|

市場調查報告書

商品編碼

1690114

硫磺回收技術-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Sulphur Recovery Technologies - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

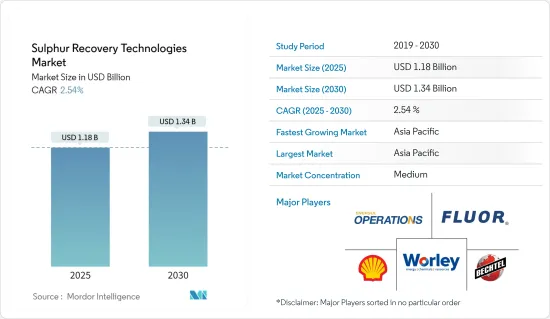

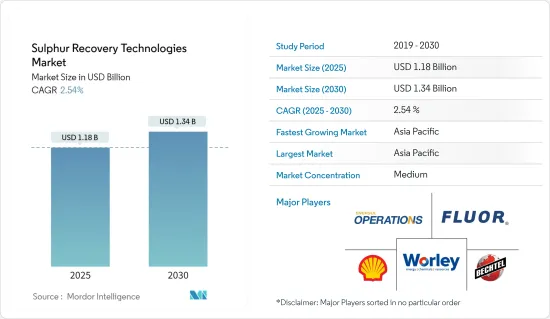

硫磺回收技術市場規模預計在 2025 年達到 11.8 億美元,預計到 2030 年將達到 13.4 億美元,預測期內(2025-2030 年)的複合年成長率為 2.54%。

主要亮點

- 從長遠來看,日益成長的環境問題、嚴格的污染標準以及即將建成的新煉油廠和擴建計劃預計將推動硫磺回收技術市場的發展。

- 另一方面,硫回收製程的局限性和降低硫含量的高成本預計將抑制市場發展。

- 然而,新興市場尚未開發的石油和天然氣潛力預計將在預測期內及以後快速成長。預計這些發展將為市場成長提供重大機會。

- 預計亞太地區將成為預測期內最大的市場,其中大部分需求來自中國和印度,原因是石油和天然氣產量高、環境法規越來越嚴格以及精製能力不斷提高。

硫回收技術的市場趨勢

煉油部門預計將顯著成長

- 硫磺回收技術在煉油廠中起著至關重要的作用,而硫磺回收裝置(SRU)是硫磺回收的關鍵。特別是降低汽油和柴油中的硫含量將有助於加強廢氣法規並減少產品使用過程中的空氣污染。

- 隨著全球範圍內對石油和氣體純化煉油廠擴建的投資不斷增加以及環境法規越來越嚴格,煉油廠有望保持其優勢。

- 精製的硫磺回收裝置 (SRU) 的任務是從酸性氣體(各種精製製程的產物)中提取 H2S,並將其轉化為工業級熔融硫。該設備採用的主要方法稱為“克勞斯法”,能夠去除氣流中 95-99.9% 的硫化氫。在克勞斯法的改良版本中,富含硫化氫的酸性氣體與氧氣一起燃燒,然後將產生的氣體冷卻,並回收熔融的硫磺。

- 例如,根據石油輸出國組織的預測,2023年煉油廠原油加工量為8,076萬桶/日,2022年為7,908萬桶/日。這項產能的主要貢獻者包括美國、中國、印度、日本、沙烏地阿拉伯和其他東南亞國協。這些國家主要依賴碳氫化合物及其衍生物。

- 許多國家正在擴大精製能力以滿足未來的需求,重點是硫回收等技術。例如,2024 年 7 月,印度石油有限公司 (BPCL) 宣布計劃投資約 59.8 億美元(5,000 億印度盧比)在印度建立一座年產量為 1,200 萬噸(MMTPA)的新煉油廠。該公司正在考慮在安得拉邦、北方邦和古吉拉突邦位置。

- 2024 年 6 月,BPCL 表示,計畫在 2029 會計年度將精製能力提高到每年 4,500 萬噸。 BPCL 在孟買、科欽和比納(中央邦)經營煉油廠,總合精製能力約 3,600 萬噸。

- BPCL 計劃在未來五年內投資約 200 億美元(1.7 兆印度盧比)。其中,7,500 億印度盧比用於煉油和石化計劃,9.57 億美元(800 億印度盧比)用於管道項目,超過 24 億美元(2,000 億印度盧比)用於行銷活動。

- 2024 年 1 月,烏干達與杜拜王室領導的一家投資公司進行了談判。談判的核心是計劃利用烏干達部分原油蘊藏量建造一座價值 40 億美元的煉油廠。

- 到2023年11月,斯里蘭卡內閣已核准中國能源巨頭中石化45億美元的投資。這項核准為中石化在具有重要戰略意義的漢班托塔港建立新的精製鋪平了道路。

- 因此,隨著對無污染燃料的需求不斷增加,預計硫磺回收技術市場在預測期內將大幅擴張。

亞太地區可望主導市場

- 亞太地區幅員遼闊,地形、氣候、社會、文化、宗教和經濟形態多元。世界上超過50%的人口居住在這一地區。該地區還有許多石油和氣體純化,是硫的主要來源。因此,克勞斯和廢氣處理裝置等硫回收技術的需求量大。

- 該地區是印度和中國等許多新興經濟體的所在地,這些經濟體正在大力投資石油和天然氣領域。因此,減少環境影響的需求正在推動對硫回收技術的需求。該地區還擁有幾個大型石化計劃,這些項目需要硫回收技術來滿足環境標準。

- 亞太地區是世界上成長最快的地區之一,因為該地區有印度和中國等新興經濟體,也有日本、韓國和澳洲等已開發國家。 2023年,中國是世界第二大石油消費國和第六大石油生產國。為了減少進口依賴並提高能源安全,該國進口了近50%的碳氫化合物。亞太地區是硫磺回收技術市場的關鍵地區之一,由於煉油廠等能源密集型產業的快速成長,預計未來亞太地區將繼續佔據主導地位。

- 中國正尋求透過開發四川盆地等各內陸頁岩盆地的國內蘊藏量來最大限度地發揮頁岩的潛力。近年來,中國頁岩氣開發穩步推進,自2017年以來年均成長21%。 2023年,中國將生產2,324.3億立方米天然氣。

- 硫磺回收技術對於印度的精製和石化產業減少有害硫磺排放和生產更清潔的燃料至關重要。 2022 年 3 月,印度跨國工程公司 Thermax Ltd 簽署了一份價值 1.4902 億美元的訂單,為印度一家公共部門煉油廠安裝硫磺回收裝置,這是印度政府「2030 年東北碳氫化合物願景」的一部分。

- 2024 年 2 月,馬來西亞國有企業馬來西亞國家石油公司透過馬來西亞石油管理局簽署了產品分成合約 (PSC),涵蓋馬來西亞半島近海兩個具有潛在天然氣蘊藏量的發現資源機會叢集。 BIGST DRO叢集的採收量估計為 4 兆立方英尺,Petronas Carigali 和上游公司 JX Nippon Oil & Gas Exploration 分別獲得了 50% 的參與權益。該叢集由五個未開發的高二氧化碳天然氣田組成:Bujang、Inas、Guling、Sepat 和 Tujo。

- 因此,亞太地區憑藉其龐大的石油和氣體純化行業以及對清潔石化燃料日益成長的需求,預計將在市場中佔據主導地位。

硫磺回收技術產業概況

硫磺回收技術市場較為分散。該市場的主要企業(不分先後順序)包括 Enersul Limited Partnership、WorleyParsons Limited、Shell PLC、Bechtel Corporation 和 Fluor Corporation。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概述

- 介紹

- 2029 年市場規模與需求預測

- 煉油廠裝置容量及2029年預測

- 2029年精製油含硫量(百萬噸/年)

- 近期趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 日益成長的環境問題和更嚴格的污染法規

- 限制因素

- 硫回收製程的局限性

- 驅動程式

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章市場區隔

- 應用

- 煉油廠

- 天然氣處理廠

- 發電廠

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 亞太地區

- 印度

- 中國

- 韓國

- 日本

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 奈及利亞

- 阿曼

- 南非

- 埃及

- 阿爾及利亞

- 其他中東和非洲地區

- 北美洲

第6章競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 市場佔有率分析

- 公司簡介

- Enersul Limited Partnership

- Worley Limited

- Shell Plc

- Bechtel Corporation

- Fluor Corporation

- Sulfur Recovery Engineering Inc.

- Honeywell UOP

- Air Liquide SA

- List of Other Prominent Companies(Company Name, Headquarters, Revenue, Relevant Products and Services, Operating Sector, Recent Trends, Technology or Projects, Contact Details, etc.)

- 市場排名分析

第7章 市場機會與未來趨勢

- 新興市場尚未開發的石油和天然氣潛力

簡介目錄

Product Code: 69995

The Sulphur Recovery Technologies Market size is estimated at USD 1.18 billion in 2025, and is expected to reach USD 1.34 billion by 2030, at a CAGR of 2.54% during the forecast period (2025-2030).

Key Highlights

- Over the long term, growing environmental concerns, strict pollution norms, and upcoming new refinery and expansion projects are expected to drive the sulfur recovery technologies market.

- On the other hand, the limitations of the sulfur recovery process and the high cost of reducing the sulfur content are expected to restrain the market.

- Nevertheless, untapped oil and gas potential in emerging markets is expected to increase rapidly beyond the forecast period. Such developments are expected to provide considerable opportunities for market growth.

- Asia-Pacific is expected to be the largest market during the forecast period, with most demand coming from China and India due to high oil and gas production, increased environmental regulations, and increased refining capacity.

Sulphur Recovery Technologies Market Trends

The Refineries Segment is Likely to Witness Considerable Growth

- Sulfur recovery technologies play a pivotal role in refineries, with the sulfur recovery unit (SRU) being a linchpin for sulfur recovery. Notably, lowering sulfur levels in gasoline and diesel enhances emission controls, subsequently curbing air pollution upon product usage.

- With the rising investments in expanding oil and gas refining plants and the global push for stricter environmental regulations, refineries are poised to maintain their dominance in the future.

- The sulfur recovery unit (SRU) in a petroleum refinery is tasked with extracting H2S from sour gases, a byproduct of various refinery processes, and transforming it into industrial-grade molten sulfur. The predominant method employed in these units, known as the "Claus Process," eliminates a substantial 95-99.9% of hydrogen sulfide from gas streams. In a modified version of the Claus Process, the H2S-rich sour gas is combusted with oxygen, followed by the resulting gas being cooled; molten sulfur is then recovered.

- For instance, according to the Organization of the Petroleum Exporting Countries, refinery crude throughput was 80.76 million barrels per day in 2023 and 79.08 million in 2022. Key contributors to this capacity were the United States, China, India, Japan, Saudi Arabia, and other ASEAN nations. These countries predominantly rely on hydrocarbons and their derivatives.

- Many nations are ramping up their oil refining capabilities, with a focus on technologies like sulfur recovery, to meet future demands. For example, in July 2024, Bharat Petroleum Corporation Limited (BPCL) unveiled plans for a new 12 million metric tons per annum (MMTPA) refinery in India, with an investment of approximately USD 5.98 billion (INR 50,000 crore). The company is scouting locations in Andhra Pradesh, Uttar Pradesh, and Gujarat.

- In June 2024, BPCL announced its ambition to boost its refining capacity to 45 mmtpa by FY 2029. BPCL, which operates refineries in Mumbai, Kochi, and Bina (Madhya Pradesh), boasts a collective refining capacity of about 36 mmtpa.

- BPCL has earmarked around USD 20 billion (INR 1.7 trillion) for investments over the next five years. Of this, INR 75,000 crore is allocated to refinery and petrochemical projects, USD 957 million (INR 8,000 crore) to pipeline initiatives, and over USD 2.4 billion (INR 20,000 crore) to its marketing endeavors.

- Uganda was in talks with an investment firm spearheaded by a member of Dubai's royal family in January 2024. The discussions centered around the development of a planned USD 4 billion refinery for a portion of its crude oil reserves.

- By November 2023, the Sri Lankan cabinet had greenlit a USD 4.5 billion investment from China's energy behemoth, Sinopec. The approval paved the way for Sinopec to set up a new petroleum refinery at the strategically vital Hambantota port.

- Therefore, with the increase in demand for clean fuel, the sulfur recovery technologies market is expected to expand considerably during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific covers a wide geographical area and has diverse landscapes, climates, societies, cultures, religions, and economies. More than 50% of the world's population lives in this region. The region is also home to a large number of oil and gas refineries, which are the primary source of sulfur. This resulted in a high demand for sulfur recovery technologies, such as Claus and Tail Gas Treating Units.

- The region is home to a number of emerging economies, such as India and China, which are investing heavily in the oil and gas sector. This has resulted in increased demand for sulfur recovery technologies due to the need to reduce environmental impact. The region is also home to several large-scale petrochemical projects, which require sulfur recovery technologies in order to meet their environmental standards.

- Asia-Pacific is one of the fastest-growing regions in the world, owing to the presence of emerging countries, like India and China, and developed countries, such as Japan, South Korea, and Australia. In 2023, China was the world's second-largest oil consumer and the sixth-largest oil producer. The country imported nearly 50% of its hydrocarbon demand to reduce dependence on imports and improve energy security. Asia-Pacific is one of the significant regions in the sulfur recovery technologies market and is likely to continue its dominance owing to the rapid growth in energy-intensive industries like refineries.

- China has been trying to maximize its shale potential by exploiting its domestic reserves across various inland shale basins, such as the Sichuan Basin. Shale gas development in China has increased steadily over the past few years, recording a growth of 21% annually since 2017. In 2023, China produced 232.43 billion cubic meters of natural gas.

- Sulfur recovery technologies are crucial for India's oil refining and petrochemical industries to reduce harmful sulfur emissions and produce cleaner fuels. In March 2022, Thermax Ltd, an Indian multinational engineering company, concluded a USD 149.02 million order from an Indian public sector refinery to set up a sulfur recovery block as a part of the Government's North East Hydrocarbon Vision 2030.

- In February 2024, Malaysia's state-owned Petronas, through Malaysia Petroleum Management, signed production sharing contracts (PSCs) for two discovered resource opportunity clusters with potential gas reserves offshore peninsular Malaysia. The BIGST DRO cluster has an estimated recovery of 4 trillion cubic feet and was awarded to Petronas Carigali and upstream firm JX Nippon Oil and Gas Exploration, each with a 50% participating interest. The cluster is made up of five undeveloped high-CO2 gas fields, namely the Bujang, Inas, Guling, Sepat, and Tujoh fields.

- Hence, Asia-Pacific is expected to dominate the market due to its large oil and gas refining industry and increasing demand for cleaner fossil fuels.

Sulphur Recovery Technologies Industry Overview

The sulfur recovery technologies market is semi-fragmented. Some of the key players in this market (not in particular order) include Enersul Limited Partnership, WorleyParsons Limited, Shell PLC, Bechtel Corporation, and Fluor Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Refinery Installed Capacity and Forecast, Till 2029

- 4.4 Allowed Sulphur Content in Refined Products in Million Tons Per Year, Till 2029

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Growing Environmental Concerns and Strict Norms on Pollution

- 4.7.2 Restraints

- 4.7.2.1 Limitations of Sulphur Recovery Process

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Refineries

- 5.1.2 Gas Processing Plants

- 5.1.3 Power Plants

- 5.1.4 Others

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Asia-Pacific

- 5.2.2.1 India

- 5.2.2.2 China

- 5.2.2.3 South Korea

- 5.2.2.4 Japan

- 5.2.2.5 Malaysia

- 5.2.2.6 Thailand

- 5.2.2.7 Indonesia

- 5.2.2.8 Vietnam

- 5.2.2.9 Rest of Asia-Pacific

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 France

- 5.2.3.3 United Kingdom

- 5.2.3.4 Spain

- 5.2.3.5 NORDIC

- 5.2.3.6 Turkey

- 5.2.3.7 Russia

- 5.2.3.8 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Nigeria

- 5.2.5.4 Oman

- 5.2.5.5 South Africa

- 5.2.5.6 Egypt

- 5.2.5.7 Algeria

- 5.2.5.8 Rest of Middle East & Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 Enersul Limited Partnership

- 6.4.2 Worley Limited

- 6.4.3 Shell Plc

- 6.4.4 Bechtel Corporation

- 6.4.5 Fluor Corporation

- 6.4.6 Sulfur Recovery Engineering Inc.

- 6.4.7 Honeywell UOP

- 6.4.8 Air Liquide S.A.

- 6.5 List of Other Prominent Companies (Company Name, Headquarters, Revenue, Relevant Products and Services, Operating Sector, Recent Trends, Technology or Projects, Contact Details, etc.)

- 6.6 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Untapped Oil And Gas Potential In Emerging Markets

02-2729-4219

+886-2-2729-4219