|

市場調查報告書

商品編碼

1689955

氣體分離膜:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Gas Separation Membrane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

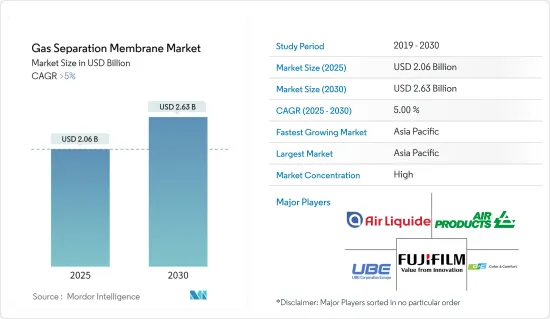

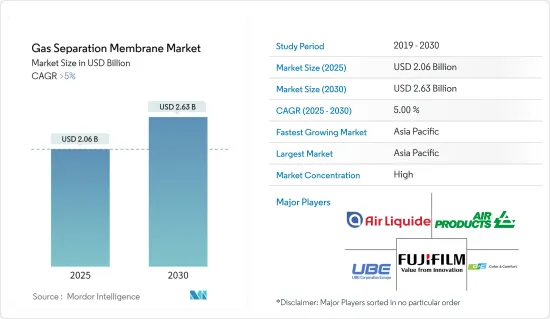

預計 2025 年氣體分離膜市場規模為 20.6 億美元,到 2030 年將達到 26.3 億美元,預測期內(2025-2030 年)的複合年成長率將超過 5%。

COVID-19疫情對氣體分離膜市場產生了負面影響。疫情擾亂了全球供應鏈,影響了製造氣體分離膜所需的原料、零件和設備的供應。生產和運輸延遲導致薄膜系統和組件暫時短缺。不過,隨著各國逐步解除封鎖限制,氣體分離膜系統的需求開始恢復。

主要亮點

- 二氧化碳分離過程中對薄膜的需求不斷成長以及政府對溫室氣體排放的嚴格監管預計將推動氣體分離膜市場的發展。

- 然而,高溫應用中聚合物膜的塑化、擴大規模和採用新膜預計會阻礙氣體分離膜市場的成長。

- 此外,混合基質膜(MMM)和聚合物薄膜的更廣泛應用有望為市場發展提供新的機會。

- 按地區分類,亞太地區佔據了最大的市場佔有率。預計中國、印度和日本對氣體分離膜的需求不斷成長,將使其成為預測期內成長最快的市場。

氣體分離膜市場趨勢

氮氣生成和富氧領域佔市場主導地位

- 制氮和富氧是各種工業應用中不可或缺的過程。石油和天然氣、化學、電子、食品和飲料以及製藥等行業需要氮氣覆蓋、吹掃、惰性、包裝等。同時,富氧對於燃燒、發酵、污水處理等過程也是必要的。

- 利用氣體分離膜生成氮氣和富氧可以實現現場氣體生產,無需運輸、儲存和處理壓縮或液化氣體。這可以降低物流成本,提高供應鏈可靠性並提高工業營運的安全性。

- 氮氣在食品和飲料行業中用於替代食品包裝中的氧氣,以延長保存期限並保持新鮮度。它們也用於對桶加壓並分配啤酒和蘇打水等碳酸飲料。在食品加工業務中,氮氣用於惰性、覆蓋、冷卻和冷凍。

- 中國啤酒產業也是全球成長最快的產業,預計到 2023年終總銷售額將達到約 1,315 億美元。

- 氮氣和氧氣在電子工業中也有應用。氮氣在半導體製造過程中用作載氣,以防止污染並維持精確的大氣條件。它還用於波峰焊、回流焊接和三防膠工藝,以提高焊料品質並防止氧化。

- 根據半導體產業協會發布的報告顯示,2023年11月全球半導體銷售額與前一年同期比較增5.3%。

- 富氧用於煉鋼、冶煉和非鐵金屬提煉等冶金工藝,以提高燃燒效率,降低燃料消費量,提高製程生產力。

- 因此,預計氣體分離膜的需求將會增加,對市場研究產生正面影響。

亞太地區佔市場主導地位

- 亞太地區包括一些成長最快的國家,例如印度、中國、日本、韓國和其他東南亞國家。這些國家正在經歷顯著的工業成長,推動了石油和天然氣、化學品、電子、醫療保健、食品和飲料等各個領域對氣體分離膜技術的需求。

- 亞太地區是製造業中心,擁有生產化學品、電子、半導體、汽車和消費品等多元化產業。氣體分離膜是許多製造流程中的重要組成部分,因此該地區對其的需求很高。

- 根據世界鋼鐵組織統計,2023年12月中國鋼鐵產量為67.4噸。同時,印度已躍升成為全球第二大粗鋼生產國。 2022-23會計年度,該國出口了672萬噸成品鋼,進口了602萬噸。

- 此外,根據半導體協會的數據,2024年1月中國半導體銷售額飆升至147.6億美元,較前一年有顯著成長。與 2023 年 1 月的 116.6 億美元銷售額相比,這是一個顯著的成長。

- 此外,該地區能源產量的成長預計將刺激該地區酸性氣體分離市場對氣體分離膜的需求。

氣體分離膜產業概況

氣體分離膜市場呈現部分整合態勢,少數幾家大公司佔據市場主導地位。市場的主要企業包括空氣產品及化學品公司、宇部興產株式會社、液化空氣高級分離公司、DIC 公司和富士膠片株式會社。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 二氧化碳分離過程中對薄膜的需求不斷增加

- 政府對溫室氣體排放制定嚴格的標準

- 限制因素

- 適用於高溫應用的聚合物薄膜的增塑

- 擴大規模並採用新膜

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 材料類型

- 聚醯亞胺和聚醯胺

- 聚碸

- 醋酸纖維素

- 其他材料類型(奈米結構薄膜)

- 應用

- 產氮富氧

- 氫氣回收

- 二氧化碳移除

- 硫化氫去除

- 其他用途(碳酸化)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 土耳其

- 俄羅斯

- 北歐的

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Air Liquide Advanced Separations

- Air Products and Chemicals Inc.

- DIC CORPORATION

- Evonik Industries AG

- FUJIFILM Corporation

- GENERON

- Honeywell International Inc.

- Linde PLC

- Membrane Technology and Research Inc.

- Parker Hannifin Corp.

- SLB(schlumberger)

- Toray Industries Inc.

- UBE Corporation

第7章 市場機會與未來趨勢

- 混合基質膜(MMM)的開發

- 聚合物薄膜應用領域的開發與拓展

The Gas Separation Membrane Market size is estimated at USD 2.06 billion in 2025, and is expected to reach USD 2.63 billion by 2030, at a CAGR of greater than 5% during the forecast period (2025-2030).

The COVID-19 pandemic negatively affected the gas separation membrane market. The pandemic disrupted the global supply chain, which affected the availability of raw materials, components, and equipment for manufacturing gas separation membranes. Delays in production and shipping led to temporary shortages of membrane systems and components. However, as countries gradually lifted lockdown restrictions, demand for gas separation membrane systems started to rebound.

Key Highlights

- The rising demand for membranes in carbon dioxide separation processes and strict government regulations for GHG emissions are expected to drive the gas separation membrane market.

- However, the plasticization of polymeric membranes in high-temperature applications and the upscaling and adoption of new membranes are expected to hamper the market growth of gas separation membranes.

- Furthermore, developing mixed matrix membranes (MMMs) and polymeric membranes with expanding applications is projected to provide new opportunities for the market studied.

- Asia-Pacific holds the largest share by geography in the market studied. It is expected to be the fastest-growing market over the forecast period due to the rising demand for gas separation membranes in China, India, and Japan.

Gas Separation Membrane Market Trends

The Nitrogen Generation and Oxygen Enrichment Segment to Dominate the Market

- Nitrogen generation and oxygen enrichment are essential processes in various industrial applications. Industries such as oil and gas, chemicals, electronics, food and beverage, and pharmaceuticals require nitrogen for blanketing, purging, inerting, and packaging. At the same time, oxygen enrichment is necessary for processes such as combustion, fermentation, and wastewater treatment.

- Nitrogen generation and oxygen enrichment using gas separation membranes enable onsite gas production, eliminating the need for transportation, storage, and handling of compressed or liquified gases. This reduces logistic costs, enhances supply chain reliability, and improves safety in industrial operations.

- Nitrogen is used in the food and beverage industry to displace oxygen in food packaging to extend the shelf life and preserve freshness. It is used to pressurize kegs and dispense carbonated beverages like beer and soda. In food processing operations, nitrogen is used for inerting, blanketing, cryogenic, and freezing.

- China's beer industry is also experiencing the quickest expansion globally, with its total revenue reaching about USD 131.5 billion by the close of 2023.

- Nitrogen and oxygen find applications in the electronics industry. Nitrogen is used as a carrier gas in semiconductor fabrication processes to prevent contamination and maintain precise atmospheric conditions. It is also used for wave soldering, reflow soldering, and conformal coating processes to improve soldering quality and prevent oxidation.

- According to the report released by the Semiconductor Industry Association, global semiconductor sales increased by 5.3 % year-to-year in November 2023.

- Oxygen enrichment is used in metallurgical processes such as steelmaking, iron smelting, and non-ferrous metal refining to increase combustion efficiency, reduce fuel consumption, and improve process productivity.

- Therefore, the demand for gas separation membranes is expected to increase and thus have a positive impact on the market studied.

Asia-Pacific to Dominate the Market

- Asia-Pacific is home to rapidly growing countries such as India, China, Japan, South Korea, and other Southeast Asian countries. These countries are experiencing significant industrial growth, driving demand for gas separation membrane technologies across various sectors, including oil and gas, chemicals, electronics, healthcare, and food and beverage.

- Asia-Pacific is a central manufacturing hub with a diverse range of industries producing chemicals, electronics, semiconductors, automobiles, and consumer goods. Gas separation membranes are essential components in many manufacturing processes, leading to high demand in the region.

- According to the World Steel Organization, in December 2023, China produced 67.4 metric tons of steel. Meanwhile, India has risen to become the second-largest producer of crude steel globally. The country exported 6.72 million metric tons of finished steel while only importing 6.02 million metric tons in the fiscal year 2022-23.

- Furthermore, according to the Semiconductor Association, in January 2024, China's semiconductor sales soared to USD 14.76 billion, marking a notable rise from the previous year. This is a considerable jump compared to the sales in January 2023, which stood at USD 11.66 billion.

- In addition, the demand for gas separation membranes in the region's acid gas separation market is expected to be stimulated by the rising energy production in this area.

Gas Separation Membrane Industry Overview

The gas separation membrane market is partially consolidated in nature, with a few major players dominating the market. The major companies operating in the market include Air Products and Chemicals Inc., UBE Corporation, Air Liquide Advanced Separations, DIC Corporation, and FUJIFILM Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Membranes in Carbon Dioxide Separation Processes

- 4.1.2 Strict Government Norms Toward GHG Emissions

- 4.2 Restraints

- 4.2.1 Plasticization of Polymeric Membranes in High-temperature Applications

- 4.2.2 Upscaling and Adoption of New Membranes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Material Type

- 5.1.1 Polyimide and Polyamide

- 5.1.2 Polysulfone

- 5.1.3 Cellulose Acetate

- 5.1.4 Other Material Types (Nanostructured Membrane)

- 5.2 Application

- 5.2.1 Nitrogen Generation and Oxygen Enrichment

- 5.2.2 Hydrogen Recovery

- 5.2.3 Carbon Dioxide Removal

- 5.2.4 Removal of Hydrogen Sulphide

- 5.2.5 Other Applications (Carbonation)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Liquide Advanced Separations

- 6.4.2 Air Products and Chemicals Inc.

- 6.4.3 DIC CORPORATION

- 6.4.4 Evonik Industries AG

- 6.4.5 FUJIFILM Corporation

- 6.4.6 GENERON

- 6.4.7 Honeywell International Inc.

- 6.4.8 Linde PLC

- 6.4.9 Membrane Technology and Research Inc.

- 6.4.10 Parker Hannifin Corp.

- 6.4.11 SLB (schlumberger)

- 6.4.12 Toray Industries Inc.

- 6.4.13 UBE Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Mixed Matrix Membranes (MMM)

- 7.2 Development in Polymeric Membranes and Expanding Applications