|

市場調查報告書

商品編碼

1689957

軟性電子產品隔熱材料:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Flexible Insulation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

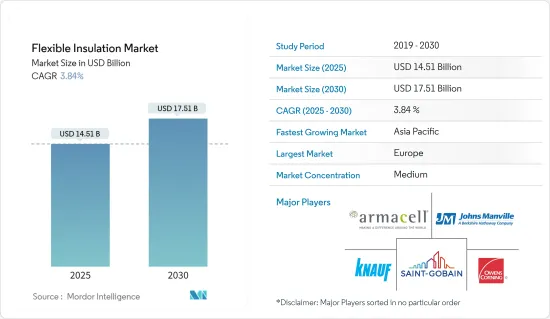

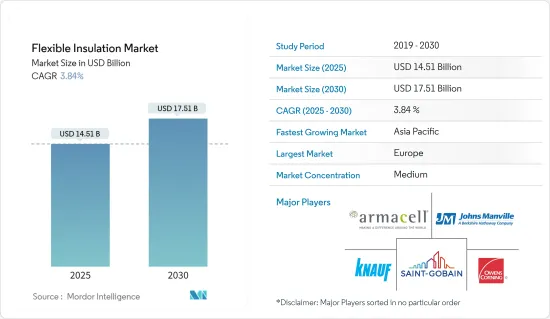

軟性電子產品隔熱市場規模預計在2025年為145.1億美元,預計到2030年將達到175.1億美元,預測期內(2025-2030年)的複合年成長率為3.84%。

主要亮點

- 建設產業對能源效率的需求不斷增加以及軟性管道隔熱材料應用的不斷擴大預計將在未來幾年推動軟性電子產品隔熱市場的發展。

- 然而,預計更好的替代品的出現將阻礙市場的成長。

- 預計在預測期內,電動汽車氣凝膠隔熱材料的新興機會將為市場創造機會。

- 雖然歐洲預計將主導市場,但由於中國、印度和日本等國家的消費不斷增加,預計亞太地區將以最高的複合年成長率成長。

軟性電子產品隔熱材料的市場趨勢

玻璃纖維隔熱材料需求不斷增加

- 玻璃纖維由細玻璃纖維和高溫黏合劑之間的極強結合組成。這些纖維(每根直徑約 6-7 微米)的分佈方式使得它們能夠捕捉數百萬個微小氣穴,從而形成出色的隔熱和隔音效果。玻璃纖維具有化學惰性,不含鐵粒、硫和氯化物等雜質。

- 它無腐蝕性,不會發黴。它由可再生原料製成,在生產的各個階段都是環保的。它可用於多種隔熱材料,如毯子(氈和捲)和鬆散填充物,也可用作硬質板和管道隔熱材料。玻璃纖維隔熱材料由沙子、石灰石、堿灰和回收玻璃玻璃屑的混合物製成。

- 兩種玻璃纖維廣泛用於住宅、商業和基礎設施建設。一種類型是纖維狀的,可製成軟性毯、剛性板、管道隔熱材料和其他預製形狀。它不易燃,並且具有出色的吸音性能。另一種類型是蜂窩狀,以板材或塊狀形式存在,可加工成管道隔熱材料和各種其他形狀。結構強度高,但抗衝擊性低。這種材質不易燃、不吸水,而且耐多種化學物質。主要用於工業烤箱、熱交換器、乾燥機、鍋爐、管道等的絕緣。

- 美國等國家的建設活動正在增加,推動了對玻璃纖維軟性電子產品隔熱的需求。例如,根據美國人口普查局的數據,2023年美國年度建築價值為19,787億美元,與2022年相比成長約7.03%。

- 玻璃纖維隔熱材料用於金屬板管道、外殼和靜壓室的外部。它可形成半剛性至剛性板,也適用於絕緣冷凍和其他加熱和冷卻設備。它可以在 0°F (-18°C) 至 450°F (232°C) 的溫度範圍內使用。

- 最近,回收的窗玻璃、汽車玻璃和瓶子玻璃擴大被用作製造玻璃纖維。市場上可獲得的再生材料的數量對再生內容做出了限制。使用回收材料有助於穩定減少製造隔熱產品所需的能源。

- 由於上述因素,預計預測期內玻璃纖維隔熱材料的需求將進一步成長。

歐洲主導市場

- 預計歐洲將成為軟性隔熱材料的最大市場。歐盟提高建築效率的指令導致了嚴格的建築能源法規,預計將推動該地區對軟性隔熱材料的需求。

- 德國等國家的建築業對軟性電子產品隔熱材料的巨大需求是軟性電子產品隔熱材料市場成長的另一個原因。預測期內,德國的酒店建設預計也將激增。 2022 年,預計推出;2023 年,還將有 78 個計劃開業,提供 13,073 間客房。預計 2024 年後酒店業發展仍將保持強勁勢頭,目前已有 153 個計劃和 22,769 間客房在籌備中。

- 此外,英國的建築計劃數量正在激增,預計將推動未來對軟性隔熱材料的需求。例如,根據《新倫敦建築》的數據,倫敦有近 540 座高層建築正在規劃或建造中,而現有的高層建築數量為 360 座。預計高層建築建設的增加將推動所研究市場的發展。

- 在法國,建設產業的營業額指數近年來一直在緩慢成長。該國建設產業在經歷八年的衰退之後,最近已恢復成長勢頭。生態與團結轉型部表示,法國建築許可總數已從 2023 年 12 月的 33,765 套增加到 2024 年 1 月的 26,585 套。

- 歐洲工業化進程迅速,擁有主要隔熱材料製造商,是最早採用新興材料並取得較高產品銷售的地區之一。

- 因此,預計歐洲地區對軟性電子產品隔熱材料的需求不斷成長將在預測期內推動市場研究。

軟性電子產品隔熱行業概況

軟性電子產品隔熱市場比較分散。市場的主要企業包括(不分先後順序)Armacell、Knauf Group、Johns Manville、Owens Corning 和 Saint-Gobain。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 建設產業對能源效率的需求日益增加

- 擴大軟性管道隔熱材料的使用

- 其他促進因素

- 市場限制

- 替代產品的可用性

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 按材質

- 氣凝膠

- 交聯聚乙烯

- 合成橡膠

- 玻璃纖維

- 其他材料

- 按絕緣類型

- 隔音

- 電氣絕緣

- 隔熱材料

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 市場排名分析

- 主要企業策略

- 公司簡介

- Altana AG

- Armacell

- Cabot Corporation

- Etex Group

- Fletcher Insulation

- Johns Manville

- Kingspan Group

- Knauf Insulation

- Owens Corning

- Saint-Gobain

- Superlon Holdings Berhad

- Thermaxx Jackets

第7章 市場機會與未來趨勢

- 氣凝膠隔熱材料在電動車中的新機會

- 其他機會

簡介目錄

Product Code: 69527

The Flexible Insulation Market size is estimated at USD 14.51 billion in 2025, and is expected to reach USD 17.51 billion by 2030, at a CAGR of 3.84% during the forecast period (2025-2030).

Key Highlights

- The increasing demand for energy efficiency from the construction industry and the increasing application of flexible piping insulation are expected to drive the flexible insulation market in the coming years.

- However, the availability of better alternatives is expected to hinder the growth of the market.

- Emerging opportunities for aerogel insulation in electric vehicles are expected to create opportunities for the market during the forecast period.

- Europe is expected to dominate the market, while Asia-Pacific is expected to register the highest CAGR owing to the increasing consumption from countries such as China, India, and Japan.

Flexible Insulation Market Trends

Rising Demand for Fiberglass Insulation

- Fiberglass consists of extremely strong bonds between thin glass fibers and a high-temperature binder. These fibers (each of nearly 6-7 microns in diameter) are distributed to trap millions of tiny pockets of air in them, thereby creating excellent thermal and acoustic insulation. Fiberglass is chemically inert and has no impurities, such as iron shots, sulfur, or chloride.

- The product is non-corrosive and does not support mold growth. It is manufactured from renewable raw materials and is eco-friendly in every stage of manufacturing. It is used in different forms of insulation, such as blankets (batts and rolls) and loose-fill, and is also available as rigid boards and duct insulation. Fiberglass insulation is manufactured with a blend of sand, limestone, soda ash, and recycled glass cullet.

- Two types of fiberglass are extensively used in residential, commercial, and infrastructural construction. One is the fibrous one, which is available in flexible blankets, rigid boards, pipe insulation, and other pre-molded shapes. It is non-combustible and has good sound absorption qualities. The second one is the cellular type, which is available in board and block forms and capable of being fabricated into pipe insulation and various shapes. It has good structural strength but poor impact resistance. The material is non-combustible, non-absorptive, and resistant to many chemicals. It is mainly used to insulate industrial ovens, heat exchangers, driers, boilers, and pipe work.

- Construction activities are increasing in countries like the United States, which is increasing the demand for fiberglass flexible insulation. For instance, according to the US Census Bureau, the annual value for construction in the United States accounted for USD 1,978.7 billion in 2023, which is an increase of about 7.03% compared to that of 2022.

- Fibrous glass insulation is applied to the exterior of sheet metal ducts, housings, and plenums. It forms semi-rigid to rigid boards that are also suitable for insulating chillers and other cold or hot equipment. It can be used in applications within the temperature range of 0°F (-18°C) to 450°F (232°C).

- In recent times, recycled windows and automotive or bottle glass have been increasingly used in the manufacture of glass fiber. The amount of usable recycled material available in the market limits the recycled content. The use of recycled material has helped to reduce the energy required to produce insulation products steadily.

- Owing to the above-mentioned factors, the demand for fiberglass insulation is expected to grow further over the forecast period.

Europe to Dominate the Market

- Europe is projected to be the largest market for flexible insulation. Stringent building energy codes accompanied by EU Directives to enhance efficiency in buildings are expected to drive the demand for flexible insulation in the region.

- Robust demand for flexible insulation from the construction sector in countries like Germany is another reason for the growth of the flexible insulation market. The construction of hotels in Germany is also expected to witness a sharp rise during the forecast period. The year 2022 witnessed the launch of 89 new hotels and 15,780 rooms, and 78 more projects with 13,073 keys were mooted for 2023. The pipeline of hotels is anticipated to stay strong for 2024 and beyond, with 153 projects and 22,769 rooms already in the works.

- Moreover, various construction projects are active in the United Kingdom, which is expected to enhance the future demand for flexible insulation. For instance, according to New London Architecture, there are nearly 540 planned and under construction high-rise buildings in London, with an existing number of 360 tall buildings. The growing construction of high-rise buildings is estimated to drive the market studied.

- In France, the construction index has been witnessing slow growth, with a gradual increase in the industry turnover index over the past few years. The construction industry in the country recently gained momentum after eight long years of decline. The Ministere de la Transition ecologique et solidaire revealed an increase in total building permits in France to 26,585 Units in January 2024 from 33,765 Units in December 2023.

- Europe was an early adopter of emerging materials on account of rapid industrialization and the presence of major insulation product manufacturers, thus leading to high product sales.

- Thus, the growing demand for flexible insulation in the Europe region is expected to drive the market studied during the forecast period.

Flexible Insulation Industry Overview

The flexible insulation market is fragmented in nature. Some of the major players in the market include (not in any particular order) Armacell, Knauf Group, Johns Manville, Owens Corning, and Saint-Gobain, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand for Energy Efficiency from the Construction Industry

- 4.1.2 Increasing Application of Flexible Piping Insulation

- 4.1.3 Other Drivers

- 4.2 Market Restraints

- 4.2.1 Availability of Alternatives

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Material

- 5.1.1 Aerogel

- 5.1.2 Cross-Linked Polyethylene

- 5.1.3 Elastomer

- 5.1.4 Fiberglass

- 5.1.5 Other Materials

- 5.2 By Insulation Type

- 5.2.1 Acoustic Insulation

- 5.2.2 Electrical Insulation

- 5.2.3 Thermal Insulation

- 5.3 By Geography

- 5.3.1 Asia - Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia - Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Ranking Analysis

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Altana AG

- 6.3.2 Armacell

- 6.3.3 Cabot Corporation

- 6.3.4 Etex Group

- 6.3.5 Fletcher Insulation

- 6.3.6 Johns Manville

- 6.3.7 Kingspan Group

- 6.3.8 Knauf Insulation

- 6.3.9 Owens Corning

- 6.3.10 Saint-Gobain

- 6.3.11 Superlon Holdings Berhad

- 6.3.12 Thermaxx Jackets

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Opportunity for Aerogel Insulation in Electric Vehicles

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219