|

市場調查報告書

商品編碼

1690081

熔模鑄造:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Investment Casting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

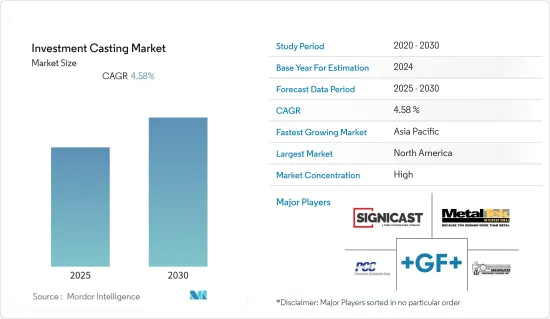

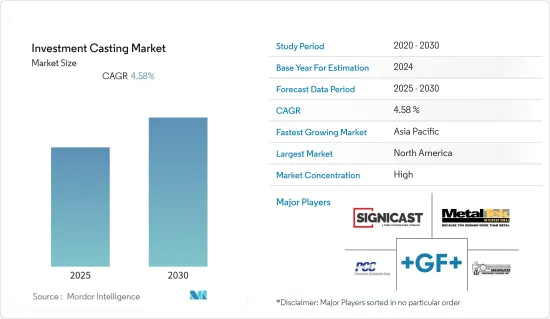

預測期內,熔模鑄造市場預計將以 4.58% 的複合年成長率成長。

新冠肺炎疫情為全球多個產業帶來了迅速且嚴重的影響。疫情導致全球需求下降,給該行業帶來了巨大壓力。隨著需求下降,企業正在考慮疫情後的策略和產業計畫。隨著經濟緩慢復甦,預計預測期內熔模鑄造市場將出現正成長。

對熔模鑄件的需求主要受到航太和國防工業的不斷發展的推動。透過熔模鑄造可以生產出飛機、直升機和噴射機等多種不同的應用和零件。透過熔模鑄造生產的飛機、直升機和噴射機零件包括飛行關鍵、安全、著陸、煞車和液壓油系統零件。

有幾個因素阻礙了熔模鑄造的需求,包括高生產成本和高能耗。然而,鑄造廠正在尋求透過合作利用模擬技術創新先進的鑄造技術來克服這些挑戰,這可能會減少現場勞動時間並提高鑄造產量比率。

北美目前引領熔模鑄造市場。該地區的成長得益於製造業、醫療保健、航太和軍事領域的擴張。預計亞太地區將成為預測期內成長最快的地區。中國很可能引領該地區,因為它是對熔模鑄造行業成長做出重大貢獻的關鍵國家之一。

熔模鑄造市場趨勢

矽酸鈉製程成長率最高

矽溶膠鑄造提高了熔模鑄件的尺寸精度和表面光潔度,最大限度地減少了缺陷。因此此製程的成本較水玻璃鑄造較高。矽溶膠鋯鋯砂價格昂貴,所需製備工藝較高,是其成本高的主要原因。

由於成本高,矽溶膠製程在鑄造廠的應用相對較少。用於汽車和工業零件的矽溶膠熔模鑄造的成本平均約為6.5美元/公斤。

目前,一些公司發現水玻璃鑄造比陶瓷鑄造更經濟。然而,當最高的鑄造品質和低修復率是最終用戶關注的重點時,這種工藝是首選。與水玻璃製程相比,矽溶膠製程可生產重量達50-100公斤的大型零件。因此,此製程用於製造更大更重的零件,如水泵、葉輪、導流殼、泵體、球閥體和閥板。同時此製程也廣泛應用於製造對尺寸精度要求高的超小型零件(2-1000g)。

矽酸鈉製程在亞太地區逐漸流行起來,其中日本佔據生產需求的前列。這是不斷努力提高所生產零件的品質和尺寸精度的結果。

北美引領熔模鑄造市場

北美引領熔模鑄造市場,並可能保持其領先地位,其次是亞太地區和歐洲。成長要素主要得益於工業氣體、航太和國防製造業的擴張,以及該地區重要國防飛機和零件製造商的存在,包括洛克希德馬丁、雷神索爾和諾斯羅普格魯曼。

航太工業是美國的主要產業之一,該地區是波音 737、波音 777、波音 787 和空中巴士 A220 等主要飛機項目的生產工廠所在地。在該國,F-35 等軍用飛機項目的生產預計將產生對熔模鑄造零件的需求。

美國是世界領先的汽車製造國,貢獻了該國國內生產總值)的至少3%。中國也是豪華車市場最大的製造商之一,2021 年淨收入達 50 億美元。豪華車製造商寶馬 2021 年銷量累計歷史新高,超過 336,600 輛。

然而,美國汽車業受到新冠疫情的嚴重打擊,大多數製造工廠要么關閉,要么降低產能。 2022年4月美國新車銷量為1,256,224輛,較2021年4月下降18%。此外,4月乘用車銷量下降23.3%至278,827輛,SUV和卡車銷量也下降16.3%至977,397輛。 2022年第一季對美國汽車業不利。汽車產業的擴張可能會引發汽車零件中熔模鑄造應用的廣泛利用,從而在長期內推動對熔模鑄造的需求。

此外,根據加拿大航太工業協會的數據,空中巴士、波音、德哈維蘭加拿大公司和龐巴迪是加拿大主要的航太製造商,其中 95% 的公司都以部分產能運作。德哈維蘭加拿大公司計分類階段開始生產該飛機。預計領先的航太公司將擴大其業務潛力,以推動該地區對熔模鑄造的需求。例如,2022年11月,飛機引擎製造商普惠公司宣布將在美國開設一個新的渦輪翼型工廠。該工廠將容納一座先進的鑄造廠,總投資額為 6.5 億美元。

此外,主要鑄件製造商正在擴大其銷售網路以滿足不斷成長的需求並擴大北美熔模鑄造的範圍。例如,2022 年 9 月,鑄造技術公司 SigniCast Corporation 宣布開設一座最先進的熔模鑄造工廠。

考慮到這些因素和不斷發展的需求,熔模鑄造由於其廣泛的應用,預計在北美將具有較高的成長潛力。

熔模鑄造產業概況

由於國際和地區熔模鑄造製造商的存在,熔模鑄造市場呈現分散狀態。熔模鑄造市場由美國鋁業公司、蒂森克虜伯股份公司、Zollern GmbH and Co. KG、喬治費歇爾有限公司、Signicast、密爾瓦基精密鑄造公司和 RLM Industries 組成。

市場分散,導致企業透過投資、合作、合資和收購來保持競爭力。例如,2021年10月,美國鋁業公司宣布計畫在2050年在其全球業務中實現溫室氣體(GHG)淨零排放。 排放排放的目標與公司的永續戰略重點相一致,並補充了其現有的目標,即到排放年將其鋁冶煉和氧化鋁精製業務的直接和間接溫室氣體排放減少30%,到2030年減少50%。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 波特五力分析

- 新進入者的威脅

- 購買者和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按類型

- 矽酸鈉工藝

- 四乙矽酸酯/矽溶膠工藝

- 按最終用戶

- 車

- 航太和軍事

- 一般工業機械

- 醫療

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 巴西

- 阿根廷

- 墨西哥

- 阿拉伯聯合大公國

- 其他國家

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Signicast

- MetalTek International

- Milwaukee Precision Casting Inc.

- Impro Precision Industries Limited

- Alcoa Corporation

- Zollern GmbH and Co. KG

- Precision Castparts Corp(Berkshire Hathaway)

- Georg Fischer Ltd

- Dongying Giayoung Precision Metal

- Taizhou Xinyu Precision Manufacture Co. Ltd

第7章 市場機會與未來趨勢

The Investment Casting Market is expected to register a CAGR of 4.58% during the forecast period.

The COVID-19 outbreak has had a swift and severe impact on many industries globally. The pandemic placed intense pressure on industries with a downward shift in global demand. With declining demand, the companies are examining their strategies and operational plans for the post-pandemic period. As economies are recovering slowly, the investment casting market is expected to grow positively during the forecast period.

The demand for investment casting is majorly driven by the growing aerospace and military industry, as there are many different applications and parts of aircraft, helicopters, and jets that are produced through investment casting. These include flight critical and safety components, landing and braking components, and hydraulic fluid system components, all of which are vital to the safety of the aircraft.

A few factors are hindering the demand for investment castings, such as manufacturing cost and high energy consumption. However, foundries are trying to overcome these challenges by collaborating to innovate advanced casting technologies using simulations, which is likely to reduce the shop-floor time and increase the casting yield.

North America is currently leading the investment casting market. The factors attributable to the region's growth are the expansion of the manufacturing, medical, and aerospace and military sectors. Asia-Pacific is projected to be the fastest-growing region over the forecast period. China is likely to lead the region as it is one of the significant countries that majorly contribute to the growth of the investment casting industry.

Investment Casting Market Trends

Sodium Silicate Process To Exhibit The Highest Growth Rate

Silica sol casting gives the investment castings better dimensional accuracy and surface finish with minimal defects. Hence, the cost of the process is higher than that of the water glass casting. Silica sol zircon sand is very expensive, and the preparation required is also higher, which is a prime reason for the higher costs.

Due to its higher costs, the silica sol process has comparatively less adoption in foundries. The silica sol investment casting used in automotive or industrial components costs around 6.5 USD/kg on average.

Several companies have now identifed the sodium silicate casting as the economical cause over the ceramic casting. However, this process is preferred if the highest casting quality and the low repair rate are the main focus of the end user. Compared to the water glass process, the silica sol process can produce extra-large parts weighing 50-100 kg. Hence, this process is used for producing larger and heavier parts, like water pumps, impellers, diversion shells, pump bodies, ball valve bodies, and valve plates. At the same time, this process is widely used to produce extra small parts (2-1000 g) that require high dimensional accuracy.

The sodium silicate process is slowly becoming more popular in regions like Asia-Pacific, where Japan has showcased itself to lead the production demand from forefront. As a result of the ongoing efforts to improve the quality and dimensional accuracy of the components produced.

North America Leads the Investment Casting Market

North America is leading the investment casting market and is likely to hold the top position, followed by Asia-Pacific and Europe. The factors attributable to North America's growth are the expanding manufacturing industry, primarily industrial gas and aerospace and defense applications, and the presence of significant defense aircraft and component manufacturers in the region, including Lockheed Martin, Raytheon, and Northrop Grumman.

Aerospace manufacturing is one of the major sectors in the United States, with production plants for major aircraft programs, like Boeing 737, Boeing 777, Boeing 787, and Airbus A220 located in the region. The manufacturing of military aircraft programs, like the F-35, in the country is expected to generate demand for investment casting parts.

The United States is one of the major automotive industries in the world, which contributes at least 3% to the overall gross domestic product (GDP) of the country. In addition, the country is one of the largest manufacturers of the luxury car market with net revenue of USD 5 billion in 2021. Luxury car maker BMW in 2021, reported record-breaking sales of over 336,600 units vehicles.

However, the automotive industry in the United States witnessed a hit due to the COVID-19 pandemic, as the majority of the production sites were either closed or operating at reduced capacity. In April 2022, United States new vehicles sales were reported 1,256, 224 units with a 18% decline compared to April 2021 figures. In addition, during April, passenger car sales dropped down to 23.3% with reporting 278,827 units, while SUV and truck sales also decreased 16.3% with 977,397 units. Q1 2022, has been less favorable for United States automotive sector. These expanding auto sector evoke high utilization of investment casting application for automotive parts and compnents will would likely to elevate the demand for investment casting during long term period.

Further, according to the Aerospace Industries Association of Canada, Airbus, Boeing, De Havilland Canada, and Bombardier Inc. are some of the major aerospace manufacturers in the countrywith 95% of companies running at partial capacity. De Havilland Canada plans to gradually begin the production of aircraft in phases. Key aersopace companies are seen expansing their business potential in order to elevate the demand for investment casting in the region. For instance, In November 2022, Aircraft engine manufacturer Pratt & Whitney announced the opening of their new turbine airfoil facility in United States. The fcility would be equipped with advance casting foundry with combined investment of USD 650 million.

Morover, key casting companies are also seeking oppotunities to expans their investment casting potnetial in North America to resonate elevated sales bars amid rising demand. For instance,In September 2022, Signicast Corporation which is form technology company announced the celebration of its new opening of latest investment casting facility.

Cosidering these factors and development demand for investment casting is anticipated to hold high potential for growth in North America owing to widely spread application.

Investment Casting Industry Overview

The investment casting market is fragmented due to the presence of international and regional investment casting manufacturers. The investment casting market is led by Alcoa Corporation, ThyssenKrupp AG, Zollern GmbH and Co. KG, Georg Fischer Ltd, Signicast, Milwaukee Precision Casting, and RLM Industries.

As the market is fragmented, companies are making investments, partnerships, joint ventures, acquisitions, etc., to stay ahead of the competition. For instance, In October 2021, Alcoa Corporation announced its plans to achieve net-zero greenhouse gas (GHG) emissions across its global operations by 2050. The aim to reach net-zero GHG emissions by 2050 for direct (scope 1) and indirect (scope 2) emissions aligns with the company's strategic priority to advance sustainably and complements its existing targets, which include reducing direct and indirect GHG emissions from aluminum smelting and alumina refining operations by 30% by 2025 and 50% by 2030.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billion)

- 5.1 By Type

- 5.1.1 Sodium Silicate Process

- 5.1.2 Tetraethyl Orthosilicate/Silica Sol Process

- 5.2 By End-user Type

- 5.2.1 Automotive

- 5.2.2 Aerospace and Military

- 5.2.3 General Industrial Machinery

- 5.2.4 Medical

- 5.2.5 Other End-user Types

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Mexico

- 5.3.4.4 United Arab Emirates

- 5.3.4.5 Other Countries

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Signicast

- 6.2.2 MetalTek International

- 6.2.3 Milwaukee Precision Casting Inc.

- 6.2.4 Impro Precision Industries Limited

- 6.2.5 Alcoa Corporation

- 6.2.6 Zollern GmbH and Co. KG

- 6.2.7 Precision Castparts Corp (Berkshire Hathaway)

- 6.2.8 Georg Fischer Ltd

- 6.2.9 Dongying Giayoung Precision Metal

- 6.2.10 Taizhou Xinyu Precision Manufacture Co. Ltd