|

市場調查報告書

商品編碼

1690067

汽車廂內後視鏡(IRVM):市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Automotive Inside Rearview Mirrors (IRVM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

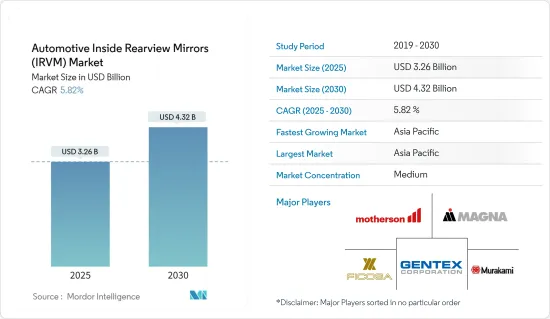

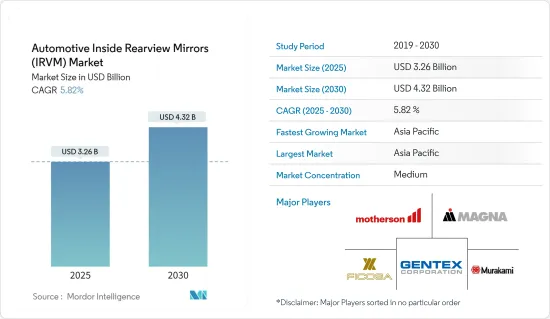

汽車廂內後視鏡市場規模預計在 2025 年達到 32.6 億美元,預計到 2030 年將達到 43.2 億美元,預測期內(2025-2030 年)的複合年成長率為 5.82%。

汽車廂內後視鏡受到疫情的影響,由於政府採取封鎖措施,大多數OEM和汽車零件供應商被迫關閉生產設施。這導致OEM對 IRVM 的需求降低以及製造商產量減少。自2021年起,隨著全球汽車銷售的成長和全球供應鏈網路的完善,IRVM的需求開始趨於穩定。

此外,從中期來看,人們對乘客舒適度和安全性的認知不斷提高以及政府對安全功能的規定預計將推動整合 ADAS 功能的車輛的生產,從而推動市場需求。例如,根據美國公路安全美國協會的數據,每年有 15,000 人因追撞事故受傷,其中最常見的受害者是幼兒和老人。此外,美國美國公路交通安全管理局報告稱,美國每年發生近 84 萬起盲點事故。因此,車輛 IRVM 被廣泛使用,以確保駕駛員的舒適和安全。

攝影機和感測器是新車輛必不可少的部件,因為它們有多種用途。它可以幫助OEM製造商製造更安全、駕駛更舒適、更省油的汽車。後視攝影機和其他汽車攝影系統通常被視為提高道路車輛安全性的有用工具。但旨在增強駕駛員視野的複雜攝影機和監控系統也可能導致駕駛員混亂和分心。

由於印度、日本和中國的汽車產量不斷增加,亞太地區可能會主導全球汽車廂內後視鏡市場。此外,由於保時捷、奧迪、福斯和寶馬等知名參與企業的存在,歐洲很可能成為第二大市場。預計這些地區的技術發展將在預測期內為汽車後視鏡市場創造重大機會。

汽車廂內後視鏡市場趨勢

乘用車市場預計將佔據主要佔有率

在預測期內,由於全球主要地區汽車產量和銷售量的成長,乘用車市場將以更快的速度成長,從而導致越來越多的領先OEM專注於推出能夠吸引廣大消費者的創新產品。例如,2021 年全球汽車銷量約為 6,670 萬輛,而 2020 年為 6,380 萬輛。全球疫情影響了世界各地的經濟活動,包括汽車銷售,一些國家實施了嚴格的封鎖措施以遏制病毒傳播。因此,2020 年的汽車銷量與 2019 年相比下降了 14.8%。然而,隨著生活恢復正常,全球汽車銷售正在上升,這可能會推動汽車 IRVM 市場在預測期內成長。

隨著乘用車需求的不斷成長以及人們對電動車的認知不斷提高,主要企業正在尋求使其現有持有實現電氣化。

- 2022年3月,福特汽車宣布將在2024年底前在歐洲推出三款純電動乘用車,並設定了2026年在歐洲每年銷售超過60萬輛電動車的目標。

- 2022年1月,通用汽車宣布考慮在密西根州的兩家工廠投資超過40億美元,以提高電動車的產能。通用汽車和 LG Energy Solution提案在蘭辛建造一個價值 25 億美元的電池工廠。

隨著乘用車銷售量的不斷成長,IRVM 的需求也呈現出良好的成長動能。如今,所有Id級及高檔乘用車都配備了先進的IRVM,並在技術上佔據市場主導地位。例如

- 2022 年 8 月,奧迪印度推出了搭載多項新技術的新款 Q3。奧迪增加了無框自動調光 IRVM 和帶後視攝影機的停車輔助系統 Plus。

- 2022 年 8 月,在看到 Tata Punch 的出色銷售後,塔塔集團宣布將於明年在 Creta 領域推出一款名為 Blackbird 的中型 SUV,該車將包含更多功能。該車將配備先進的數位儀表主機、自動調光 IRVM、自動氣候控制、電動 ORVM 等。

汽車廂內後視鏡市場正面臨乘用車領域新興攝影機技術的激烈競爭。主要汽車製造商和廂內後視鏡製造商正在將攝影機整合到傳統後視鏡中,以提高駕駛員的可視度。在某些情況下,駕駛員透過後視鏡看到的車輛後方視線可能會受到阻礙,從而影響其視力。

因此,將攝影機整合到廂內後視鏡系統中是汽車行業迄今為止最好的解決方案。考慮到這些發展和乘用車銷量的不斷成長,預計預測期內對 IRVM 的需求將呈現高成長率。

預計亞太地區在預測期內將顯著成長

由於原料成本低廉、勞動力廉價以及政府加強對本地生產的力度,亞太地區佔據了最大的市場佔有率。在該地區,中國是最大的電動車生產國和消費國之一,而印度、日本和韓國等國家的乘用車銷量不斷成長也推動了汽車行業對廂內後視鏡的需求。

中國是全球最大的電動車市場,受到政府的慷慨支持。中國已將購買新能源汽車的優惠政策延長至2022年。亞太地區正積極支持電動車的普及。例如

- 2020 年 1 月,特斯拉汽車公司在上海建成了一座價值 20 億美元的工廠,到 2020 年 3 月,當這家電動車巨頭的所有其他全球工廠因 COVID-19 疫情而關閉時,該工廠每週組裝近 3,000 輛汽車。

- 21會計年度末,現代汽車3月全球銷量為313,926輛。銷售統計與前一年同期比較去年同期下降了17%。銷量甚至低於 2021 年第一季。此外,現代汽車部門經歷了快速成長,電動車銷量幾乎加倍。因此,純電動車銷量成長了 105%,達到 11,447 輛。此外,插電式電動車銷量總計14,693輛,與前一年同期比較成長58%。

市場和前沿市場的政府正在將大部分財富用於改善交通和安全。因此,汽車銷售量不斷成長,對滿足汽車安全需求的附加功能的需求也在成長。由於 IRVM 高度依賴汽車銷售,亞太地區已成為 IRVM 採用的中心,引領全球汽車銷售。考慮到這些因素,預計預測期內對 IRVM 的需求將出現高成長率。

汽車廂內後視鏡產業概況

汽車市場細分程度適中,有許多本地和全球參與企業,例如 Gentex Corporation、Magna International Inc. 和 Samvardhana Motherson Reflectec。

企業正在增加對研發計劃的投入,以便在不更換傳統後視鏡的情況下為車主提供更便利、更安全的體驗。不斷進步的技術以及增強的 IRVM 能力正在推動市場的成長。例如

- 2022年8月,Mahindra and Mahindra推出了新款Scorpio N汽油車,配備自動調光IRVM,以提高用戶爬坡時的安全性和舒適度。

- 2022年7月,芯馳科技宣布奇瑞OMODA 5 SUV將採用芯馳科技X9系列汽車SoC(系統晶片)。 X9系列可透過單一晶片驅動多達10個高清螢幕,包括儀錶面板、主機控制、廂內後視鏡和後座乘客娛樂系統。支援多螢幕共用和互動。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 按車輛類型

- 搭乘用車

- 商用車

- 按動力傳動系統

- 內燃機

- 電

- 依功能類型

- 自動燈光控制

- 棱鏡

- 盲點指示器

- 按分銷管道

- OEM

- 售後市場

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 其他

- 巴西

- 阿拉伯聯合大公國

- 其他國家

- 北美洲

第6章競爭格局

- 供應商市場佔有率

- 公司簡介

- Gentex Corporation

- Samvardhana Motherson Reflectec

- Magna International, Inc.

- Ficosa International SA

- Continental AG

- Murakami Corporation

- Tokai Rika Co., Ltd.

- Mitsuba Corporation

- SL Corporation

- Flabeg Automotive Holding GmbH

第7章 市場機會與未來趨勢

The Automotive Inside Rearview Mirrors Market size is estimated at USD 3.26 billion in 2025, and is expected to reach USD 4.32 billion by 2030, at a CAGR of 5.82% during the forecast period (2025-2030).

The Automotive inside rearview mirrors was negatively affected by the pandemic, as majority of OEM and auto component suppliers had to close down their production sites with ongoing government lockdown measures. This held the market with low demand from OEMs for IRVM and reduces production volumes from manufacturers. After 2021, market started witnessing a steady demand for the IRVM with rising auto sales across the globe coupled with an improved supply chain network worldwide.

Moreover, over the medium term, growing production of vehicles with integrated ADAS features in wake of rising awareness toward comfort and safety of passengers and government regulations mandating safety features expected to drive demand in the market. For instance, According to Insurance Institute for Highway Safety says 15,000 people are injured annually in back over accidents, with children and elders having been the most victims. Additionally, the National Highway Traffic Safety Administration report says that nearly 840,000 blind-spot accidents occur every year in the United States. This makes its prime utilization for vehicle IRVM to maintain driver comfort and safety.

Cameras and sensors are a vital part of any new vehicle, as they serve many different purposes. They help OEMs to manufacture cars that are safer, more comfortable to drive, and more fuel-efficient. Rear-view cameras and other camera systems for vehicles have generally been seen as useful tools for improving the safety of vehicles on the road. But in some cases, the complex camera and monitor systems that are supposed to increase the driver's visibility become confusing and distracting.

Asia-Pacific region is likely to dominate global automotive rear view mirror market owing to rising production of vehicle in the India, Japan and China. In addition, this is Europe are likely to register second largest market due to the presence of prominent players in the region for instance, Porsche, AUDI, Volkswagen, and BMW. The technological development in these regions is expected to create significant opportunities in automotive mirror market over the forecast period.

Automotive Rear View Mirror Market Trends

Passenger Car Segment Likely to Hold Significant Share in the Market

The Passenger car segment of the market during the forecast period to grow at faster pace owing to rising vehicle production and growing focus of jey OEMs on launching innovative products to attract wide range of consumers in wake of rising vehicle sales across major regions in the world. For instance, In 2021, the global car sales were around 66.7 Million, which in 2020 were 63.8 Million. The global pandemic impacted economic activities all around the world including car sales the globe, and strict lockdowns were enforced in several countries to contain the spread of the virus. Owing to this the number of cars sold in 2020 was 14.8% lower than compared in 2019. But with life returning to normalcy, the number of cars sold globally has increased which will aid the automotive IRVM market to grow in the forecast period.

Owing to the increase in the demand for passenger cars and the growing awareness of electric mobility, major players are looking forward to electrifying their present fleet. For instance,

- In March 2022, Ford Motors announced to include three all-electric passenger vehicles in Europe by the end of 2024 and set a target to sell more than 600,000 electric vehicles annually by 2026 in the Europe region.

- In January 2022, General Motors announced considering investing more than USD 4 billion in two Michigan factories to increase its electric car manufacturing capacity. GM and LG Energy Solution have proposed constructing a USD 2.5 billion battery facility in Lansing.

With rising sales of the passenger car segment, demand for IRVM is witnessing promising growth. Nowadays, all the id-segment and luxury passenger cars are equipped with advanced IRVM which has posed technological dominance over the market. For instance,

- In August 2022, Audi India has introduced its new Q3 which has adopted several new technologies to look at. Audi has added frameless auto dimming IRVM and parking aid plus with rear view camera, which shall improve the driver safety and comfort apart from other added features in complete Q3.

- In August 2022, after witnessing impressive sales on Tata Punch, Tata Group is announced that ist going to launch a Creta segment mid-size SUV named Blackbird next year which shall encompass added features. The car shall be equipped with advance digital instrument console, auto-dimming IRVM, automatic climate control, electrically operated ORVMs and may more other features.

The automotive inside rear-view mirror market is facing tough competition from new camera technologies with are coming in the passenger car segment. Leading automotive OEMs and interior rear-view manufacturers are integrating cameras with conventional mirrors to provide a better view of the drivers. In certain situations, the rear view of the vehicle through a mirror is blocked and causes hindrance to the driver's view.

Thus, camera integration with the rear-view mirror system has been the best solution so far in the automotive industry. Considering these developments and factors with rising passenger car sales, demand for IRVM is expected to witness a high growth rate in the forecast period.

Asia-Pacific Region Anticipated to Grow at Significant Level During the Forecast Period

The Asia-Pacific region accounts for the largest share in the market owing to the availability of low-cost raw materials, cheap labour, and increasing government initiatives toward local manufacturing. In the region, China is one of the largest producers and consumers of electric vehicles as well as increasing demand for passenger car sales in the countries like India, Japan, South Korea, etc., are likely to boost the demand for inside rear-view mirrors in the automotive industry.

China, which is the largest electric vehicle market in the world, has been backed up by generous support from the government. China has extended the incentives related to the purchase of new energy vehicles (NEVs) till 2022. Asia-Pacific region is aggressively supporting the electrical vehicle adoption. For instance,

- In January 2020, Tesla Motors inaugurated a USD 2 billion facility in Shanghai that was assembling nearly 3000 cars per week in March 2020, when all the other global facilities of the electric vehicle giant were shut down due to the COVID-19 pandemic.

- During the end of FY21, Hyundai sold 313, 926 cars globally in March. The sales statistics stood at a drop of 17% compared to previous years. The sales were even less than Q1 2021. Moreover, Hyundai observed that its automotive segment witnessed a sharp rise with almost doubled sales figures for its all-electric cars. This in turn makes the sales figure for its BEV to stood at 11,447 units with a rise of 105%. In addition, the plug-in electric cars increased to 14,693 units to 58% year and year growth.

Governments and administrations in developing and untapped markets are spending a major portion of their wealth on improving transportation and its safety. This will result in the sales growth of vehicles and also calls for additional features to suit the needs of vehicle safety. With IRVM being highly dependent of sales of the vehicles, Asia-pacific has been leading the vehicles sales across the globe making its epicentre for IRVM adoption. Considering these aspects demand for IRVM is expected to witness high growth rate during the forecast period.

Automotive Rear View Mirror Industry Overview

The automotive market is moderately fragmented due to the presence of many local and global players such as Gentex Corporation, Magna International Inc., and Samvardhana Motherson Reflectec amongst others. The market is transforming but the new technologies are right now available mostly in luxury vehicles and in a selected market and near future, it will not replace the conventional mirrors. As the laws are still with conventional mirrors.

Although companies are increasing investment in R&D projects to provide more convenient and safer experience to the car owner without replacing the conventional mirrors. With rising technological dominance and improved IRVM features market has witnessed immense growth. For instance,

- In August 2022, the Mahindra and Mahindra introduced the new Scorpio N petrol variant with the auto dimming IRVM in order to improve user safety and comfort during the rises.

- In July 2022, SemiDrive announced that Chery's OMODA 5 SUV has adopted SemiDrive's X9 series automotive SoC (system-on-a-chip). The X9 series can provide outputs of up to 10 HD screens, such as instrument panels, console control, rearview mirrors, and entertainment for back row passengers, through a single chip. It supports multi-screen sharing and interaction.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value in USD Million)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Car

- 5.1.2 Commercial Vehicle

- 5.2 By Powertrain Type

- 5.2.1 ICE

- 5.2.2 Electric

- 5.3 By Feature Type

- 5.3.1 Auto-Dimming

- 5.3.2 Prismatic

- 5.3.3 Blind spot indicator

- 5.4 By Sales Channel Type

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Brazil

- 5.5.4.2 United Arab Emirates

- 5.5.4.3 Other Countries

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Gentex Corporation

- 6.2.2 Samvardhana Motherson Reflectec

- 6.2.3 Magna International, Inc.

- 6.2.4 Ficosa International SA

- 6.2.5 Continental AG

- 6.2.6 Murakami Corporation

- 6.2.7 Tokai Rika Co., Ltd.

- 6.2.8 Mitsuba Corporation

- 6.2.9 SL Corporation

- 6.2.10 Flabeg Automotive Holding GmbH