|

市場調查報告書

商品編碼

1690142

英國資料中心 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)United Kingdom Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

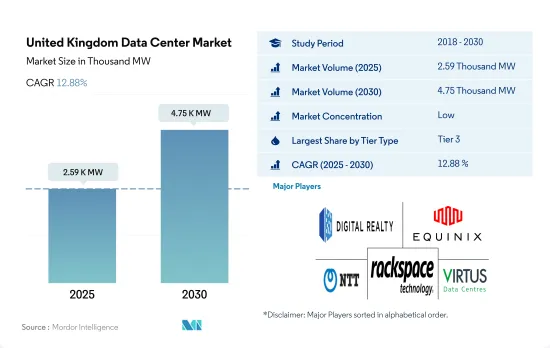

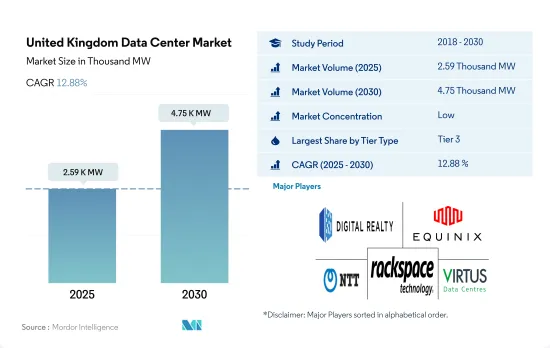

英國資料中心市場規模預計在 2025 年達到 2,590kW,預計到 2030 年將達到 4,750kW,複合年成長率為 12.88%。

預計 2025 年主機託管收益將達到 26.61 億美元,2030 年將達到 67.995 億美元,預測期內(2025-2030 年)的複合年成長率為 20.64%。

就容量而言,到 2023 年, 層級 3資料中心將佔據大部分佔有率,預計在預測期內將繼續佔據主導地位。

- 3層級資料中心因具有現場協助、電力和冷卻冗餘等特點而最受歡迎。 2022 年, 層級 3 直流市場運作容量為 1,540.98 兆瓦。預測期間的預計容量預計將從 2023 年的 1,813.19 兆瓦成長到 2029 年的 3,369.24 兆瓦,複合年成長率為 10.88%。這些資料中心具有「可同時維護」的特點,其主要區別在於冗餘組件。

- 中小型企業通常喜歡至少層級 3 級的系統,因為它提供的冗餘保護要好得多。在英國,小型企業佔企業總數的99.9%。據估計,到2022年初,英國私人企業數量將達到550萬家。層級設施的廣泛採用體現在批發和超大規模主機託管主要被 BFSI、電訊和媒體娛樂用戶採用。截至 2022 年,全國約有 148 個層級資料中心,約有 28 個層級資料中心正在興建中。

- 層級 4 因其容錯能力強、停機時間短、執行時間高達 99.99% 而成為大型企業的下一個首選資料中心。預計雲端運算和通訊領域的主要終端用戶採用超大規模主機託管將在預測期內見證市場的成長潛力。英國政府的 G-Cloud 計畫正在改變公共部門購買資訊和通訊技術的方式。 2022 年,該國擁有兩座層級資料中心,分別由 Exascale Ltd 和 ServerMania 擁有。

- 1 級和 2 級資料中心是最不受歡迎的,因為它們是供電和冷卻的單一途徑,與 3 級和 4 級設施相比,預期運作為 99.671%(每年停機時間為 28.8 小時)。

英國資料中心市場趨勢

智慧型手機普及率的提高以及 4G 和 5G 服務的出現將推動市場成長

- 預計到 2022 年,該國智慧型手機用戶數將達到 6,346 萬,到 2029 年將達到 6,800 萬,預測期內的複合年成長率為 1.01%。

- 英國智慧型手機普及率逐年上升,預計2022年將達到93%。在16-24歲族群中,2022年的智慧型手機擁有率為99%。英國行動網路用戶數已達6,230萬,預計隨著4G和5G的出現,這一數字將成長約286萬,到2026年將超過6,500萬。此外,自新冠疫情爆發以來,人們增加了智慧型手機的使用,並在網路遊戲和媒體串流平台上花費了更多時間。因此,2020年4月,該產業將個人非接觸式卡片付款的消費限額從30英鎊提高到45英鎊,以支持線上付款。這種情況導致智慧型手機的普及率不斷提高,並且這種情況持續至今。

- 用戶數量的增加帶動了資料中心市場的需求。這一成長是由電子商務、媒體娛樂和 BFSI 領域的成長所推動的,這些領域產生了大量資料。智慧型手機需要即時處理大量資料,這需要資料中心進行儲存。在智慧型手機普及率從 2017 年的 72% 成長到 2022 年的 90% 以上的歷史時期內,資料中心機架的數量從 2017 年的約 215,000 個增加到 2022 年的 388,000 個。預計這一趨勢將在預測期內持續下去。

2G 和 3G 的逐步淘汰以及 4G 和 5G 網路的採用,以及行動裝置使用量的增加,將推動市場成長

- 英國首個 5G 網路於 2019 年 5 月運作,4G 網路於 2012 年 10 月推出。自運作以來,這兩個網路的資料通訊速度都有所提升。 4G通訊速度已從 2012 年的 12Mbps 提升至 2022 年的 36.40Mbps。同樣,5G 速度也從 2019 年的 139.5 Mbps 提升至 2022 年的 160.15 Mbps。根據 2022 年 5 月的一項行業調查,在英國(英國),約 67% 的受訪者在智慧型手機上使用 4G 服務,約 25% 的受訪者正在使用 5G 服務。

- 英國將在2033年前逐步淘汰2G和3G行動服務。所有通訊業者的一項關鍵策略是關閉其2G和3G網路,並將投資和頻譜資源集中在進一步改善4G客戶體驗,同時推出5G。英國政府承諾支持1.1億英鎊(1.35億美元)的投資,以加速5G和6G的發展。此外,還與行動網路營運商沃達豐、EE、維珍媒體、O2 和 Three 就 2G 和 3G 轉換日期達成了一致。

- 更高的速度和整體改善的連接性也為其他終端用戶產業鋪平了道路。 2021 年,英國用戶平均每天在行動裝置上花費四個小時。這比 2020 年增加了 0.3 小時。 2022 年初英國社群媒體用戶數量佔總人口的 84.3%,2021 年至 2022 年間增加了 460 萬人。總體而言,這將提高行動資料速度,增加資料流量,從而增加資料中心存儲和處理資料的需求。

英國資料中心產業概況

英國資料中心市場較為分散,前五大公司佔34.50%的市佔率。該市場的主要企業包括 Digital Realty Trust Inc.、Equinix Inc.、NTT Ltd、Rackspace Technology Inc. 和 Virtus Data Centres Properties Ltd (STT GDC)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 市場展望

- 負載能力

- 占地面積

- 主機代管收入

- 安裝的機架數量

- 機架空間利用率

- 海底電纜

第5章 產業主要趨勢

- 智慧型手機用戶數量

- 每部智慧型手機的資料流量

- 行動資料速度

- 寬頻資料速度

- 光纖連接網路

- 法律規範

- 英國

- 價值鍊和通路分析

第6章市場區隔

- 熱點

- 倫敦

- 其他中東和非洲地區

- 資料中心規模

- 大規模

- 超大規模

- 中等規模

- 超大規模

- 小規模

- 層級類型

- 1層級和2級

- 層級

- 層級

- 吸收量

- 未使用

- 使用

- 按主機託管類型

- 超大規模

- 零售

- 批發的

- 按最終用戶

- BFSI

- 雲

- 電子商務

- 政府

- 製造業

- 媒體與娛樂

- 電信

- 其他

第7章競爭格局

- 市場佔有率分析

- 商業狀況

- 公司簡介.

- Colt Technology Services

- CyrusOne Inc.

- Digital Realty Trust Inc.

- Equinix Inc.

- Global Switch Holdings Limited

- Global Technical Realty SARL

- Kao Data Ltd

- NTT Ltd

- Rackspace Technology Inc.

- Telehouse(KDDI Corporation)

- Vantage Data Centers LLC

- Virtus Data Centres Properties Ltd(STT GDC)

第8章:CEO面臨的關鍵策略問題

第9章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 全球市場規模和DRO

- 資訊來源及延伸閱讀

- 圖表清單

- 關鍵見解

- 資料包

- 詞彙表

The United Kingdom Data Center Market size is estimated at 2.59 thousand MW in 2025, and is expected to reach 4.75 thousand MW by 2030, growing at a CAGR of 12.88%. Further, the market is expected to generate colocation revenue of USD 2,661 Million in 2025 and is projected to reach USD 6,799.5 Million by 2030, growing at a CAGR of 20.64% during the forecast period (2025-2030).

Tier 3 data center accounted for majority share in terms of volume in 2023, it will continue its dominance during forecast period

- Tier 3 data centers are the most preferred due to features such as onsite assistance, power, and cooling redundancy. The Tier 3 DC market was operating at 1540.98 MW in 2022. The expected capacity during the forecast period is expected to grow from 1813.19 MW in 2023 to 3369.24 MW in 2029 at a CAGR of 10.88%. These data centers are 'concurrently maintainable' with redundant components as a key differentiator.

- SMBs generally prefer to use at least a tier III-rated system for the far superior redundancy protections offered. In the United Kingdom, SMEs account for 99.9% of the business population. At the start of 2022, there were estimated to be 5.5 million businesses in the UK private sector. Major adoption of tier 3 facilities is reflected in BFSI, telecom, and media and entertainment users are majorly adopting wholesale and hyperscale colocation. As of 2022, there are around 148 Tier 3 data centers in the country, and around 28 upcoming data centers are under construction with Tier 3 standards.

- Tier 4 is the next most preferred data centers by large enterprises due to their fault-tolerant functionality, lower downtime, and 99.99% uptime. It is expected that the market will showcase potential growth during the forecast period with the adoption of hyperscale colocation by major end users in the cloud and telecom sectors. The UK government's G-Cloud program is changing the way public sector organizations purchase information and communications technology. In 2022, the country had two Tier 4 data centers owned by Exascale Ltd and ServerMania.

- The Tier 1&2 data centers are the least preferred due to their single path for power and cooling and providing expected uptime of 99.671% (28.8 hours of downtime annually) when compared to Tier 3 and Tier 4 facilities.

United Kingdom Data Center Market Trends

Increase smartphone penetration rate, emergence of 4G and 5G services to boost market growth

- The number of smartphone users in the country was 63.46 million in 2022 and is expected to witness a CAGR of 1.01% during the forecast period to reach a value of 68 million by 2029.

- The smartphone penetration rate in the United Kingdom has increased each year, reaching an overall figure of 93% in 2022. Among the age group of 16-24, the smartphone ownership rate was 99% in 2022. The number of mobile internet users in the United Kingdom reached 62.3 million, a figure which is projected to increase by approximately 2.86 million and amount to over 65 million by 2026 with the emergence of 4G and 5G. Further, since the COVID-19 pandemic hit, people have increased their smartphone usage and spent more time on online gaming or media streaming platforms. As a result, in April 2020, the industry increased the spending limit on individual contactless card payments from GBP 30 to GBP 45 to help with online payments. Such a scenario has increased smartphone penetration and is currently following the same trend.

- The growth of the user base positively boosted the market demand for data centers. The increasing rate has positively upheld its growth in the e-commerce, media and entertainment, and BFSI sectors, where a large chunk of data has been generated. Since smartphones necessitate real-time processing on having a large data chunk, they mostly require a data center for storage. During the historical period, when smartphone usage penetration increased from 72% in 2017 to more than 90% in 2022, the number of racks in the data center increased from around 215k in 2017 to 388k in 2022. This trend is further expected to be witnessed during the forecast period.

Phase out of 2G and 3G and adoption of 4G and 5G network and increase in use of mobile devices to drive market growth

- The United Kingdom's first 5G network was activated in May 2019, and 4G was launched in October 2012. Since being commissioned, both networks have shown an increment in their data speed. 4G speed increased from 12 Mbps in 2012 to 36.40 Mbps in 2022. Similarly, 5G speed increased from 139.5 Mbps in 2019 to 160.15 Mbps in 2022. In May 2022, according to an industry survey, around 67% of respondents in the United Kingdom (UK) had a 4G service on their smartphone, while about 25% had a 5G service.

- The UK will phase out 2G and 3G mobile services by 2033. The major strategy for all the operators is to turn off their 2G and 3G networks, allowing them to focus investments and spectrum resources on further improving the 4G customer experience while rolling out 5G. The UK government has outlined its intentions to invest in driving 5G and 6G development with the support of GBP 110 million (USD 135 million) worth of investment. Moreover, the switch-off date for 2G and 3G has been agreed upon with mobile-network operators Vodafone, EE, Virgin Media, O2, and Three.

- The growth in speed and better overall connectivity is paving the way for other end-user industries. In 2021, users in the United Kingdom spent an average of four hours per day using their mobile devices. This was an increase of 0.3 hours up from 2020. The number of social media users in the United Kingdom at the start of 2022 was equivalent to 84.3% of the total population, and it increased by 4.6 million between 2021 and 2022. Overall, this will increase the mobile data speed, increasing the data traffic, which thereby requires data centers for storing and processing data.

United Kingdom Data Center Industry Overview

The United Kingdom Data Center Market is fragmented, with the top five companies occupying 34.50%. The major players in this market are Digital Realty Trust Inc., Equinix Inc., NTT Ltd, Rackspace Technology Inc. and Virtus Data Centres Properties Ltd (STT GDC) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 MARKET OUTLOOK

- 4.1 It Load Capacity

- 4.2 Raised Floor Space

- 4.3 Colocation Revenue

- 4.4 Installed Racks

- 4.5 Rack Space Utilization

- 4.6 Submarine Cable

5 Key Industry Trends

- 5.1 Smartphone Users

- 5.2 Data Traffic Per Smartphone

- 5.3 Mobile Data Speed

- 5.4 Broadband Data Speed

- 5.5 Fiber Connectivity Network

- 5.6 Regulatory Framework

- 5.6.1 United Kingdom

- 5.7 Value Chain & Distribution Channel Analysis

6 MARKET SEGMENTATION (INCLUDES MARKET SIZE IN VOLUME, FORECASTS UP TO 2030 AND ANALYSIS OF GROWTH PROSPECTS)

- 6.1 Hotspot

- 6.1.1 London

- 6.1.2 Rest of United Kingdom

- 6.2 Data Center Size

- 6.2.1 Large

- 6.2.2 Massive

- 6.2.3 Medium

- 6.2.4 Mega

- 6.2.5 Small

- 6.3 Tier Type

- 6.3.1 Tier 1 and 2

- 6.3.2 Tier 3

- 6.3.3 Tier 4

- 6.4 Absorption

- 6.4.1 Non-Utilized

- 6.4.2 Utilized

- 6.4.2.1 By Colocation Type

- 6.4.2.1.1 Hyperscale

- 6.4.2.1.2 Retail

- 6.4.2.1.3 Wholesale

- 6.4.2.2 By End User

- 6.4.2.2.1 BFSI

- 6.4.2.2.2 Cloud

- 6.4.2.2.3 E-Commerce

- 6.4.2.2.4 Government

- 6.4.2.2.5 Manufacturing

- 6.4.2.2.6 Media & Entertainment

- 6.4.2.2.7 Telecom

- 6.4.2.2.8 Other End User

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Landscape

- 7.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.3.1 Colt Technology Services

- 7.3.2 CyrusOne Inc.

- 7.3.3 Digital Realty Trust Inc.

- 7.3.4 Equinix Inc.

- 7.3.5 Global Switch Holdings Limited

- 7.3.6 Global Technical Realty SARL

- 7.3.7 Kao Data Ltd

- 7.3.8 NTT Ltd

- 7.3.9 Rackspace Technology Inc.

- 7.3.10 Telehouse (KDDI Corporation)

- 7.3.11 Vantage Data Centers LLC

- 7.3.12 Virtus Data Centres Properties Ltd (STT GDC)

- 7.4 LIST OF COMPANIES STUDIED

8 KEY STRATEGIC QUESTIONS FOR DATA CENTER CEOS

9 APPENDIX

- 9.1 Global Overview

- 9.1.1 Overview

- 9.1.2 Porter's Five Forces Framework

- 9.1.3 Global Value Chain Analysis

- 9.1.4 Global Market Size and DROs

- 9.2 Sources & References

- 9.3 List of Tables & Figures

- 9.4 Primary Insights

- 9.5 Data Pack

- 9.6 Glossary of Terms