|

市場調查報告書

商品編碼

1689954

阿爾法甲基苯乙烯:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Alpha Methylstyrene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

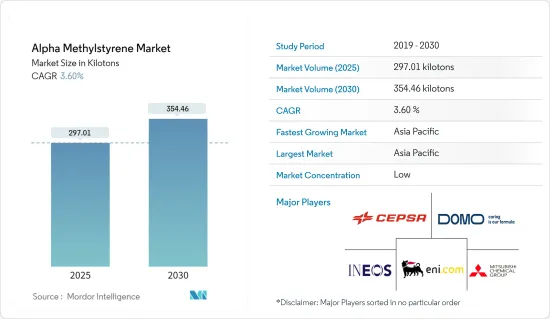

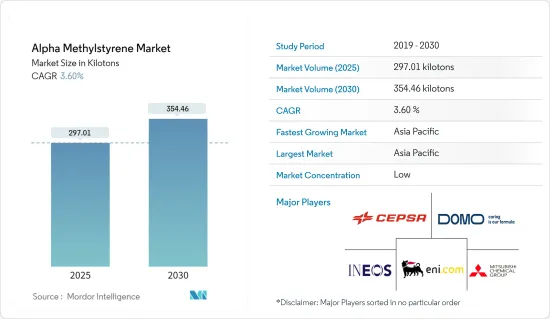

預計 2025 年 α 甲基苯乙烯市場規模為 297.01 千噸,到 2030 年將達到 354.46 千噸,預測期內(2025-2030 年)的複合年成長率為 3.6%。

由於所有行業都停止了生產流程,COVID-19 對市場產生了負面影響。封鎖、社交距離和貿易制裁已導致全球供應鏈網路嚴重中斷。不過,預計這種情況將在 2021 年恢復,有利於預測期內的市場。

主要亮點

- 從中期來看,ABS 樹脂製造需求的增加以及電子產業對 α 甲基苯乙烯的需求上升是推動市場發展的關鍵因素。

- 另一方面,生產α-甲基苯乙烯過程中排放的危險廢棄物可能會抑制市場的成長。

- 對耐用蠟和耐熱黏合劑的需求不斷增加,這可能會在未來幾年為市場帶來好處。

- 亞太地區貢獻了最高的市場佔有率,並可能在預測期內佔據市場主導地位。

阿爾法甲基苯乙烯市場趨勢

汽車產業佔市場主導地位

- 甲基苯乙烯是生產 ABS 樹脂的中間體。此外,ABS 塑膠在汽車工業中用作金屬替代品。為了實現輕量化,ABS樹脂被用於汽車的各種零件。 ABS 常用於儀表板組件、座椅靠背、安全帶組件、方向盤、車門滑軌、柱飾板和儀錶面板等零件。

- 根據國際汽車製造商協會(OICA)預測,2022年全球汽車產量將達到8,501萬輛,而2021年為8,020萬輛,成長率為6%。

- 此外,電動車產量的增加可能會增加市場對市場研究的需求。例如,根據 EV Volumes 的數據,2022 年將交付總合1,050 萬輛新的 BEV 和 PHEV,比 2021 年成長 55%。

- 亞太地區是全球最有價值汽車製造商的所在地。中國、印度、日本和韓國等新興經濟體努力加強製造業基礎,建立高效率的供應鏈以提高盈利。

- 中國是全球最大的汽車生產基地,根據中國工業協會的數據,預計2022年汽車總產量將從去年的2,610萬輛增加3.4%至2,720萬輛。

- 德國是歐洲主要汽車製造國之一。根據德國工業協會(VDA)統計,2022年7月德國汽車產量為263,400輛,較2021年同期成長7%。此外,德國對電動車的需求也在成長。因此,各公司都在該國增加電動車的產量。例如,2023年6月,福特宣佈在德國科隆開設電動車中心,這是一座高科技生產工廠。

- OICA 表示,在北美,2022 年的汽車產量將達到 1,770 萬輛,較 2021 年的約 1,610 萬輛成長 10%。

- 因此,預計預測期內對 α 甲基苯乙烯的需求將隨著汽車產量的擴大而成長。

亞太地區主導 Alpha 甲基苯乙烯市場

- 亞太地區在全球α-甲基苯乙烯市場中佔有突出佔有率,預計在預測期內將繼續佔據市場主導地位。

- 國家統計局發布的資料顯示,中國輪胎產業取得了顯著成長,反映出國內和國際市場對輪胎的需求不斷增加。

- 根據中國國家統計局的數據,截至2023年5月,中國塑膠製品月產量約600萬噸。自2020年1月以來,塑膠製品月產量最高的是2021年12月,為795萬噸。

- 此外,中國是化學加工中心,佔世界化學產品的很大一部分。在中國這個全球最大的化學品市場,預計2023年化學品產量成長將略有放緩。繼俄烏戰爭之後,全球供應鏈已經因能源和原料成本上升、疫情、經濟不確定性和政治動盪而緊張,而2022年化學工業又遭遇了進一步的瓶頸。根據BASF《化工產業展望》,預計2023年中國化學品產量將小幅下降5.9%。不過,新建化工廠的投資正在增加,這將在中期內支撐對AMS的需求。

- 印度是亞太地區繼中國之後最大的橡膠生產國和消費國之一。在印度,65%以上的橡膠產量用於製造汽車輪胎(50%)和自行車輪胎和內胎(15%)。此外,該國擁有近 66 家輪胎生產廠和約 41 家輪胎製造公司。

- 據IBEF稱,2022年4月至9月塑膠出口總額為63.8億美元。在此期間,塑膠原料、醫療製品、管線及配件出口分別比去年同期成長32.3%、24.8%和17.9%。

- 因此,預計預測期內各行業需求的增加將推動該地區研究市場的發展。

Alpha 甲基苯乙烯產業概況

甲基苯乙烯市場比較分散。市場的主要企業包括 ENI SpA、INEOS、Cepsa、三菱化學和 Domo Chemicals。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- ABS 樹脂製造需求增加

- 電子業對 α-甲基苯乙烯的需求不斷增加

- 限制因素

- α-甲基苯乙烯生產過程中的危險廢棄物排放

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 應用

- ABS 製造

- 塑膠添加劑和中間體

- 膠水

- 被覆劑

- 其他用途

- 最終用戶產業

- 胎

- 車

- 電子產品

- 塑膠

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 世界其他地區

- 南美洲

- 中東和非洲

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- AdvanSix

- Altivia

- Cepsa

- Chang Chun Group

- Deepak

- Domo Chemicals

- Eni SPA

- INEOS

- Kraton Corporation

- Kumho P&B Chemicals.,inc.

- Mitsubishi Chemical Corporation

- Prasol Chemicals Limited

- Rosneft

- Seqens

- SI Group, Inc.

- Solvay

- Yangzhou Lida Chemical Co., Ltd.

第7章 市場機會與未來趨勢

- 對耐用蠟和耐熱黏合劑的需求不斷增加

- 其他機會

The Alpha Methylstyrene Market size is estimated at 297.01 kilotons in 2025, and is expected to reach 354.46 kilotons by 2030, at a CAGR of 3.6% during the forecast period (2025-2030).

COVID-19 negatively impacted the market as all the industries halted their manufacturing processes. Lockdowns, social distances, and trade sanctions triggered massive disruptions to global supply chain networks. However, the condition is recovered in 2021, which is expected to benefit the market during the forecast period.

Key Highlights

- In the medium term, the major factors driving the market studied are the increasing demand for the manufacturing of ABS resins and increasing demand for alpha-methyl styrene in the electronics segment.

- On the flip side, hazardous waste release during the production of alpha methyl styrene is likely to restrain the market growth.

- Increase in demand for durable waxes and heat-resistant adhesives is likely to act as an opportunity for the market in coming years.

- Asia-Pacific accounted for the highest market share, and the region is likely to dominate the market during the forecast period.

Alpha Methylstyrene Market Trends

Automotive Industry to Dominate the Market

- Alpha methyl styrene is an intermediate for the production of ABS resin. Further, ABS resin is used as a replacement for metal in the automotive industry. Various automotive parts that look for weight reduction factors use ABS thermoplastic. ABS is commonly used for parts that include dashboard components, seat backs, seat belt components, handles, door loners, pillar trim, and instrument panels.

- According to the Organization Internationale des Constructeurs d'Automobiles (OICA), global automotive vehicle production reached 85.01 million in 2022, with a growth rate of 6% as compared to 80.20 million vehicles manufactured in 2021, thereby indicating an increased demand for alpha methyl styrene from the automotive industry.

- Furthermore, the rising production of electric vehicles is likely to enhance the market demand for the market-studied. For instance, according to the EV Volumes, a total of 10.5 million new BEVs and PHEVs were delivered during 2022, an increase of 55 % compared to 2021.

- Asia-Pacific region is home to some of the world's most valuable vehicle manufacturers. Developing countries such as China, India, Japan, and South Korea have been working hard to strengthen the manufacturing base and develop efficient supply chains for greater profitability.

- According to the China Association of Automobile Manufacturers (CAAM), China has the largest automotive production base in the world, with a total vehicle production of 27.2 million units in 2022, registering an increase of 3.4 % compared to 26.1 million units produced last year.

- In Europe, Germany is among the vital manufacturer of vehicles. According to the German Association of the Automotive Industry (VDA), Germany produced 263,400 units of cars in July 2022, registering a growth rate of 7% compared to the same period in 2021. Additionally, the demand for electric cars is increasing in Germany. Thus, various companies are increasing the production volume of electric cars in the country. For instance, in June 2023, Ford announced the inauguration of the Cologne Electric Vehicle Center, a hi-tech production facility in Germany.

- In North America, according to the OICA, automotive production in 2022 accounted for 17.7 million units, an increase of 10% compared to that in 2021, which was around 16.1 million units.

- Therefore, the demand for alpha methyl styrene is expected to grow with the expanding automotive production during the forecast period.

Asia-Pacific to Dominate Alpha Methyl Styrene Market

- Asia-Pacific holds a prominent share in the alpha-methylstyrene market globally and is expected to dominate the market during the period of forecast.

- As per the data released by the National Bureau of Statistics, China's tire industry is experiencing substantial growth, reflecting the increasing demand for tires in the domestic as well as international markets.

- According to the National Bureau of Statistics of China, as of May 2023, China produces roughly 6 million metric tons of plastic products monthly. Since January 2020, the highest monthly output of plastic products was recorded in December 2021, at 7.95 million metric tons.

- Furthermore, China is a hub for chemical processing, accounting for a major chunk of global chemicals. In China, the world's largest chemicals market, a slight slowdown in chemical production growth is expected in 2023. Following Russia and Ukraine war, the chemical industry experienced a year marked by further bottlenecks in global supply chains already strained by rising energy and raw material costs, pandemic, economic uncertainty, and political turmoil in 2022. Continuing on the tumultuous grounds, China is expected to register a slightly weaker growth of 5.9% in chemical production in 2023, as per the BASF's chemical industry outlook. However, the increasing investments in the construction of new chemical plants support the demand for AMS in the mid-term.

- India is one of the largest producers and consumers of rubber after China in the Asia-Pacific region. In India, over 65% of the rubber produced is used for manufacturing automotive (50%) and bicycle tires and tubes (15%). Moreover, the country has almost 66 tire-producing plants and about 41 tire-producing companies.

- According to IBEF, total plastics exports between April-September 2022 stood at USD 6.38 billion. During this period, the exports of plastic raw materials, medical items, and pipes and fittings increased by 32.3%, 24.8%, and 17.9% over the same time last year.

- Thus, rising demand from various industries is expected to drive the market studied in the region during the forecast period.

Alpha Methylstyrene Industry Overview

The alpha methyl styrene market is fragmented in nature. Some of the major companies in the market include ENI S.p.A., INEOS, Cepsa, Mitsubishi Chemical Corporation, and Domo Chemicals, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand For the Manufacturing of ABS Resins

- 4.1.2 Increasing Demand For Alpha-methyl Styrene In the Electronics Segment

- 4.2 Restraints

- 4.2.1 Hazardous Waste Release During the Production of Alpha Methyl Styrene

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume and Value)

- 5.1 Application

- 5.1.1 ABS Manufacture

- 5.1.2 Plastic Additives and Intermediates

- 5.1.3 Adhesives

- 5.1.4 Coatings

- 5.1.5 Other Applications

- 5.2 End-user Industry

- 5.2.1 Tire

- 5.2.2 Automotive

- 5.2.3 Electronics

- 5.2.4 Plastics

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AdvanSix

- 6.4.2 Altivia

- 6.4.3 Cepsa

- 6.4.4 Chang Chun Group

- 6.4.5 Deepak

- 6.4.6 Domo Chemicals

- 6.4.7 Eni S.P.A.

- 6.4.8 INEOS

- 6.4.9 Kraton Corporation

- 6.4.10 Kumho P&B Chemicals.,inc.

- 6.4.11 Mitsubishi Chemical Corporation

- 6.4.12 Prasol Chemicals Limited

- 6.4.13 Rosneft

- 6.4.14 Seqens

- 6.4.15 SI Group, Inc.

- 6.4.16 Solvay

- 6.4.17 Yangzhou Lida Chemical Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increase in Demand for Durable Waxes and Heat-resistant Adhesives

- 7.2 Other Opportunities