採取合併、收購、合作和產品創新等戰略舉措。

2023 年 2 月,Atos 宣布推出全新的「5Guard」安全產品,面向希望部署私有 5G 網路的企業和希望實現整合自動化的通訊業者。這些公司正在編配安全措施來保護和捍衛他們的資產和客戶。 Atos產品系列包括 Atos 加密解決方案(Trustway)、識別及存取管理軟體、公共關鍵基礎設施解決方案(IDnomic)以及 Atos 託管偵測和回應 (MDR) 平台,透過近乎即時地偵測和回應潛在威脅來提高 5G 網路元素、應用程式和工作負載的安全性。

2023 年 1 月,數位基礎架構製造商 Equinix 與雲端服務製造商 Aviatrix 合作,為企業環境提供高效能加密。透過此次合作,Aviatrix Edge 軟體將在全球 25 多個 Equinix 商業交換資料中心推出。此組合解決方案利用 Equinix Network Edge 和 Equinix Fabric,提供最快、最安全的雲端連接,並能夠查看跨多個雲端發生的情況。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 網路安全漏洞不斷增多

- 許多組織擴大採用雲端技術

- 市場問題

- 實施網路加密解決方案的成本高昂

第6章市場區隔

- 依實施類型

- 雲

- 本地

- 按組件

- 硬體

- 解決方案和服務

- 按組織規模

- 中小型企業

- 大型企業

- 按最終用戶產業

- 通訊和 IT

- BFSI

- 政府

- 媒體與娛樂

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- Thales Trusted Cyber Technologies

- ATMedia Gmbh

- Atos SE

- Juniper Networks Inc.

- Certes Networks Inc.

- Senetas Corporation Ltd.

- Viasat Inc.

- Raytheon Technologies Corporation

- Securosys SA

- Packetlight Networks

- Rohde & Schwarz Cybersecurity GmbH

- Colt Technology Services Group Ltd.

- Ciena Corporation

第8章投資分析

第9章:市場的未來

The Network Encryption Market size is estimated at USD 5.24 billion in 2025, and is expected to reach USD 7.85 billion by 2030, at a CAGR of greater than 8.43% during the forecast period (2025-2030).

The growth of network encryption is primarily attributed to the increasing concern for data security and privacy in organizations.

Key Highlights

- The growth of the internet, cloud computing, and the increasing number of cyberattacks have led to the need for more secure data communication and storage. Additionally, increasing government regulations, such as the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS), require organizations to implement secure data transmission methods, further driving the growth of network encryption.

- Furthermore, the growth in adopting Internet of Things (IoT)-based solutions by the various end-user industries in their operations has increased the need for encryption to secure data transmitted over IoT networks, supporting market growth.

- The network encryption industry has grown because new encryption algorithms and better encryption software have been made. For example, using encryption algorithms that quantum computers can't break is becoming more important because quantum computers could break traditional encryption methods.

- Putting encryption solutions into place can be hard and expensive, especially for businesses with few IT resources. For some organizations, the cost of buying and setting up encryption solutions and training staff to use and maintain them can be a reason not to use them. Also, some encryption algorithms may have technical problems that make them unsuitable for s networks. Such factors are expected to challenge the market's growth during the forecast period.

- The most important factors affecting the market's growth are the growing number of network security breaches, the increasing use of cloud technologies by many organizations, and the growing need to meet ever-changing regulatory standards for better data protection.

- The COVID-19 pandemic significantly affected the network encryption market. As the trend toward working from home grew, there was more demand for secure remote work solutions. With more people working from home, there was a need for secure and reliable virtual private networks (VPNs) and remote desktop solutions to protect sensitive corporate data. This led to a surge in demand for network encryption products and services, boosting growth in the industry. Additionally, businesses increased their investment in cybersecurity to address the rise in cyber-attacks and security breaches related to the pandemic.

Network Encryption Market Trends

Telecom and IT Sector is Expected to Hold a Significant Share of the Market

- Some of the main things pushing the IT and telecom industries worldwide to use network encryption are the growing use of the cloud, increasing investment in optical communication, growing network data breaches, and strict government regulations.

- Furthermore, the growing adoption of a private network, trends in network automation, and the rollout of 5G networks are expected to significantly increase network traffic, requiring more advanced security measures. Network encryption will keep sensitive data safe on these networks, opening up new business opportunities.

- According to VIAVISION, as of April 2023, with the highest 5G network access, it was available in 503 cities in the United States; with 5G availability in 356 cities, China followed in second.

- Emerging ICT technologies such as smart factories, intelligent transportation systems, the 5th generation of cellular networks and beyond, the Internet of Things, distributed ledger technologies, and quantum-safe communication need technical and organizational measures to address various threats and risks.

- The deployment of 5G technology will probably lead to increased Internet of Things (IoT) devices connected to networks, opening up new chances for hackers to conduct more extensive and sophisticated assaults. According to Ericsson, Total mobile data traffic is expected to grow from 26 EB per month in 2023 to 73 EB per month in 2029, growing at a CAGR of 19 percent. All these factors are expanding the scope of network automation among telecom vendors, fueling the demand in the studied market.

- Furthermore, the innovation expansion launch and adoption of security services across the globe have further boosted the demand for network encryption techniques. Threats against telecommunications result from a combination of typical IP-based threats in an industry with legacy technology. As 5G technology advances, the threat surface will only expand, giving attackers more opportunities. This leaves cybersecurity teams at telecom companies looking for ways to leverage new technology and automation to streamline workflows to stay ahead of attackers in the face of new threats and an increasing number of alerts to triage.

North America is Expected to Hold Significant Market Share

- North America is a well-equipped region in terms of technology. It has a significant market share because of developed economies like the United States and Canada, and it has the right platforms for businesses of all sizes to follow government rules and regulations.

- The government of North America has put in place rules that require sensitive data to be protected while in transit. This has driven the need for network encryption solutions to meet these regulatory requirements.

- Furthermore, in September 2023, Arqit Quantum Inc., one of the global leaders in quantum-safe encryption, and Exclusive Networks North America, a global trusted cybersecurity specialist for digital infrastructure, announced an agreement for Arqit's unique Symmetric Key Agreement Platform. Joining Networks' portfolio of vendors and channel partners can provide Arqit's technology that protects against current and future cyber threats, including the risk from quantum computing.

- As the tech industry in the region continues to grow, there is more demand for network encryption solutions. This is because cloud computing is becoming more popular, and organizations want to protect sensitive data while it is being sent to and from the cloud. The companies also spend money on research and development to develop more advanced ways to encrypt networks. This investment is contributing to the growth of the industry.

- While the recently amended EARN IT Act would leave strong encryption on unstable ground if passed into law, The Lawful Access to Encrypted Data Act (LAEDA) is a direct assault on the tool millions of people rely on for personal and national security each day.

Network Encryption Industry Overview

The network encryption market is fragmented, with several players operating. The major players with a prominent share in the market are focusing on expanding their customer base across foreign countries by leveraging strategic collaborative initiatives to increase their market share and profitability. Thales Trusted Cyber Technologies, Atos SE, Juniper Networks, Inc., Certes Networks, Inc., Senetas Corporation Ltd., Viasat Inc., Raytheon Technologies Corporation, Securosys SA., and Packetlight Networks are some of the major players present in the current market and undergoing strategic initiatives such as mergers, acquisitions, collaboration, product innovation, and others.

In February 2023, Atos announced the launch of its new '5Guard' security offering for organizations looking to deploy private 5G networks and for telecom operators looking to enable integrated, automated. They orchestrated security to protect and defend their assets and customers. Atos'product portfolio is Atos'encryption solutions (Trustway), identity and access management software; public critical infrastructure solutions (IDnomic); and Atos Managed Detection and Response (MDR) platform that elevates the security of 5G network elements, applications, and workloads by detecting and responding to potential threats in near real-time.

In January 2023, Equinix, a company that makes digital infrastructure, worked with Aviatrix, which makes cloud services, to make high-performance encryption for enterprise environments. This partnership will make the Aviatrix Edge software available in over 25 of Equinix's global business exchange data centers. The combined solution, which uses Equinix's Network Edge and Equinix Fabric, gives you the fastest, most secure connection to the cloud to see what's happening in multiple clouds.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Network Security Breaches

- 5.1.2 Increasing Adoption of Cloud Technologies by Numerous Organizations

- 5.2 Market Challenges

- 5.2.1 High Implementation Cost of Network Encryption Solutions

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 Cloud

- 6.1.2 On-premise

- 6.2 By Component

- 6.2.1 Hardware

- 6.2.2 Solutions & Services

- 6.3 By Organization Size

- 6.3.1 Small and Medium-sized Enterprises

- 6.3.2 Large-sized Enterprises

- 6.4 By End-user Industry

- 6.4.1 Telecom & IT

- 6.4.2 BFSI

- 6.4.3 Government

- 6.4.4 Media & Entertainment

- 6.4.5 Other End-user Industries

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Thales Trusted Cyber Technologies

- 7.1.2 ATMedia Gmbh

- 7.1.3 Atos SE

- 7.1.4 Juniper Networks Inc.

- 7.1.5 Certes Networks Inc.

- 7.1.6 Senetas Corporation Ltd.

- 7.1.7 Viasat Inc.

- 7.1.8 Raytheon Technologies Corporation

- 7.1.9 Securosys SA

- 7.1.10 Packetlight Networks

- 7.1.11 Rohde & Schwarz Cybersecurity GmbH

- 7.1.12 Colt Technology Services Group Ltd.

- 7.1.13 Ciena Corporation