|

市場調查報告書

商品編碼

1690151

中東可再生能源:市場佔有率分析、產業趨勢和成長預測(2025-2030 年)Middle East Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

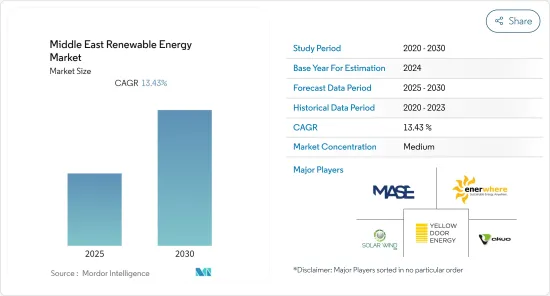

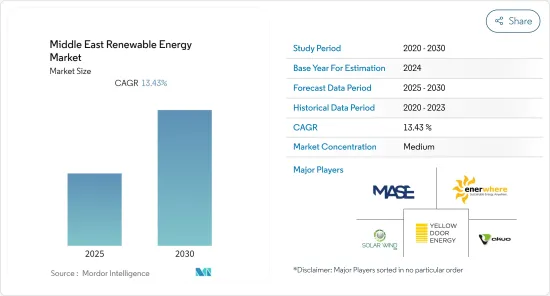

預測期內,中東可再生能源市場預計將以 13.43% 的複合年成長率成長

關鍵亮點

- 從中期來看,預計市場將受到政府各種措施的推動,以實現能源結構多樣化並增加對可再生能源的投資。

- 然而,預計在預測期內,天然氣發電使用量的增加和價格的下降將抑制市場成長。

- 可再生能源是一種間歇性能源來源。因此,儲能對於維持再生能源的分佈穩定至關重要。因此,可再生能源與能源儲存系統的日益整合有望在未來創造市場機會。

- 由於即將實施的計劃和政府目標,預計阿拉伯聯合大公國將在預測期內見證中東可再生能源市場的顯著成長。

中東可再生能源市場趨勢

太陽能領域將經歷顯著成長

- 在中東地區,太陽能在實現各國可再生能源目標方面發揮關鍵作用,預計在預測期內將顯著成長。 2015年中東地區太陽能發電裝置容量約為1GW,預計2021年將成長至8.4GW。

- 根據全球能源監測報告,阿拉伯國家計劃建造的太陽能和風力發電場將使中東的可再生能源生產能力提高五倍。該計劃包括近45個風電場和114個太陽能發電廠。

- 此外,根據國際可再生能源機構的《泛阿拉伯清潔能源舉措》,到2030年,中東國家可再生能源發電計劃將實現92%的目標。預計到2030年,這些國家的太陽能和風力發電將使該地區的可再生能源發電量增加一倍。

- 此外,天然氣價格上漲和太陽能成本下降正在提高阿拉伯聯合大公國可再生能源的效用。預計阿拉伯聯合大公國三年內20%的電力將來自非石化燃料,2050年50%的能源將來自非石化燃料。

- 此外,中東地區正在對可再生能源和太陽能進行投資,其中的計劃將把太陽能發電廠改造成能源樹,這將徹底改變世界。 「E 樹」形狀似一棵巨大的遮蔭樹,由一個巨大的漏斗形結構組成,該結構傾斜 360 度,形成一個巨大的懸臂,懸停在下面的花園上方。周圍還有19棵較小的“電力樹”,可額外提供28%的電力。這些樹全天追蹤太陽並旋轉 180 度以最佳化能量收集。這些樹木也為下面的花園提供遮蔭和陽光。

- 因此,由於上述因素,預計預測期內太陽能將在中東可再生能源市場中呈現顯著成長。

阿拉伯聯合大公國:預計將經歷顯著成長

- 近年來,阿拉伯聯合大公國在採用可再生能源,特別是太陽能方面邁出了重要一步。預計到 2050 年可再生能源發電計劃將產生超過 70 吉瓦的電力,投資額將達到 7,000 億美元。

- 此外,為了滿足日益成長的需求,該國已開始面臨加強能源安全、實現能源來源多樣化和增加太陽能在電力結構中的比重的挑戰。

- 該國已證明其擁有世界上最好的太陽能資源,同時支持經濟和監管舉措以及清潔能源計劃。其中一個因素是能否獲得負擔得起的融資。

- 除了傳統的計劃融資外,太陽能領域還出現了金融創新,以促進和提供長期所需的投資,其中包括1000億迪拉姆的杜拜綠色基金,用於支持旨在刺激屋頂太陽能板安裝的「沙姆斯杜拜舉措」。

- 此外,多種因素共同作用,使太陽能成為滿足國家能源需求的一個有吸引力的選擇。杜拜地理位置優越,太陽輻射量約 2,285 kWh/m2。這裡是世界上太陽輻射量最高的地區之一,具有巨大的可再生能源開發潛力。

- 此外,太陽能電池組件和電池技術成本的下降也有助於提高太陽能在阿拉伯聯合大公國的普及率。隨著太陽能成本的快速下降,阿拉伯聯合大公國正在評估其電力產業的策略。

- 阿拉伯聯合大公國2050能源策略的目標是到2050年將清潔能源在該國整體能源結構中的比例提高到50%,從而節省約1,900億美元的整體能源成本。這可減少70%的二氧化碳排放,並提高40%的消費效率。

- 該國致力於應對氣候變化,並承諾加入國際太陽能聯盟,該聯盟的目標是到2030年向開發中國家提供1,000吉瓦的太陽能。

- 因此,預計阿拉伯聯合大公國將在預測期內見證中東可再生能源市場的顯著成長。

中東可再生能源產業概況

中東可再生能源市場中等程度細分。市場的主要企業包括(不分先後順序)MASE、Enerwhere Sustainable Energy DMCC、Solarwind ME、Akuo Energy SAS 和 Yellow Door Energy。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章執行摘要

第3章調查方法

第4章 市場概述

- 介紹

- 可再生能源結構(2020年)

- 2027年裝置容量和吉瓦預測

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場區隔

- 按類型

- 水力發電

- 太陽熱

- 風

- 其他

- 按地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 阿曼

- 伊朗

- 以色列

- 約旦

- 其他中東地區

第6章競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- MASE

- Enerwhere Sustainable Energy DMCC

- Solarwind ME

- Akuo Energy SAS

- Yellow Door Energy Limited

- Masdar(Abu Dhabi Future Energy Co.)

- Canadian Solar Inc.

- Siraj Power Contracting LLC

- ACWA POWER BARKA SAOG

- EDF Renewables

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 70304

The Middle East Renewable Energy Market is expected to register a CAGR of 13.43% during the forecast period.

Key Highlights

- Over the medium term, factors such as various governments' plans to diversify the energy mix and increase investments in renewable energy are expected to drive the market.

- On the other hand, the increasing penetration of natural gas for power generation and its lower price are expected to restrain the growth of the market during the forecast period.

- Nevertheless, renewable power is an intermittent energy source. Therefore, the storage of electricity is essential to maintain the constant power distribution of generated renewable power. Thus, the increasing integration of renewable energy and energy storage systems is expected to create future market opportunities.

- The United Arab Emirates (UAE) is expected to witness significant growth in the Middle Eastern renewable energy market during the forecast period, owing to upcoming projects and government targets.

Middle East Renewable Energy Market Trends

Solar Energy Segment to Witness Significant Growth

- In the Middle Eastern region, solar energy plays a vital role in achieving the country's renewable energy target, and it is expected to show significant growth during the forecast period. In 2015, solar power installed capacity in the Middle East was around 1 GW, which increased to 8.4 GW in 2021.

- According to the Global Energy Monitor report, solar and wind power plants that are to be built by Arab Countries will increase the Middle Eastern renewable energy production capacity by five times. Nearly 45 wind power plants and 114 solar power plants are included in this project.

- Furthermore, according to the Pan Arab Clean Energy initiative by the International Renewable Energy Agency, 92% of the target to be attained through renewable energy generation projects in Middle Eastern countries will be reached by 2030. Solar and wind energy generated by these countries will double the region's renewable power generation capacity by 2030.

- Additionally, increasing natural gas prices and decreasing solar PV costs in UAE have made renewable energy more useful. The country is anticipated to achieve 20% of its electricity from non-fossil fuel sources within three years and derives 50% of its energy from these sources by 2050.

- Furthermore, an upcoming project in the Middle East, investing in renewable energy and solar energy to convert from solar farms to E-trees, will mark a revolution in the world. 'E-tree' is reminiscent of a giant shade tree consisting of a funnel-shaped structure that forms an enormous, slanted 360-degree cantilever that hovers above the garden below. It is also surrounded by 19 small 'E-trees,' which help supply an additional 28% of electricity. These trees will track the sun around the day and optimize harvesting the energy by rotation of 180 degrees. These trees also provide shade and stippled sunlight to the gardens below.

- Therefore, owing to the abovementioned factors, solar energy is expected to witness significant growth in the Middle Eastern renewable energy market during the forecast period.

The UAE is Expected to Witness Significant Growth

- The UAE has undertaken significant steps over the past few years, driving the region toward adopting renewable energy, particularly in the solar sector. Renewable energy projects will generate more than 70 GW of power by 2050, witnessing an investment of USD 700 billion.

- Furthermore, to meet the rising demand, the country embarked on a challenging mission to increase its energy security, diversify its energy sources, and increase the share of solar energy in its power mix.

- The country has proven that it has some of the world's best solar resources while supporting economic and regulatory policies and helping its clean energy program. One of the contributing factors is access to affordable finance.

- In addition to conventional project financing, the solar sector is witnessing financial innovation to help facilitate and provide investments required in the long term, including the AED 100 billion Dubai Green Fund to support the Shams Dubai initiative, a program aimed at promoting the installation of rooftop solar panels.

- Further, several factors converged to make solar energy an attractive option, to meet the country's energy needs. The country is geographically well-positioned, with solar irradiance of approximately 2,285 kWh/m2. It has one of the highest solar exposure rates globally, thereby holding tremendous potential for renewable energy development.

- In addition, the declining cost of solar modules and battery technology is increasing solar PV adoption in the United Arab Emirates. As the cost of solar power is declining rapidly, the United Arab Emirates is evaluating its strategies related to the power sector, which currently relies on large subsidies for electricity generated from natural gas or liquefied natural gas (LNG).

- The 'UAE Energy Strategy 2050' aims to increase the contribution of clean energy to the country's overall national energy mix, to 50%, by 2050, thereby saving approximately USD 190 billion of the overall energy costs. It will help reduce carbon emissions by 70% and increase consumption efficiency by 40%.

- The country is committed to tackling climate change and announced joining the International Solar Alliance, which aims to help developing countries harness 1,000 GW of solar power by 2030.

- Therefore, owing to the abovementioned factors, the United Arab Emirates is expected to witness significant growth in the Middle Eastern renewable energy market during the forecast period.

Middle East Renewable Energy Industry Overview

The Middle Eastern renewable energy market is moderately fragmented. Some of the major players in the market include (in no particular order) MASE, Enerwhere Sustainable Energy DMCC, Solarwind ME, Akuo Energy SAS, and Yellow Door Energy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Mix, 2020

- 4.3 Installed Capacity and Forecast in GW, till 2027

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Hydro

- 5.1.2 Solar

- 5.1.3 Wind

- 5.1.4 Other Types

- 5.2 By Geography

- 5.2.1 United Arab Emirates (UAE)

- 5.2.2 Saudi Arabia

- 5.2.3 Oman

- 5.2.4 Iran

- 5.2.5 Israel

- 5.2.6 Jordan

- 5.2.7 Rest of Middle East

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 MASE

- 6.3.2 Enerwhere Sustainable Energy DMCC

- 6.3.3 Solarwind ME

- 6.3.4 Akuo Energy SAS

- 6.3.5 Yellow Door Energy Limited

- 6.3.6 Masdar (Abu Dhabi Future Energy Co.)

- 6.3.7 Canadian Solar Inc.

- 6.3.8 Siraj Power Contracting LLC

- 6.3.9 ACWA POWER BARKA SAOG

- 6.3.10 EDF Renewables

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219