|

市場調查報告書

商品編碼

1689959

物聯網閘道 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2032)IoT Gateway - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2032) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

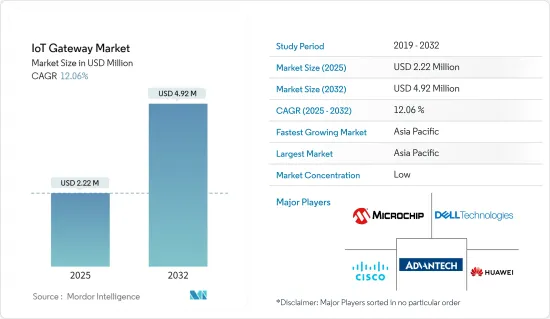

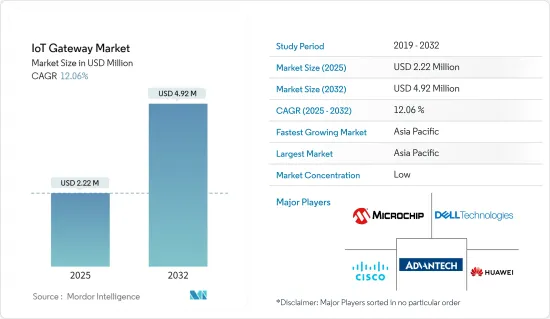

預計 2025 年物聯網閘道市場規模為 222 萬美元,到 2032 年將達到 492 萬美元,預測期內(2025-2032 年)的複合年成長率為 12.06%。

物聯網 (IoT) 徹底改變了裝置和事物通訊和互動的方式。物聯網閘道器是實現物聯網設備與雲端之間無摩擦通訊的關鍵中介。它是任何物聯網架構的重要組成部分,因為它在整合來自感測器的資料、連接網際網路和協調資料流方面發揮關鍵作用。隨著各行各業的企業採用物聯網解決方案來提高生產力、降低成本和改善決策流程,全球物聯網閘道市場正在經歷顯著成長。

關鍵亮點

- 物聯網設備和解決方案在許多行業的廣泛使用導致對物聯網閘道器的需求日益成長。隨著越來越多的企業將物聯網技術融入業務,對有效和安全的資料管理和傳輸的需求變得越來越迫切。隨著邊緣運算的發展,物聯網閘道的功能不斷增強。邊緣運算將推動物連網閘道器的採用,它允許更靠近源頭進行資料處理,從而減少延遲、頻寬使用和對雲端基礎的資源的依賴。隨著物聯網設備的激增及其潛在漏洞的出現,確保強大的安全性和資料隱私已成為企業關注的首要問題。物聯網閘道器充當安全層,提供加密、身份驗證和安全資料傳輸。

- 物聯網閘道市場的主要促進因素包括專用 MCU 的成長、靈活的 SOC 類型設計以及新興國家智慧城市的興起。在系統晶片(SoC) 內開發電子電路具有顯著的優勢,包括提高效率和相容性,同時減少空間需求和開發速度。包含無線技術的 SoC 的物聯網有助於避免網路整合、不相容和可靠性問題等實施挑戰。

- 隨著智慧城市的發展和基於物聯網的解決方案融入城市基礎設施,對物聯網閘道器進行妥善管理各種設備和資料流的需求日益增加。基於 IIoT 的解決方案將融入城市基礎設施。隨著工業部門採用 IIoT 應用來提高業務效率並獲得即時洞察,對工業級物聯網閘道的需求正在顯著成長。

- 阻礙物聯網閘道器市場成長的挑戰包括對用戶資料安全和隱私的擔憂,以及缺乏物聯網技術的通用通訊協定和通訊標準。物聯網技術的標準化通訊協定正處於開發階段。然而,由於標準通訊協定預計將在未來幾年內訂定,因此這項挑戰的影響將在未來幾年逐漸減弱。

- 後疫情時代,許多產業的物聯網應用都出現了成長。物聯網閘道已在醫療保健、製造業、農業和運輸等多個行業中找到了新的案例和潛在應用。該農場使用物聯網閘道器和感測器來監測土壤水分、溫度和濕度。這使得灌溉和資源管理更加精準,進而提高農業生產力。

物聯網閘道市場趨勢

藍牙領域佔據主要市場佔有率

- 藍牙閘道器將基於藍牙的產品連接到其他裝置和硬體。該閘道器旨在以無線方式從藍牙設備收集資料並透過網際網路網路傳輸到雲端。路由器和閘道器即時從藍牙 BLE 信標和感測器產品發送和接收資料。

- 功耗是近距離無線通訊技術中最重要的問題之一。高功耗的設備不應用於行動應用,並且應該由穩定電源而不是電池供電。當比較Zigbee和BLE的功耗時,BLE技術的功耗最低。

- 此外,RDF(無線電測向)和RSSI(接收訊號強度指示器)技術使藍牙追蹤訊號方向和強度以定位設備的能力提高了四倍,從而有利於在更多物聯網設備中接受先進的藍牙應用。

- 藍牙連接已成為物聯網的首選技術,因為它可以釋放創造性的應用,加速未來智慧生活的發展——從智慧照明、智慧醫療、智慧建築到智慧城市。此外,根據制定藍牙標準的藍牙技術聯盟(Bluetooth SIG)的《藍牙市場更新報告》,預測期內藍牙裝置網路裝置的年出貨量預計將成長 2.63 倍,達到 16.3 億台。

- 支援藍牙連接的物聯網閘道器具有低功耗運行的優勢,這支持了基於藍牙的物聯網閘道器市場的成長。此外,智慧建築和零售領域對物聯網閘道器的溫度監控需求正在產生包括藍牙閘道在內的市場需求,這推動了預測期內全球物聯網閘道市場的成長。

亞太地區佔市場主導地位

- 印度工業部門正在迅速採用物聯網技術來提高業務效率、減少停機時間並最佳化資源利用率。工業物聯網 (IIoT) 解決方案的日益普及正在推動印度對工業應用物聯網閘道的需求。

- 在「數位印度」和「智慧城市」等政府措施的推動下,印度的物聯網生態系統正在迅速擴張。該國龐大的人口、不斷成長的智慧型手機普及率以及發達的連接基礎設施正在加速各行各業採用物聯網解決方案。物聯網閘道器透過實現物聯網設備和雲端之間的一致網路和資訊交流,成為此生態系統的重要組成部分。

- 大中華區既是工業IoT的龐大市場,也是構成物聯網基礎的感測器、微晶片和其他組件的組件技術的主要供應商。此外,最初使用物聯網來提高效率的中國製造商現在看到了其增加收益和管理風險的潛力。因此,隨著中國向更有效率的發電方式轉型,以及企業尋求替代方案在該地區更貼近新客戶生產產品,泰國、印尼和越南等國家預計將變得更加重要。

- 在政府的大力支持、工業IoT的採用以及連接基礎設施的進步的推動下,中國的物聯網閘道器市場正在經歷顯著的成長和轉型。隨著中國持續注重技術創新和數位轉型,物聯網閘道市場預計將進一步擴大,並為國內外參與企業帶來機會。

- 日本擁有強大的技術生態系統,主要企業和研究機構積極參與開發和部署物聯網解決方案。日本的工程專業知識和研究能力正在促進物聯網閘道器和相關技術的創新和進步。

- 該研究涵蓋的其他亞太地區國家包括韓國、澳洲和台灣等,但它們各自的貢獻並不顯著。相反,整體捐款佔了更大的佔有率。

物聯網閘道器產業概覽

該市場由思科系統公司和戴爾公司等老字型大小企業組成,這些公司在改進其產品技術方面投入了大量資金。這些參與企業的存在和不斷的創新活動使得市場競爭激烈。市場參與企業正在進行研究,以加強其分銷管道和影響力,並為其產品提供最新規格,從而獲得競爭優勢。公司正試圖透過採取聯盟和收購等強力的競爭策略來擴大其在市場上的產品供應。由於該市場資本密集的特性,退出門檻相當高。這意味著市場參與企業面臨激烈的競爭。市場上其他主要企業包括研華、微晶片科技公司和華為技術有限公司。

- 2023年7月-研華推出全新數位商務平台“IoTMart International”,協助跨國線上商務服務。該平台是對研華現有銷售模式的補充。該平台是對研華現有分銷模式的補充,旨在滿足不同客戶群的多樣化需求,特別關注中小型客戶的需求。

- 2023 年 5 月 - 專業IT基礎設施和服務公司 NTT Ltd 與思科聯手創建並實施了一項協作解決方案,有效支援領先組織的永續發展目標。利用 NTT 的邊緣即服務 (EaaS) 產品組合和思科的物聯網功能,兩家公司的共同努力將實現即時資料分析、增強安全措施、改進決策流程,並透過預測性維護、資產追蹤和供應鏈管理功能降低營運成本。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 專用 MCU 和靈活的 SOC 類型設計的成長

- 智慧城市的新興發展

- 市場限制

- 用戶資料安全和隱私問題

- 物聯網技術缺乏通用通訊協定和通訊標準

第6章市場區隔

- 按組件

- 處理器

- 感應器

- 記憶體和儲存設備

- 其他

- 連結性別

- Bluetooth

- Wi-Fi

- ZigBee

- 乙太網路

- 蜂巢

- 其他連線類型

- 按最終用戶

- 汽車和運輸

- 醫療保健

- 工業的

- 消費性電子產品

- BFSI

- 石油和天然氣

- 零售

- 航太與國防

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章競爭格局

- 公司簡介

- Cisco Systems Inc.

- Advantech Co. Ltd

- Dell Inc.

- Microchip Technology Inc.

- Huawei Technologies Co. Ltd

- Hewlett Packard Enterprise Development LP

- Samsara Networks Inc.

- Eurotech Inc.

- ADLINK Technology Inc.

- Kontron S& T AG

第8章投資分析

第9章:市場的未來

The IoT Gateway Market size is estimated at USD 2.22 million in 2025, and is expected to reach USD 4.92 million by 2032, at a CAGR of 12.06% during the forecast period (2025-2032).

. The communication and interaction between devices and objects have been completely transformed by the Internet of Things (IoT). IoT gateways are key intermediaries in enabling frictionless communication between IoT devices and the cloud. They are critical parts of any IoT architecture since they play a crucial role in combining data from sensors, connecting to the internet, and regulating data flow. The global IoT gateway market has grown significantly as businesses from various industries implement IoT solutions to increase productivity, cut costs, and improve decision-making processes.

Key Highlights

- The need for IoT gateways has increased as a result of the widespread use of IoT devices and solutions in numerous industries. The necessity for effective and secure data management and transmission is becoming increasingly important as more businesses incorporate IoT technology into their operations. The capabilities of IoT gateways have improved with the development of edge computing. IoT gateway adoption is facilitated by edge computing, which enables processing data closer to the source, lowering latency, bandwidth usage, and dependency on cloud-based resources. Making sure there is strong security and data privacy has become a top concern for enterprises due to the increasing number of IoT devices and potential vulnerabilities. IoT gateways provide encryption, authentication, and safe data transport, acting as a security layer.

- The key drivers for the IoT gateway market include the growth of application-specific MCUs, flexible SOC-type designs, and the emerging development of smart cities. Building electronic circuits within a system-on-chip (SoC) has significant benefits, such as improving efficiency and compatibility while reducing space requirements and development speed. IoT with SoC, including wireless technology, helps prevent the implementation challenges, such as network integration, incompatibility, and reliability issues.

- IoT gateways are increasingly needed to properly manage a variety of devices and data streams as smart cities are developed and IoT-based solutions are integrated into urban infrastructure. The adoption of IIoT-based solutions is integrated into urban infrastructure. The adoption of IIoT applications by the industrial sector to increase operational effectiveness and obtain real-time insights has greatly increased demand for industrial-grade IoT gateways.

- The factors challenging the growth of the IoT gateway market include concerns regarding the security and privacy of user data and the lack of common protocols and communication standards of IoT technology. The standardization communication protocols of IoT technology are at a developing stage. However, the standard protocols are expected to happen in the next few years, making the impact of the challenge gradually low in the next few years.

- The post-COVID-19 era recorded the growth of IoT applications across numerous industries. IoT gateways discovered new cases and potential for adoption in industries ranging from healthcare and manufacturing to agriculture and transportation. Farms were monitored for soil moisture, temperature, and humidity using IoT gateways and sensors. This allowed for precise irrigation and resource management, which enhanced agricultural productivity.

IoT Gateway Market Trends

Bluetooth Segment Holds Major Market Share

- Bluetooth gateway connects Bluetooth-based products to other devices or hardware. Gateways are designed to collect data wirelessly from Bluetooth devices and then transfer it to the cloud via internet networks. Routers or gateways transmit and receive real-time data from Bluetooth BLE beacons and sensor products.

- Power consumption is among the most essential issues in short-range wireless communication technologies. Devices with high power consumption should not be used for mobile applications and should instead be used with a steady power source rather than a battery. While comparing Zigbee and BLE power consumption, BLE technology offers the lowest energy consumption.

- Further, Radio Direction Finding( RDF) and Received Signal Strength Indicator (RSSI) technologies have quadrupled Bluetooth's ability to locate devices by tracing the direction and strength of signals, which increases the acceptance of advanced Bluetooth applications into many IoT devices.

- Bluetooth connectivity has become a preferred technology of the IoT because it unlocks creative applications accelerating the future of intelligent living through smart lighting, smart healthcare, and intelligent buildings to smart cities. Additionally, according to the Bluetooth Market Update report by Bluetooth SIG, a company developing Bluetooth standards, the annual shipments of Bluetooth device network devices would achieve 2.63 times growth from during the forecast period, reaching 1.63 billion.

- The advantage of Bluetooth connectivity supported IOT gateways for IOT applications can be operated with low power consumption, which supports the market growth of Bluetooth-based IOT gateways in the market. In addition, the demand for IOT gateways in smart buildings and retail sector temperature monitoring is creating a demand for the market, including Bluetooth-enabled gateways, which is driving the market growth of IOT gateways worldwide during the forecast period.

Asia Pacific to Dominate the Market

- The industrial sector in India is rapidly adopting IoT technologies to enhance operational efficiency, reduce downtime, and optimize resource utilization. The increasing adoption of IIoT solutions is driving the demand for IoT gateways tailored to industrial applications in India.

- India's IoT ecosystem is rapidly expanding, fueled by government initiatives such as Digital India and Smart Cities Mission. The country's vast population, rising smartphone penetration, and increasing connectivity infrastructure drive IoT solutions adoption across industries. IoT gateways form a critical part of this ecosystem by enabling consistent network and information exchange between IoT gadgets and the cloud.

- Greater China is both a huge market for industrial IoT and a major supplier of component technologies, which consist of sensors, microchips, and other components that are the fabric of IoT. Also, after initially using IoT to drive efficiency improvement, Chinese manufacturers are focused on the potential for revenue growth and risk management. As a result, nations such as Thailand, Indonesia, and Vietnam are anticipated to become more vital as China shifts to more efficient generation as companies look for alternative ways to manufacture items closer to new clients within the region.

- The IoT gateway market in China is witnessing significant growth and transformation, driven by strong government support, industrial IoT adoption, and advancements in connectivity infrastructure. As China continues its focus on technological innovation and digital transformation, the IoT gateway market is expected to witness further expansion and opportunities for both domestic and international players.

- Japan has a robust technological ecosystem, with leading companies and research institutions actively involved in developing and deploying IoT solutions. The country's engineering expertise and research capabilities have contributed to the innovation and advancement of IoT gateways and related technologies.

- The rest of the Asia-Pacific region in the study considers the countries like South Korea, Australia, and Taiwan, which individually have a minor contribution. Rather, the collective contribution account for a significant share.

IoT Gateway Industry Overview

The market consists of long-standing established players, such as Cisco Systems Inc. and Dell Inc., which have made significant investments to improve product technology. The presence of these players and their constant innovative activities are intensifying the competition in the market studied. The players in the market are engaging in research in order to achieve a competitive edge by strengthening their distribution channels and presence, as well as by offering the latest specifications in their products. The companies are striving to expand their offerings in the market by employing powerful competitive strategies, such as partnerships and acquisitions. Owing to the capital-intensive nature of the market, the barriers to exit are considerably high. Hence, the players in the market are subjected to intense competition. Some other major players in the market include Advantech Co. Ltd, Microchip Technology Inc., Huawei Technologies Co. Ltd, etc.

- July 2023 - Advantech introduced a new digital commerce platform, IoTMart International, to facilitate cross-border online business services. This platform complements Advantech's existing distribution model. It is specifically designed to cater to the diverse requirements of different customer segments, particularly focusing on the needs of small and medium-sized customers.

- May 2023 - NTT Ltd, a company specializing in IT infrastructure and services, and Cisco joined forces to create and implement collaborative solutions that effectively aid the sustainability objectives of major organizations. By utilizing NTT's Edge as a Service portfolio and Cisco's IoT capabilities, the combined efforts of the two companies will deliver real-time data analysis, heightened security measures, better decision-making processes, and reduced operational expenses through predictive maintenance, asset tracking, and supply chain management capabilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Application-specific MCUs and Flexible SOC-type Designs

- 5.1.2 Emerging Development of Smart Cities

- 5.2 Market Restraints

- 5.2.1 Concerns Regarding the Security and Privacy of the User Data

- 5.2.2 Lack of Common Protocols and Communication Standards of IoT Technology

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Processor

- 6.1.2 Sensor

- 6.1.3 Memory and Storage Device

- 6.1.4 Other Components

- 6.2 By Connectivity

- 6.2.1 Bluetooth

- 6.2.2 Wi-Fi

- 6.2.3 ZigBee

- 6.2.4 Ethernet

- 6.2.5 Cellular

- 6.2.6 Other Connectivity Types

- 6.3 By End User

- 6.3.1 Automotive and Transportation

- 6.3.2 Healthcare

- 6.3.3 Industrial

- 6.3.4 Consumer Electronics

- 6.3.5 BFSI

- 6.3.6 Oil and Gas

- 6.3.7 Retail

- 6.3.8 Aerospace and Defense

- 6.3.9 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia Pacific

- 6.4.3.1 India

- 6.4.3.2 China

- 6.4.3.3 Japan

- 6.4.3.4 Rest of Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Advantech Co. Ltd

- 7.1.3 Dell Inc.

- 7.1.4 Microchip Technology Inc.

- 7.1.5 Huawei Technologies Co. Ltd

- 7.1.6 Hewlett Packard Enterprise Development LP

- 7.1.7 Samsara Networks Inc.

- 7.1.8 Eurotech Inc.

- 7.1.9 ADLINK Technology Inc.

- 7.1.10 Kontron S&T AG