|

市場調查報告書

商品編碼

1689944

訊號產生器:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Signal Generator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

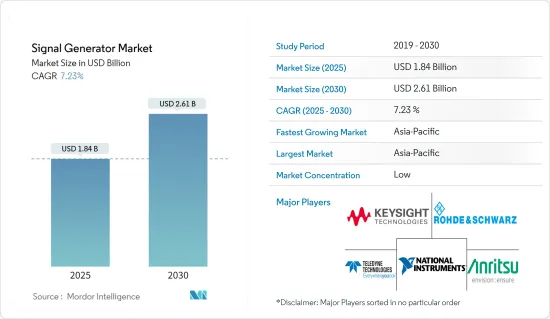

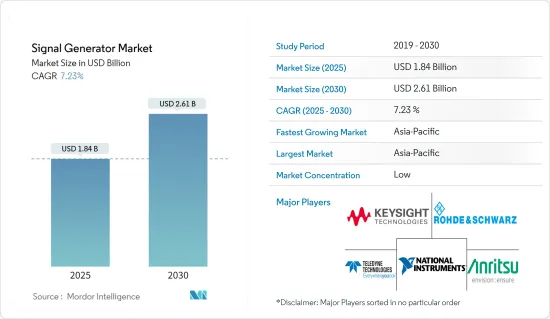

訊號產生器市場規模預計在 2025 年為 18.4 億美元,預計到 2030 年將達到 26.1 億美元,預測期內(2025-2030 年)的複合年成長率為 7.23%。

訊號產生器(也稱為頻率合成器)幾乎是所有射頻/微波測試和測量系統中的關鍵儀器。廣泛用於測試、修理和排除各種電子設備和系統的故障。此外,預計未來幾年它將成為全球測試和測量市場中成長最快的部分。訊號產生器已經從簡單的連續波設備發展成為具有卓越軟體控制、調變能力和用戶介面的先進調變設備。線性度、頻寬等改進,以及使用增強訊號產生能力的新軟體技術,進一步增加了訊號產生器的市場佔有率。

主要亮點

- 無線通訊、航太和國防、汽車工業以及 5G 等新技術預計將推動需求。 5G 研究、開發和設計活動將主要影響對射頻產生器的需求。預計無線標準的持續發展將在預測期內進一步推動對此類設備的需求。業界也要求更複雜的波形,從傳統的類比調變到更複雜的向量格式,如 IQ調變。 5G和下一代無線蜂窩技術等新興技術預計將使市場需求轉向更高的運作頻率和更寬的調變頻寬。

- WiMAX(微波接入無線互通性)、第三代(3G)無線、第四代(4G)無線以及寬頻分碼(WCDMA)等標準的快速發展將推動 5G 領域的成長。這可能會進一步增加對訊號產生器的需求。預計測試將成為所有應用中應用最廣泛的。隨著物聯網 (IoT) 的普及,現在許多設備都連接到網際網路。雖然短期內由於成本問題,低延遲不會適用於所有應用程式和設備,但某些設備和應用程式需要低延遲或零延遲,這為使用訊號產生器的測試製造商提供了機會。

- 2021 年 2 月,STI Vibration Monitoring Inc. 推出了 CMCP-TKSG 現場訊號產生器,這是一款用於振動和位移測量的小型可攜式設備。 CMCP-TKSG現場訊號產生器是工程師和技術人員安裝、維護、故障排除和校準檢驗振動監測系統的理想選擇。電池供電的 CMCP-TKSG 可模擬固定頻率的加速度、速度或位移訊號以及用於間隙/位置監視器的直流電壓。訊號幅度可以透過 10 個預定義步驟進行調整,或使用可變輸出設定手動調整。

- 兩家公司也建立了夥伴關係。例如,2021 年 11 月,安全和航太公司洛克希德馬丁公司和是德科技公司宣佈建立夥伴關係,以推進 5G 發展,確保支援航太和國防應用中任務關鍵型通訊的訊號產生器的響應能力和安全性。

- 向最終用戶普及互通性和專用測試設備的需求對於市場成功至關重要。目前,最終用戶缺乏對主動解決方案必要性的認知,限制了訊號產生器的大規模使用。最終用戶無法從各種相同的系統中找出正確答案,這限制了採用。新冠肺炎疫情為市場帶來嚴重衝擊,消費者偏好轉向必需品,導致汽車和電子產品的需求下降。由於邊境關閉和國際旅行禁令,航太業也大幅下滑。因此,為這些行業提供服務的供應商報告稱,2020 年第一季的收入下降。

訊號產生器市場趨勢

汽車業預計將佔很大佔有率

- 汽車產業是該市場背後的驅動力之一。新興國家對電動車的日益普及可能會在預測期內支持市場成長。由於汽車中電子元件和感測器的使用越來越多,需要使用訊號產生器來測試和排除感測器、螺線管、致動器、主點火和次級點火裝置以及通訊資料流的故障。在汽車產業,訊號產生器通常用於測試車載娛樂和駕駛輔助設備,例如倒車停車感應器和遙控鑰匙。

- 近年來,由於自動駕駛汽車技術和混合動力傳動系統系統研發中的測試要求,對訊號產生器的需求不斷增加。全球汽車製造商擴大採用訊號產生器來確保自動駕駛汽車技術中使用的雷達和感測器的安全性、品質和可靠性。訊號產生器測試雷達、感測器和中央處理單元等關鍵設備之間的通訊鏈路。電動和電子車輛技術的最新進展使得訊號產生器對於測試、故障排除和診斷幾乎不可或缺。

- 此外,歐盟還推出了緊急呼叫(eCall)系統的新法規,以便在發生車禍時提供快速救援。基於以上因素,從2018年第一季起,所有在歐洲市場銷售的新車均須配備支援eCall的車載系統(IVS)。這些系統在出售之前必須經過適當的測試。需要在實驗室中使用符合標準的 GNSS 訊號來刺激 IVS,以確保可重複和標準化的測試,其中訊號產生器起著關鍵作用。

- 新的 eCall 法規還包括新標準,以保護基於 GNSS 的設備免受相鄰頻寬干擾的影響。此標準由歐洲通訊標準協會(ETSI)制定。該標準確保在歐盟推出的任何新的或修改的 GNSS 產品能夠容忍相鄰頻寬干擾並繼續不間斷運作。這些系統也需要測試,從而產生了對訊號產生器的需求。

- 自動駕駛汽車的發展正在推動對確保安全駕駛的感測器和雷達系統的需求。這些感測器和雷達基於頻譜範圍約為 40 kHz 的超音波頻率。隨著車載娛樂系統的普及和研發投入的增加,新型車載系統對頻率在 50 至 100 MHz 之間的訊號產生器的需求不斷增加。

亞太地區可望強勁成長

- 預計亞太地區的訊號發生器市場將顯著成長。這是由於訊號產生器的需求急劇增加,尤其是中國、印度和韓國等國家。亞太地區 LTE 的日益普及也推動了市場的成長。愛立信估計,亞太地區的 LTE 用戶數量將從 2019 年的 3 億增加到 2020 年的 30 億左右。汽車和電子設備製造商對訊號產生器的需求不斷成長,正在推動全部區域的市場成長。

- 2021年10月,中國移動採用羅德與施瓦茲的R&S SMM100A向量訊號產生器檢驗5G技術。這個新的訊號源為研究應用產生5G訊號,以檢驗目前和未來的5G技術。該計劃延續了中國移動與羅德與施瓦茨中國公司的長期合作。中國移動也為其研究實驗室配備了R&S SMM100A向量訊號產生器,用於5G測試計劃。

- 2021 年 1 月,羅德與施瓦茨推出了 R&S SMM100A,這是同類產品中唯一具有毫米波測試功能的向量訊號產生器。這些儀器在尖端無線通訊設備投入生產時為其產生數位訊號,滿足開發未來產品和技術的嚴格期望。新型 R&S SMM100A 向量訊號產生器在 100 MHz 至 44 GHz 的整個頻率範圍內具有出色的射頻特性,可滿足此需求。它涵蓋所有無線標準使用的頻寬,包括 LTE、5G NR、最新的 WLAN 標準、Wi-Fi 6 和 Wi-Fi 6E(最高 7.125 GHz)。

- 2022年1月,安立公司宣布將在澳洲發布新的干擾波形圖(用於5G NR接收機測試的干擾波形圖MX371055A)和干擾波形圖(用於LTE接收機測試的干擾波形圖MX371054A)。這些工具使用訊號產生器MG3710E 產生 3GPP 干擾波形模式,用於測試 5G 和 LTE 使用者裝置 (UE) 和模組的接收器靈敏度和吞吐量。將這些工具安裝在 MG3710E 中並將其與無線通訊測試站 MT8000A 和無線通訊分析儀 MT8821C 相結合,可輕鬆執行 3GPP RF 一致性測試所需的干擾評估測試。

訊號產生器產業概況

訊號產生器市場高度分散,許多公司佔據相當大的市場佔有率。不斷增加的研發力度、新技術的出現以及訊號產生器的日益普及為頻譜分析儀市場提供了豐厚的機會。整體而言,現任者之間的競爭敵意較高。

- 2021 年 5 月-模組化訊號產生和處理介面供應商 LYNX Technik 宣布了其最新的 greenMachine 通用硬體設備 Callisto+。 Callisto+ 支援 2x 3G,並以相同的功能集和性能補充現有的 greenMachine Titan 硬體(支援 4K)。當不需要或不需要 4K 時,Callisto+ 為使用者提供更具成本效益的入門級訊號處理解決方案。

- 2021 年 5 月 - 是德科技公司 (Keysight Technologies, Inc.) 是一家提供先進設計和檢驗解決方案以加速創新以連接和保護世界的技術公司,該公司今天宣布推出 Keysight N9042B UXA X 系列訊號分析儀解決方案,用於對航太、國防和衛星通訊的毫米波 (mmWave) 進行創新性能測試。

- 2021 年 6 月-無線電信集團公司宣布,其 Boonton 品牌已推出 SGX1000 射頻訊號產生器,進入訊號產生器市場,這是一系列新儀器,結合了高效能訊號產生功能和直覺的使用者介面。 SGX1000 基於最新的 Boonton 儀器平台,以緊湊的價格分佈提供了現代、易於使用的介面,為半導體、航太、醫療、軍事和通訊行業的普遍使用提供了經濟實惠的高性能訊號生成。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 市場促進因素

- 電子設備的普及

- 最新通訊系統

- 對任意波形產生器的需求不斷增加

- 市場限制

- 激烈的競爭帶來價格壓力

- 進口原料的進口關稅和稅費較高

- COVID-19 產業影響評估

第5章 市場區隔

- 按產品

- 通用訊號產生器

- 射頻訊號產生器

- 微波訊號產生器

- 任意波形產生器

- 專用訊號產生器

- 視訊訊號產生器

- 音訊訊號產生器

- 音調產生器

- 函數產生器

- 類比訊號產生器

- 數位訊號產生器

- 掃描函數產生器

- 通用訊號產生器

- 依技術分類

- 2G

- 全球行動電話系統 (GSM)

- 分碼(CDMA)

- 3G

- 寬頻分碼(WCDMA)

- 分碼(CDMA2000)

- 5G-4G

- 3GPP 長期演進 (LTE)

- 無線網路

- 2G

- 按應用

- 設計

- 測試

- 製造業

- 故障排除

- 維修

- 其他用途

- 按最終用戶產業

- 通訊業

- 航太和國防

- 車

- 電子製造業

- 衛生保健

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第6章 競爭格局

- 公司簡介

- Keysight Technologies Inc.

- Rohde & Schwarz Gmbh & Co. Kg

- National Instruments Corporation

- Anritsu Corporation

- Tektronix Inc.(Keithley Instruments Inc.)

- Teledyne Technologies Incorporated

- B&K Precision Corporation

- Fluke Corporation

- Stanford Research Systems

- Good Will Instrument Co. Ltd

- Yokogawa Electric Corporation

第7章投資分析

第 8 章:市場的未來

The Signal Generator Market size is estimated at USD 1.84 billion in 2025, and is expected to reach USD 2.61 billion by 2030, at a CAGR of 7.23% during the forecast period (2025-2030).

Signal generators are also called frequency synthesizers and are crucial instruments of almost all RF/microwave test -and -measurement systems. They are extensively used to test, repair, and troubleshoot various electronic devices and systems. Further, they are expected to be the fastest-growing segment in the global test-measurement market over the next few years. Signal generators have evolved from simple continuous-wave devices to advanced modulation devices with superior software control, modulation capabilities, and user interfaces. Improvements such as using new software techniques that enhance the linearity, bandwidth, and signal creation capabilities further increase the market share for signal generators.

Key Highlights

- It is expected that the demand will be driven by wireless communications, aerospace and defense, automotive industries, and new technologies such as 5G. 5G R&D and design activity primarily impact demand for RF Generators. Continued development of wireless standards is further expected to push the need for this equipment over the forecast period. The industry also demands more complex waveforms, ranging from traditional analog modulation to complex vector formats such as IQ modulation. A shift in market requirements toward higher operating frequencies and wider modulation bandwidths is expected due to new technologies such as 5G and the next generation of wireless cellular technology.

- The rapid development of standards such as wireless interoperability for microwave access (WiMAX), third-generation (3G) wireless, fourth-generation (4G) wireless, and wideband code-division multiple access (WCDMA) will aid in growth in the 5G domain. This would further increase the demand for signal generators. Testing is forecast to be the most widely used among all the applications. With the increased adoption of the Internet of Things (IoT), many devices are connected to the internet. While low latency is not provided for all applications and devices in the short term due to costs, the desire for low or no latency for several devices and applications exists and offers opportunities to test manufacturers, who then utilize signal generators.

- In February 2021, STI Vibration Monitoring Inc. launched its CMCP-TKSG field signal generator, a compact, portable device for vibration and displacement measurements. The CMCP-TKSG field signal generator is ideal for engineers and technicians who perform installation, maintenance, troubleshooting, and calibration verification on vibration monitoring systems. The battery-powered CMCP-TKSG simulates a fixed frequency acceleration, velocity or displacement signal, and DC voltages for gap/position monitors. The signal amplitude can be adjusted in 10 pre-defined increments or manually adjusted using the variable output setting.

- Companies are also involved in partnerships. For instance, in November 2021, Lockheed Martin, a security and aerospace company, and Keysight Technologies Inc. announced a partnership to advance 5G to check the response and security of signal generators to support mission-critical communications for aerospace and defense applications.

- Educating end users on interoperability and the need for specialized testing equipment is essential for market success. At present, the lack of end-user awareness of the need for proactive solutions limits the large-scale use of a signal generator. End-user inability to identify the appropriate answer from various identical systems limits adoption. The COVID-19 pandemic harmed the market, with customers' preferences moving toward essential items, dropping the demand for automobiles and electronics. The aerospace sector also witnessed a significant decline due to the closing of borders and the international travel ban. Thus, vendors supplying these industries reported a decline in revenue in the first quarter of 2020.

Signal Generator Market Trends

Automotive Expected to Hold Significant Share

- The automotive industry is one of the driving forces for the market studied. The growing adoption of electric cars in emerging countries may support market growth over the forecast period. Due to the increased use of electronic components and sensors in vehicles, signal generators have become necessary for testing and troubleshooting sensors, solenoids, actuators, primary and secondary ignitions, and communication data streams. In the Automotive industry, signal generators are generally used to test in-car entertainment and driver assisting aids such as reverse parking sensors and remote keys.

- In recent years, the demand for signal generators has increased due to testing requirements in the R&D of autonomous vehicle technologies and hybrid power-train systems. Global automakers increasingly use signal generators to ensure the safety, quality, and reliability of radars and sensors used in autonomous vehicle technologies. Signal generators test the communication link between critical devices such as radars, sensors, and the central computing unit. Advances in electrical and electronic vehicle technology, which occurred over recent years, made signal generators in testing, troubleshooting, and diagnosis almost mandatory.

- The European Union has also deployed a new regulation, the emergency call (eCall) system, which offers fast assistance in the event of a car accident. Due to the above factor, all new vehicles sold in the European market after the first quarter of 2018 are necessitated to have an In-Vehicle System (IVS) supporting eCall. These systems are required to be appropriately tested before being sold. It is necessary to stimulate the IVS with standard conform GNSS signals in a laboratory to ensure repetitive and standard testing, where a signal generator plays a prominent role.

- Also, to the new eCall regulations, there is a new standard to safeguard GNSS-based devices from the consequences of adjacent band interference. This standard was deployed by the European Telecommunications Standards Institute (ETSI). The standard ensures that any new or altered GNSS product launched in the European Union can withstand adjacent band interference and continue operating without interruption. These systems also need to be tested, generating demand for signal generators.

- The development of autonomous cars has increased the demand for sensors and radar-based systems deployed for safe operation. These sensors and radars are based on an ultrasonic frequency with a spectrum range of around 40 kHz. With the increasing deployment of the in-car entertainment systems and growing investments in R&D, new automotive systems generate the demand for signal generators with frequencies of 50-100 MHz.

Asia-Pacific Expected to Witness Significant Growth

- The Asia-Pacific region is expected to witness significant growth in the signal generator market. The increase is due to the surging demand for signal generators, especially in nations, like China, India, and South Korea. The growing LTE adoption in Asia-Pacific is also driving the market's growth. Ericsson estimated that Asia-Pacific would account for approximately 3 billion LTE subscriptions in 2020, increasing from 300 million LTE subscriptions in 2019. There is a rising demand for signal generators among automotive and electronics manufacturers, helping the market grow across the region.

- In October 2021, China Mobile selected the R&S SMM100A vector signal generator from Rohde & Schwarz to validate its 5G technology. The new signal source generates 5G signals in research applications to verify current and future 5G technologies. The project continues the long-term cooperation between China Mobile and Rohde & Schwarz China. Also, China Mobile has equipped its research lab with the R&S SMM100A vector signal generator for 5G test projects.

- In January 2021, Rohde & Schwarz introduced the R&S SMM100A, the only vector signal generator with mmWave testing capabilities in its class. The instrument meets the rigorous expectations for generating digital signals for the most advanced wireless communication devices entering production and developing future products and technologies. The new R&S SMM100A vector signal generator meets this need, displaying excellent RF characteristics across the entire frequency range from 100 MHz to 44 GHz. It covers all the bands used by any wireless standards, including LTE and 5G NR, and the latest WLAN standards, Wi-Fi 6, and Wi-Fi 6E (up to 7.125 GHz).

- In January 2022, Anritsu Corporation announced the launch of its new Interference Waveform Pattern for 5G NR Receiver Test MX371055A and Interference Waveform Pattern for LTE Receiver Test MX371054A software in Australia. These tools generate 3GPP interference waveform patterns for testing the receiver sensitivity and throughput of 5G and LTE user equipment (UE) and modules using the Signal Generator MG3710E. Installing these tools in the MG3710E combined with the Radio Communication Test Station MT8000A and Radio Communication Analyzer MT8821C facilitates easy interference evaluation tests required by the 3GPP RF Compliance Test.

Signal Generator Industry Overview

The Signal Generator Market is quite fragmented as many companies occupy a significant share in the market. Increased R&D efforts, new technologies, and increased adoption of signal generators provide lucrative opportunities in the spectrum analyzer market. Overall, the competitive rivalry among the existing competitors is high.

- May 2021 - LYNX Technik, a modular signal generating and processing interfaces provider, announced its latest greenMachine general-purpose hardware device, Callisto+. Callisto+ is 2x 3G capable and complements the existing greenMachine Titan hardware (4K capable) with the same feature set and performance. Callisto+ provides users with a more cost-effective, entry-level signal processing solution when 4K is unnecessary or required.

- May 2021 - Keysight Technologies Inc., a technology firm that delivers advanced design and validation solutions to accelerate innovation to connect and secure the world, announced the launch of the Keysight N9042B UXA X-Series signal analyzer solution, which enables customers to test the performance of millimeter-wave (mmWave) innovations in aerospace and defense and satellite communications.

- June 2021 - Wireless Telecom Group Inc. announced that its Boonton brand had entered the signal generation market by introducing the SGX1000 RF Signal Generator, a new series of instruments that combine high-performance signal generation capabilities with an intuitive user interface. The SGX1000 is built on the latest Boonton instrument platform that provides an easy-to-use modern interface in a compact form and offers high-performance signal generation within an affordable price range for general use in semiconductors, aerospace, medical, military, and communications industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Increased Adoption of Electronic Devices

- 4.4.2 Modern Communication Systems

- 4.4.3 Increasing Demand for Arbitrary Waveform Generators

- 4.5 Market Restraints

- 4.5.1 Intense Competition Causing Pricing Pressure

- 4.5.2 High Import Duty and Taxes on Imported Raw Materials

- 4.6 Assessment of Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 General Purpose Signal Generator

- 5.1.1.1 RF Signal Generator

- 5.1.1.2 Microwave Signal Generator

- 5.1.1.3 Arbitrary Waveform Generator

- 5.1.2 Special Purpose Signal Generator

- 5.1.2.1 Video Signal Generator

- 5.1.2.2 Audio Signal Generator

- 5.1.2.3 Pitch Generator

- 5.1.3 Function Generator

- 5.1.3.1 Analog Function Generator

- 5.1.3.2 Digital Function Generator

- 5.1.3.3 Sweep Function Generator

- 5.1.1 General Purpose Signal Generator

- 5.2 By Technology

- 5.2.1 2G

- 5.2.1.1 Global System For Mobile Phones (GSM)

- 5.2.1.2 Code Division Multiple Access (CDMA)

- 5.2.2 3G

- 5.2.2.1 Wideband Code Division Multiple Access (WCDMA)

- 5.2.2.2 Code Division Multiple Access (CDMA2000)

- 5.2.3 5G - 4G

- 5.2.3.1 3GPP Long Term Evolution (LTE)

- 5.2.3.2 Wimax

- 5.2.1 2G

- 5.3 By Application

- 5.3.1 Designing

- 5.3.2 Testing

- 5.3.3 Manufacturing

- 5.3.4 Troubleshooting

- 5.3.5 Repairing

- 5.3.6 Other Applications

- 5.4 By End-user Industry

- 5.4.1 Telecommunication

- 5.4.2 Aerospace and Defense

- 5.4.3 Automotive

- 5.4.4 Electronics Manufacturing

- 5.4.5 Healthcare

- 5.4.6 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Keysight Technologies Inc.

- 6.1.2 Rohde & Schwarz Gmbh & Co. Kg

- 6.1.3 National Instruments Corporation

- 6.1.4 Anritsu Corporation

- 6.1.5 Tektronix Inc. (Keithley Instruments Inc.)

- 6.1.6 Teledyne Technologies Incorporated

- 6.1.7 B&K Precision Corporation

- 6.1.8 Fluke Corporation

- 6.1.9 Stanford Research Systems

- 6.1.10 Good Will Instrument Co. Ltd

- 6.1.11 Yokogawa Electric Corporation