|

市場調查報告書

商品編碼

1689948

乙二醇:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Glycol - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

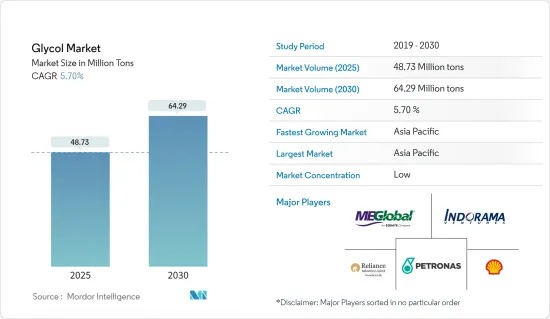

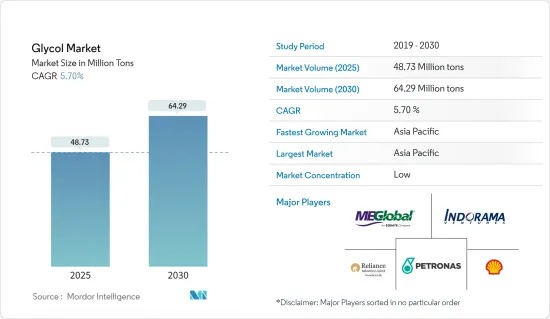

乙二醇市場規模預計在 2025 年為 4,873 萬噸,預計在 2030 年達到 6,429 萬噸,在市場估計和預測期(2025-2030 年)內以 5.7% 的複合年成長率成長。

2020 年,新冠疫情導致全球採取封鎖和社交距離措施,擾亂了供應鏈並關閉了許多製造部門。這對乙二醇市場產生了負面影響。然而,預計市場將在 2021 年復甦,並在預測期內實現穩步成長。

主要亮點

- 短期內,紡織業用量增加和食品飲料產業需求上升是推動市場需求的主要因素。

- 毒性和環境問題預計會阻礙市場成長。

- 然而,對生物基乙二醇的需求不斷增加預計將為市場創造新的機會。

- 預計亞太地區將主導全球市場,其中中國、印度和日本的需求將佔大部分市場。

乙二醇市場趨勢

在紡織業的應用日益增多

- 主要原料丙二醇和乙二醇對於多種產品,特別是聚酯纖維的生產至關重要。這些纖維用於服飾、室內裝潢、地毯、枕頭等。

- 乙二醇最突出的用途是在紡織業中占主導地位的聚酯纖維。此外,乙二醇醚作為染浴添加劑在紡織品市場中發揮重要作用,可提高色光準確性、染色均勻性和牢度等性能,並降低染色溫度和循環時間。

- 隨著全球紡織業的崛起,對乙二醇的需求也不斷增加。根據《2023年世界貿易統計評論》和聯合國商品貿易統計資料庫的數據,中國、歐盟和印度是2022年三大紡織品出口國,三者合計佔全球紡織品出口的72.1%。

- 中國氨綸產量和消費量均居世界之冠。中國化纖協會氨綸部報告稱,預計到2023年底,我國氨綸產能將達到123.95萬噸/年。調整後的產能將淨增加143噸/年,較2022年增加13%。

- 紡織業是印度最古老的產業之一,對經濟有著重大影響,貢獻了該國 GDP 的 2.3%、工業生產的 13% 和出口的 12%。根據印度品牌股權基金會的數據,2023 年紡織品和服裝出口總額將達到 367 億美元。預計到2024年將達到359億美元。同時,成衣及配件出口達142.3億美元。 24會計年度,印度對美國(印度最大市場)的紡織品和服飾出口將占出口總額的32.7%。預計出口激增將提振印度對乙二醇的需求。

- 根據美國全國紡織組織理事會(NCTO)的數據,美國是世界第三大紡織品出口國。美國紡織業提供軍方8,000多種產品,2023年的出出貨收益價值達648億美元。美國在紡織研發領域處於世界領先地位。

- 義大利以其頂級時尚品牌而聞名,其紡織業正在經歷轉型,並在擁抱技術進步的同時努力現代化。據ITMA稱,義大利擁有約45,000家紡織和時裝公司。

- 根據巴西Comex Stat數據顯示,2023年阿根廷將成為巴西紡織品服裝出口的主要目的地,出口額將超過2.3億美元。緊隨其後的是巴拉圭和烏拉圭,出口額分別為 1.33 億美元和 0.78 億美元。

- 在非洲,南非預計將成為非洲大陸領先的紡織品出口國,2023 年出口額將達 38 億美元。根據南非服裝和紡織協會的數據,這些出口產品(主要是技術紡織品)大部分運往航空公司。

- 考慮到這些動態,全球乙二醇市場在未來幾年將會成長。

亞太地區佔市場主導地位

- 亞太地區將引領乙二醇消費並主導市場,成為預測期內成長最快的地區。這種快速成長是由來自不同終端使用者產業日益成長的需求所推動的,包括包裝、食品和飲料、汽車、運輸、化妝品和紡織品,尤其是中國、印度、韓國、日本和東南亞國家。

- 在亞太地區,由於出口和國內消費的增加,食品飲料、消費品等產業對包裝材料的需求日益增加。該地區的包裝市場受到對包裝食品和快速消費品日益成長的需求的支持,尤其是隨著電子商務的興起。由於其優勢,工程塑膠產品,尤其是PET容器和瓶子,在包裝領域正在顯著成長。 PET衍生乙二醇、對苯二甲酸二甲酯 (DMT) 和對苯二甲酸。

- 中國包裝工業是世界重要的包裝工業之一。隨著經濟的成長和購買力不斷增強的中階的快速壯大,中國的包裝產業一直經歷著持續的成長。此外,該國的包裝產業預計還會成長。中國政府報告估計,到 2025 年,該產業的價值將達到 2 兆元(2,900 億美元)。

- 食品加工產業的興起預計將推動印度對食品包裝的需求。食品加工部強調,食品加工產業是印度經濟的主要企業,佔整個食品市場的32%。根據市場估計和預測,到2025年,該產業產值預計將達到5,350億美元,年成長率為15.2%,支持市場的成長。

- 除了包裝之外,乙二醇作為汽車散熱器的防凍劑也扮演著重要角色。汽車產業正在蓬勃發展,中國處於領先地位。根據國際汽車工業組織(OICA)的數據,2023年中國汽車產量將達到3,016萬輛,較2022年的2,702萬輛成長12%。汽車產量的激增將提振乙二醇市場。

- 韓國擁有成熟的汽車工業,擁有現代、三星、起亞等知名品牌。根據汽車工業協會和韓國汽車研究所的預測,到 2024 年,國內汽車產量預計將增加 1.0%,達到 436 萬輛。預計這種成長將推動市場需求。

- 過去十年,中國化妝品市場快速成長。根據中國國家統計局的數據,2023年化妝品零售額將達到約4,141.7億元人民幣(585億美元)。由於二、三線城市需求激增以及男士護膚需求顯著增加,乙醇酸市場預計將出現成長。

- 韓國是全球十大美容市場之一,因其創新、使用天然成分和精美包裝而受到讚譽。根據韓國食品藥品安全部數據顯示,2023年韓國化妝品出口額預計將達85億美元,穩居全球第四。

- 印度製藥業以提供價格實惠的優質藥品而聞名,其科學進步速度很快。政府預測,到 2030 年,這一數字將從 500 億美元躍升至 1,300 億美元,到 2047 年將增至 4,500 億美元。這一成長表明,在預測期內,製藥製造業對乙二醇的需求將會增加。

- 鑑於這些動態,在各行各業需求激增的推動下,亞太地區將顯著成長。

乙二醇產業概況

乙二醇市場較為分散。主要參與者包括殼牌公司、MEGlobal、Indorama Ventures Public Company Limited、Reliance Industries Limited、PETRONAS Chemicals Group Berhad 等。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 在紡織業的應用日益增多

- 食品和飲料行業需求增加

- 其他

- 限制因素

- 毒性和環境問題

- 其他

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按類型

- 乙二醇

- 乙二醇(MEG)

- 二伸乙甘醇(DEG)

- 三甘醇(TEG)

- 聚乙二醇(PEG)

- 丙二醇

- 其他

- 乙二醇

- 按最終用戶產業

- 汽車與運輸

- 包裝

- 飲食

- 化妝品

- 製藥

- 纖維

- 其他

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- BASF SE

- China Petrochemical Corporation

- China Sanjiang Fine Chemical Co. Ltd

- Dow

- Huntsman International LLC

- India Glycols Limited

- Indian Oil Corporation Ltd

- Indorama Ventures Public Company Limited

- INEOS

- LOTTE Chemical Corporation

- LyondellBasell Industries Holdings BV

- MEGlobal

- Mitsubishi Chemical Group Corporation

- Nouryon

- PETRONAS Chemicals Group Berhad

- Petrorabigh

- Reliance Industries Limited

- SABIC

- Shell PLC

第7章 市場機會與未來趨勢

- 生物基乙二醇的需求不斷成長

- 其他機會

The Glycol Market size is estimated at 48.73 million tons in 2025, and is expected to reach 64.29 million tons by 2030, at a CAGR of 5.7% during the forecast period (2025-2030).

In 2020, the COVID-19 pandemic triggered nationwide lockdowns and social distancing measures, disrupting supply chains and shuttering numerous manufacturing sectors. This adversely affected the glycol market. However, the market recovered in 2021, and it is expected to grow steadily during the forecast period.

Key Highlights

- Over the short term, increasing usage in the textile industry and growing demand from the food and beverage sector are the major factors driving the demand for the market studied.

- However, toxicity and environmental concerns are expected to hinder the market's growth.

- Nevertheless, increasing demand for bio-based glycols is expected to create new opportunities for the market studied.

- Asia-Pacific is expected to dominate the global market, with the majority of demand coming from China, India, and Japan.

Glycol Market Trends

Increasing Usage in the Textile Industry

- Key raw materials propylene glycol and ethylene glycol are pivotal in producing various products, most notably polyester fibers. These fibers find applications in clothing, upholstery, carpets, and pillows.

- Ethylene glycol's most prominent application is in polyester fibers, which dominate the textile industry. Additionally, glycol ethers play a crucial role as dyebath additives in the textile market, enhancing properties like shade accuracy, level dyeing, colorfastness, and reducing dyeing temperatures and cycle times.

- With the global textile sector on the rise, the demand for glycols is set to increase. Data from the World Trade Statistical Review 2023 and UN Comtrade highlighted that in 2022, China, the European Union, and India were the top three textile exporters, collectively accounting for 72.1% of global textile exports.

- China leads the world in both spandex production and consumption. The Spandex Branch of China Chemical Fibers Association reported that by the end of 2023, China's spandex capacity reached 1.2395 million tons/year. After adjustments, this marked a net capacity increase of 143 kt/year, translating to a 13% growth from 2022.

- India's textile sector, one of the nation's oldest industries, impacts the economy significantly, accounting for 2.3% of the GDP, 13% of industrial production, and 12% of exports. Data from the Indian Brand Equity Foundation showed that the total textile and apparel exports reached USD 36.7 billion in 2023. It is estimated to reach USD 35.9 billion in 2024. Additionally, exports of readymade garments and accessories were valued at USD 14.23 billion. In FY 2024, exports of textiles and apparel to the United States, India's largest market, constituted 32.7% of the total export value. This surge in exports is expected to bolster the demand for glycols in India.

- According to data from the National Council of Textile Organization (NCTO), the United States ranks as the world's third-largest textile exporter. The US textile industry supplies over 8,000 products to the military and achieved shipments worth USD 64.8 billion in 2023. The country stands out as a global leader in textile research and development.

- Renowned for its prestigious fashion brands, Italy is witnessing a transformation in its textile sector, striving for modernization while embracing technological advancements. ITMA reports that Italy boasts around 45,000 textile and fashion companies.

- Data from Comex Stat (Brazil) revealed that in 2023, Argentina was the primary destination for Brazilian textile and apparel exports, valued at over USD 230 million. Paraguay and Uruguay followed, with exports worth USD 133 million and USD 78 million, respectively.

- In Africa, South Africa emerged as the continent's leading textile exporter, with exports reaching USD 3.8 billion in 2023. A significant portion of these exports, primarily technical textiles, catered to aeronautics companies, as reported by the data from the Apparel and Textile Association of South Africa.

- Given these dynamics, the global glycol market is poised for growth in the coming years.

Asia-Pacific to Dominate the Market

- Asia-Pacific is poised to lead glycol consumption, dominating the market and emerging as the fastest-growing region during the forecast period. This surge is fueled by escalating demands from diverse end-user industries, including packaging, food and beverage, automotive, transportation, cosmetics, and textiles, particularly in nations like China, India, South Korea, Japan, and various Southeast Asian countries.

- In Asia-Pacific, industries such as food and beverage and consumer goods are increasingly seeking packing materials, driven by rising exports and domestic consumption. The region's packaging market is buoyed by a growing appetite for packaged foods and fast-moving consumer goods, especially with the rise of e-commerce. Due to their advantages, engineering plastic products, notably PET containers and bottles, are witnessing a significant uptick in the packaging sector. PET is derived from ethylene glycol, dimethyl terephthalate (DMT), or terephthalic acid.

- China's packaging industry is one of the significant global packaging industries. The consistent growth of China's packaging industry can be attributed to its expanding economy and a burgeoning middle class with increased purchasing power. Furthermore, the packaging industry in the country is expected to grow. A report by the Chinese government estimates the industry achieving a valuation of CNY 2 trillion (USD 290 billion) by 2025.

- With the rising food processing industry, India anticipates heightened demand for food packaging. The Ministry of Food Processing highlights that the food processing sector, a major player in India's economy, represents 32% of the overall food market. Projections estimate the industry's output to hit USD 535 billion by 2025, growing at an annual rate of 15.2%, supporting the market's growth.

- Beyond packaging, ethylene glycol plays a crucial role as an anti-freezing agent in car radiators. The automotive landscape is vibrant, with China leading globally. Data from the Organisation Internationale des Constructeurs d'Automobiles (OICA) revealed that in 2023, China produced 30.16 million vehicles, a 12% increase from 27.02 million in 2022. This surge in automobile production is poised to bolster the glycol market.

- South Korea boasts a mature automotive industry with notable brands like Hyundai, Renault, Samsung, and Kia. Projections from the Automobile Manufacturers Association and Korea Automobile Research Institute anticipate a 1.0% rise in domestic automobile production for 2024, reaching 4.36 million units. This growth is expected to drive demand in the market studied.

- China's cosmetics landscape has seen rapid growth over the past decade. Data from the National Bureau of Statistics of China indicated that in 2023, retail sales of cosmetics reached approximately CNY 414.17 billion (~USD 58.5 billion). With demand surging in second and third-tier cities and a notable rise in men's skincare, the glycol market is set to thrive.

- South Korea ranks among the top ten global beauty markets and is celebrated for its innovation, use of natural ingredients, and attractive packaging. According to the data from the Ministry of Food and Drug Safety (MFDS), Korea's cosmetics exports hit USD 8.5 billion in 2023, securing fourth position globally.

- India's pharmaceutical sector, known for its affordable and high-quality medicines, is on a trajectory of rapid scientific advancements. The government forecasts the industry's value to soar from USD 50 billion to USD 130 billion by 2030 and an ambitious USD 450 billion by 2047. Such growth signals a heightened demand for glycol in pharmaceutical drug production during the forecast period.

- Given these dynamics, Asia-Pacific is set for significant growth, driven by surging demands across various industries.

Glycol Industry Overview

The glycol market is fragmented in nature. The major players include Shell PLC, MEGlobal, Indorama Ventures Public Company Limited, Reliance Industries Limited, and PETRONAS Chemicals Group Berhad.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Dynamics

- 4.1 Drivers

- 4.1.1 Increasing Usage in the Textile Industry

- 4.1.2 Growing Demand from the Food and Beverage Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Toxicity and Environmental Concerns

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 Market Segmentation (Market Size in Volume)

- 5.1 By Type

- 5.1.1 Ethylene Glycol

- 5.1.1.1 Monoethylene Glycol (MEG)

- 5.1.1.2 Diethylene Glycol (DEG)

- 5.1.1.3 Triethylene Glycol (TEG)

- 5.1.1.4 Polyethylene Glycol (PEG)

- 5.1.2 Propylene Glycol

- 5.1.3 Other Types

- 5.1.1 Ethylene Glycol

- 5.2 By End-user Industry

- 5.2.1 Automotive and Transportation

- 5.2.2 Packaging

- 5.2.3 Food and Beverage

- 5.2.4 Cosmetics

- 5.2.5 Pharmaceuticals

- 5.2.6 Textile

- 5.2.7 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 China Petrochemical Corporation

- 6.4.3 China Sanjiang Fine Chemical Co. Ltd

- 6.4.4 Dow

- 6.4.5 Huntsman International LLC

- 6.4.6 India Glycols Limited

- 6.4.7 Indian Oil Corporation Ltd

- 6.4.8 Indorama Ventures Public Company Limited

- 6.4.9 INEOS

- 6.4.10 LOTTE Chemical Corporation

- 6.4.11 LyondellBasell Industries Holdings B.V.

- 6.4.12 MEGlobal

- 6.4.13 Mitsubishi Chemical Group Corporation

- 6.4.14 Nouryon

- 6.4.15 PETRONAS Chemicals Group Berhad

- 6.4.16 Petrorabigh

- 6.4.17 Reliance Industries Limited

- 6.4.18 SABIC

- 6.4.19 Shell PLC

7 Market Opportunities and Future Trends

- 7.1 Increasing Demand for Bio-based Glycols

- 7.2 Other Opportunities