|

市場調查報告書

商品編碼

1690116

印度LED照明:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)India LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

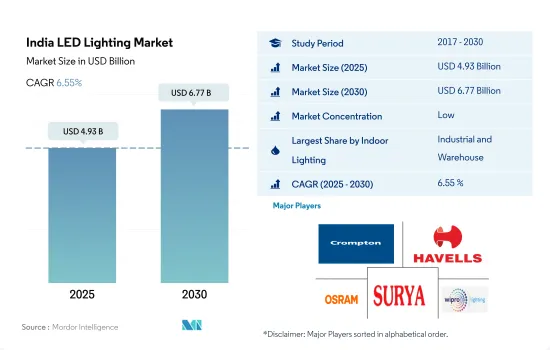

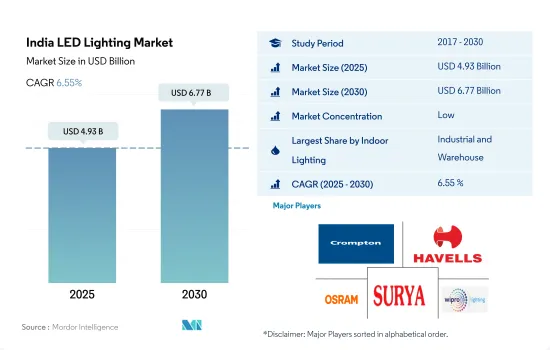

印度LED照明市場規模預計在2025年為49.3億美元,預計到2030年將達到67.7億美元,預測期內(2025-2030年)的複合年成長率為6.55%。

工業領域發展和住宅數量的增加將推動LED照明市場的成長

- 就價值佔有率而言,預計工業和倉儲領域將在 2023 年佔據最大佔有率(58%),其次是住宅(24.4%)、商業(15.2%)和農業照明(2%)。印度的目標是到2030年實現商品出口額達1兆美元,並有望成為全球主要製造地。此外,國家製造業計劃等各種計劃和舉措的實施也可能會促進市場發展,該計劃旨在到 2025 年將製造業在 GDP 中的佔有率提高到 25%。該計劃旨在加速核心製造業的發展。倉儲、物流和工業營運對工業照明的需求正在穩步成長。例如,倉儲、工業和物流 (WIL) 類別預計對於實現印度到 2025 會計年度成為 5 兆美元經濟體的願景至關重要。這些因素正在推動全國各地倉庫和工業領域 LED 照明銷售的成長。

- 就數量佔有率而言,預計2023年住宅照明將佔最大佔有率(68%),其次是商用(28.4%)、工業/倉庫照明(2%)和農業照明(2%)。 2022 年,包括登記在冊的家庭在內,全國平均家庭規模將達到每戶 4.4 人,這將導致單人家庭和屋主數量增加。在印度,超過50%的人住在自己的家裡,近30%的人住在租來的房子裡,13%的人住在父母家。此外,由於對辦公和住宅空間的需求不斷增加,印度房地產行業近年來也出現了顯著成長。 2021 會計年度第四季度,印度 7 個城市的住宅銷量成長了 29%,而新掛牌房屋數量與 2020 會計年度第四季相比成長了 51%。

印度LED照明市場趨勢

印度政府計畫提供經濟適用住宅,推動該國LED照明的普及

- 2023年,印度人口將超過14億人。 2021 年,印度每 1,000 人中約有 16.42 名新生兒,這意味著每位母親約有 2.03 名嬰兒出生。該國雄心勃勃的 Pradhan Mantri Awas Yojana (PMAY) 計劃旨在到 2022 年在全國大都會圈建造 2000 萬套經濟適用住宅,該計劃推動了住宅行業的發展。預計都市區住宅單元的成長以及商業和零售辦公空間的擴張將需要提高能源效率。預計這將推動節能 LED 照明的需求。 2023年7月乘用車、三輪車、摩托車和四輪車總產量為208萬輛。到 2030 年,印度有望成為共享出行領域的領導者,為能源和自動駕駛汽車提供機會。印度政府已設定目標,2030年,印度銷售的新車中30%將實現節能。使用LED燈照明非常重要,預計將促進LED的銷售。

- 印度的汽車工業正在大幅擴張。 2021年4月至2022年3月汽車產量為23,046,660輛,2022年4月至2023年3月汽車產量為25,931,867輛。 2023 年乘用車銷量將從 2022 年的 1,467,039 輛增加到 1,747,376 輛。印度人的汽車持有超過 7%。乘用車的需求量很大,預計在預測期內將繼續成長。隨著道路上車輛數量的增加,對可靠、明亮的汽車照明(尤其是節能 LED)的需求必將增加。

核心家庭、都市化和人均收入的提高推動了住宅產業的成長

- 2014年,印度的平均家庭規模為每戶4.8人。在許多州和聯邦屬地,農村家庭的人口多於都市區家庭的人口。到 2022 年,包括所有登記家庭在內的平均家庭規模將達到 4.4 人,導致單人家庭/房屋所有權增加。雖然印度超過 50% 的人住在自己的家裡,但有近 30% 的人租房子住,13% 的人住在父母家。移民占都市區總人口的很大一部分。隨著移民的增加,LED 預計將變得更加普及,以滿足照明需求。

- 印度的可支配收入正在增加,這反過來又提高了個人的消費能力並增加了對新生活空間的支出。 2022 年 3 月,印度的人均收入為 2,301.4 美元,而 2021 年 3 月為 1,971.6 美元。與一些開發中國家相比,印度的人均收入較低。例如,2022年日本的人均所得為3,3,911.2美元,越南為3,716.8美元,中國為1,2732.5美元。這顯示印度個人的購買力可能低於其他國家。

- 由於對辦公室和住宅的需求不斷增加,印度房地產行業近年來一直經歷高速成長。 2021 會計年度第四季度,印度 7 個城市的住宅銷售量與 2020 會計年度第四季相比成長了 29%,而新房開售量增加了 51%。政府已推出多項節能計劃。電力部在 UJALA(全民可負擔 LED 燈 Unnat Jyoti)計劃下,七年內已分發了 3.678 億盞 LED 燈,每年節省 4.778 億千瓦時電力。該計劃於2015年1月5日開始實施。此類案例預計將進一步增加日本對LED照明的需求。

印度LED照明產業概況

印度LED照明市場較為分散,前五大企業市佔率為13.91%。市場的主要企業包括 Crompton Greaves Consumer Electricals Limited、Havells India Ltd.、OSRAM GmbH.、Surya Roshni Limited 和 Wipro Lighting Limited(Wipro Enterprises Ltd.)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 汽車產量

- 人口

- 人均收入

- 汽車貸款利率

- 充電站數量

- 道路上的汽車數量

- LED進口總量

- 照明功耗

- #家庭數量

- 道路網路

- LED滲透率

- #體育場數量

- 園藝區

- 法律規範

- 室內照明

- 印度

- 戶外照明

- 印度

- 汽車照明

- 印度

- 室內照明

- 價值鍊和通路分析

第5章市場區隔

- 室內照明

- 農業照明

- 商業照明

- 辦公室

- 零售

- 其他

- 工業/倉庫

- 住宅照明

- 戶外照明

- 公共設施

- 路

- 其他

- 汽車公共產業照明

- 日間行車燈 (DRL)

- 方向指示器

- 頭燈

- 倒車燈

- 紅綠燈

- 尾燈

- 其他

- 汽車照明

- 二輪車

- 商用車

- 搭乘用車

第6章競爭格局

- 關鍵策略趨勢

- 市場佔有率分析

- 商業狀況

- 公司簡介

- Crompton Greaves Consumer Electricals Limited

- Fiem Industries Ltd.

- Havells India Ltd.

- Lumax Industries

- Marelli Holdings Co., Ltd.

- Orient Electric Limited

- OSRAM GmbH

- Signify Holding(Philips)

- Surya Roshni Limited

- Wipro Lighting Limited(Wipro Enterprises Ltd.)

第7章:CEO面臨的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源及延伸閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The India LED Lighting Market size is estimated at 4.93 billion USD in 2025, and is expected to reach 6.77 billion USD by 2030, growing at a CAGR of 6.55% during the forecast period (2025-2030).

Increasing developments in the industrial category and increase in the number of residential houses to drive the growth of the LED lighting market

- In terms of value share, the industrial and warehouse segment was expected to have the largest share (58%) in 2023, followed by residential (24.4%), commercial (15.2%), and agricultural lighting (2%). India is on track to become a major manufacturing hub in the world with its aim to export USD 1 trillion worth of goods by 2030. Furthermore, the implementation of various programs and policies, such as the National Manufacturing Policy, which aims to increase the manufacturing share of GDP to 25% by 2025, may also facilitate the market. The effort is aimed at accelerating the development of the core manufacturing industry. Demand for industrial lighting has grown steadily in warehousing, logistics, and industrial operations. For example, the Warehousing, Industry, and Logistics (WIL) category is expected to be crucial to realizing India's vision of becoming a USD 5 trillion economy by FY 2025. These factors are increasing sales of LED lighting in domestic warehouses and industries.

- In terms of volume share, residential lighting is expected to have the largest share (68%) in 2023, followed by commercial (28.4%), industrial and warehouse lighting (2%), and agricultural lighting (2%). The average household size, including all registrants nationwide, in 2022 was 4.4 people per household, leading to an increase in private households and homeowners. Over 50% of people in India live in their own homes, nearly 30% live in rented houses, and 13% live in their parents' homes. In addition, the Indian real estate industry has recently experienced significant growth due to increased demand for office and residential spaces. Home sales in seven Indian cities increased by 29% in Q4 FY 2021, with new listings up by 51% compared to Q4 FY 2020.

India LED Lighting Market Trends

Indian government schemes are providing affordable residential homes, boosting the LED light penetration in the country

- In 2023, India had a population of over 1.40 billion. In India, there were roughly 16.42 live births per 1,000 people in 2021, with approximately 2.03 children born to each mother. The national government's ambitious Pradhan Mantri Awas Yojana (PMAY) scheme, which aimed to construct 20 million affordable residences in metropolitan areas all across the nation by 2022, drove the residential sector. The anticipated expansion in urban housing units, along with the rising commercial and retail office space, necessitates greater energy efficiency. This is projected to drive the demand for energy-efficient LED lighting. In July 2023, the total production of passenger vehicles, three-wheelers, two-wheelers, and quad bikes was 2.08 million units. In 2030, India is expected to be a leader in shared mobility, providing opportunities for energy and autonomous vehicles. The Indian government has set a target to have 30% of new cars sold in India be energy-efficient by 2030. Lighting using LED lights will be very important, boosting LED sales.

- In India, the automotive industry has experienced significant expansion. In comparison to 23,040,066 automobiles produced from April 2021 to March 2022, the industry produced 25,931,867 vehicles from April 2022 to March 2023. The sales of passenger cars in 2023 increased from 14,67,039 in 2022 to 17,47,376. The percentage of Indians who own an automobile exceeded 7%. With a sizable demand for passenger vehicles, the expanding trend is anticipated to continue during the forecast period. The demand for dependable and brilliant car lighting, particularly LEDs due to their energy efficiency, will increase more as the number of vehicles on the road rises.

Increasing nuclear families, urbanization, and increasing per capita income are driving the growth of the housing sector

- The average household size in India in 2014 was 4.8 people per household. In many states and union territories, more people live in rural households than in urban households. The average household size, including all registered households, was 4.4 by 2022, which resulted in increased private household/own housing ownership. More than 50% of people in India live in their own houses, while almost 30% live on a rental basis and 13% in their parents' houses. A large share of the total urban population are migrants. The increase in the number of migrants is expected to create LED penetration in the country to meet the need for illumination.

- In India, disposable income is growing, resulting in the rising spending power of individuals and spending on new residential spaces. India's per capita income reached USD 2,301.4 in March 2022, compared to 1,971.6 USD in March 2021. Compared to some developing nations, India's per capita income is less. For instance, in 2022, Japan's per capita income was USD 33,911.2, Vietnam's was USD 3,716.8, and China's was USD 12,732.5. This suggests that the purchasing power of individuals in India may be lower than those of other nations.

- The Indian real estate sector has witnessed high growth in recent times with a rise in demand for office as well as residential spaces. Housing sales in seven Indian cities increased by 29% and new launches by 51% in Q4 FY21 over Q4 FY20. The government introduced a few energy-saving schemes. The Power Ministry distributed 36.78 crore LED lights under the Unnat Jyoti by Affordable LEDs for All (UJALA) program in seven years, which saved 47,778 million units of electricity per annum. The program was launched on January 05, 2015. Such instances are further expected to raise the demand for LED lighting in the country.

India LED Lighting Industry Overview

The India LED Lighting Market is fragmented, with the top five companies occupying 13.91%. The major players in this market are Crompton Greaves Consumer Electricals Limited, Havells India Ltd., OSRAM GmbH., Surya Roshni Limited and Wipro Lighting Limited (Wipro Enterprises Ltd.) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 Lighting Electricity Consumption

- 4.9 # Of Households

- 4.10 Road Networks

- 4.11 Led Penetration

- 4.12 # Of Stadiums

- 4.13 Horticulture Area

- 4.14 Regulatory Framework

- 4.14.1 Indoor Lighting

- 4.14.1.1 India

- 4.14.2 Outdoor Lighting

- 4.14.2.1 India

- 4.14.3 Automotive Lighting

- 4.14.3.1 India

- 4.14.1 Indoor Lighting

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

- 5.2 Outdoor Lighting

- 5.2.1 Public Places

- 5.2.2 Streets and Roadways

- 5.2.3 Others

- 5.3 Automotive Utility Lighting

- 5.3.1 Daytime Running Lights (DRL)

- 5.3.2 Directional Signal Lights

- 5.3.3 Headlights

- 5.3.4 Reverse Light

- 5.3.5 Stop Light

- 5.3.6 Tail Light

- 5.3.7 Others

- 5.4 Automotive Vehicle Lighting

- 5.4.1 2 Wheelers

- 5.4.2 Commercial Vehicles

- 5.4.3 Passenger Cars

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Crompton Greaves Consumer Electricals Limited

- 6.4.2 Fiem Industries Ltd.

- 6.4.3 Havells India Ltd.

- 6.4.4 Lumax Industries

- 6.4.5 Marelli Holdings Co., Ltd.

- 6.4.6 Orient Electric Limited

- 6.4.7 OSRAM GmbH.

- 6.4.8 Signify Holding (Philips)

- 6.4.9 Surya Roshni Limited

- 6.4.10 Wipro Lighting Limited (Wipro Enterprises Ltd.)

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms