|

市場調查報告書

商品編碼

1690105

德國資料中心:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Germany Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

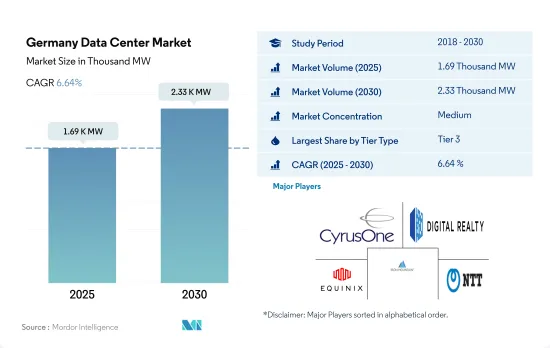

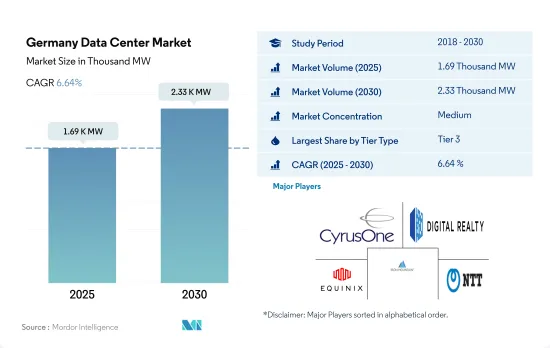

預計 2025 年德國資料中心市場規模為 1,690 千瓦,2030 年將達到 2,330 千瓦,複合年成長率為 6.64%。

預計 2025 年主機託管收益將達到 30.557 億美元,2030 年將達到 44.867 億美元,預測期內(2025-2030 年)的複合年成長率為 7.98%。

預計到 2023 年, 層級 3資料中心將佔據最大佔有率,並在整個預測期內保持主導地位。

- 根據層級容量, 層級 4 部分在德國資料中心市場中處於領先地位。預計該領域的容量將從 2023 年的 524.3 兆瓦成長到 2029 年的 1,112.5 兆瓦,複合年成長率為 13.4%。隨著技術的發展,德國人正在採用一系列網路設備,包括桌上型電腦、平板電腦、智慧型手機、主機和智慧型設備,用於串流內容、家庭安全、線上遊戲和其他服務。

- 這一趨勢導致人們從傳統的桌上型電腦和筆記型電腦轉向一系列新設備。最初,資料中心是為了滿足客戶的最低要求。因此,資料中心規模較小,僅通過了 Tier 1 和 Tier 2 認證,機架數量極少。

- 隨著新設備的普及以及 5G 網路的推出,企業正在轉向提供不間斷運算服務的設施,這些網路提供了充分利用這些設備所需的速度。因此,預計層級 4 設施的市場佔有率將從 2023 年的 34% 增加到 2029 年的 47.2%。

- 居住在智慧城市的人數約佔76%,預計未來還會增加。例如,在魏瑪這樣的智慧城市,能源價格上漲導致街道照明從傳統燈泡轉變為智慧 LED。約83%的照明已被智慧照明系統取代,有助於節省10萬千瓦時的能源並降低照明成本。此類基礎設施開發由層級 3 和層級 4 設施支持,停機時間最短,促進了這些細分市場的成長。

德國資料中心市場的趨勢

5G智慧型手機和行動商務的激增將推動資料中心市場的發展

- 德國的智慧型手機使用量正在上升,預計到 2029 年複合年成長率將達到 1.4%。年輕一代的智慧型手機使用量正在增加,約有 81% 的 16-29 歲年輕人使用智慧型手機進行網路購物。此外,它還強調了行動商務如何推動市場成長。此外,智慧型手機網路購物的使用率從 2020 年的 54% 成長至 2021 年的 60% 左右,顯示市場的數位包容性。

- 根據 GFU 的資料,智慧型手機的平均價格從 2018 年的 489 歐元左右上漲到 2021 年的 555 歐元。此外,該國的智慧型手機收益從 2019 年的 108.6 億歐元成長到 2021 年的 11,930 歐元。這凸顯了該國買家的智慧型手機購買力和需求,從而推動了智慧型手機數量的增加。隨著德國 5G 智慧型手機數量的增加,預計用戶將繼續購買這些設備,以利用不斷擴大的頻寬和網路基礎設施。主要網路服務供應商的目標是到 2025 年將 5G 服務覆蓋範圍擴大到幾乎全國人口,從而在預測期內推動智慧型手機市場的發展。

- 2021 年智慧型手機普及率為 80%,預計到 2025 年將增至 84% 左右,用戶普及率為 89%。這將導致更多的資料生成點,從而在德國創造對資料中心的需求,以提供以智慧型手機為中心的軟體和線上儲存選項所需的處理平台。

FTTH技術應用激增推動資料中心市場發展

- 德國的大部分網路和網際網路基礎設施由向家庭和企業提供網際網路的銅線網路組成。根據經濟合作暨發展組織提供的資料,2019 年純光纖系統僅佔寬頻連線的 2%,到 2022 年這一比例將僅上升至 5.4%。儘管營運商已使用向量化技術來增強其銅線網路,但即使在網路可用性良好的地區,也尚未實現 250Mbps 以上的速度。

- 作為歐盟的一部分,「歐洲2020」計畫推動網路發展,通用目標是到2020年為50%的家庭提供100Mbps的網速。然而,儘管採用了向量化技術和大規模DSL部署,到2017年,德國祇有約77%的家庭網路速度達到50Mbps左右,與目標相差甚遠。然而,在擴大光纖連接方面,德國政府在 2019 年宣布計劃投資 120 億歐元,到 2025 年將實現約 1,000 Mbps 的大規模速度。

- 新冠疫情凸顯了對更快網路連線的需求,加速了德國 FTTH 的引進。目標是到 2022 年與 2021 年相比增加約 66%,預計到 2025 年將實現大規模採用。這將吸引更多的資料中心設施和投資機會,以利用預測期內德國的發展。

德國資料中心產業概況

德國資料中心市場適度整合,前五大公司佔58.36%的市場。市場的主要企業有:CyrusOne Inc.、Digital Realty Trust Inc.、Equinix Inc.、Iron Mountain Incorporated 和 NTT Ltd(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章執行摘要和主要發現

第2章 報告要約

第3章 引言

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 市場展望

- 負載能力

- 占地面積

- 主機代管收入

- 安裝的機架數量

- 機架空間利用率

- 海底電纜

第5章 產業主要趨勢

- 智慧型手機用戶數量

- 每部智慧型手機的資料流量

- 行動資料速度

- 寬頻資料速度

- 光纖連接網路

- 法律規範

- 德國

- 價值鍊和通路分析

第6章市場區隔

- 熱點

- 法蘭克福

- 德國其他地區

- 資料中心規模

- 大規模

- 超大規模

- 中等規模

- 百萬

- 小規模

- 層級類型

- 1層級和2級

- 層級

- 層級

- 吸收量

- 未使用

- 使用

- 按主機託管類型

- 超大規模

- 零售

- 批發的

- 按最終用戶

- BFSI

- 雲

- 電子商務

- 政府

- 製造業

- 媒體與娛樂

- 電信

- 其他最終用戶

第7章競爭格局

- 市場佔有率分析

- 商業狀況

- 公司簡介.

- CyrusOne Inc.

- Digital Realty Trust Inc.

- Equinix Inc.

- Global Switch Holdings Limited

- GlobalConnect AB

- Iron Mountain Incorporated

- Leaseweb Global BV

- Lumen Technologies Inc.

- Noris Network AG

- NTT Ltd

- Telehouse(KDDI Corporation)

- Vantage Data Centers LLC

- LIST OF COMPANIES STUDIED

第8章:CEO面臨的關鍵策略問題

第9章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 全球市場規模和DRO

- 資訊來源及延伸閱讀

- 圖表清單

- 關鍵見解

- 資料包

- 詞彙表

The Germany Data Center Market size is estimated at 1.69 thousand MW in 2025, and is expected to reach 2.33 thousand MW by 2030, growing at a CAGR of 6.64%. Further, the market is expected to generate colocation revenue of USD 3,055.7 Million in 2025 and is projected to reach USD 4,486.7 Million by 2030, growing at a CAGR of 7.98% during the forecast period (2025-2030).

Tier 3 data center accounted for majority share in terms of volume in 2023, and is expected to dominate through out the forecasted period

- The tier 4 segment leads the German data center market based on tier capacity. The segment's capacity is expected to grow from 524.3 MW in 2023 to 1112.5 MW by 2029, with a CAGR of 13.4%. With evolving technology, the German population is increasingly adopting various internet devices such as desktops, tablets, smartphones, consoles, and smart gear for streaming content, home security, online gaming, and other services.

- This trend has led to a shift from traditional desktops or laptops to a range of new devices. Initially, data centers were meant to cater to the minimal requirements of clients. Thus, they were small in size and had Tier 1 & 2 certifications and minimum racks.

- With the growing adoption of new devices and the implementation of a 5G network to provide the necessary speeds to use these devices at the fullest potential, companies are shifting toward facilities that offer uninterrupted computing services. Therefore, the market share of tier 4 facilities is expected to increase from 34% in 2023 to 47.2% in 2029.

- The number of people living in smart cities accounts for around 76%, which is expected to increase further. For instance, smart cities such as Weimar have transitioned their street lighting from traditional bulbs to smart LEDs due to rising energy prices. Around 83% of the lighting has been replaced with the smart lighting system, thus helping save energy of 100,000 kWh and reduce lighting expenses. Such infrastructural developments are supported by tier 3 and 4 facilities with minimal downtimes, thus complementing the growth of these segments in the market.

Germany Data Center Market Trends

Surge in 5G-enabled smartphones and m-commerce is boosting the data center market

- Smartphone usage in Germany is expected to increase and register a CAGR of 1.4% by 2029. Smartphone usage is growing among the younger audience, with about 81% between the ages of 16 and 29 using their smartphones to shop online. It further highlights how m-commerce is driving the market growth. Also, the overall usage of the smartphone for shopping online increased from 54% in 2020 to about 60% in 2021, suggesting the digital inclusiveness of the market.

- The data from GFU suggested that the average price of a smartphone increased from about EUR 489 in 2018 to EUR 555 in 2021. Also, the smartphone revenue generated by the country increased from EUR 10,860 million in 2019 to EUR 11,930 in 2021. This highlights the buying power and requirement of smartphones among the buyers in the country, contributing to the increasing number of smartphones. As more 5G-enabled smartphones are available in Germany, users are expected to continue to buy the devices and leverage the growing bandwidth and network infrastructure. Major network service providers are aiming to extend the 5G service coverage to almost the entire population of the country by 2025, driving the smartphone market during the forecast period.

- With the smartphone adoption rate of 80% in 2021 to increase to about 84% by 2025 and an estimated subscriber penetration rate of 89% by 2025, the region is expected to see a rise in the number of smartphones. This would create more data-generating points, creating demand for data centers to provide the required processing platforms for smartphone-centric software and online storage options in Germany.

Surge in adoption of FTTH technology boost the data center market

- Most of Germany's network and internet infrastructure comprises copper wire networks delivering the internet to households and businesses. The data provided by the Organization for Economic Cooperation and Development suggested only about 2% of the broadband connections accounted for pure fiber-optic systems in 2019, increasing to just 5.4% in 2022, which still indicated more than 90% of the rest of the connections to use improved copper connections. The companies used vectoring technology to enhance the copper wire network, which still could not get speeds exceeding 250 Mbps even in the areas with better network availability.

- Being a part of the EU, "Europe 2020" pushed the network development with a common goal to provide 100 Mbps to 50% of households by 2020. However, despite vectoring technology and large-scale DSL implementation, by 2017, only about 77% of German households received speeds of about 50 Mbps, far less than the targeted speeds. However, for fiber connectivity expansion, in 2019, the German government announced a plan to invest EUR 12 billion to achieve about 1,000 Mbps speed at a large scale by 2025.

- The requirement for faster network connectivity highlighted in the COVID-19 pandemic has hastened the introduction of FTTH in Germany. The data suggested that the country exhibited the third-highest growth rate in FTTH deployment in Europe, with an increase of about 66% in 2022, compared to 2021, with goals for considerable roll-outs by 2025. This would also attract more data center facilities and investment opportunities to leverage the developed conditions in Germany during the forecast period.

Germany Data Center Industry Overview

The Germany Data Center Market is moderately consolidated, with the top five companies occupying 58.36%. The major players in this market are CyrusOne Inc., Digital Realty Trust Inc., Equinix Inc., Iron Mountain Incorporated and NTT Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 MARKET OUTLOOK

- 4.1 It Load Capacity

- 4.2 Raised Floor Space

- 4.3 Colocation Revenue

- 4.4 Installed Racks

- 4.5 Rack Space Utilization

- 4.6 Submarine Cable

5 Key Industry Trends

- 5.1 Smartphone Users

- 5.2 Data Traffic Per Smartphone

- 5.3 Mobile Data Speed

- 5.4 Broadband Data Speed

- 5.5 Fiber Connectivity Network

- 5.6 Regulatory Framework

- 5.6.1 Germany

- 5.7 Value Chain & Distribution Channel Analysis

6 MARKET SEGMENTATION (INCLUDES MARKET SIZE IN VOLUME, FORECASTS UP TO 2030 AND ANALYSIS OF GROWTH PROSPECTS)

- 6.1 Hotspot

- 6.1.1 Frankfurt

- 6.1.2 Rest of Germany

- 6.2 Data Center Size

- 6.2.1 Large

- 6.2.2 Massive

- 6.2.3 Medium

- 6.2.4 Mega

- 6.2.5 Small

- 6.3 Tier Type

- 6.3.1 Tier 1 and 2

- 6.3.2 Tier 3

- 6.3.3 Tier 4

- 6.4 Absorption

- 6.4.1 Non-Utilized

- 6.4.2 Utilized

- 6.4.2.1 By Colocation Type

- 6.4.2.1.1 Hyperscale

- 6.4.2.1.2 Retail

- 6.4.2.1.3 Wholesale

- 6.4.2.2 By End User

- 6.4.2.2.1 BFSI

- 6.4.2.2.2 Cloud

- 6.4.2.2.3 E-Commerce

- 6.4.2.2.4 Government

- 6.4.2.2.5 Manufacturing

- 6.4.2.2.6 Media & Entertainment

- 6.4.2.2.7 Telecom

- 6.4.2.2.8 Other End User

7 COMPETITIVE LANDSCAPE

- 7.1 Market Share Analysis

- 7.2 Company Landscape

- 7.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.3.1 CyrusOne Inc.

- 7.3.2 Digital Realty Trust Inc.

- 7.3.3 Equinix Inc.

- 7.3.4 Global Switch Holdings Limited

- 7.3.5 GlobalConnect AB

- 7.3.6 Iron Mountain Incorporated

- 7.3.7 Leaseweb Global BV

- 7.3.8 Lumen Technologies Inc.

- 7.3.9 Noris Network AG

- 7.3.10 NTT Ltd

- 7.3.11 Telehouse (KDDI Corporation)

- 7.3.12 Vantage Data Centers LLC

- 7.4 LIST OF COMPANIES STUDIED

8 KEY STRATEGIC QUESTIONS FOR DATA CENTER CEOS

9 APPENDIX

- 9.1 Global Overview

- 9.1.1 Overview

- 9.1.2 Porter's Five Forces Framework

- 9.1.3 Global Value Chain Analysis

- 9.1.4 Global Market Size and DROs

- 9.2 Sources & References

- 9.3 List of Tables & Figures

- 9.4 Primary Insights

- 9.5 Data Pack

- 9.6 Glossary of Terms